by Calculated Risk on 8/08/2012 12:02:00 PM

Wednesday, August 08, 2012

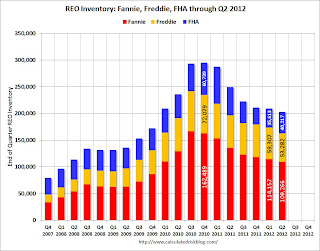

Fannie, Freddie, FHA REO declined 18% Year-over-year

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

According to Fannie Mae, "foreclosures continue to proceed at a slow pace", even following the mortgage settlement:

Our foreclosure rates remain high; however, foreclosures continue to proceed at a slow pace caused by continuing foreclosure process issues encountered by our servicers and changing legislative, regulatory and judicial requirements. The delay in foreclosures, as well as a net increase in the number of dispositions over acquisitions of REO properties, has resulted in a decrease in the inventory of foreclosed properties since December 31, 2010.The bulk sales program has had a minimal impact so far:

In February 2012, FHFA announced the pilot of an REO initiative that solicited bids from qualified investors to purchase approximately 2,500 foreclosed properties from us with the requirement to rent the purchased properties for a specified number of years. The pilot involves the sale of pools of foreclosed homes including both vacant properties and occupied rental properties. The first pilot transaction involves the sale of pools of properties located in geographically concentrated locations across the United States. The winning bidders have been chosen and transactions are expected to close in the third quarter of 2012. We do not yet know whether this initiative will have a material impact on our future REO sales and REO inventory levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and the FHA.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. Most analysts expect an increase in foreclosures, and the number of REO might increase over the next several quarters.

Although REO was down for Fannie and Freddie in Q2 from Q1, but REO increased for the FHA - this is something to watch.