by Calculated Risk on 6/02/2012 08:59:00 PM

Saturday, June 02, 2012

Schedule for Week of June 3rd

Earlier:

• Summary for Week Ending June 1st

Employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

• Employment Graphs

The key report this week is the April Trade Balance report.

Also the ISM non-manufacturing (service) index will be released on Tuesday.

Fed Chairman Ben Bernanke will provide Senate testimony on Thursday. There are several Fed speeches scheduled this week, and the Fed Beige Book will be released on Wednesday.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 0.1% increase in orders.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for May (a measure of transportation).

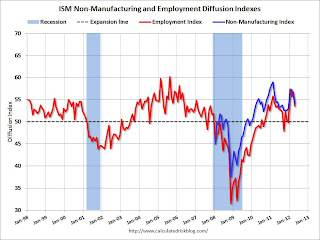

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for the index to be unchanged at 53.5. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for the index to be unchanged at 53.5. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index. The index declined sharply in April.

10:00 AM: Trulia Price & Rent Monitors for May. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record low mortgage rates and probably an increase in refinance activity.

8:30 AM: Productivity and Costs for Q1 (Final). The consensus is for a 2.1% increase in unit labor costs.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This will receive extra attention this month as investors look for signs of a slowdown.

7:00 PM: Speech by Fed Vice Chair Janet Yellen, "The Economic Outlook and Monetary Policy", At the Boston Economic Club Dinner, Boston, Massachusetts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 379 thousand from 383 thousand last week.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, "Economic Outlook and Policy", before the Joint Economic Committee, U.S. Senate.

3:00 PM: Consumer Credit for April. The consensus is for a $12.0 billion increase in consumer credit.

12:00 PM: Q1 Flow of Funds Accounts from the Federal Reserve.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. Exports increased in March, and were at record levels. Imports increased even more. Exports are 13% above the pre-recession peak and up 7% compared to March 2011; imports are 3% above the pre-recession peak, and up about 8% compared to March 2011.

The consensus is for the U.S. trade deficit to decrease to $49.3 billion in April, down from from $51.8 billion in March. Export activity to Europe will be closely watched due to economic weakness. Also oil prices started to decline in April, but that probably won't reduce imports until May.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.5% increase in inventories.