by Calculated Risk on 1/27/2009 01:40:00 PM

Tuesday, January 27, 2009

DataQuick: Temporary Drop in California Foreclosure Activity

Click on graph for larger image in new window.

Click on graph for larger image in new window.

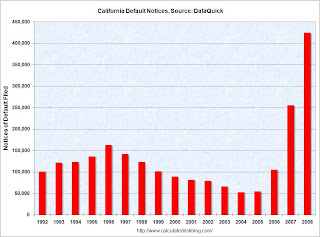

This graph shows the Notices of Default (NOD) by year in California from DataQuick.

There were a record 423,962 NODs filed in 2008, breaking the old record of 254,824 NODs in 2007.

The previous record had been in 1996 with 162,678 NODs filed. That was during the previous California housing bust in the early to mid-90s.

From DataQuick: Temporary Drop in California Foreclosure Activity

The number of mortgage default notices filed against California homeowners fell last quarter to its lowest level in more than a year, the temporary result of a procedural change that took effect in September, a real estate information service reported.

Lending institutions sent homeowners 75,230 default notices during the October-through-December period. That was down 20.2 percent from 94,240 for the prior three months, and down 7.7 percent from 81,550 for fourth-quarter 2007, according to MDA DataQuick.

Recorded default notices peaked in second-quarter 2008 at 121,673.

...

While recordings were back up to 39,993 in December it's unclear whether lenders were mainly playing catch-up, or whether a new wave of foreclosure activity was building.

"No one expected defaults to stay at the much lower levels we saw immediately after the new law took effect last fall. The bigger question is whether or not the housing market has hit a low and is dragging along bottom, or if the markets that so far have remained unaffected by the foreclosure problem are due for a fall. With today's atypical market trends, it's impossible to predict," said John Walsh, DataQuick president.

Most foreclosure activity was still concentrated in affordable inland areas where the availability of so-called subprime financing fueled a buying and refinancing frenzy in 2005/2006. Those sub-markets, which represent about 25 percent of the state's housing stock, account for more than 50 percent of the default activity. That ratio is the same now as a year ago, indicating that the problem has not yet migrated into more established, expensive markets.

Most of the loans that went into default last quarter were originated between October 2005 and January 2007. The median age was 29 months, up from 21 months a year earlier. More than three million home loans were originated in 2006. That dropped to two million in 2007, and 1.1 million last year.