by Calculated Risk on 2/29/2012 09:04:00 PM

Wednesday, February 29, 2012

Restaurant Performance Index declines in January, Still "solidly positive"

From the National Restaurant Association: Restaurant Industry Outlook Remains Positive Despite Slight Dip in Restaurant Performance Index

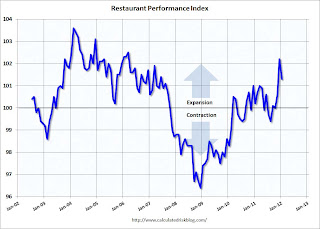

The outlook for the restaurant industry is positive for the coming months, as the National Restaurant Association’s Restaurant Performance Index (RPI) remained well above 100 in January. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.3 in January, down from December’s strong level of 102.2. Despite the decline, January represented the third consecutive month that the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“Although the Restaurant Performance Index dipped somewhat from December’s nearly six-year high, it remained solidly in positive territory,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported positive same-store sales for the eighth consecutive month, and a majority of them expect business to continue to improve in the months ahead.”

...

Restaurant operators reported positive same-store sales for the eighth consecutive month in January. ... Restaurant operators also reported positive customer traffic results in January.

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.3 in January from 102.2 in December (above 100 indicates expansion).

The data for this index only goes back to 2002.

This is "D-list" data (at best), but restaurant spending is discretionary and can tell us a little something about the overall economy. This index showed contraction in July and August, but is now solidly positive.

Fannie Mae Serious Delinquency rate declines, Freddie Mac rate increases

by Calculated Risk on 2/29/2012 04:31:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in January to 3.90%, down from 3.91% in December. This is down from 4.45% in January 2011. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.59% in January, up from 3.58% in December. This is the fifth month in a row with a small increase in the delinquency rate. Freddie's rate is down from 3.82% in January 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The serious delinquency rate has been declining, but declining very slowly. The recent uptrend for Freddie Mac would seem to require an explanation (I have none). The reason for the slow decline is most likely the backlog of homes in the foreclosure process due to processing issues (aka robo-signing), and with the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Fed's Beige Book: Economic activity increased at "modest to moderate" pace

by Calculated Risk on 2/29/2012 02:00:00 PM

Reports from the twelve Federal Reserve Districts suggest that overall economic activity continued to increase at a modest to moderate pace in January and early February. Activity expanded at a moderate pace in the Cleveland, Chicago, Kansas City, Dallas, and San Francisco Districts. St. Louis noted a modest pace of growth and Minneapolis characterized the pace of growth as firm. Economic activity rose at a somewhat faster pace in the Philadelphia and Atlanta Districts, while the New York District noted a somewhat slower pace of expansion. The Boston and Richmond Districts, in turn, noted that economic activity expanded or improved in most sectors.And on real estate:

...

Reports of consumer spending were generally positive except for sales of seasonal items, and the sales outlook for the near future was mostly optimistic.

Residential real estate activity increased modestly in most Districts. Boston, Cleveland, Richmond, Atlanta, Kansas City, and Dallas reported growth in home sales, while New York noted steady to slightly softer home sales. Philadelphia reported strong residential real estate activity. In contrast, home sales declined in St. Louis and San Francisco noted that home demand persisted at low levels. Contacts' outlooks on home sales growth were mostly optimistic.This was based on data gathered on or before February 17th. Mostly sluggish growth, but perhaps the most "positive" comments on residential real estate a long long time.

...

Commercial real estate markets displayed positive results in some Districts, as leasing showed overall improvement. Minneapolis, Richmond, Chicago, and Dallas noted increased leasing. Boston, however, reported mostly unchanged leasing fundamentals with some modest improvement since the previous report.

Fannie Mae: REO inventory declines 27% in 2011

by Calculated Risk on 2/29/2012 12:20:00 PM

This morning Fannie Mae reported results for Q4 and all of 2011. Fannie reported that they acquired 47,256 REO in Q4 (Real Estate Owned via foreclosure or deed-in-lieu) and disposed of 51,344 REO. This has been the pattern all year; Fannie has sold more REO than they acquired (acquisitions slowed because of the process issues, but dispositions picked up sharply in 2011). Here is a table for the last two years:

| Fannie Mae REO Acquisitions and Dispositions | ||

|---|---|---|

| 2011 | 2010 | |

| Acquisitions | 199,696 | 262,078 |

| Dispositions | 243,657 | 185,744 |

| Net | -43,961 | 76,334 |

This has been true for most lenders - they sold more REO than they acquired in 2011 - not just Fannie and Freddie. A common misperception is that when the lenders start foreclosing again at a higher level, that there will be a surge in REO sales. Fannie could increase acquisitions by 20%, and keep the sales pace the same, and their REO inventory wouldn't increase.

The following graph shows Fannie REO inventory, acquisition and dispositions over the last several years.

Click on graph for larger image.

Click on graph for larger image.When the blue line is above the red line, acquisitions are higher than dispositions, and REO inventory increases. In 2011 the opposite was true, and REO inventory declined by 27% from Q4 2010.

A few comments from Fannie:

Foreclosures generally take longer to complete in states where judicial foreclosures are required than in states where non-judicial foreclosures are permitted. For foreclosures completed in 2011, measuring from the last monthly period for which the borrowers fully paid their mortgages to when we added the related properties to our REO inventory, the average number of days it took to ultimately foreclose ranged from a low of 391 days in Missouri, a non-judicial foreclosure state, to a high of 890 days in Florida, a judicial foreclosure state. As of December 31, 2011, Florida accounted for 30% of our loans that were in the foreclosure process.The non-judicial states will recover first.

The FHFA announced a pilot program to sell REO, and many analysts were surprised that most of the REO in the pilot were already leased. That will not continue since Fannie only has 9,000 leased properties:

We currently lease properties to tenants who occupied the properties before we acquired them into our REO inventory, which can minimize disruption by providing additional time to find alternate housing, help stabilize local communities, provide us with rental income, and support our compliance with federal and state laws protecting tenants in foreclosed properties. As of December 31, 2011, over 9,000 tenants leased our REO properties.Freddie is expected to report results tomorrow.

In February 2012, FHFA announced that it was beginning the pilot phase of an REO initiative that will allow qualified investors to purchase pools of foreclosed properties from us with the requirement to rent the purchased properties for a specified number of years. During the pilot phase, we will offer for sale pools of various types of assets including rental properties, vacant properties and nonperforming loans with a focus on the hardest-hit areas. The pilot transactions are expected to provide insight into how the participation of private investors can maximize the value of foreclosed properties and stabilize communities. We do not yet know whether this initiative will have a material impact on our future REO sales and REO inventory levels.

Bernanke Testimony: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/29/2012 10:00:00 AM

Q4 GDP revised up to 3.0% from 2.8% in advance estimate.

Chicago PMI comes in at 64.0 well above expectations.

Chicago Purchasing Managers reported the February CHICAGO BUSINESS BAROMETER rose to its highest level in ten months. The barometer also marked a 29th month of expansion and its fourth consecutive month above 60. Increases were seen in six of eight Business Activity Indexes, highlighted by a very large advance in Employment. BUSINESS ACTIVITY: • EMPLOYMENT highest since May 1984; • ORDER BACKLOGS moved back into expansion; • INVENTORIES dipped; • NEW ORDERS highest level since March 2011:Note: Testimony starts at 10 AM ET.

Here is the CSpan feed

Here is the CNBC feed.

Prepared testimony from Fed Chairman Ben Bernanke: Semiannual Monetary Policy Report to the Congress

Misc: Purchase Mortgage Applications increase, ECB LTRO €530bn

by Calculated Risk on 2/29/2012 07:38:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2.2 percent from the previous week. The seasonally adjusted Purchase Index increased 8.2 percent from one week earlier.From the Financial Times Alphaville on the ECB's Long-Term Refinancing Operation (LTRO): LTRO.2 €530bn

...

"Mortgage rates remained near survey lows last week, but refinance volume fell slightly," said Michael Fratantoni, Vice President of Research and Economics at the Mortgage Bankers Association. Fratantoni continued, "According to survey participants, more than 20 percent of refinance applications were for HARP loans. The HARP share of total refinance applications has increased over the past month. Purchase application volume increased over the week, but remains within the narrow and anemic range of activity we have seen since the expiration of the homebuyer tax credit in May 2010."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.07 percent from 4.09 percent

That’s €530bn with 800 bidders — 277 more than participated last time, when the uptake was €489bn.

Tuesday, February 28, 2012

Goldman Sachs and Wells Fargo receive Wells notices from SEC

by Calculated Risk on 2/28/2012 09:03:00 PM

From HousingWire: Wells Fargo, Goldman receive Wells notices over MBS disclosures

Wells Fargo and Goldman Sachs received Wells notices over mortgage-backed securities disclosures, according to regulatory filings.The earlier Goldman settlement was related to CDO derivatives (Collateralized Debt Obligations). Now the SEC is investigating the securitization of the underlying MBS.

Goldman Sachs disclosed the Wells notice in its 10-K, while Wells reported the notice in its 2011 annual report to shareholders.

The notice from the Securities and Exchange Commission concerns "the disclosures contained in the offering documents used in connection with a late 2006 offering of approximately $1.3 billion of subprime residential mortgage-backed securities underwritten by GS&Co.," Goldman said in its regulatory filing. "The firm will be making a submission to, and intends to engage in a dialogue with, the SEC staff seeking to address their concerns."

At Wells Fargo, the Wells notice also relates to the bank's disclosures in mortgage-backed securities offering documents.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in December

• Real House Prices and Price-to-Rent fall to late '90s Levels

• All current house price graphs

FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q4

by Calculated Risk on 2/28/2012 02:53:00 PM

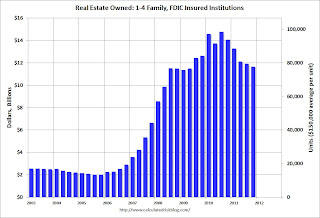

The FDIC released the Quarterly Banking Profile today for Q4. The report showed that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to $11.64 billion in Q4, from $11.9 billion in Q3 - and from $14.05 billion in Q4 2010.

As economist Tom Lawler has pointed out before, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Using an average of $150,000 per unit would suggest the number of 1-4 family REOs declined from 79,335 in Q3 to 77,584 in Q4.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO gives 77.6 thousand REO at the end of Q4.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

Of course this is just a small portion of the total 1-4 family REO. The FHA has already reported that REO declined sharply in Q4, and Fannie and Freddie are expected to report declines in REO later this week.

Although REO inventories declined over the last year - a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process - there are still many more foreclosures coming.

Real House Prices and Price-to-Rent fall to late '90s Levels

by Calculated Risk on 2/28/2012 12:06:00 PM

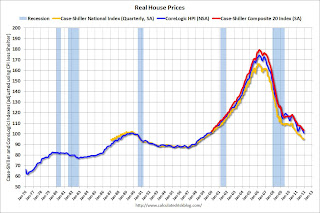

Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1998 and early 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to January 2003 levels, and the CoreLogic index is back to February 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000, and the CoreLogic index back to December 1999.

In real terms, all appreciation in the '00s - and more - is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to December 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels, and will all probably be back to late '90s levels within the next few months.

Earlier:

• Case Shiller: House Prices fall to new post-bubble lows in December

Misc: Richmond Fed shows expansion, Consumer confidence increases, FDIC problem banks decline

by Calculated Risk on 2/28/2012 10:48:00 AM

• From the Richmond Fed: Manufacturing Activity Expanded for the Third Straight Month; Expectations Remain Upbeat

In February, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — increased eight points to 20 from January's reading of 12.Every regional survey showed faster expansion in February compared to January. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

Labor market conditions at District plants strengthened further in February. The manufacturing employment index moved up nine points to end at 13, and the average workweek indicator increased six points to 10. In contrast, wage growth eased, losing three points to 7.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

The ISM index for February will be released Thursday, March 1st and the regional surveys suggest another increase in February. The consensus is for a slight increase to 54.6 from 54.1 in January.

• The Conference Board Consumer Confidence Index® Increases

The Conference Board Consumer Confidence Index®, which had decreased in January, increased in February. The Index now stands at 70.8 (1985=100), up from 61.5 in January. The Present Situation Index increased to 45.0 from 38.8. The Expectations Index rose to 88.0 from 76.7 in January.This was well above expectations of an increase to 64.

• From the FDIC: Quarterly Banking Profile

Fourth-quarter earnings totaled $26.3 billion, an increase of $4.9 billion (23.1 percent) compared with the same period of 2010. ... For the third time in the last four quarters, net operating revenue posted a year-over-year decline. ... Net charge-offs totaled $25.4 billion in the fourth quarter, a decline of $17.1 billion (40.2 percent) from a year ago. The fourth quarter total represents the lowest level for quarterly charge-offs since first quarter 2008. This is the sixth consecutive quarter in which charge-offs have posted a year-over-year decline. Improvements occurred across all major loan types. ... The amount of loan balances that were noncurrent (90 days or more past due or in nonaccrual status) declined for the seventh quarter in a row, falling by $4.3 billion (1.4 percent).The number of problem institutions decreased to 813 in Q4 from 844 in Q3, and assets of problem institutions declined to $319.4 billion from $339 billion in Q3.

Case Shiller: House Prices fall to new post-bubble lows in December

by Calculated Risk on 2/28/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December (a 3 month average of October, November and December).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the quarterly national index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: All Three Home Price Composites End 2011 at New Lows According to the S&P/Case-Shiller Home Price Indices

Data through December 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed that all three headline composites ended 2011 at new index lows. The national composite fell by 3.8% during the fourth quarter of 2011 and was down 4.0% versus the fourth quarter of 2010. Both the 10- and 20-City Composites fell by 1.1`% in December over November, and posted annual returns of -3.9% and -4.0% versus December 2010, respectively. These are worse than the -3.8% respective annual rates both reported for November. With these latest data, all three composites are at their lowest levels since the housing crisis began in mid-2006.

In addition to both Composites, 18 of the 20 MSAs saw monthly declines in December over November. Miami and Phoenix were up 0.2% and 0.8%, respectively. ...

“In terms of prices, the housing market ended 2011 on a very disappointing note,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “With this month’s report we saw all three composite hit new record lows."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.0% from the peak, and down 0.5% in December (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and down 0.5% in December (SA). The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.9% compared to December 2010.

The Composite 20 SA is down 4.0% compared to December 2010. This was a slightly larger year-over-year decline for both indexes than in November.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next few months (this report was for the three months ending in December). I'll have more on house prices later this morning.

Durable Goods orders decline 4% in January

by Calculated Risk on 2/28/2012 08:39:00 AM

Durable goods is always very volatile. Durable goods orders were expected to decline due to lower aircraft orders (Nondefense aircraft and parts declined 19%) and the expiration of a tax credit that allowed for faster depreciation of equipment purchases.

From the Census Bureau: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders

January 2012

New orders for manufactured durable goods in January decreased $8.6 billion or 4.0 percent to $206.1 billion,the U.S. Census Bureau announced today. This decrease, down following three consecutive monthly increases, followed a 3.2 percent December increase. Excluding transportation, new orders decreased 3.2 percent. Excluding defense, new orders decreased 4.5 percent.

Transportation equipment, down following two consecutive monthly increases, had the largest decrease, $3.6 billion or 6.1 percent to $55.2 billion. This was due to nondefense aircraft and parts, which decreased $3.8 billion.

Monday, February 27, 2012

Dallas Fed: Texas Manufacturing Expansion Strengthens in February

by Calculated Risk on 2/27/2012 09:19:00 PM

This was released earlier today. These high frequency surveys are useful because they provide a glimpse of what was happening just a week or two ago - as opposed to other data that is released with a long lag.

From the Dallas Fed: Texas Manufacturing Expansion Strengthens

Texas factory activity continued to increase in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 5.8 to 11.2, suggesting a pickup in the pace of growth.All of the regional surveys were stronger in February than in January; the last regional survey, from the Richmond Fed, will be released tomorrow.

Other measures of current manufacturing conditions also indicated expansion in February. The new orders index was positive for a second month in a row but fell from 9.5 to 5.8. Similarly, the shipments index moved down from 6.1 to 4.2. Capacity utilization increased further in February; the index edged up from 8.5 to 10.

...

The general business activity index rose to 17.8, its highest reading since November 2010.

...

Labor market indicators reflected a sharp increase in hiring and longer workweeks. The employment index jumped to 25.2, its highest level since the beginning of 2006.

...

Prices and wages increased in February. The raw materials price index was 25.2, little changed from January. The finished goods price index climbed from 9 to 16.2, suggesting selling prices rose at a faster pace.

FHFA: "Tremendous" interest in new HARP Refinance Program

by Calculated Risk on 2/27/2012 05:02:00 PM

From Bloomberg: U.S. Refinancing Program Garners ‘Tremendous Borrower Interest,’ FHFA Says

A program designed to help homeowners who have lost equity in their properties has generated “tremendous borrower interest,” said Edward J. DeMarco, acting director of the Federal Housing Finance Agency.The key to the new HARP program is the elimination of the representations and warranties on the original loan for the lenders. If the lenders can get borrowers to refinance (only loans owned or guaranteed by Fannie and Freddie), the lenders will no longer be responsible if the original loan defaults. This is important for the banks (these are well seasoned loans, so it makes sense for Fannie and Freddie too).

DeMarco made his comments in written testimony prepared for delivery tomorrow to the Senate Banking Committee.

The elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until sometime in March. The lenders and servicers know which loans are 1) owned or guaranteed by Fannie and Freddie, and 2) qualify for HARP. The lenders are very motivated to get borrowers to refinance ... and the borrowers will be very motivated to get much lower mortgage rates. So it should be no surprise that there is "tremendous borrower interest"!

FHFA announces Pilot REO Bulk Sales Offer

by Calculated Risk on 2/27/2012 03:26:00 PM

From the FHFA: FHFA Announces Pilot REO Property Sales in Hardest-Hit Areas

The Federal Housing Finance Agency (FHFA) today announced the first pilot transaction under the Real Estate-Owned (REO) Initiative, targeted to hardest-hit metropolitan areas — Atlanta, Chicago, Las Vegas, Los Angeles, Phoenix and parts of Florida.Here is an over view of the properties being offered. The offer is for 2,490 Fannie Mae properties with a total of 2,854 units (some properties are 2, 3 and 4-units).

With this next step, prequalified investors will be able to submit applications to demonstrate their financial capacity, experience and specific plans for purchasing pools of Fannie Mae foreclosed properties with the requirement to rent the purchased properties for a specified number of years.

Click on graph for larger image.

Click on graph for larger image.What is surprising is that most of these units are already rented (85% of the units are rented) and almost 60% of the units on term leases (the rest are month-to-month).

The original idea behind the REO-to-rental program was to sell vacant REO to investors and only in certain areas. These investors would agree to rent the properties for a certain period, and that would reduce the number of vacant units on the market (or coming on the market). This offer doesn't seem to match that goal.

Fannie already has a program to keep tenants in place if they foreclose on a rented property - and this sounds like Fannie is selling some of these tenant-in-place properties.

Germany's Bundestag votes for Greek Bailout

by Calculated Risk on 2/27/2012 02:03:00 PM

Yesterday I listed some key events in Europe this week and over the next couple of months (list repeated below). The German Bundestag voted overwhelmingly today for the Greek Bailout.

From the WSJ: German Lawmakers Endorse Greek Bailout

Of 591 valid votes cast in the Bundestag, or lower house of Parliament, 496 lawmakers were in favor of the bailout, while 90 were against. Five lawmakers abstained.Feb 27th: Germany's Bundestag votes on Greek Bailout deal (done).

Chancellor Angela Merkel now has a mandate from Parliament to give her approval of the €130 billion ($174.8 bililon) aid package at a meeting of European Union leaders in Brussels this week.

Feb 29th: ECB three year Long Term Refinancing Operation (LTRO)

Feb 29th: Finland lawmakers vote on Greek Bailout deal.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: €200bn private sector bond swap is scheduled. From the Financial Times Alphaville: A special invitation from the Hellenic Republic ... "The invitation will expire at 9:00 P.M. (C.E.T.) on 8 March 2012, unless extended, re-opened, amended or terminated ..."

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: €14.4bn of Greek bonds scheduled to mature.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France election.

NY Fed: Delinquent Debt Shrinks while Real Estate Debt Continues to Fall

by Calculated Risk on 2/27/2012 11:30:00 AM

From the NY Fed: Delinquent Debt Shrinks while Real Estate Debt Continues to Fall

Aggregate consumer debt fell $126 billion to $11.53 trillion in the fourth quarter of 2011 according to the Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit, a 1.1 percent decrease from the $11.66 trillion reported in the prior quarter’s findings.Here is the Q4 report: Quarterly Report on Household Debt and Credit. Here are two graphs:

...

Mortgage and home equity lines of credit (HELOC) balances fell a combined $146 billion, a sign that consumers continue to reduce housing related debt.

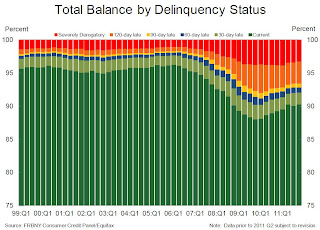

After a mild uptick in the third quarter, total household delinquency rates resumed their downward trend in the fourth quarter. The report finds that $1.12 trillion of consumer debt (or 9.8 percent of outstanding debt) is currently delinquent, with $824 billion seriously delinquent (at least 90 days late). Meanwhile about 2.2 percent of mortgage balances transitioned into delinquency during the fourth quarter, resuming the recent trend of reductions in this measure. However, delinquency rates remain elevated compared to historical figures.

"While we continue to see improvements in the delinquent balances and delinquency transition rates this quarter, there has been a noticeable decrease in the rate of improvement compared to 2009-2010," said Andrew Haughwout, vice president and economist at the New York Fed. "Overall it appears that delinquency rates are stabilizing at levels that remain significantly higher than pre-crisis levels."

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q4. From the NY Fed:

Aggregate consumer debt fell slightly in the fourth quarter. As of December 31, 2011, total consumer indebtedness was $11.53 trillion, a reduction of $126 billion (1.1%) from its September 30, 2011 level. Mortgage balances shown on consumer credit reports fell again ($134 billion or 1.6%) during the quarter; home equity lines of credit (HELOC) balances fell by $12 billion (1.9%). Household mortgage and HELOC indebtedness are now 11.0% and 11.7%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances again rose slightly ($20 billion or about 0.8%) in the quarter. Consumers’ non-real estate indebtedness now stands at $2.635 trillion. Student loan indebtedness rose slightly, to $867 billion.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached. From the NY Fed:

As of December 31, 9.8% of outstanding debt was in some stage of delinquency, compared to 10.0% on September 30. About $1.12 trillion of consumer debt is currently delinquent, with $824 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

...

About 2.2% of current mortgage balances transitioned into delinquency during 2011Q4, reinstating the recent trend of reductions in this measure which had been temporarily reversed in 2011Q3. The rate of transition from early (30-60 days) into serious (90 days or more) delinquency also fell slightly, to 28.8%. This reduction in delinquency transitions was accompanied by an improved cure rate: 27.2% of mortgage balances in early delinquency became “current” during the fourth quarter.

NAR: Pending home sales increase in January

by Calculated Risk on 2/27/2012 10:07:00 AM

From the NAR: January Pending Home Sales Rise, Market on Uptrend

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 2.0 percent to 97.0 in January from a downwardly revised 95.1 in December and is 8.0 percent higher than January 2011 when it was 89.8. The data reflects contracts but not closings.December was revised down from 96.6, so most of the 2% increase was due to the downward revision. Without the downward revision, this was below the consensus of a 1.5% increase.

The January index is the highest since April 2010 when it reached 111.3 as buyers were rushing to take advantage of the home buyer tax credit.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in February and March.

Consensus Housing Forecast for 2012: 700,000 starts

by Calculated Risk on 2/27/2012 08:55:00 AM

I guess we can call this the "consensus" forecast for housing starts, from the NABE: NABE Outlook February 2012

Housing starts are expected to increase 19 percent in 2012. The economists surveyed expect housing starts to reach 700,000 units in 2012, up from 610,000 in 2011 and an upward revision from the November forecast. The forecast for 2013 shows continued improvement, with housing starts reaching 850,000 units. Correspondingly, real residential investment is forecast to increase 6.6 percent in 2012, slightly higher than the 4.3 percent predicted in November, and then strengthen further, rising 10 percent in 2013. The projection for home prices in 2012 was lowered slightly from a projected increase in the FHFA index of 0.9 percent (Q4/Q4) in the November survey to home prices remaining unchanged in the February survey. In 2013 home prices are expected to increase slightly more than 2 percent.Here was housing economist Tom Lawler's forecast for 2012.

The following table shows several forecasts for 2012:

| Some Housing Forecasts for 2012 (000s) | |||

|---|---|---|---|

| New Home Sales | Single Family Starts | Total Starts | |

| Consensus (NABE) | 700 | ||

| Merrill Lynch | 330 | 713 | |

| Fannie Mae | 336 | 473 | 704 |

| Wells Fargo | 350 | 457 | 690 |

| John Burns | 359 | 717 | |

| NAHB | 360 | 501 | 709 |

| Tom Lawler | 365 | 515 | 740 |

| Moody's | 530 | 687 | |

| 2011 Actual | 304 | 431 | 609 |

Sunday, February 26, 2012

Question Contest, iPad Update, RSS and Twitter

by Calculated Risk on 2/26/2012 09:23:00 PM

• For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login right now. The contest has two parts: 1) every day, before 9:30 AM ET, you can enter whether you think the S&P 500 will be up or down that day, and 2) I'll ask some economic predictions (for March 1st, I'm asking: Will light vehicle sales increase in February compared to January?)

Contestants receive 1 point for each correct answer (either stocks or economic predictions). At the end of the month, starting in March, I'll list the leaders in a post on the blog. For February, I'm the leader (just a few friends entered). Hey, play along and beat CR!

• iPad layout. Based on feedback, I've switched the iPad layout back to the standard blog layout. For those who liked the touch layout, use this URL touch.calculatedriskblog.com

• RSS Feed: For those interested, here is the RSS feed for Calculatedrisk.

• on Twitter @calculatedrisk (My family friend Sasha Cohen, Olympic skater, economics student at Columbia and future hedge fund manager is on twitter @SashaCohenNYC)

Join the contest - beat CR!

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Europe: A few key dates

by Calculated Risk on 2/26/2012 07:17:00 PM

This will be another busy week in Europe. Germany and Finland will vote on the new Greek bailout, the ECB will conduct the second LTRO, and EU leaders will meet in Brussels at the end of the week.

Feb 27th: Germany's Bundestag votes on Greek Bailout deal.

Feb 29th: ECB three year Long Term Refinancing Operation (LTRO)

Feb 29th: Finland lawmakers vote on Greek Bailout deal.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: €200bn private sector bond swap is scheduled. From the Financial Times Alphaville: A special invitation from the Hellenic Republic ... "The invitation will expire at 9:00 P.M. (C.E.T.) on 8 March 2012, unless extended, re-opened, amended or terminated ..."

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: €14.4bn of Greek bonds scheduled to mature.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France election.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

2011: Record Low Placements of Manufactured Homes, and Record low Total Completions

by Calculated Risk on 2/26/2012 02:03:00 PM

Last week the Census Bureau released the placements of manufactured homes in December and for all of 2011. Placements were at 3.4 thousand in December, and at a record low of 46.0 thousand for all of 2011.

Although the manufactured home data only goes back to 1980, it is pretty clear that total housing completions (single and multi-family) and manufactured home placements were at record low levels since at least the early '60s. Here is a table of the worst years on record:

| Worst Years for Housing Completions and Placements | |

|---|---|

| Year | Total Completions (000s) |

| 2011 | 631.2 |

| 2010 | 701.6 |

| 2009 | 848.9 |

| 2008 | 1,200.2 |

| 1982 | 1,239.4 |

| 1991 | 1,265.3 |

Unfortunately there is no timely count of household formation, so it is hard to tell how quickly the excess supply of housing is being absorbed.

Note: Household formation is a function of changes in population, and also of changes in household size. During the '70s, the baby boomers started moving out of their parents' homes, and there was a dramatic decrease in the number of persons per household and that led to a huge demand for apartments. We can't directly compare the level of total completions in the '00s to the '70s or '80s - we need to know the number of households being formed.

Click on graph for larger image.

Click on graph for larger image.This graph shows total housing completions and placements since 1980. The net additional to the housing stock is less because of demolitions and destruction of housing units.

Although we don't know the exact number, it is pretty clear that there are more households being formed than housing units completed last year - and the excess supply is being absorbed.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Unofficial Problem Bank list increases to 960 Institutions

by Calculated Risk on 2/26/2012 09:18:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 24, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for January 2012 this Friday. Moreover, after playing footsie with community bankers last week as part of an effort to stem proposed Congressional action to broaden the examination appeal process, the FDIC got back to closing a couple this week. The release of these actions and closings contributed to many changes in the Unofficial Problem Bank List. In all, this week there were four removals and eight additions, which leave the list at 960 institutions with assets of $389.7 billion. A year ago, the list held also held 960 institutions but assets were higher at $413.8 billion.

With this being the last Friday of the month, it is time to review changes for the month. After experiencing declines in the number of institutions each month since July 2011, the list count increased by four institutions during February 2012. While the increase in assets of $649 million during the month was small, it was the first increase in total assets since October 2011. Other interesting factoids include the absence of any unassisted mergers during the month, which has not happened since November 2010; and the monthly additions of 16 are the highest since 18 institutions were added in October 2011.

Removals this week include two rehabilitations -- Ridgestone Bank, Brookfield, WI ($423 million) and Fireside Bank, Pleasanton, CA ($278 million Ticker: KMPR); and two failures -- Home Savings of America, Little Falls, MN ($440 million) and Central Bank of Georgia, Ellaville, GA ($276 million).

Among the eight additions are Britton & Koontz Bank, N.A., Natchez, MS ($371 million Ticker: BKBK); Crown Bank, Edina, MN ($258 million); Rabun County Bank, Clayton, GA ($248 million); and Farmers & Merchants Bank, Statesboro, GA ($231 million). After 76 failures, inclusive of the one tonight, many might think there are not any banks left in Georgia to turn bad.

Other changes to the list include the FDIC issuing Prompt Corrective Action orders against 1st Commerce Bank, North Las Vegas, NV ($32 million); First Carolina State Bank, Rocky Mount, NC ($90 million); Pisgah Community Bank, Asheville, NC ($30 million); Sunrise Bank, Valdosta, GA ($86 million); and Sunrise Bank of Albuquerque, Albuquerque, NM ($61 million). All five banks are controlled by Capitol Bancorp, Ltd., which has divested or merged 45 institutions that were under its control during the crisis. Capitol has pending sale agreements for two of the banks just issued PCA orders. Should any bank controlled by Capitol fail, the other 18 banks controlled by Capitol could be liable for the resolution cost should the FDIC decide to apply cross guaranty. The FDIC did not apply cross guaranty to Capitol back in November 2009, when Commerce Bank of Southwest Florida failed, which cost the FDIC insurance fund approximately $31 million.

Next week, the FDIC will likely release its quarterly financial performance report for the fourth quarter of 2010, which will include an update on the Official Problem Bank List figures.

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 425 bank failures since the beginning of 2008, and so far, closings this year are running at about half the rate of 2010.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Saturday, February 25, 2012

Buffett's Views on Housing

by Calculated Risk on 2/25/2012 06:44:00 PM

In Feb 2010, Warren Buffett wrote:

[W]ithin a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious.Of course I disagreed with his timing.

Then in Feb 2011, Buffett wrote:

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point.As I noted last year, the key word was "begin" and sure enough - based on housing starts and new home sales - it appears a modest recovery has begun.

Today Buffett wrote:

Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong.Really? And I was going to give him a little credit this time. Oh well.

More from Buffett:

Housing will come back – you can be sure of that. Over time, the number of housing units necessarily matches the number of households (after allowing for a normal level of vacancies). For a period of years prior to 2008, however, America added more housing units than households. Inevitably, we ended up with far too many units and the bubble popped with a violence that shook the entire economy. That created still another problem for housing: Early in a recession, household formations slow, and in 2009 the decrease was dramatic.Buffett makes several key points:

That devastating supply/demand equation is now reversed: Every day we are creating more households than housing units. People may postpone hitching up during uncertain times, but eventually hormones take over. And while “doubling-up” may be the initial reaction of some during a recession, living with in-laws can quickly lose its allure.

At our current annual pace of 600,000 housing starts – considerably less than the number of new households being formed – buyers and renters are sopping up what’s left of the old oversupply. (This process will run its course at different rates around the country; the supply-demand situation varies widely by locale.) While this healing takes place, however, our housing-related companies sputter, employing only 43,315 people compared to 58,769 in 2006. This hugely important sector of the economy, which includes not only construction but everything that feeds off of it, remains in a depression of its own. I believe this is the major reason a recovery in employment has so severely lagged the steady and substantial comeback we have seen in almost all other sectors of our economy.

1) Housing completions have been at record lows.

2) There are currently more households being formed than new housing units completed, and this is decreasing the excess supply.

3) The excess supply will be "sopped up" at different rates across the country.

4) Housing is a key reason for the sluggish economy (not the only reason).

Earlier:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Schedule for Week of February 26th

by Calculated Risk on 2/25/2012 01:15:00 PM

Earlier:

• Summary for Week ending February 24th

The key reports this week are the January Personal Income and Outlays report, and the ISM Manufacturing survey - both will be released on Thursday. Other key reports include the Case-Shiller house price index on Tuesday, vehicle sales on Thursday, and the second estimate of Q4 GDP on Wednesday.

On Wednesday and Thursday, Fed Chairman Ben Bernanke provides the Fed's Semiannual Monetary Policy Report to the House and Senate respectively.

NOTES: The February employment report will be released the following week on Friday March 9th. Also both Fannie Mae and Freddie Mac are expected to report results this week.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 1.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for February. The consensus is for 15.0 for the general business activity index, down slightly from from 15.3 in January.

11:00 AM: New York Fed to release Q4 2011 Report on Household Debt and Credit

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes (the Composite 20 was started in January 2000).

The consensus is for a 0.7% decrease in prices (NSA) in December. I expect these indexes to be at new post-bubble lows, both seasonally adjusted (SA) and not seasonally adjusted (NSA). The CoreLogic index declined 1.4% decrease in December (NSA).

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for an increase to 64.0 from 61.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. The consensus is for an increase to 13 for this survey from 12 in January (above zero is expansion). This is the last of the regional Fed manufacturing surveys for February, and the other surveys have indicated stronger expansion in February.

10:00 AM: Testimony, Fed Governor Elizabeth A. Duke, "The Housing Market", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Q4 GDP (advance release). This is the second estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q4 (same as advance estimate).

8:30 AM: Q4 GDP (advance release). This is the second estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q4 (same as advance estimate).This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the advance estimate for Q4 GDP.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for an increase to 61.0, up from 60.2 in January.

10:00 AM: Testimony, Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 355,000 from 351,000 last week.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.5% increase in personal income in January, and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

10:00 AM: Construction Spending for January. The consensus is for a 1.0% increase in construction spending.

10:00 AM ET: ISM Manufacturing Index for February.

10:00 AM ET: ISM Manufacturing Index for February. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight increase to 54.6 from 54.1 in January.

All day: Light vehicle sales for February. Light vehicle sales are expected to decline slightly to 14.0 million from 14.13 million in January (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate. TrueCar is forecasting:

The February 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 14.3 million new car sales, up from 13.3 million in February 2011 and up from 14.2 million in January 201210:00 AM: Testimony, Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate (repeat of previous day testimony).

No Releases Scheduled.

Summary for Week ending February 24th

by Calculated Risk on 2/25/2012 08:18:00 AM

There were few economic releases last week, but once again most of the data suggested some increase in economic activity. Of course the better than normal weather helped again, especially for housing.

The key economic release last week was new home sales. Although the Census Bureau report showed a small decline in sales from December, this was because December was revised up from a 307 thousand sales rate (Seasonally Adjusted Annual Rate) to 324 thousand. After averaging a 300 thousand sales rate for the 18 months following the expiration of the tax credit, new home sales have averaged a sales rate over 320 thousand for the last 3 months. Not much of an increase from a historical perspective, but it appears new home sales have bottomed. Of course it is just 3 months of better sales, and the critical selling months are coming up.

For existing home sales, the key number is inventory - and the NAR reported inventory declined 20.6% year-over-year in January. The sharp decline in inventory has lead to a scramble to explain the decline. Both Tom Lawler and I posted some thoughts on the decline (something we've been tracking all year, so we weren't surprised), see: Comments on Existing Home Inventory and Lawler: Declining Inventory of Existing Homes for Sale: Don’t Forget Conversion to Rentals

Other positive data included another drop in the four week average of initial weekly unemployment claims, an increase in consumer sentiment, and another positive reading for the Architecture Billings Index, and for manufacturing, an increase in Kansas City (10th District) manufacturing survey showing faster expansion in February.

Overall this was another solid week. Here is a summary in graphs:

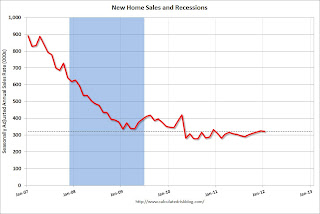

• New Home Sales in January at 321,000 Annual Rate

Click on graph for larger image.

Click on graph for larger image.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 321 thousand. This was down from a revised 324 thousand in December (revised up from 307 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. This was below the revised December rate of 324,000 and is 3.5 percent above the January 2011 estimate of 310,000.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

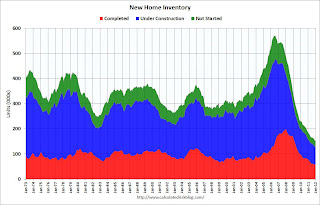

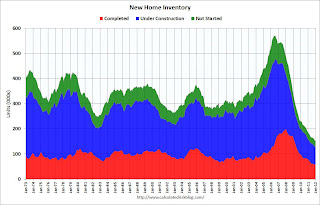

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 57,000 units in January. The combined total of completed and under construction is at the lowest level since this series started.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up. With the record low levels of inventory, any pickup in sales should translate into more construction.

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

The NAR reported: Existing-Home Sales Rise Again in January, Inventory Down

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in January 2012 (4.57 million SAAR) were 4.3% higher than last month, and were 0.7% above the January 2011 rate.

But the key number in the report was inventory.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 2.31 million in January from 2.32 million in December. This is the lowest level of inventory since March 2005.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply.

Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 20.6% year-over-year in January from January 2011. This is the eleventh consecutive month with a YoY decrease in inventory.

Months of supply decreased to 6.1 months in January, down from 6.4 months in December.

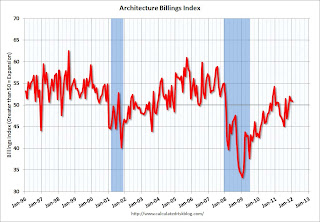

• AIA: Architecture Billings Index indicated expansion in January

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Third Straight Month

This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

• Weekly Initial Unemployment Claims unchanged at 351,000

The DOL reports:

The DOL reports:In the week ending February 18, the advance figure for seasonally adjusted initial claims was 351,000, unchanged from the previous week's revised figure of 351,000. The 4-week moving average was 359,000, a decrease of 7,000 from the previous week's revised average of 366,000.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 359,000.

The 4-week moving average is at the lowest level since early 2008.

Note: Nomura analysts argue some of the recent improvement is related to seasonal distortions, see Financial Times Alphaville: US jobs and seasonality: the DeLorean edition.

• Other Economic Stories ...

• From the Chicago Fed: Index shows economic growth in January again above average

• DOT: Vehicle Miles Driven increased 1.3% in December

• LPS: Number of delinquent mortgage loans declined in January, In foreclosure increases slightly

• Kansas City Fed: Tenth District Manufacturing Activity Increased Further in February

Friday, February 24, 2012

Oil Prices and the Economy

by Calculated Risk on 2/24/2012 10:18:00 PM

Once again we have to consider the impact of high oil prices on the US economy. Bloomberg reports brent crude futures are up to $125.47 per barrel, and WTI is up to $109.77.

From the WSJ: Gas Prices Annoy Consumers but Don't Dim Outlook Yet

Prices at the pump have risen in recent weeks as tensions with Iran have sparked fears of a supply disruption, driving up the cost of crude oil. Prices of crude hit a nearly 10-month high on Friday, rising $1.94 a barrel to close at $109.77 on the New York Mercantile Exchange, their highest level since early May. Nationally, the average price of a gallon of regular gasoline hit $3.647 on Friday, according to the auto club AAA, up nearly 27 cents from a month earlier and up 11.8 cents in the past week.When oil prices are increasing, I usually turn to Professor Hamilton's blog. In earlier research, Dr. Hamilton showed that prices had to rise above previous prices to be a significant drag on the economy. Last August he wrote: Economic consequences of recent oil price changes

...

"Consumers are not as concerned with the current level of gas prices as they were in past episodes," said Jonathan Basile, an economist with Credit Suisse.

In my 2003 study, I found the evidence favored a specification with a longer memory, looking at where oil prices had been not just over the last year but instead over the last 3 years. My reading of developments during 2011 has been that, because of the very high gasoline prices we saw in 2008, U.S. car-buying habits never went back to the earlier patterns, and we did not see the same shock to U.S. automakers as accompanied some of the other, more disruptive oil shocks. My view has been that, in the absence of those early manifestations, we might not expect to see the later multiplier effects that account for the average historical response summarized in the figure above. If one uses the 3-year price threshold that the data seem to favor, the inference would be that we'll do just fine in 2011:H2, because oil prices in 2011 never exceeded what we saw in 2008.So far gasoline prices aren't above the 2011 peak levels, although they are getting close. I'm not sure 2008 counts since that is more than 3 years ago.

Another post from Hamilton two days ago: Crude oil and gasoline prices. Just something to think about ...

Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Bank Failure #11 in 2012: Home Savings of America, Little Falls, Minnesota

by Calculated Risk on 2/24/2012 06:13:00 PM

Where the Feds often will play

Where seldom is heard,

A bid for this turd,

And the skies are not cloudy all day

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of Home Savings of America, Little Falls, Minnesota

As of December 31, 2011, Home Savings of America had $434.1 million in total assets and $432.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $38.8 million. Home Savings of America is the eleventh FDIC-insured institution to fail in the nation this year, and the second in Minnesota.We haven't seen a payout in some time ... I guess no one wanted this one.

Bank Failure #10 in 2012: Central Bank of Georgia, Ellaville, Georgia

by Calculated Risk on 2/24/2012 05:10:00 PM

Feds in Georgia discover

Deposits to dust

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Assumes All of the Deposits of Central Bank of Georgia, Ellaville, Georgia

As of December 31, 2011, Central Bank of Georgia had approximately $278.9 million in total assets and $266.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $67.5 million. ... Central Bank of Georgia is the tenth FDIC-insured institution to fail in the nation this year, and the second in Georgia.Here is a "central bank" that failed ...

Lawler: Declining Inventory of Existing Homes for Sale: Don’t Forget Conversion to Rentals

by Calculated Risk on 2/24/2012 03:16:00 PM

CR Note: Yesterday I posted some thoughts on the sharp decline in listed inventory. Here are some additional comments from housing economist Tom Lawler:

While there has been a lot of discussion among analysts on the reasons behind the “stunning” plunge in existing SF homes listed for sale over the past several years, few have mentioned what appears to have been a substantial increase in the number of SF homes purchased by investors with the explicit intention to rent the homes out for several years. One reason, of course, is that there are not good, reliable, and timely statistics on the number of SF homes rented out, much less any data at all on the intended holding-period of folks renting out SF homes. There are, of course, lots of anecdotal stories about a surge in the number of investors (including LLCs, hedge funds, etc.) buying SF properties, especially REO properties, because of attractive rental yields; there are some data from local MLS on leasing activity showing a surge in the past several years; and there are certainly surveys pointing not just to an increase in investor buying of homes, but a rise in the cash share of investors purchases over the past several years. But there is a dearth of actual data.

Data from the ACS does suggest that the share of occupied SF detached homes that were occupied by renters increased rather dramatically in the latter part of last decade, The below table is based on decennial Census data for 2000, and the 5-year, 3-year, and 1-year estimates from the ACS for 2006-10, 2008-10, and 2010.

While last year there was a drop in completed foreclosures, there was no corresponding drop in the sales of REO properties, many of which were to investors not planning to “flip” properties, but to rent them out. Short sales also increased last year, and anecdotal evidence suggests that a non-trivial share were to investors looking to rent the properties out. I’d guess that the 2011 data will suggest that the share of occupied SF detached homes occupied by renters will come in at around 16%.

Net, a not insignificant share of the decline in the share of homes for sale reflects the acquisition of SF (and condo) properties by investors as multi-year rental properties.

| Percent of Occupied Single Family Detached Homes Occupied by Renters | ||||

|---|---|---|---|---|

| 2000 | 2006-07 Avg. | 2008-09 Avg. | 2010 | |

| US | 13.2% | 12.8% | 14.3% | 15.1% |

| Maricopa County | 10.4% | 13.5% | 16.8% | 19.8% |

| Clark County | 12.5% | 18.2% | 22.0% | 24.4% |

| Sacramento County | 18.8% | 16.7% | 20.2% | 22.4% |

| Lee County | 10.6% | 12.3% | 14.6% | 17.3% |

New Home Sales: 2011 Still the Worst Year, "Distressing Gap" remains very wide

by Calculated Risk on 2/24/2012 12:09:00 PM

Even with the upward revisions to new home sales in October, November and December, 2011 was the worst year for new home sales since the Census Bureau started tracking sales in 1963. The three worst years were 2011, 2010, and 2009 with sales of 304, 323 and 375 thousand respectively.

Sales will probably increase in 2012, and sales will also probably be higher than the 323 thousand in 2010. But I expect this year will still be the third worst on record.

The following graph shows the recent minor increase off the bottom for new home sales:

Click on graph for larger image.

Click on graph for larger image.

Not much of an increase.

Last month I posted a few housing forecasts for 2012. The forecasts for new home sales ranged from 330 thousand to 365 thousand (excluding Moody's) - and that wouldn't be much of an increase from the current level.

The second graph shows existing home sales (left axis) and new home sales (right axis) through January. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

I expect this gap to eventually close once the number of distressed sales starts to decline.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

On January New Home Sales:

• New Home Sales in January at 321,000 Annual Rate

• New Home Sales graphs

Earlier this week on Existing Home sales:

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

New Home Sales in January at 321,000 Annual Rate

by Calculated Risk on 2/24/2012 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 321 thousand. This was down from a revised 324 thousand in December (revised up from 307 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in January 2011 were at a seasonally adjusted annual rate of 321,000. This is below the revised December rate of 324,000 and is 3.5 percent above the January 2011 estimate of 310,000.

Click on graph for larger image.

Click on graph for larger image.

The second graph shows New Home Months of Supply.

Months of supply decreased to 5.6 in January. This is the lowest level since January 2006.

The all time record was 12.1 months of supply in January 2009.

This is now normal (less than 6 months supply is normal).

This is now normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of January was 151,000. This represents a supply of 5.6 months at the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 57,000 units in January. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In January 2012 (red column), 22 thousand new homes were sold (NSA). This was the second weakest January since this data has been tracked. The record low for January was 21 thousand set in 2011. The high for January was 92 thousand in 2005.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up.It appears New Home sales have started to slowly increase. I'll have more later.