by Calculated Risk on 1/12/2014 11:51:00 AM

Sunday, January 12, 2014

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Friday on the employment report:

• December Employment Report: 74,000 Jobs, 6.7% Unemployment Rate

• Comments on the Disappointing Employment Report

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is at 2.5% of the labor force - the lowest since April 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

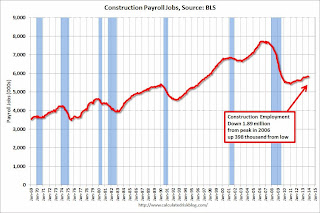

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 398 thousand.

According to the BLS, construction employment declined in December (probably due to weather). Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in 2014.

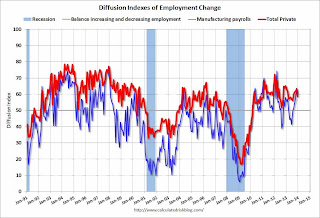

The BLS diffusion index for total private employment was at 58.8 in December, down from 63.2 in November.

The BLS diffusion index for total private employment was at 58.8 in December, down from 63.2 in November.For manufacturing, the diffusion index increased to 60.5, down from 63.6 in November.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was still fairly widespread in December (a good sign even with fewer jobs added).