by Calculated Risk on 7/21/2012 01:01:00 PM

Saturday, July 21, 2012

Schedule for Week of July 22nd

Earlier:

• Summary for Week Ending July 20th

This will be an important week for economic data. The key U.S. economic report for the coming week is the Q2 advance GDP report to be released on Friday; this is the last major economic release before the FOMC meeting the following week.

Also New Home sales will be released on Wednesday.

For manufacturing, two regional manufacturing reports will be released (Richmond and Kansas City Fed surveys).

8:30 AM: Chicago Fed National Activity Index (June). This is a composite index of other data.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for July. The consensus is for a reading of 52.6, down slightly from 52.9 in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for an increase to 0 for this survey from -3 in June (above zero is expansion).

10:00 AM: FHFA House Price Index for May 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.3% increase in house prices.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM ET: New Home Sales for June from the Census Bureau.

10:00 AM ET: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for an increase in sales to 370 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 369 thousand in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 380 thousand from 386 thousand.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

10:00 AM ET: Pending Home Sales Index for June. The consensus is for a 0.9% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for July. The consensus is for an increase to 4 from 3 in June (above zero is expansion).

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.2% annualized in Q2.

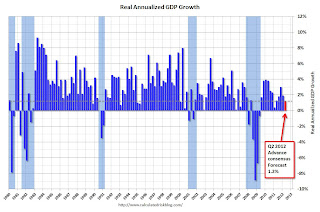

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.2% annualized in Q2.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q2 GDP. The BEA will also release the revised estimates for 2009 through First Quarter 2012.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for no change from the preliminary reading of 72.0.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.