by Calculated Risk on 7/09/2009 12:14:00 AM

Thursday, July 09, 2009

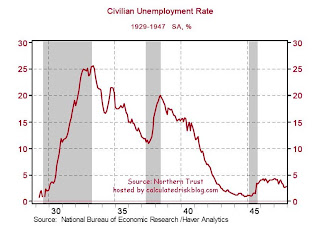

Depression Era Unemployment Rate

Just for information purposes, the following graph is from Northern Trust.

What was the high of the unemployment rate in the Great Depression?

The civilian unemployment rate was around 25% during several months of 1932-1933

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the unemployment rate from 1929 through 1947.

The surge in unemployment in 1937 was related to an attempt to unwind the monetary and fiscal stimulus policies, with disastrous results for employment. Just something to remember when the Fed and Treasury start to unwind the current stimulus programs.

Several people have commented on 1937 lately ...

Alan Blinder wrote in the New York Times in May:

From its bottom in 1933 to 1936, the G.D.P. climbed spectacularly (albeit from a very low base), averaging gains of almost 11 percent a year. But then, both the Fed and the administration of Franklin D. Roosevelt reversed course.And from Paul Krugman in the NY Times in June:

In the summer of 1936, the Fed looked at the large volume of excess reserves piled up in the banking system, concluded that this mountain of liquidity could be fodder for future inflation, and began to withdraw it. ...

About the same time, President Roosevelt looked at what seemed to be enormous federal budget deficits, concluded that it was time to put the nation’s fiscal house in order and started raising taxes and reducing spending. ...

Thus, both monetary and fiscal policies did an abrupt about-face in 1936 and 1937, and the consequences were as predictable as they were tragic. The United States economy, which had been rapidly climbing out of the cellar from 1933 to 1936, was kicked rudely down the stairs again ...

The first example of policy in a liquidity trap comes from the 1930s. The U.S. economy grew rapidly from 1933 to 1937, helped along by New Deal policies. America, however, remained well short of full employment.

Yet policy makers stopped worrying about depression and started worrying about inflation. The Federal Reserve tightened monetary policy, while F.D.R. tried to balance the federal budget. Sure enough, the economy slumped again, and full recovery had to wait for World War II.