by Calculated Risk on 6/15/2009 12:06:00 AM

Monday, June 15, 2009

Krugman: Stay the Course

From Paul Krugman in the NY Times: Stay the Course

The debate over economic policy has taken a predictable yet ominous turn: the crisis seems to be easing, and a chorus of critics is already demanding that the Federal Reserve and the Obama administration abandon their rescue efforts. For those who know their history, it’s déjà vu all over again — literally.Let me add I think the "green shoots" metaphor we keep hearing is wrong. That implies new growth and some sort of immaculate recovery. Yes, right now the pace of contraction appears to have slowed - and that is good news - but even if we are nearing the bottom of the economic cliff, the eventual "recovery" will be very sluggish.

For this is the third time in history that a major economy has found itself in a liquidity trap ...

The first example of policy in a liquidity trap comes from the 1930s. The U.S. economy grew rapidly from 1933 to 1937, helped along by New Deal policies. America, however, remained well short of full employment.

Yet policy makers stopped worrying about depression and started worrying about inflation. The Federal Reserve tightened monetary policy, while F.D.R. tried to balance the federal budget. Sure enough, the economy slumped again, and full recovery had to wait for World War II.

The second example is Japan in the 1990s. After slumping early in the decade, Japan experienced a partial recovery, with the economy growing almost 3 percent in 1996. Policy makers responded by shifting their focus to the budget deficit, raising taxes and cutting spending. Japan proceeded to slide back into recession.

And here we go again.

...

To sum up: A few months ago the U.S. economy was in danger of falling into depression. Aggressive monetary policy and deficit spending have, for the time being, averted that danger. And suddenly critics are demanding that we call the whole thing off, and revert to business as usual.

Those demands should be ignored. It’s much too soon to give up on policies that have, at most, pulled us a few inches back from the edge of the abyss.

As I've written over and over (see A Return to Trend Growth in 2010? and The Impact of Changes in the Saving Rate on PCE ), the usual engines of recovery - personal consumption expenditures (PCE) and residential investment (RI) - will both remain under pressure (even if they show some sluggish growth).

The end of cliff diving is not the same as new growth.

And look at the unemployment rate ...

UPDATE: ht Geoff at Innocent Bystanders

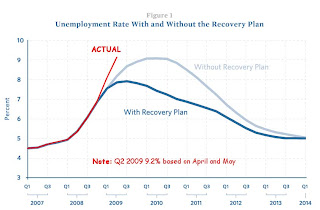

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the actual quarterly unemployment rate (in red) with the Obama economic forecast from January 10th: The Job Impact of the American Recovery and Reinvestment Plan

If anything the situation is worse than expected, not better.