by Calculated Risk on 12/09/2010 01:14:00 PM

Thursday, December 09, 2010

Q3 Flow of Funds: Household Real Estate assets declined $650 Billion in Q3 2010

The Federal Reserve released the Q3 2010 Flow of Funds report this morning: Flow of Funds.

According to the Fed, household net worth is now off $11 Trillion from the peak in 2007, but up $5.8 trillion from the trough in Q1 2009.

The Fed estimated that the value of household real estate fell $684 billion to $16.55 trillion in Q3 2010, from $17.2 trillion in Q2 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

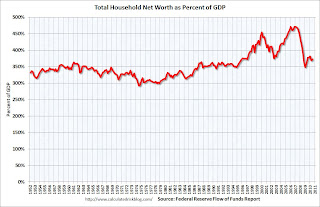

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices collapsed in 2007 and 2008.

In Q3 2010, household percent equity (of household real estate) declined to 38.8% as the value of real estate assets fell by almost $650 billion.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.8% equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $65 billion in Q3. Mortgage debt has now declined by $488 billion from the peak. Studies suggest most of the decline in debt has been because of defaults.

Assets prices, as a percent of GDP, have fallen significantly and are not far above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.