by Calculated Risk on 3/16/2010 09:32:00 PM

Tuesday, March 16, 2010

Some previous FOMC forecasts

This is just a reminder to take FOMC forecasts with a grain of salt.

First, the NBER determined that the great recession started in December 2007, and the FOMC met that same month - so we can see what they were thinking. The participant were aware that the incoming data was weakening, but their outlook was still for growth in 2008 and beyond ...

From the December 2007 FOMC Minutes:

In their discussion of the economic situation and outlook, participants generally noted that incoming information pointed to a somewhat weaker outlook for spending than at the time of the October meeting. The decline in housing had steepened, and consumer outlays appeared to be softening more than anticipated, perhaps indicating some spillover from the housing correction to other components of spending. These developments, together with renewed strains in financial markets, suggested that growth in late 2007 and during 2008 was likely to be somewhat more sluggish than participants had indicated in their October projections. Still, looking further ahead, participants continued to expect that, aided by an easing in the stance of monetary policy, economic growth would gradually recover as weakness in the housing sector abated and financial conditions improved, allowing the economy to expand at about its trend rate in 2009.And here are the October projections mentioned in the December minutes:

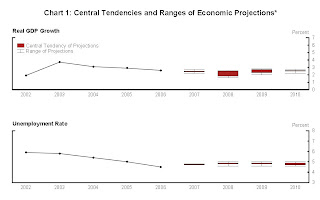

Click on graph for larger image in new window.

Click on graph for larger image in new window.In October 2007, FOMC participants were forecasting GDP in the 2% range in 2008 with a return to trend growth in 2009, and the unemployment rate rising to perhaps 5%. How did that work out?

Of course this is nothing new. Here are a few quotes from Fed Chairman Alan Greenspan back in 1990 (bear in mind that the recession started in July, 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].” Greenspan, July 1990Of course I started marking my graphs with recession blue bars in January 2008 (I had luckily predicted the December start to the recession). Although my current view is for sluggish and choppy growth in 2010, there are still some downside risks - especially in the 2nd half of the year. Right now I think Q1 GDP growth will be sluggish, and the impact from the stimulus will fade over the year.

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.” Greenspan, August 1990

“... the economy has not yet slipped into recession.” Greenspan, October 1990