by Calculated Risk on 10/31/2008 09:33:00 PM

Friday, October 31, 2008

FDIC Bank Failures

Just to put the 17 bank failures this year into perspective, here are insured bank failures by year since the FDIC was founded: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Of course the size of the failed banks, and the cost to the FDIC, also matter.

The failure today, Freedom Bank, was a small bank by asset size ($287 million). Still the size of the cost to the FDIC is pretty amazing compared to the size of the bank (cost estimated at between $80 million and $104 million). Many analysts expect over 100 bank failures. Dr. Roubini expects "hundreds of banks" to fail in the cycle. If so, we are just getting started.

Note: there are 8,451 FDIC insured banks as of Q3 2008.

Bank Failure #17: Freedom Bank, Bradenton, Florida

by Calculated Risk on 10/31/2008 06:41:00 PM

From the FDIC: Fifth Third Bank Acquires All the Deposits of Freedom Bank, Bradenton, Florida

Freedom Bank, Bradenton, Florida, was closed today by the Commissioner of the Florida Office of Financial Regulation, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Fifth Third Bank, Grand Rapids, Michigan, to assume all of the deposits of Freedom Bank.Happy Halloween!

...

As of October 17, 2008, Freedom Bank had total assets of $287 million and total deposits of $254 million. Fifth Third agreed to assume all the deposits for a premium of 1.16 percent. In addition to assuming the failed bank's deposits, Fifth Third will purchase approximately $36 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be between $80 million and $104 million. Fifth Third's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. The last failure in Florida was First Priority Bank, Bradenton, which was closed on August 1, 2008. Freedom Bank is the seventeenth FDIC-insured institution to be closed this year.

IMF to Bailout Pakistan

by Calculated Risk on 10/31/2008 04:34:00 PM

Form the Telegraph: Pakistan to receive $9bn from IMF in fight against bankruptcy

Pakistan is to receive a $9bn (£5.5bn) bail-out loan from the International Monetary Fund as the country has three weeks to stave off bankruptcy. ... The IMF agreed in principle to a billion dollar economic stabilisation plan for Pakistan during a week-long meeting with Pakistani officials in Dubai ... Pakistan needs at least $4bn to avoid defaulting on its foreign debts ...Iceland, Hungary, Ukraine and Pakistan ... the list is growing.

Credit Crisis Indicators: Some Progress

by Calculated Risk on 10/31/2008 02:17:00 PM

The London interbank offered rate, or Libor, for three month loans in dollars slid 0.16 point to 3.03 percent, the 15th consecutive drop, according to the British Bankers' Association.The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.36% yesterday), so a 3 month yield of 0.42% is in the right range. I'd like to see the effective funds rate closer to the target rate.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper - and increasing the spread between AA and A2/P2 CP. So this indicator is a little misleading right now. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off a little, but the A2P2 spread is at a record high probably because of the Fed buying CP - so there is some progress.

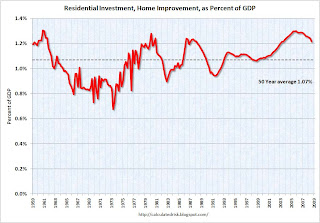

Residential Investment and Home Improvement

by Calculated Risk on 10/31/2008 11:49:00 AM

We frequently discuss "residential investment" (RI) without mentioning the components of RI according to the Bureau of Economic Analysis (BEA). Residential investment includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement ($175.2 billion SAAR) is almost at the same level as investment in single family structures ($176.0 billion SAAR) in Q3 2008.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

Currently investment in single family structures is at 1.22% of GDP, significantly below the average of the last 50 years of 2.35% - and just above the record low in 1982 of 1.20%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.21% of GDP, off the high of 1.3% in Q4 2005 - but still well above the average of the last 50 years of 1.07%. Maybe lenders are boosting home improvement spending fixing up all those damaged REOs!

This would seem to suggest there is significant downside risk to home improvement spending over the next couple of years.

Frank: Bailout Funds are for Lending

by Calculated Risk on 10/31/2008 10:35:00 AM

From Reuters: Rep. Frank: bailout funds must be used for lending (hat tip Yal)

"I am deeply disappointed that a number of financial institutions are distorting the legislation that Congress passed at the president's request to respond to the credit crisis by making funds available for increased lending," Rep. Barney Frank said in a statement.But money is fungible, so how do we tell which funds are being used for which purpose?

"Any use of the these funds for any purpose other than lending -- for bonuses, for severance pay, for dividends, for acquisitions of other institutions, etc. -- is a violation of the terms of the Act."

Architecture Billings Index: Falls "precipitously"

by Calculated Risk on 10/31/2008 10:04:00 AM

I overlooked the ABI this month (hat tip Karl). Here is the American Institute of Architects billing index for September: Architecture Billings Index Falls More than Six Points Click on graph for larger image in new window.

Click on graph for larger image in new window.

Following three consecutive months of signs of greater stability in design activity, the Architecture Billings Index (ABI) fell precipitously, dropping more than six points. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI rating was 41.4, down sharply from the 47.6 mark in August (any score above 50 indicates an increase in billings). The inquiries for new projects score was 51.0. This is also the first time in 2008 that the institutional sector has fallen below the 50 mark.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment in late 2008 and throughout 2009.

“With all of the anxiety and uncertainty in the credit market, the conditions are likely to get worse before they get better,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Many architects are reporting that clients are delaying or canceling projects as a result of problems with project financing.”

emphasis added

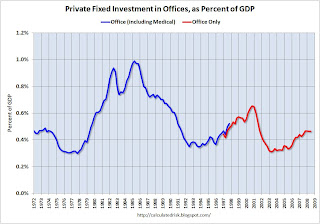

Q3: Office, Malls and Lodging Investment

by Calculated Risk on 10/31/2008 09:04:00 AM

Here are a couple of graphs for non-residential structure investment based on the underlying details for the Q3 GDP report.

Based on tighter lending standards, rising vacancy rates (lower occupancy rate for hotels), and the Architectural Billing index, and declining non-residential construction spending, it appears there will be a sharp slowdown in investment in offices, malls and hotels at the end of 2008 and through 2009.

So far this slowdown is not showing up in the BEA numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Investment in multimerchandise shopping structures (malls) increased slightly in Q3 2008, after peaking in Q4 2007.

Investment in lodging soared in Q3 to $48.3 billion (SAAR) from $36.5 billion (SAAR) in Q3 2007. This is probably due to builders rushing to finish projects.

This investment in lodging will probably decline sharply in the 2nd half of '08 and in '09 as builders cancel or postpone projects. As an example, from the WSJ: MGM Mirage Suspends Casino Projects as Profit Falls

Predevelopment work has been done on the MGM Grand Atlantic City, but the company will halt development until the economy and capital markets "are sufficiently improved," said Chairman and Chief Executive Terry Lanni.

He added that design and preconstruction work on its Las Vegas joint venture with Kerzner International and Istithmar is also being deferred.

MGM has been struggling to find financing to complete construction of its $11 billion CityCenter project on the Las Vegas Strip.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.With the office vacancy rate rising sharply, office investment will probably decline through 2009.

NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline through 2009.

Real Personal Spending Declined Sharply in September

by Calculated Risk on 10/31/2008 08:37:00 AM

As expected - based on the advance GDP report - the BEA reports that real Personal Consumption Expenditures (PCE) declined sharply in September.

The year-over-year change in real PCE is now negative for the first time since 1991.

The change from June (third month of Q2) to September declined at a 3.9% annual rate, the fastest 3 month decline since 1991. Note: I look at the change in the same month in each quarter (June to September here) to compare to the quarterly GDP report.

Here is the story from the WSJ: Consumer Spending Declines

Quotes on Possible Treasury Mortgage Plan

by Calculated Risk on 10/31/2008 12:29:00 AM

A few quotes from David Streitfeld's piece in the NY Times: Mortgage Plan May Aid Many and Irk Others

“Why am I being punished for having bought a house I could afford? I am beginning to think I would have rocks in my head if I keep paying my mortgage.”

Todd Lawrence, homeowner, outside Norwich, Conn.

“If the lunch truly is free, the demand for free lunches will be large.”

Paul McCulley, PIMCO

“If the government says, ‘Prove that you can’t afford your house and we’ll redo your mortgage,’ then people are going to try to qualify.”

Peter Schiff, President of Euro Pacific Capital

“I guess they are forcing me to deliberately stop paying to look worse than I am. Crazy, don’t you think?”

Anonymous Countrywide borrower, Los Angeles

Thursday, October 30, 2008

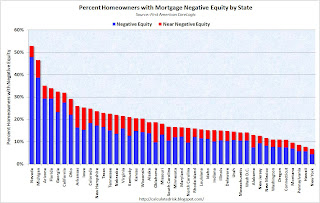

Report: Almost Half of Nevada Homeowners Underwater

by Calculated Risk on 10/30/2008 09:32:00 PM

The WSJ reports on a new report from First American CoreLogic that estimates 48% of homeowners with a mortgage in Nevada owe more than their homes are worth. The WSJ reports that First American CoreLogic estimates 18% of homeowners with a mortgage nationwide are underwater.

Using the Census Bureau 2007 estimate of 51.6 million households with mortgages, 18% would be 9.3 homeowners with negative equity. This is less than the recent estimate from Moody's Economy.com of 12 million households underwater. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the percent of homeowners with mortgages underwater by state (data from First American CoreLogic via the WSJ)

Note: there is no data for Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia and Wyoming.

It's interesting that the two worst states are Nevada and Michigan - one a bubble state, the other devastated by a poor economy. That pattern continues - everyone expects the bubble states of Arizona, Florida and California to be near the top of the list, and Ohio too because of the weak economy - but what about Arkansas, Iowa and even Texas?

The housing problems are everywhere.

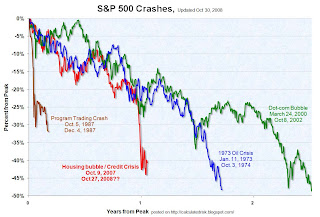

Comparing Stock Market Crashes

by Calculated Risk on 10/30/2008 07:22:00 PM

Fed Holds $145.7 Billion in Commercial Paper as of Oct 29

by Calculated Risk on 10/30/2008 04:47:00 PM

The Fed released the weekly balance sheet report today. The Fed reported that the Commercial Paper Funding Facility LLC holds $145.7 billion in 16 to 90 day commercial paper.

From Bloomberg: Fed Buys $145.7 Billion of Commercial Paper in Start of Program

The Federal Reserve bought commercial paper valued at $145.7 billion in the first days of the program aimed at backstopping the market, indicating the central bank is generating most of this week's record gains in short-term corporate borrowing.

The central bank extended $144.8 billion of loans as of yesterday to a unit that paid $143.9 billion for the debt, the Fed's weekly balance-sheet report said today.

Fed's Yellen: "Economy Contracting Significantly"

by Calculated Risk on 10/30/2008 03:57:00 PM

From San Francisco Fed President Dr. Janet Yellen: The Mortgage Meltdown, Financial Markets, and the Economy. Excerpt on the economic outlook:

[R]ecent data on the economy have been deeply worrisome. Data released this morning reveal that the economy contracted slightly in the third quarter. For the fourth quarter, it appears likely that the economy is contracting significantly. Mainly for this reason, inflationary risks have diminished greatly."It appears likely that the economy is contracting significantly". Strong words from a Fed president. Q4 is going to be ugly.

...

For consumers, the credit crunch is one of several negative factors accounting for the decline in spending in recent months. Consumer credit is costlier and harder to get: loan rates are up, loan terms are tougher, and increasing numbers of borrowers are being turned away entirely. This explains, in part, the exceptional weakness we have seen in auto sales. In addition, of course, employment has now declined for nine months in a row, and personal income, in inflation-adjusted terms, is virtually unchanged since April. Furthermore, household wealth is substantially lower as house prices have continued to fall and the stock market has declined sharply.

Business spending, too, is feeling the crunch in the form of a higher cost of capital and restricted access to credit. ... Some of our business contacts report that bank lines of credit are more difficult to negotiate, and many indicate that they have become cautious in managing liquidity, in committing to capital spending projects that can be deferred, and even in extending credit to customers and other

counterparties. Nonresidential construction also is headed lower largely because of the financial crisis; the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up.

...

Until recently, weakness in domestic final demand was offset by a major boost from exporting goods and services to our trading partners. Unfortunately, economic growth in the rest of the world has slowed noticeably. ... As a result, exports will not provide as much of an impetus to growth as they did earlier in the year.

emphasis

added

PCE: Worse in September

by Calculated Risk on 10/30/2008 03:12:00 PM

Just a quick note: Real Personal Consumption Expenditures (PCE) declined 3.1% (annualized) in Q3 according to the BEA Q3 Advance GDP report. This was the first decline since 1992, and real PCE was less in Q3 2008 than in Q3 2007!

This also suggests that spending declined sharply in September (or that earlier months were revised down).

My "two month" estimate for PCE in Q3 was -2.4%, and two Fed researchers proposed another method that forecast PCE of -2.3%.

Either way, the quarterly decline of -3.1% suggests that the decline in consumer spending was even worse in September than for July and August, and assuming no downward revision for the previous months, this indicates a decline of -4.4% (annual rate) for September compared to June.

Note: when comparing months, the headline number will be to the previous month (August in this case), but the better comparison - for comparing to the quarterly data - is to compare to the monthly data of the same month of the previous quarter (third month in Q2 or June).

The BEA will release the numbers for September tomorrow morning, and they will probably be ugly.

Cliff Diving du jour: Insurance Companies

by Calculated Risk on 10/30/2008 02:07:00 PM

From MarketWatch: Hartford Financial loses over half its market value

The company reported a big third-quarter loss late Wednesday and said that it couldn't gauge the amount of extra capital it has because of market volatility.Harford is off 51%

Assurant Inc is off 25%

Prudential Financial is off 22%

CIGNA Corp is off 22%

Office Vacancy Rate vs. Unemployment

by Calculated Risk on 10/30/2008 12:27:00 PM

One of the key components of non-residential structure investment is construction of new offices. When the supplemental data is released for Q3 GDP, I expect it will show that office investment started to decline in the most recent quarter - and I expect office investment will decline significantly over the next year.

The following graphs show office vacancy rate vs. unemployment (hat tip Will). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, we'd expect the office vacancy rate to rise too. And this will discourage investment in new office structures - and put significant pressure on office rents and prices. The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

I've added the polynomial trend line (with R^2 of 0.88). The two most recent quarters are marked in red.

This suggests that office vacancy rates are currently below the expected level, and vacancy rates will probably increase sharply over the next year.

Credit Crisis Indicators: Mixed

by Calculated Risk on 10/30/2008 10:56:00 AM

According to data from the British Bankers' Association, three-month U.S. dollar Libor fell to 3.1925% from Wednesday's fixing of 3.42%. The rate peaked at 4.81875% on Oct. 10.

The 3 month yield was close to zero for a few days, so this is still some improvement from the worst of the credit crisis. Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. Update: however, the effective Fed Funds rate is even lower (0.67% yesterday), so a 3 month yield of 0.48% is in the right range.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was 4.66, and there has been no progress here.

The LIBOR is down and the TED spread is off a little, but the A2P2 spread is at a record high - so there is some progress in some areas, and none by other measures.

Investment in Structures: Residential vs. Non-Residential

by Calculated Risk on 10/30/2008 09:09:00 AM

The following graph shows residential investment compared to investment in non-residential structures as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red).

Residential investment was 3.3% of GDP in Q3 2008, the lowest level since 1982 (just under 3.2%).

Non-residential investment in structures increased to almost 4% of GDP in Q3. This investment is slowing down right now (the Census Bureau has reported declines in non-residential investment for the last two months), and investment in non-residential structures will almost certainly be negative in Q4.

The positive contributions to GDP were exports, government spending, and investment in non-residential structures. Non-residential structures will be negative in Q4, and exports are slowing - so Q4 GDP will probably be much worse than Q3.

Note: I'll have much more on non-residential investment in offices, malls and hotels when the underlying details are released in a few days.

Q3 GDP Declines 0.3%

by Calculated Risk on 10/30/2008 08:30:00 AM

From the BEA: GROSS DOMESTIC PRODUCT: THIRD QUARTER 2008 (ADVANCE)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 0.3 percent in the third quarter of 2008 ...PCE declined -3.1% (annualized). This is the first decline in consumer spending since 1991.

The decrease in real GDP in the third quarter primarily reflected negative contributions from personal consumption expenditures (PCE), residential fixed investment, and equipment and software that were largely offset by positive contributions from federal government spending, exports, private inventory investment, nonresidential structures, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

Private investment declined -1.9%. I'll have some graphs on investment shortly.

IMF Creates $100 Billion Fund

by Calculated Risk on 10/30/2008 01:00:00 AM

From the WSJ: IMF Creates $100 Billion Fund to Aid Crisis Fight

The International Monetary Fund will offer as much as $100 billion in a new kind of loan to countries that are battered by the financial crisis ... The new three-month loans, aimed at economies the IMF judges to be troubled but basically sound, wouldn't require countries to make the often severe changes in their policies that the IMF has demanded for decades.The IMF has always required painful, some would argue too painful, changes to a country's fiscal policies in exchange for help. This is apparently true for the bailouts of Hungary and the Ukraine. This lending facility would not come with as many strings attached and might be useful for recapitalizing banks - but I'm not sure about the "defending currency" idea since that usually doesn't work.

...

The IMF's new program, called the Short Term Liquidity Facility, would be used largely to pad a country's reserves, which could help the recipient defend its currency. But the funds could also be used to help recapitalize banks or cover import bills.

The IMF plan is its clearest recognition that its insistence on tough conditions is driving away potential borrowers that might need its help. But the new plan also puts the IMF in the position of deciding who can have money with few strings attached, and who can't.

Wednesday, October 29, 2008

Wells Fargo Issues Shares to TARP for $25 Billion

by Calculated Risk on 10/29/2008 06:20:00 PM

Press Release: Wells Fargo Issues Shares in U.S. Treasury Capital Purchase

Wells Fargo ... announced today it has issued to the U.S. Department of the Treasury 25,000 shares of Wells Fargo’s Fixed Rate Cumulative Perpetual Preferred Stock, Series D without par value. The shares have a liquidation amount per share equal to $1,000,000, for a total price of $25 billion. This issuance is part of the Treasury Department’s Troubled Asset Relief Program (TARP) ...Now they have the money. Will they lend it?

As an aside, the National Debt has increased $880 billion since the beginning of September - that isn't a typo - almost $1 trillion in less than two months as the Treasury raises cash for the TARP and for the Fed's liquidity initiatives.

The National Debt is now $10.53 trillion. Remember when the debt passed $10 trillion? That was on September 30th ... less than one month ago.

Roubini: S&P500 May Decline Another 30%

by Calculated Risk on 10/29/2008 05:49:00 PM

Here is an interview with Professor Roubini this morning on Bloomberg:

Treasury, FDIC Considering Plan to Rework Millions of Mortgages

by Calculated Risk on 10/29/2008 03:49:00 PM

From the WaPo: Treasury, FDIC Crafting Plan to Rework Millions of Mortgages

Officials with the Treasury and the Federal Deposit Insurance Corp. are crafting a plan under which the government would guarantee the mortgages of as many as 3 million homeowners now struggling to avoid foreclosure ...

Under the program being discussed, the lender would agree to reduce borrowers’ monthly payments, for example by lowering the interest rate or principal of a mortgage loan, based on the homeowner’s ability to pay. ... the government would then guarantee to repay the lender for a portion of its loss if the borrower defaulted on the reconfigured loan.

More Swap Lines from the Fed

by Calculated Risk on 10/29/2008 03:34:00 PM

Today, the Federal Reserve, the Banco Central do Brasil, the Banco de Mexico, the Bank of Korea, and the Monetary Authority of Singapore are announcing the establishment of temporary reciprocal currency arrangements (swap lines). These facilities, like those already established with other central banks, are designed to help improve liquidity conditions in global financial markets and to mitigate the spread of difficulties in obtaining U.S. dollar funding in fundamentally sound and well managed economies.Next up, $30 billion for the Bank of CR & Tanta.

...

These new facilities will support the provision of U.S. dollar liquidity in amounts of up to $30 billion each by the Banco Central do Brasil, the Banco de Mexico, the Bank of Korea, and the Monetary Authority of Singapore.

These reciprocal currency arrangements have been authorized through April 30, 2009.

The FOMC previously authorized temporary reciprocal currency arrangements with ten other central banks: the Reserve Bank of Australia, the Bank of Canada, Danmarks Nationalbank, the Bank of England, the European Central Bank, the Bank of Japan, the Reserve Bank of New Zealand, the Norges Bank, the Sveriges Riksbank, and the Swiss National Bank.

Fed Funds Rate Cut 50 bps to 1.0%

by Calculated Risk on 10/29/2008 02:15:00 PM

FOMC statement:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 1 percent.

The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures. Business equipment spending and industrial production have weakened in recent months, and slowing economic activity in many foreign economies is damping the prospects for U.S. exports. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit.

In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate in coming quarters to levels consistent with price stability.

Recent policy actions, including today’s rate reduction, coordinated interest rate cuts by central banks, extraordinary liquidity measures, and official steps to strengthen financial systems, should help over time to improve credit conditions and promote a return to moderate economic growth. Nevertheless, downside risks to growth remain. The Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Richard W. Fisher; Donald L. Kohn; Randall S. Kroszner; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 1-1/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Cleveland, and San Francisco.

emphasis added

Report: GM-Chrysler Major Acquisition Issues Resolved

by Calculated Risk on 10/29/2008 01:16:00 PM

From Reuters: Major issues resolved in GM-Chrysler talks-sources

General Motors and Cerberus Capital have resolved the major issues in a proposed GM-Chrysler merger but the final form of any deal will depend on the financing and government support available ... As GM seeks some $10 billion in U.S. government aid to support the deal, Chrysler owner Cerberus is in its own set of intense discussions with banks to refinance $9 billion of Chrysler debt ...This deal will make GM the number one auto maker again - at least for a little while. GM has fallen further behind Toyota, see WSJ: GM's Vehicle Sales Fell 11% in 3rd Quarter

GM ... sold 2.11 million vehicles in the [third] quarter. That pushed GM, until recently the world's largest auto maker by sales, further behind Toyota Motor Corp., which last week reported third-quarter global sales of 2.24 million vehicles ...

Credit Crisis Indicators

by Calculated Risk on 10/29/2008 12:51:00 PM

While we wait for the Fed ...

The 3 month yield was close to zero for a few days, so this is still a significant improvement from the worst of the credit crisis. Usually the 3 month trades below the Fed Funds rate by around 25 bps, so this is reasonable if the Fed cuts rates to 0.75%, but the yield is too low if the Fed cuts 50 bps to 1.0%.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was 4.66, and there has been little progress here.

No thaw today.

New Home Sales: Shift to FHA Financing

by Calculated Risk on 10/29/2008 10:08:00 AM

According to the Census Bureau, 17% of new homes sold in Q3 2008 were financed with FHA loans. This is up from an average of 4% in the 2005 through 2007 period.

This huge percentage increase in FHA loans was partially driven by Downpayment Assistance Programs (DAPs). These programs allowed the seller to provide the buyer with the downpayment by funneling the money through a charity.

DAPs have been eliminated (finally!) as of Oct 1st.

Eliminating DAPs is a positive for the economy and housing. FHA loans using DAPs had significantly higher default rates than when the buyers actually made a down-payment, and DAPs encouraged appraisal fraud.

Although good for housing and the economy in the long term, eliminating DAPs might impact new home sales in the fourth quarter of 2008. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows new home sales by percent financing type. The percent of FHA loans increased dramatically in 2008, and this was probably driven by DAPs.

The second graph shows the same information but by the number of units sold. Of the 118,000 homes sold in Q3 2008, 20,000 were bought using FHA financing.

Of the 118,000 homes sold in Q3 2008, 20,000 were bought using FHA financing.

This compares to 7,000 FHA financed homes in Q3 2007 out of 181,000 new homes sold.

The number and percent of FHA loans will probably decline in Q4 2008, and this will probably impact about 10% of potential home buyers.

LIBOR Slowly Declines

by Calculated Risk on 10/29/2008 09:08:00 AM

From Bloomberg: Libor Declines on Central Bank Cash Funding, Fed Rate Outlook

The London interbank offered rate, or Libor, that banks charge each other for three-month loans in dollars fell 5 basis points today to 3.42 percent, its 13th straight decline, according to the British Bankers' Association.But the TED spread has increased slightly because the 3 month treasury yield has declined - perhaps because traders think the Fed might cut the Fed Funds rate by 75 bps today.

...

"The strains in money markets are beginning to ease, but only at a glacial pace," said Nick Stamenkovic, a fixed-income strategist in Edinburgh at RIA Capital Markets.

Mathew Padilla at Google Talk

by Calculated Risk on 10/29/2008 01:59:00 AM

I frequently link to Mathew Padilla's outstanding writing at the Orange County Register.

Matt co-authored a book on the mortgage crisis: "Chain of Blame".

His blog, "Mortgage Insider" is available at: www.ocregister.com/mortgage

This is 45 minute talk. Matt knows his stuff, but he was a little nervous at the beginning of this talk ...

Tuesday, October 28, 2008

NY Times: Lenders Begin to Curb Credit Cards

by Calculated Risk on 10/28/2008 10:42:00 PM

From Eric Dash at the NY Times: As Economy Slows, Lenders Begin to Curb Credit Cards

Lenders wrote off an estimated $21 billion in bad credit card loans in the first half of 2008 as more borrowers defaulted on their payments. With companies laying off tens of thousands of workers, the industry stands to lose at least another $55 billion over the next year and a half, analysts say. Currently, the total losses amount to 5.5 percent of credit card debt outstanding, and could surpass the 7.9 percent level reached after the technology bubble burst in 2001.

“If unemployment continues to increase, credit card net charge-offs could exceed historical norms,” Gary L. Crittenden, Citigroup’s chief financial officer, said.

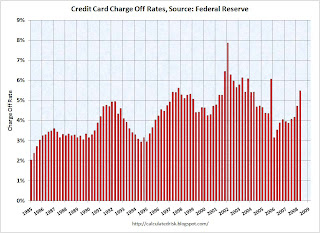

Click on graph for larger image.

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed and a new record will probably set during this recession.

To add to the story, here is a comment from the Capital One conference call two weeks ago:

We have tightened underwriting standards across the boar. In our US card business we have gotten more conservative. We have begun to reduce credit lines. We have continued to tweak our underwriting models and to the recalibrate models this may be unstable. We have adapted our models and approaches as the economic environment has changed and we are intervening judgmentally even more than our models would indicate.No Home ATM. No credit cards. What is a debt addicted U.S. consumer to do?

S&P Case-Shiller: Real Prices for Selected Cities

by Calculated Risk on 10/28/2008 07:10:00 PM

Earlier today I posted the following graph showing the price declines from the peak for each city included in S&P/Case-Shiller indices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In Phoenix and Las Vegas home prices have declined about 36% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 3% from the peak.

For the most part, the size in the percentage price decline is related to the size of the price bubble for each area. The second graph shows real prices for cities at the extremes - Las Vegas and Charlotte, and Chicago in the middle. This shows real prices (adjusted with CPI less Shelter) for three cities. Las Vegas had a huge price increase in the early '00s, and now prices are falling rapidly.

This shows real prices (adjusted with CPI less Shelter) for three cities. Las Vegas had a huge price increase in the early '00s, and now prices are falling rapidly.

Charlotte had a small price bubble, and prices have only declined a few percent. It appears prices in the bubbly areas (like Las Vegas) are still too high, but prices are already close to normal for Charlotte.

WSJ: Bailout might Include Privately Held Banks

by Calculated Risk on 10/28/2008 06:02:00 PM

From the WSJ: Treasury May Expand Financial Rescue to Non-Publicly Traded Banks

Treasury Department officials ... met with representatives from the banking industry Tuesday to discuss expanding the Troubled Asset Relief Program to make mutually held, family-owned and other private banks eligible for federal funds.The line is getting longer ...

...

Non-public banks are typically more conservatively run and may be more ready to lend money back into the financial system ... The banking industry's trade group estimates that as many as 6,500 closely held financial institutions aren't eligible for the capital program under the current rules ... because their structure doesn't permit them to issue preferred shares that the Treasury would buy.

The Fed Starts Buying Commercial Paper

by Calculated Risk on 10/28/2008 03:54:00 PM

From Bloomberg: Fed Spurs Record Surge in Longer-Term Commercial Paper Issuance (hat tip Scott)

Companies yesterday sold more than 1,500 issues totaling a record $67.1 billion of the debt due in more than 80 days, compared with a daily average of 340 issues valued at $6.7 billion last week, according to data published by the Fed. Most of the difference was probably absorbed by the Fed ... The Fed began buying commercial paper from companies yesterday to reduce rates, lure back investors and unlock the market ...

SL Green on CRE

by Calculated Risk on 10/28/2008 03:09:00 PM

From the SL Green conference call today (SL Green is a REIT focusing on commercial office and retail properties):

Analyst: Based on your estimation, when should we expect some of the [distressed property] to potentially start to enter the market?The CRE version of stated income loans involved lending on overly optimistic pro forma income projections (aka wishful thinking), and the NegAM feature was called "interest reserves".

SL Green: I think you'll certainly see more in 2009 than we did in 2008 as interest reserves run short. And then the real forced selling to the extent that there's not a replacement debt market and to the extent, depending on where cap rates shake out will be in '10, '11 as you start getting floating rate maturities. There are unlikely to be a lot of final maturities next year without extension options. But we'll see the stress where people burn their interest reserves and don't come up with cash.

Analyst: In the last few leases that you've actually signed, if you were to do those deals or look at those same deals a year ago, how far off are the economics on the deals you just signed versus what they would have been say at the peak on a percentage basis.

SL Green: They are probably down 10% on nominal rent with slightly bigger concession packages than we would have offered a year ago. So I think squarely within the ten to 15 that we've been referencing in the past. Some less, not many more. Not many more on a net [effective] basis ... we do costs dozens and dozens of leases per quarter it's hard to generalize but I think we've been taking most of those rents down by 10% what have we would have gotten earlier in the year.

Just last month, chief economist at REIS, Sam Chandan noted:

"Even a modest slowdown, as we have already observed in the New York market, confutes the underwriting assumptions that prevailed in the period leading up to the last year's investment peak."And Michael Slocum, executive vice president at Capital One Bank, added:

"The key issue is what happens to the overleveraged properties purchased and financed in the past three years. In many cases, the financial projects were based on rising rents and debt markets remaining stable. Many of the loans required the borrowers to provide interest reserves, but they will likely exhaust over the 2009-2010 time frame." ... "It always comes back to cash flow on commercial real estate. Properties financed on true cash flow should be fine."At least everyone sees the problem coming!

Real Case-Shiller Composite Indices

by Calculated Risk on 10/28/2008 02:09:00 PM

Here is a look at the real (inflation adjusted) Case-Shiller Composite 10 and 20 city indices. Nominal prices are adjusted using CPI less shelter, and Jan 2000 is set to 100. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms, prices have fallen close to 30% from the peak, and have fallen by about 2/3 of the way back to January 2000 real prices.

Of course there is nothing magical about 2000 prices, and prices could fall more or less than to 100 on the graph. I don't have much to add, but I think real prices are a better gauge than nominal prices as to how far prices will probably fall. I expect these real indices to decline for some time.

Credit Crisis Indicators: Mostly Unchanged

by Calculated Risk on 10/28/2008 12:15:00 PM

The 3 month yield was close to zero for a few days, so this is a significant improvement from the worst of the credit crisis. With the pending Fed Funds rate cut it is hard to guess just how high the 3 month should rise. Usually the 3 month trades below the Fed Funds rate by around 25 bps, so the current yield might be reasonable.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was around 4.6 (I don't have the exact number)

This is another day with little progress.

Consumer Confidence Hits Record Low

by Calculated Risk on 10/28/2008 10:32:00 AM

From MarketWatch: U.S. consumer confidence plunges to record low

U.S. consumer confidence plunged in October, reaching an all-time low in the series' 41-year existence, the Conference Board reported Tuesday. ... Despite falling gasoline prices, the October consumer confidence index fell to 38 from an upwardly revised September reading of 61.4.I usually don't post consumer confidence numbers because they are mostly coincident indicators - they tell you pretty much what you already know - but a new record low is hard to overlook.

Q3: Homeownership and Vacancy Rates

by Calculated Risk on 10/28/2008 10:00:00 AM

This morning the Census Bureau reported the homeownership and vacancy rates for Q3 2008. Here are a few graphs and some analysis ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased slightly to 67.9% and is now back to the levels of the summer of 2001. Note: graph starts at 60% to better show the change.

Here is an excerpt from a piece I wrote earlier this year on the impact of the change in homeownership rate (with a hat tip to Jan Hatzius):

As the graph shows, the homeownership rate increased from 64% in 1994 to 69% in 2004, or about 0.5% per year. With 110 million total households in the U.S., this change in the homeownership rate would mean an increase of about 550 thousand new homeowners per year during that period – even with no population growth.The second graph shows the homeowner vacancy rate since 1956. The homeownership vacancy rate was steady at 2.8% (down from a record 2.9% in Q1).

The U.S. population has been growing just under 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these numbers, there would be close to 1.25 million new households formed per year in the U.S.

Since about two thirds of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year.

So we could add the 550K from the increasing homeownership rate, to the 800K due to the increase in households (due to population growth), and the U.S. would have needed 1.35 million additional owner occupied homes per year during the period from 1995 to 2004. If the homeownership rate now stabilized, the U.S. would only need 800K additional units per year.

And if the homeownership declined – as it has been for the last 2+ years – at a rate of around 0.5% per year, the U.S. would need 800K minus 550K new units per year, or only 350K additional owner occupied units per year!

This number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for, but this does show the homebuilders had a tailwind behind them for a decade, and are now flying into a headwind.

Even when the homeownership rate stabilizes, the U.S. would only need 800K new owner occupied homes per year – far below the level of 1995 to 2004.

This means the builders have two problems over the next few years: 1) There is too much inventory, and 2) demand will be significantly lower over the next few years than from 1995 to 2004.

Why did the homeownership rate increase?

A 1007 research paper by Matthew Chambers, Carlos Garriga, and Don E. Schlagenhauf (Sep 2007), "Accounting for Changes in the Homeownership Rate", Federal Reserve Bank of Atlanta, suggests that there were two main factors for the increase in homeownership rate between 1994 and 2004: 1) mortgage innovation, and 2) demographic factors (a larger percentage of older people own homes, and America is aging). The authors found that mortgage innovation accounted for between 56 and 70 percent of the recent increase in homeownership rate, and that demographic factors accounted for 16 to 31 percent. Even as we unwind some of the excesses of recent years, not all innovation is going away (securitization and some smaller down payment programs will stay). And the population is still aging, so the homeownership rate will probably only decline to 66% or 67%, not all the way to 64%.

In summary: For as long as the homeownership rate declines – probably for at least another couple of years - this means the need for new owner occupied units will stay depressed, and even when the homeownership rate stabilizes and the inventory is reduced, demand will only be about 2/3 of the 1995-2004 period.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.This leaves the homeowner vacancy rate almost 1.1% above normal, and with approximately 75 million homeowner occupied homes; this gives about 825 thousand excess vacant homes.

The rental vacancy rate decreased slightly to 9.9% in Q3 2008, from 10.0% in Q2. The rental vacancy rate had been flat or trending down slightly for almost 3 years (with some noise).

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 9.9% to 8%, there would be 1.9% X 40 million units or about 760,000 units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 9.9% to 8%, there would be 1.9% X 40 million units or about 760,000 units absorbed. This would suggest there are about 760 thousand excess rental units in the U.S.

There are also approximately 200 thousand excess new homes above the normal inventory level (for home builders) - plus some uncounted condos.

If we add this up, 760 thousand excess rental units, 825 thousand excess vacant homes, and 200 thousand excess new home inventory, this gives about 1.8 million excess housing units in the U.S. that need to be absorbed over the next few years. (Note: this data is noisy, so it's hard to compare numbers quarter to quarter, but this is probably a reasonable approximation).

These excess units will keep pressure on housing starts and prices for some time.

S&P Case-Shiller: House Prices Decline in August

by Calculated Risk on 10/28/2008 09:12:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for August this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 22.0% from the peak.

The Composite 20 index is off 20.3% from the peak.

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.7% over the last year.

The Composite 20 is off 16.6% over the last year.

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix and Las Vegas, home prices have declined about 36% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 3% from the peak.

In Phoenix and Las Vegas, home prices have declined about 36% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 3% from the peak.

This shows the difference between the bubble areas (Krugman in 2005 called the "Zoned Zones") and the "Flatland" areas.

There was a bubble in Flatland too caused by the rapid migration from renting to buying - facilitated by loose lending - that pushed up Flatland prices. But those bubbles were small compared to the bubbles in the Zoned Zones.

Now that the bubble has burst, prices in the more bubbly Zoned Zones are falling much more than in Flatland.

Detroit is an exception with prices off 27% from the peak, even though Detroit never had a price bubble. The reason is Detroit has a weak economy and a declining population. Since housing is very durable, there is excess supply in Detroit, and prices for existing homes are below replacement costs.

Another exception is New York. Prices in New York are only off 10.6% even though New York is part of the Zoned Zone. New York had a price bubble, but until recently prices had held up pretty well.

S&P Case-Shiller: Home prices off 16.6% in past year

by Calculated Risk on 10/28/2008 09:10:00 AM

From Rex Nutting at MarketWatch: Home prices off record 16.6% in past year, Case-Shiller says

Home prices in 20 major U.S. cities dropped 1% in August compared with July and had fallen a record 16.6% from the previous year ... Prices have fallen in all 20 cities compared with a year ago.More - plus graphs - as soon as the data is available online.

First Fed: Over 22% of Loan Portfolio to Underwater Households

by Calculated Risk on 10/28/2008 12:02:00 AM

The 8-K filed by First Fed with the SEC today has some interesting information on current LTVs. (hat tip Brian) Click on table for larger image in new window.

Click on table for larger image in new window.

This table shows the original LTV of First Fed's $4.5 billion loan portfolio, and the current LTV using OFHEO House Price Index for price declines.

This shows that about 22.3% of First Fed loans (by dollar) are underwater. It would be a larger percentage using the Case-Shiller price index.

Approximately $1.0 billion in loans are underwater out of $4.5 billion in loans. Using the above table, and the delinquent loans by LTV on page 8, we can determine the percent delinquent by LTV category.

Using the above table, and the delinquent loans by LTV on page 8, we can determine the percent delinquent by LTV category.

As expected, the higher the current LTV, the larger the percentage of delinquent loans. Probably most of the loans listed as 90% to 100% LTV are also currently underwater too since First Fed uses OFHEO (and Case-Shiller is probably worse and I believe more representative of actual price changes).

Also see the bottom of page 7 for delinquencies by borrower documentation type. For Verified Income/Verified Assets loans, 5.7% of loans are delinquent. For Stated Income (and no income) loans, around 20% of loans are delinquent. Not exactly a surprise ...

This is important for the entire industry: the higher the LTV, the higher the delinquency rate. As house prices continue to fall, and more and more households have negative equity - Moody's Economy.com estimates 12 million households currently are underwater, and this will probably increase to 20+ million by the time housing prices bottom - the delinquency rate (and foreclosures) will continue to increase.

Monday, October 27, 2008

BofE Report: Britian Banks May Need More Capital

by Calculated Risk on 10/27/2008 08:22:00 PM

From The Times: Banks may need further support from taxpayers as recession bites

Britain's banks may need to raise capital above and beyond the £50 billion of taxpayer-underwritten money already earmarked for them.The U.S. GDP is about five times the U.K, and that would suggest the eventual cost of the U.S. bailout might be over $1 trillion.

The Bank of England's report into financial stability today suggests that a recession as severe as that of the early 1990s would lead to credit losses of £130 billion for Britain's six biggest financial institutions and possibly wipe out the entire government-backed funding package.

Note: £130 billion X 5 / exchange rate 0.646329 = $1 trillion.

That is less than the number Professor Krugman speculated about over the weekend:

Do the math ... these numbers seem to suggest that an eventual outlay of $2 trillion is in the realm of possibility.But more might be required.

WSJ: GM may get $5 Billion Government loan

by Calculated Risk on 10/27/2008 05:31:00 PM

From the WSJ: GM May Get Loan for Chrysler Deal

The Department of Energy is working to release $5 billion in loans to General Motors Corp. ... The funds would come from a pool of $25 billion in low-interest loans approved by Congress to help Detroit retool its plants to meet new fuel-efficiency standards. It's not clear how quickly the money could be made available or whether it would come with strings attached.And from Reuters: US Treasury working on aid for GM, Chrysler merger

The U.S. government is considering direct financial assistance to facilitate a possible merger between General Motors Corp and Chrysler ... The Treasury Department is weighing aid of at least $5 billion, which could include capital injections and government purchases of bad auto loans ...It looks more and more likely that GM will acquire Chrysler.

Also of interest, just last week Daimler wrote the value of their Chrysler holdings down to zero according to a report in the Free Press: Daimler: Chrysler worth nothing

The German automaker has depreciated its stake in Chrysler to zero from $268 million at the end of June, the company said Thursday. A little over a year ago, the company valued its 19.9% stake in Chrysler at $2.2 billion.

Non-Residential Investment: WalMart Spending to Decline

by Calculated Risk on 10/27/2008 03:44:00 PM

From MarketWatch: Wal-Mart U.S. to add remodels, trim new store growth

Capital spending for Wal-Mart U.S. is expected to decline to $5.8 billion to $6.4 billion for fiscal 2009 from $9.1 billion last year. For fiscal 2010, capital spending is pegged at $6.3 billion to $6.8 billion ...Just more evidence of the imminent non-residential construction downturn.

New Home Sales: Annual and Through September

by Calculated Risk on 10/27/2008 01:17:00 PM

New home sales in 2008 might be at the lowest level since 1982. However adjusted for changes in owner occupied units, the current year is the worst on record.

The following graph shows both annual new home sales (from the Census Bureau) and sales through September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In 2008, sales through September (before revisions) have totaled 402 thousand. This is slightly ahead of the pace in 1991 (391 thousand sales through September).

However sales have slowed in the 2nd half of 2008, and it appears that annual sales might be below the 509 thousand in 1991. It will probably be close, but if sales are below the 1991 level, this would mean sales would be the lowest since 1982 (412 thousand).

Of course the U.S. population and the number of households were much lower in 1982. In 1982 there were 54.2 million owner occupied units in the U.S., in 1991 there were 61.0 million, and there are approximately 76 million today.

If we use a ratio of owner occupied units to compare periods, the low in 1982 was 412 thousand X (76/54.2) = 578 thousand units (based on the number of owner occupied units today).

The calculation for 1991 gives 634 thousand units (to compare to today).

By this measure, 2008 is the worst year for new home sales since the Census Bureau started tracking new home sales (starting in 1963).

Credit Crisis Indicators: Progress

by Calculated Risk on 10/27/2008 11:37:00 AM

[LIBOR was] 3.5075%, according to Monday's daily Libor fixing by the British Bankers Association. That's down from 3.51625% Friday ...

The Fed is expected to lower rates this week by anywhere from 25 bps to even 75 bps, but I'd still like to see the three month treasury closer to 1.0% (or whatever the Fed Funds rate is this week). The effective Fed Funds rate is about 0.93%, so the three month yield is still a little low.

Here is a list of SFP sales. The Treasury announced another $40 Billion for the Fed this morning - no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

The progress is slow, but this is a positive day in the credit markets.

September New Home Sales: Lowest September Since 1981

by Calculated Risk on 10/27/2008 10:00:00 AM

According to the Census Bureau report, New Home Sales in September were at a seasonally adjusted annual rate of 464 thousand. Sales for August were revised down slightly to 452 thousand.

Note that the most recent wave of the credit crisis started in mid-September. Since New Home sales are reported when the contract is signed, September sales were only partially impacted by the credit crisis. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for September since 1981. (NSA, 36 thousand new homes were sold in September 2008, 28 thousand were sold in September 1981).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in September 2008 were at a seasonally adjusted annual rate of 464,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 2.7 percent above the revised August rate of 452,000, but is 33.1 percent below the September 2007 estimate of 694,000.

"Months of supply" is at 10.4 months.

"Months of supply" is at 10.4 months. Note that this doesn't include cancellations, but that was true for the earlier periods too. Sales are falling quickly, but inventory is declining too, so the months of supply is slightly lower than the peak of 11.4 months in August 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of September was 394,000. This represents a supply of 10.4 months at the current sales rateInventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

As I noted a couple of months ago, I now expect that 2008 will be the peak of the inventory cycle for new homes, and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties).

This is a another very weak report.