by Calculated Risk on 12/03/2013 04:17:00 PM

Tuesday, December 03, 2013

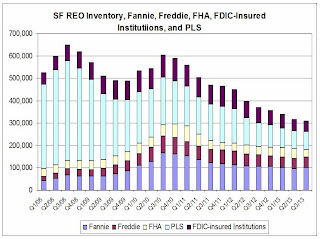

Lawler: Single Family Inventory Down Again, But Pace of Decline Slowed in Q3

From housing economist Tom Lawler:

The overall SF REO inventory appears to have declined again last quarter, though the pace of decline slowed. Both Fannie and Freddie reported slight increases last quarter, reflecting modest increases in acquisitions (mainly in judicial foreclosure states) and declines in dispositions in part reflecting “market conditions. FHA’s SF REO inventory, in contrast, declined last quarter following increases in the previous two quarters.

REO inventory both held by private-label securities and at FDIC-insured institutions also fell last quarter, though at a slower pace than the previous few quarters. (Note: I get my PLS inventory estimates from Barclays Capital, but only have data through August. For FDIC-insured institutions, I assume that the average carrying value is 50% higher than that at Fannie and Freddie).

Click on graph for larger image.

Click on graph for larger image.

CR Note: This is most, but not all, of the lender owner foreclosure inventory, aka "Real Estate Owned" (REO). There is also REO for the VA, and some other non-FDIC insured institutions - but this is probably close to 90% of all REOs.