by Calculated Risk on 9/30/2009 04:02:00 PM

Wednesday, September 30, 2009

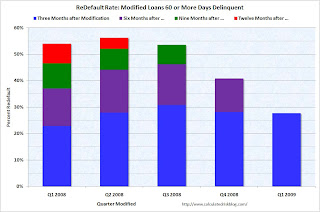

OCC and OTS: Modification Re-Default Rates

Here is some more data from the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Second Quarter 2009

Modified Loan Performance ... [T]he percentage of loans that were 60 or more days delinquent or in the process of foreclosure rose steadily in the months subsequent to modification for all vintages for which data were available. Modifications made in third quarter 2008 showed the highest percentage of modifications that were 60 or more days past due following the modification. Modifications made during fourth quarter 2008 and first quarter 2009 performed better in the first three to six months after the modification than those made in the third quarter 2008.Note: This doesn't include HAMP yet because all of those modifications are still in the "trial period". That raises a question: If a borrower re-defaults during the trial, will they still be considered a "re-default"? Something to watch for if the re-default rate drops sharply next quarter - they might be excluding the trial period re-defaulters.

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative re-default rate by quarter of modifications. About 25% to 30% of modifications fail in the first three months.

For Q1 and Q2 2008, about 55% of borrowers have re-defaulted. Q3 2008 will probably be worse, and Q4 2008 and Q1 2009 about the same.

Over time, I expect a very high re-default rate since many of these modifications are just "extend and pretend" (the missed payments and fees are added to the principal, and the rate is reduced for a few years), although about 10% of borrowers received a principal reduction in Q2 (more than double as in Q1).