by Calculated Risk on 2/08/2011 11:07:00 AM

Tuesday, February 08, 2011

CoreLogic: House Prices declined 1.8% in December

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from November to December 2010. The CoreLogic HPI is a three month weighted average of October, November, and December and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Decline for Fifth Straight Month

CoreLogic ... released its December Home Price Index (HPI) which shows that home prices in the U.S. declined for the fifth month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 5.46 percent in December 2010 compared to December 2009 and declined by 4.39 percent in November 2010 compared to November 2009.

Excluding distressed sales, year-over-year prices declined by 2.31 percent in December 2010 compared to December 2009 and declined by 2.81 percent in November 2010 compared to November 2009.

...

According to Mark Fleming, chief economist with CoreLogic, 2010 was a year of ups and downs as a result of the improvements brought on by the tax credits followed by the declines that occurred when they expired. “It was a bumpy ride which ended with a net gain/loss of zero. Despite the continued monthly decline in home prices and year-over-year depreciation, we’re encouraged that on an annual basis we’re unchanged relative to a year ago. Excess supply continues to drive prices downward, but the silver lining is that the rate of decline is decelerating,” he said.

Click on graph for larger image in graph gallery.

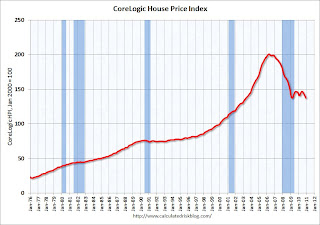

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.46% over the last year, and off 31.6% from the peak.

This is the fifth straight month of year-over-year declines, and the sixth straight month of month-to-month declines. The index is only 0.07% above the low set in March 2009 (essentially at the low), and I expect to see a new post-bubble low for this index with the January release.