by Calculated Risk on 11/19/2009 01:14:00 PM

Thursday, November 19, 2009

Hotel RevPAR off 15.7 Percent

From HotelNewsNow.com: New Orleans leads ADR, RevPAR declines in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 6.4 percent to end the week at 52.6 percent, ADR dropped 9.9 percent to US$95.86, and RevPAR decreased 15.7 percent to finish at US$50.47.

Click on graph for larger image in new window.

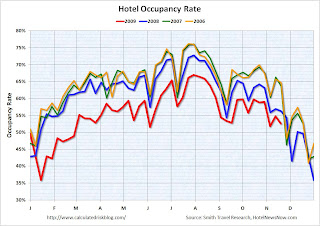

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008 (and will be late in 2009), so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 6.4% compared to 2008, occupancy is off about 18% compared to 2006 and 2007.

Smith Travel Research released an updated hotel forecast 2011 can’t get here too soon .

Occupancy: 2009 will end at -8.8 percent (revised from -8.4 percent); 2010 figures will be down 0.2 percent (revised from -0.6 percent); and 2011 will be up 2.4 percent.Here is a PDF of the new forecast (free registration required)

Average daily rate: 2009 will close down 8.9 percent (revised from -9.7 percent); 2010 will be down 3.4 percent (unchanged from previous forecast); and 2011 will be up 5.5 percent.

“In the current cycle, it’s increasingly easy to predict supply and a little easier to predict demand,” [Mark Lomanno, STR’s president] said. “What is difficult is predicting rate growth ... how aggressive the industry will be in raising rates is virtually impossible to predict.”

...

Revenue per available room: 2009’s RevPAR will decline 17.0 percent (revised from 17.1 percent; it will drop 3.6 percent in 2010 (revised from -4.0 percent) before jumping 5.5 percent in 2011.

Supply: The number of guestrooms will end 2009 up 3.2 percent (revised from +3.0 percent); up 1.8 percent in 2010; and up 0.8 percent in 2011.

“The construction pipeline will mostly be built between now and early 2011,” Lomanno said.

...

Demand: Room demand in 2009 will be down 6.0 percent (revised from -5.5 percent) before turning positive in 2010 at +1.6 percent (revised from +1.3 percent). Demand will grow 3.2 percent in 2011, according to the STR forecast.

...

“Clearly commercial real estate will be a second shoe dropping in 2010,” [Randy Smith, STR’s co-founder and chairman] said. “That’s going to be a process that will hurt demand for the hotel industry. A huge chunk of demand for our industry will continue to be wiped out as long as the construction industry is on its back.”

The good news is the supply of new hotels is slowing sharply. The bad news is that means less construction employment - and also negatively impacts hotel occupancy.