by Calculated Risk on 1/31/2009 01:44:00 AM

Saturday, January 31, 2009

January Economic Summary in Graphs

Here is a collection of 20 real estate and economic graphs from January ... New Home Sales in December

New Home Sales in December

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for December since 1966. (NSA, 23 thousand new homes were sold in December 2008, 23 thousand were sold in December 1966). As the graph indicates, sales in 2008 are substantially worse than the previous years. From: Record Low New Homes Sales in December Housing Starts in December

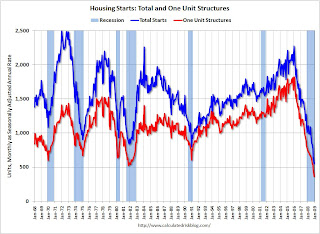

Housing Starts in December

Total housing starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959.

Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in December, suggesting single family starts may fall even further next month. From: Housing Starts at All Time Low  Construction Spending in November

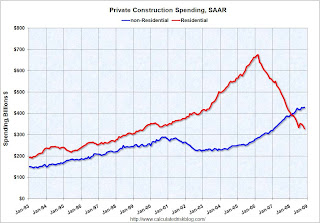

Construction Spending in November

This graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending held up as builders completed projects. This showed up in the Q4 GDP report too (non-residential investment in structures was off only slightly in Q4). From: Construction Spending Declines in November Strip Mall Vacancy Rate

Strip Mall Vacancy Rate

REIS reported: "At neighborhood and community shopping centers, the vacancy rate rose to 8.9 percent from 8.4 percent in the third quarter, the highest since Reis began publishing quarterly data in 1999."

This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change. Strip mall vacancy rates are headed for double digits this year. From: Mall Vacancies Reach 10-Year High  December Employment Report

December Employment Report

This graph shows the unemployment rate and the year over year change in employment vs. recessions. The unemployment rate rose to 7.2 percent; the highest level since January 1993.

Nonfarm payrolls decreased by 524,00 in December, and November payrolls were revised down to a loss of 584,000 jobs. The economy lost over 1.5 million jobs in Q4 alone! From: Employment Declines Sharply, Unemployment Rises to 7.2 Percent  December Retail Sales

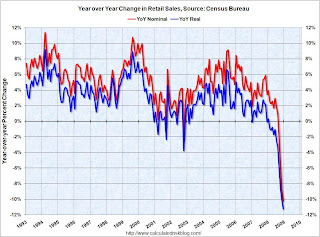

December Retail Sales

This graph shows the year-over-year change in nominal and real retail sales since 1993.

Although the Census Bureau reported that nominal retail sales decreased 10.2% year-over-year (retail and food services decreased 9.8%), real retail sales declined by 11.3% (on a YoY basis). This is the largest YoY decline since the Census Bureau started keeping data. From: Retail Sales Collapse in December  LA Port Traffic in December

LA Port Traffic in December

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Inbound traffic was 19% below last December. For the LA area ports, outbound traffic continued to decline in December, and was 30% below the level of December 2007. From: LA Area Port Traffic Collapses in December December Capacity Utilization

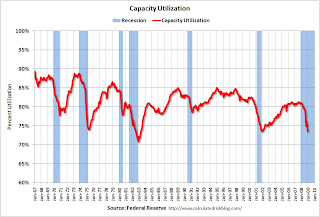

December Capacity Utilization

Capacity utilization fell to 73.6% from 75.2%. This is the lowest level since December 2001.

The significant decline in capacity utilization suggests less investment in non-residential structures for some time. From: Capacity Utilization and Industrial Production Cliff Diving  Vehicle Sales

Vehicle Sales

This graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

This shows that sales have plunged to just over a 10 million annual rate - the lowest rate since the early '80s recession. From: Vehicle Sales NAHB Builder Confidence Index in January

NAHB Builder Confidence Index in January

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The builder confidence index was at 8 in January, a new record low. From: NAHB Housing Market Index Falls to New Record Low  Architecture Billings Index for December

Architecture Billings Index for December

The American Institute of Architects (AIA) reported the December ABI rating was 36.4, up from the 34.7 mark in November (any score above 50 indicates an increase in billings).

From: Architecture Billings Index Near Record Low Vehicle Miles driven in November

Vehicle Miles driven in November

This graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off a record 3.7% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in November 2008 were 5.4% less than November 2007, so the YoY change in the rolling average may get worse. From: DOT: U.S. Vehicle Miles Driven Declines Sharply Existing Home Sales in December

Existing Home Sales in December

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2008 (4.74 million SAAR) were 6.5% higher than last month, and were 3.5% lower than December 2007 (4.91 million SAAR). From: Existing Home Sales Increase in December Existing Home Inventory

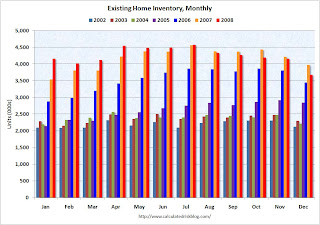

Existing Home Inventory

This graph shows inventory by month starting in 2002. Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle. From: Existing Home Sales (NSA)  Case Shiller House Prices for November

Case Shiller House Prices for November

This graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 26.6% from the peak. The Composite 20 index is off 25.1% from the peak. From: Case-Shiller: House Prices Fall Sharply in November  California Notices of Default

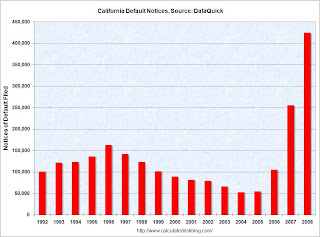

California Notices of Default

This graph shows the Notices of Default (NOD) by year in California from DataQuick.

There were a record 423,962 NODs filed in 2008, breaking the old record of 254,824 NODs in 2007.

The previous record had been in 1996 with 162,678 NODs filed. That was during the previous California housing bust in the early to mid-90s. From: DataQuick: Temporary Drop in California Foreclosure Activity ATA Truck Tonnage Index

ATA Truck Tonnage Index

"The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index plunged 11.1 percent in December 2008, marking the largest month-to-month reduction since April 1994, when the unionized less-than-truckload industry was in the midst of a strike. December’s drop was the third-largest single-month drop since ATA began collecting the data in 1973." From: Truck Tonnage Index: Cliff Diving Unemployment Claims

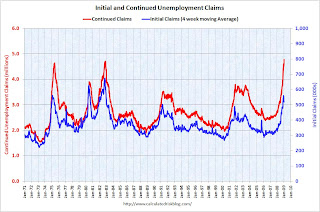

Unemployment Claims

This graph shows weekly claims and continued claims since 1971.

The four week moving average is at 542,500; still below the recent peak of 558,750

in December.

Continued claims are now at 4.78 million - a new record (not adjusted for population) - just above the previous all time peak of 4.71 million in 1982. From: Continued Unemployment Claims at Record High  Restaurant Performance Index for December

Restaurant Performance Index for December

"The Association's Restaurant Performance Index (RPI) - a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry - stood at 96.4 in December, down 0.2 percent from November and its 14th consecutive month below 100."

From: Restaurant Performance Index at New Low New Home Sales

New Home Sales

This graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

From: Record Low New Homes Sales in December