by Calculated Risk on 8/31/2008 11:00:00 PM

Sunday, August 31, 2008

Cartoon of the Day

Don't Worry, There's a PLAN

by PJ on 8/31/2008 03:20:00 PM

I've seen CR refer to some of the woes/speculation regarding the future for Lehman Bros; news today from the WSJ says that CEO Richard Fuld is a man with a plan. Er, or at least, we think so:

There's more in the Journal story, including the admission that Lehman's big plan involves it financing "at least some" of its own spinoffs, a la Merrill Lynch's $30bn CDO sale. Lehman's got about $65 billion in commercial and residential RE "assets" that would be part of the "sale." And with financing tough to come by, the cynic in me thinks that Lehman will end up self-financing more than "some" of whatever is eventually spun off.The Wall Street firm run by Chief Executive Officer Richard Fuld is still hammering out the final details and it isn't clear when a plan will be unveiled. One sticking point: finding financing in this cash-strapped environment for a spinoff or sale of these assets.

In addition to offloading the real-estate assets, Lehman is trying to sell its Neuberger Berman investment-management unit. Ideally, Lehman management would like to announce both transactions at the same time so it can assure investors that it has a bold plan to navigate its way out of the current credit crisis.

For the real-estate assets, Lehman has set up a so-called good bank/bad bank structure. Such a deal is likely to involve a spinoff of the holdings to shareholders as well as an investment by outside investors.

Details of the plan weren't clear. One option may be a "sponsored spin." That would involve bundling some of the troubled assets into a new entity, which would then be spun off to Lehman holders on a tax-free basis. Also, a new investor or group of investors could take a big minority stake in the new company, thus "sponsoring" it.

And until more details emerge, I'm calling it a "sale," in quotes. Because financing the sale of your own assets to a company you have majority interest in is sort of like letting your brother date an annoying ex: you think you've cut ties, but she keeps showing up at the dinner table anyway.

Alabama County Faces Bankruptcy

by PJ on 8/31/2008 10:12:00 AM

Talk about being in the sewer. I lived in Orange County,CA in 1994 when the county went bankrupt; now that BK's standing as the largest municipal bankruptcy in U.S. history is being threatened by Jefferson County, Alabama. Over sewer bonds. $3.2 billion of them, to be exact:

Another unforseen effect of the credit crunch.Alabama's largest county offered a plan Friday to restructure its $3.2 billion sewer debt and, at least for now, put off filing the largest municipal bankruptcy in U.S. history.

Gov. Bob Riley said an attorney for Jefferson County proposed restructuring the bond debt at a lower, fixed rate over a longer term, and Wall Street creditors allowed the county to delay any further interest payments at no cost until Sept. 30 ...

The county had the cash to make a $2 million interest payment that was due Friday, but Commissioner Jim Carns said officials must decide whether to continue making payments indefinitely or file for bankruptcy because its obligations far outstrip revenues from the sewer system.

Carns, who did not attend the meeting, said the county must stop the bleeding.

"It's a matter of whether we can get an agreement to stop it or whether we have to get court protection to stop it," he said.

Jefferson is Alabama's most populous county with about 658,000 residents and includes the state's biggest city, Birmingham....

Acting at the suggestion of outside advisers, the county borrowed money for the project on the bond market in a complex and risky series of transactions. When the mortgage crisis hit and banks began tightening up on their lending, the interest rates on the debt ballooned.

Saturday, August 30, 2008

Cartoon of the Day

by Calculated Risk on 8/30/2008 11:00:00 PM

Gustav takes aim at N'awlins, oil prices

by PJ on 8/30/2008 09:23:00 PM

(Note: CR is off hiking, and asked me to help with guest posts. For those who don't know, I run HousingWire when I'm not helping out friends. Anything you want discussed, feel free to shoot an email to pjackson@housingwire.com.....)

Hurricane Gustav is shaping up to be a real problem for the Gulf Coast. Per weather.com, it's now very dangerous Cat 4, and will likely become a Cat 5 hurricane before tonight is up. While CR is West Coast, yours truly is in the DFW metroplex, and we're already seeing an influx of the tens of thousands fleeing the Gulf Coast.....

We're already seeing gas prices get hit. Shell Oil said it will pull all workers off platforms, along with nearly every other producer. More importantly, the Louisiana Offshore Oil Port will halt taking crude this weekend; it's the only deepwater oil port in the nation.

My best to anyone out there running from what appears to be another major U.S. hurricane, but the oil effects appear as if they'll be felt by all of us, too.

Update: some stats on Gustav, after NO mayor Ray Nagin just ordered a mandatory evacuation:

....Gustav, currently a Category 4 Hurricane with winds of up to 150 miles per hour, now has a 900-mile wide footprint. The storm surge it delivers as it powers ashore on Monday could be as high as 24 feet – higher than Hurricane Katrina, Nagin says he was told. [emphasis added]

I worked in the mortgage/default industry after Katrina. Given what servicers are already dealing with, this is just one more straw on the camel's proverbial back, should it come to pass.

Open thread

by Anonymous on 8/30/2008 12:08:00 PM

Great Balance Sheet! Strong Earnings!

by Anonymous on 8/30/2008 10:53:00 AM

A pet peeve of mine is analysts. When is the last time you heard one of them speak about cash flows other than in passing? If you do not address the components of the Statement of Cash Flows, you cannot opine on the strength of the Balance Sheet or Earnings. What’s the problem? The Statement of Cash Flows is conceptually difficult to grasp as it’s traditionally taught. The statement might be called “Statement of all the other assets and activities affected cash.” It’s not that one thing is more important than the other 2, it’s that the stool needs 3 legs.

It’s even more important to know this now. Cash is always nice to have, but even more so in a down market when it’s not so easy to borrow cash. If any of you are buying individual stocks, you have to learn how The Statement of Cash Flows works. It is not possible to assess a company’s condition without understanding it. I surfed around a bit and didn’t find anything that was very good. The Wikipedia entry was as good as any.

http://en.wikipedia.org/wiki/Cash_flow_statement

Between long hours and airports, I did not have adequate time to assemble an adequate post on the topic but thought it worth a rant.

Why are regulators always behind?

by Anonymous on 8/30/2008 09:46:00 AM

Here's an article featuring regulators reacting to 3 to 5 year-old news.

http://www.bloomberg.com/apps/news?pid=20601068&sid=aBDDcYvIKUdE&refer=economy

I have some observations about regulators:

1. They are retstrained by Congressional inaction or mission statements.

2. They are not actively in the marketplace, so they miss the first signs of trouble. More than a year ago, a retail store owner could have told you the economy was sinking. For our small consulting firm, 9 months ago it became easier to find accounting talent. Are regulators in the Ivory Tower?

3. There are more inputs into any economic analysis than there ever were before. In the early 90's recession, Asia meant Japan, Europe was 3 countries, the Middle East was just a gas station and The Americas was the US. Now, there are so many more countries with real economies, what's the benchmark?

What can regulators do? What should they do?

SFAS 157, Fair Value and Other Fairy Tales

by Anonymous on 8/30/2008 07:39:00 AM

There’s been much discussion on various blogs about Fair Value Accounting. Proponents make an excellent point in that, what difference does it make what you paid for something? If you’re telling me, an investor, that you have a certain amount of assets on your books, prove to me what they’re worth. Not exactly a revolutionary thought to have. The fact is, this is what balance sheets have supposed to be reflecting all along. “Lower of Cost or Market” they called it back in school over the sounds of clicking abaci.

What really changed recently with SFAS 157 are the number of assets under fair value rules and the additional required disclosures, mostly footnotes, for Fair Value accounting for various instruments.

What types of assets should be subject to fair value accounting? Should a company revalue its land and equipment each year? Seems like a lot of work and expense. Corporations already keep two sets of books, GAAP and Tax. To be fair, the underlying transactions are the same for both, but the more in-depth analysis is performed by two separate groups of well paid employees, the Reporting Group and Tax Department. Fair value will involve hiring another group of accountants; perhaps not as large, but more expense.

What is the benefit? Fair Value isn’t going to mean much for internal operations. Some of the biggest opponents are US based manufacturers, headed by automakers. Does it matter what your plant’s equipment is worth? Not for internal purposes. It won’t help you analyze your business. In the case of Plant Equipment, not even the investors benefit much from fair value.

What types of assets should be valued at fair value? Most of us agree that securities are at the center. We’re now in the process of sorting out the values of nicely packaged garbage on banks’ books. Basic Economics and Accounting theory posits that assets should be valued at discounted future cash flows. Cash is the exit strategy for all assets. Nowhere is this more evident than valuing securities. With securities, we need to look at the intent of the owner; the exit strategy to convert to cash. So, the exit strategy defines the valuation method. For securities, this brings us to the three categories of investments; Levels 1, 2 and 3. Here are guidelines:

Prior Name; Available for Sale

English Translation; We’re selling if the price is right

Valuation; Market value, preferably on an exchange

Prior Name; Held to Maturity

English Translation; We’re not selling

Valuation; Cost, unless the loss is “other than temporary”.

The levels indicate how obvious or concrete the market comparisons, with L1 the highest. Do you see a trend in valuations? It’s ALL exit value. It’s all based on intent. The reason we don’t time value discount Level 1 and 2 securities is because the cash conversion is projected to happen now (or soon enough).

Side note: Temporary L2 asset losses are found further down on the Income Statement under Other Comprehensive Income (sort of purgatory place) where they do not get factored into P/E ratios.

Friday, August 29, 2008

Cartoon of the Day

by Calculated Risk on 8/29/2008 11:00:00 PM

Bank Failure: Integrity Bank, Alpharetta, Georgia

by Calculated Risk on 8/29/2008 05:27:00 PM

From the FDIC: Regions Bank Acquires All the Deposits of Integrity Bank, Alpharetta, Georgia

Integrity Bank, Alpharetta, Georgia, with $1.1 billion in total assets and $974.0 million in total deposits as of June 30, 2008, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation was named receiver.One more. We will see two today?

The FDIC Board of Directors today approved the assumption of all the deposits of Integrity Bank by Regions Bank, Birmingham, Alabama. All depositors of Integrity Bank, including those with deposits in excess of the FDIC's insurance limits, will automatically become depositors of Regions Bank for the full amount of their deposits, and they will continue to have uninterrupted access to their deposits. Depositors will continue to be insured with Regions Bank so there is no need for customers to change their banking relationship to retain their deposit insurance.

...

Regions Bank has agreed to pay a total premium of 1.012 percent for the failed bank's deposits. In addition, Regions Bank will purchase approximately $34.4 million of Integrity Bank's assets, consisting of cash and cash equivalents. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to its Deposit Insurance Fund will be between $250 million and $350 million. Regions Bank's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to all alternatives because the expected losses to uninsured depositors were fully covered by the premium paid for the failed bank's franchise.

Integrity Bank is the tenth FDIC-insured bank to fail this year, and the first in Georgia since NetBank in Alpharetta on September 28, 2007.

The End is Nigh

by Anonymous on 8/29/2008 02:11:00 PM

When you're going after the "impulse depositor" market share off the sidewalk, you're in trouble.

(Thanks, Alex.)

Oil and Gustav

by Calculated Risk on 8/29/2008 01:48:00 PM

It's way too early to tell if this will be a huge story or a "nothingburger" (hopefully), but Tropical Storm Gustav is a potential threat to the GOM and oil production.

Click on image for larger image in new window.

Here are some excellent sites to track hurricanes:

National Hurricane Center

Weather Underground Note: See Jeff Master's blog.

IndyMac Mods: Principal Forbearance Vs. Reduction

by Anonymous on 8/29/2008 09:49:00 AM

Having done my share of griping about the FDIC's plan for modifying IndyMac loans, I feel obligated to point out that I didn't describe the program as fully and accurately as I might have. This is a problem I must rectify.

I'm not, apparently, the only one who missed the implications of the FDIC's use of the term "principal forbearance" in the context of this plan. An RBS research report on the potential impact of the plan for IMB securities that was published recently uses the terms "principal forbearance" and "principal reduction" interchangeably. A new JP Morgan report, however, which was recently updated and republished after someone spent some time asking the FDIC for further information (smart move), clarifies for us exactly what the FDIC means by "principal forbearance."

To remind everyone, the FDIC approach is to arrive at a total housing-payment-to-income ratio or HTI, which they confusingly call a "DTI," of 38%. This can be achieved by using one or more of the following restructuring approaches.

First, the interest rate is lowered to the current Freddie Mac survey rate for fixed rate mortgages, and fully amortized as a fixed rate loan. As far as I can tell, at this initial step, the loan is amortized over its remaining term, whatever that is.

If that is not enough to achieve 38% HTI, then the interest rate is "stepped" for up to five years. That means that the initial rate is set no lower than 3.00% for the first year, and increased each year by no more than 1.00% per year, until it hits the Freddie Mac survey rate (which was 6.50% at the time FDIC published). This does not make the loan an ARM or subject it to negative amortization; the payment is re-amortized each year after the interest rate "steps up" until it hits the permanent rate. That means that the loan is always paying some principal from the inception of the mod.

Remember that ARMs involve potential rate increases; whether they happen or not, and how far they go, depend on future (unknown) movements in the underlying index. A "step loan," which is what I understand these mods to be, has scheduled rate increases that are exactly specified in the modification agreement, and which are not subject to future market rate fluctuations: each loan will "step up" to the permanent rate, regardless of what happens in a year or four to market interest rates. So the borrower gets the same kind of long-term "rate lock" of a fixed rate loan--the rate will never be higher than 6.50% (or whatever the Freddie rate is on the day the mod is drawn up), and after the initial "step" period it will never be lower than that. The step period simply "ramps" the borrower into the fully-amortized payment at 6.50% by starting out with a fully-amortized payment at a lower rate and slowly increasing that rate each year until the final rate is achieved.

If the "rate stepping" all the way down to 3.00% isn't enough to hit a 38% DTI, then the whole thing is recalculated with a 40-year term, rather than with the remaining term of the loan. This part won't mean much if the loan was originally a 40-year term (and lots of OAs were) and it's only a year or two old. However, if the loan was originally a 30-year, extending the amortization term by another 10 years may reduce the payment enough to hit the 38% limit. The tricky part here for securitized loans, though, is that some and possibly most of these securities have a maximum loan maturity of 30 years written into the deal docs. So the modification will not actually extend the legal maturity date of the loan to 40 years; it will simply create a balloon loan (principal due in 30 years but payment calculated over 40 years).

If the term extension, added to the rate reduction, still doesn't hit the number, then and only then will the FDIC use "principal forbearance." The real issue I wanted to get to today was that part. What the FDIC apparently means by "principal forbearance" is not what most people think they mean by "principal reduction." The rate reduction on these loans, in contrast, is a true permanent reduction in the interest rate: the borrower is never in any scenario obligated to "make up" or pay back the difference between the original interest rate and the reduced rate.

However, with the principal, what the FDIC is doing is not forgiving principal but offering an interest-free forbearance of repayment of part of the principal. This means that the actual principal amount due and payable at maturity of the loan (or sale of the property) is the original unmodified principal amount, less any and all periodic principal payments the borrower makes until maturity or sale. However, the contractual payment the borrower makes is no longer "fully amortized," it is partially amortized, because a portion of the loan's principal is excluded from the amortization calculation, essentially making that portion a zero-interest balloon payment. (There may already be a balloon payment on this loan, if its original term was less than 40 years. But that balloon is not zero-interest. Confused yet?)

Here's an example: the remaining principal balance of the loan at modification is $100,000. We have already gotten down to a 3.00% first-step rate and a 40-year amortization, but the payment still results in an HTI greater than 38%. Therefore we take, say, 10% of the balance out of the amortization formula, meaning we calculate the payment on a $90,000 balance at 3.00% for 40 years. That would reduce the loan payment from $357.98 to $322.19. The remaining $10,000 in principal is still secured by the mortgage, so it would be due and payable in a lump sum (a "balloon payment") at the original maturity date of the loan. If the borrower sold the home or refinanced prior to maturity, the $10,000 is due and payable at the time, in addition to the remaining balance of the rest of the loan ($90,000 less amortized principal payments).

So "principal forbearance" does not mean principal "forgiveness." It certainly means that the effective interest rate on such loans is lower than the Freddie Mac survey rate, discounted for the stepping or not, because the contractual interest is not charged on the entire loan balance. It certainly means that the investor is going to have to write down the forborne principal when the modification is done, since this falls under the accounting rules that make you write down a loan to the amount considered collectible, and it is clear that a loan in this much trouble, with property values where they are, probably is not going to pay you back 100% of principal. But if, in fact, property values recover in the future and the home sells for at least the total loan amount due, the investor will receive that forborne principal back as a recovery.

This is not the same thing, technically, as a "shared appreciation" provision; it's rather more a compromise between shared appreciation and outright principal forgiveness. The borrower never has to pay the foregone interest on the forborne principal out of future sales proceeds or in any way "make the investor whole" for the rate reduction. But unlike outright forgiveness, the borrower does have to pay the full principal amount back out of sales (or refinance) proceeds.

Which, of course, leads us to wonder what happens if there's never enough sales proceeds to pull this off. My guess is that we're going through all this "principal forbearance" business, which isn't exactly easy for your average consumer to understand, because investors like it better than outright forgiveness and it's supposed to mitigate the "moral hazard" problem. But the other side is that the FDIC or whoever buys that portfolio of modified loans is going to face the possibility of being confronted with a cohort of loans needing short sales or short refis in a year or two, because some borrowers will always need to move on before home prices "recover."

At some level, it seems a bit odd to do this elaborate "forbearance" of principal in the original workout, only to have to cave in and do outright forgiveness of principal down the road in a second workout involving a short sale. The FDIC, I suspect, is making a rather different set of assumptions about how long-term the commitment to homeownership is likely to be in a portfolio like IndyMac's, and how long it will take for property values to recover, than I would. After all, this FDIC program is not--unlike, say, the new FHA short-refi program--reducing principal to achieve "above water" loans. It is forbearing principal only as a last resort, if the rate reduction and term extension doesn't work, and only enough to hit an "affordable" monthly payment. That means it is possible that loans could get a principal forbearance that still leaves them underwater; they just become "affordable" underwater loans. And that, unfortunately, is what puts you at risk of having to do a short sale down the road when the borrower needs to move or just can no longer handle having 38% of pre-tax income going to the house payment with all the other bills they have.

The JP Morgan analysts note that maximum principal forbearances on the IndyMac portfolio aren't likely to be that much: even a loan that originally had an HTI of 60% (which is extremely high even for stated income loans; remember that this isn't DTI or total debt-to-income ratio) and that got a 400 bps rate reduction plus a 10-year term extension would require only about a 17-18% principal forbearance to hit 38%. A loan that started out with a 45% HTI would be unlikely to need any principal forbearance at all, because the rate and term adjustments would be sufficient. The difficulty for analysts of the IndyMac-serviced loan pools, both securitized and unsecuritized, is that we don't really know what current (real) HTIs are. We have reported DTIs--total house payment plus all other monthly debt--but those were based on original reported income. We are pretty sure that actual current income for these borrowers is less than what was originally reported, but since databases stopped reporting HTI and DTI, relying solely on DTI alone, we don't know how many of these borrowers have high DTIs resulting from very high house payments and not much other debt, versus relatively reasonable house payments and a lot of other debt. The FDIC's approach will help the former but not the latter. While an 18% principal forbearance may sound like a lot, in terms of IndyMac's actual loan portfolio it may not work out to much if only a tiny sliver of loans have HTIs that high (and managed to make even the first payment). The real impact on investors will be the interest reductions and cash-flow changes resulting from slowing down the amortization to 40 years.

Bottom line: there just isn't a free lunch, not for anybody.

(Hat tip to Hoover for sending me the Morgan report. Hat tip to Morgan analysts for clarifying this subject. Note to Morgan analysts: the past tense of "forbear" is "forborne," not "forbeared." Y'all owe me a new keyboard.)

Personal Income and Outlays Report Suggests Slowdown

by Calculated Risk on 8/29/2008 09:16:00 AM

From the BEA: July Personal Income and Outlays

Real DPI decreased 1.7 percent in July, compared with a decrease of 2.6 percent in June. Real PCE decreased 0.4 percent, compared with a decrease of 0.1 percent.So real Disposable Personal Income (DPI) declined in both June and July, as did real Personal Consumption Expenditures (PCE). This suggests that the impact from the stimulus checks is mostly behind us, and there is a good chance PCE growth will be negative in the 2nd half of 2008.

For more, see the WSJ: Consumer Spending Slowed in July As Inflation Continued to Take Toll

Thursday, August 28, 2008

Cartoon of the Day

by Calculated Risk on 8/28/2008 09:00:00 PM

All: While I'm gone, Tanta and Paul Jackson (of Housing Wire) will be posting. Plus a guest post or two ... I've also scheduled some cartoon of the day posts. Enjoy.

To start, here is the first in a series on housing from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. This is from 2003:

Click on cartoon for larger image in new window.

Bank of China Reduces Fannie, Freddie Investments

by Calculated Risk on 8/28/2008 07:40:00 PM

From the Financial Times: Bank of China flees Fannie-Freddie

Bank of China has cut its portfolio of securities issued or guaranteed by troubled US mortgage financiers Fannie Mae and Freddie Mac by a quarter since the end of June.This selling is probably why the spread between Fannie and Freddie debt yields and Treasury debt is so high. From the WSJ last week: Deflating Mortgage Rates

The sale by China’s fourth largest commercial bank, which reduced its holdings of so-called agency debt by $4.6bn is a sign of nervousness among foreign buyers of Fannie and Freddie’s bonds and guaranteed securities.

The differences, or spreads, between Fannie's and Freddie's debt yields and Treasury yields have widened considerably since the start of the housing crisis because of jitters about the highly leveraged companies' stability. Last September, Fannie issued three-year debt at 0.55% over Treasury yields. Last week, it paid 1.23% over Treasury yields.So there was probably more foreign selling in July and August.

FDIC Prepares for More Bank Failures

by Calculated Risk on 8/28/2008 04:28:00 PM

From Bloomberg: FDIC Adds Office Space in Dallas, Ready for More Bank Failures

The Federal Deposit Insurance Corp. is preparing to sign a five-year lease to add five floors of space at its Dallas regional office as the agency prepares to increase scrutiny of failing and troubled U.S. banks.Someone is hiring.

The federal agency ... will add 125,000 square feet to the 185,000 square feet it rented last year ... That agency will add about 300 staff at the building, including some of the 69 retirees it is bringing back to help handle the increased workload, said spokesman Andrew Gray.

...

Dallas is the headquarters of the agency's Division of Resolution and Receivership, the unit that handles failed banks.

Lehman Layoffs, Citi Cost Cutting

by Calculated Risk on 8/28/2008 02:03:00 PM

From Bloomberg: Lehman Said to Be Poised to Eliminate as Many as 1,000 Jobs

Lehman ... is preparing to eliminate as many as 1,000 jobs in what would be the firm's fourth round of cuts this year ... The cuts may be announced when Lehman ... releases third-quarter financial results next month ...And more cost cutting from Citigroup, from Craine's Internal memo reveals Citi penny-pinching

[A]ccording to published reports, management at one of the biggest U.S. banks has not only banned off-site meetings among employees—it’s also asked workers to cut back on the amount of photocopying they do.You know it's tough when they limit color copies.

According to an internal memo confirmed by a Citigroup spokesman, the bank wants presentations to be printed double-sided to reduce unnecessary paper usage. In addition, the use of certain copiers will be confined to client presentations. “Over time, we will be removing color copiers and printers from the locations where they are not essential,” the memo stated.

... And in perhaps the biggest blow of all to investment bankers, the memo says Citi will be conducting a review of BlackBerry usage.

Mortgage Rates Decrease Slightly

by Calculated Risk on 8/28/2008 11:31:00 AM

From Housing Wire: Mortgage Rates Drift Lower as Economic Concerns Linger

Economic concerns continued to help mortgage rates in the past week, according to data released Thursday by Freddie Mac. The GSE said that its weekly mortgage market survey found 30-year fixed-rate mortgages averaged 6.40 percent with an average 0.6 point for the week ending Aug. 21, down 7 basis points from last week. Last year at this time, the 30-year FRM averaged 6.67 percent.Personal Note: I'll be hiking the John Muir Trail from Yosemite Valley to Mt Whitney (and to Whitney Portal) starting on Sunday morning. While I'm gone, Paul Jackson from Housing Wire will be helping Tanta.

When I return I'll have more time for analysis (all the hours working out has really cut into my analysis time over the last couple of months)! In a couple of weeks I'll post my forecasts for housing and the economy. Also - I apologize for not responding to all emails recently. Best to all.

Unemployment: Continued Claims over 3.4 Million

by Calculated Risk on 8/28/2008 09:10:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Aug. 23, the advance figure for seasonally adjusted initial claims was 425,000, a decrease of 10,000 from the previous week's revised figure of 435,000. The 4-week moving average was 440,250, a decrease of 6,000 from the previous week's revised average of 446,250.And continued claims are now above 3.4 million for the first time since 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The advance number for seasonally adjusted insured unemployment during the week ending Aug. 16 was 3,423,000, an increase of 64,000 from the preceding week's revised level of 3,359,000.By this measure, the economy is clearly in recession.

Plunge Protection Team, Pakistan Style

by Calculated Risk on 8/28/2008 12:49:00 AM

From Bloomberg: Pakistan Sets Floor on Stock Prices to Stop Plunge

Pakistan set a floor for stock prices on the benchmark exchange, moving to halt a plunge that has wiped out $36.9 billion of market value since April.Ahhh ... stock prices that can only go up. That is a real PPT (Plunge Protection Team).

Securities can trade within their daily limit of 5 percent ``but not below the floor-price level'' of yesterday's close ...

This is funny, but doomed.

Wednesday, August 27, 2008

Freddie Mac on House Prices

by Calculated Risk on 8/27/2008 05:13:00 PM

From Freddie Mac: National Home-Value Drop Moderates in Second Quarter

Freddie Mac (NYSE: FRE) announced today that its Conventional Mortgage Home Price Index (CMHPI) Purchase-Only Series registered a modest 0.4 percent annualized decline in U.S. home values during the second quarter of 2008, following a downward revised 10.8 percent annualized drop in the first quarter. Over the four quarters ending with the second quarter of 2008, home sales prices fell an average of 6.0 percent in the CMHPI Purchase-Only Series – the largest annual fall in values over the 39-year history of the series.

"While U.S. home value indexes continued to decline, an encouraging sign has been the significant moderation in the rate of decline of the Purchase-Only series," said Frank Nothaft, Freddie Mac vice president and chief economist. "After falling sharply over the prior two quarters – more than a 10 percent annualized drop – home value depreciation slowed substantially to only a 0.4 percent annualized rate. While we expect to see further declines in average U.S. home values throughout this year and into 2009, we will be watching for signs of stabilization in indicators of real housing activity, such as a leveling off in home sales and for-sale inventories.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in the Conventional Mortgage Home Price Index (CMHPI) Purchase-Only Series vs. the quarterly change (annualized).

Guess what? There is a strong seasonal component to the series, and I see nothing encouraging about this "moderation" when seasonal factors are considered.

The headline could have read:

"Worst Second Quarter Ever for Freddie Mac CMHPI Purchase-Only House Price Series"

Moody's: Rising RMBS Delinquencies

by Calculated Risk on 8/27/2008 03:56:00 PM

From the WSJ: Delinquencies, Losses Continue to Rise On Loans Backing Residential MBS

Delinquencies and losses on pools of loans backing U.S. residential mortgage-backed securities issued in 2006 and 2007 continued to weaken through the first half of the year, according to Moody's Investors Service. ... Deals backed by subprime, Alt-A and jumbo loans have all weakened compared with prior years. ... The agency is now reviewing for potential downgrade all jumbo transactions originated in 2006 and 2007.Alt-A and Jumbo; the new subprime. Also the article describes the outlook for HELOC pools as "daunting".

CRE Version of Stated Income: "Lenders Would Believe Anything"

by Calculated Risk on 8/27/2008 01:52:00 PM

Terry Pristin at the NY Times has an interesting article on apartment buildings in New York: Fear of Defaults After a Flurry of Apartment House Sales (hat tip Brian)

As we've discussed before, the CRE version of stated income loans involved lending on overly optimistic pro forma income projections (aka wishful thinking):

Most investors, like most lenders, thought that values would keep escalating, said the broker, who did not want his name published in order to protect his business relationships. But, he added, underwriting standards were very casual. “Back then, you could write down anything, and people would believe you,” he said.And just like for residential, some CRE lenders made some bad choices:

“As the financiers got farther and farther away from New York, everything looked like Manhattan below 96th Street to them,” [Harold M. Shultz, a senior fellow at the Citizens Housing and Planning Council] said. “They all got caught up in the bubble mentality.”Sounds like more defaults to me.

Quote of the Day: Thornberg on Housing

by Calculated Risk on 8/27/2008 12:50:00 PM

"People are saying the reason prices are falling are because of all of the foreclosures, but the foreclosures are happening because the prices are falling. They've got it backwards. The prices are falling because they're too freakin' high."The above quote is from a Voice of San Diego article by Kelly Bennett: Local Prices Down 30 Percent from Peak

Chris Thornberg, Beacon Economics, Aug 27, 2008

The article notes that there has been an increase in sales recently, but this is probably a "false dawn":

The 10.5 percent [sales] increase in July compared to July 2007 was the first year-over-year increase in more than four years, according to DataQuick Information Systems.And prices are now falling for luxury homes too:

...

Usually, an increase in sales means a market is recovering, and the bump up in sales has been touted as a potential turnaround for the local market.

...

But foreclosure sales counted for a large portion of that increase, leaving analysts expecting continued price declines.

...

"When you see sales begin to increase, that's often an indicator of a market turning," said Chris Thornberg, founding partner at Beacon Economics and former economics professor at the University of California, Los Angeles. "But this is a bit of a false dawn."

[E]ven luxury homes are now showing weakness. ... That "prestige homes" index found that in the second quarter this year, values on many such houses in San Diego dropped 2 percent from the first quarter and 7.8 percent from second quarter 2007. The average price among those homes has fallen to $2.02 million, from a peak of $2.19 million in the second quarter 2007.No area is immune. The housing bust is now moving up the price chain.

OTS: More Losses for Thrifts

by Calculated Risk on 8/27/2008 12:18:00 PM

From Bloomberg: Thrifts Posted $5.4 Billion Loss in Second Quarter

U.S. savings and loans posted a $5.4 billion loss in the second quarter as lenders set aside record reserves for loan losses amid the slump in the housing market, the [Treasury's Office of Thrift Supervision] said.The S&Ls have problems too.

Provisions for bad loans reached $14 billion ...

The OTS list of ``problem thrifts'' increased to 17 from 12 at the end of the first quarter and accounted for 2.1 percent of all the OTS-supervised thrifts ...

FDIC Increases Loss Estimate for IndyMac

by Calculated Risk on 8/27/2008 09:40:00 AM

From Reuters: FDIC says IndyMac failure costlier than expected

The Federal Deposit Insurance Corp said on Tuesday it now expects IndyMac's failure in July to cost its insurance fund $8.9 billion, compared with the previous expected range of $4 billion to $8 billion.This is quite an increase in the expected loss.

...

Diane Ellis, the FDIC's associate director of financial-risk management, said IndyMac's expected hit to the fund blossomed because analysts have had more time to value IndyMac's assets and have assigned some higher loss rates.

Also, some deposits that the FDIC originally thought were uninsured are actually insured, Ellis said.

Some Plan

by Anonymous on 8/27/2008 08:29:00 AM

Dean Baker is highly annoyed by this line from Sheila Bair, as paraphrased by the New York Times:

The swelling tide of toxic home loans is proving to be even more worrisome than initially feared, Ms. Bair said.I think I've become more or less impervious to the hoocoodanode line, given too much exposure to it. I'm actually rather more blown away by the following quote:

She is struggling to clean up the mess and forestall home foreclosures with a plan to ease loan terms for hard-pressed homeowners.People ask me all the time something like this: "So, well, you think you're so smart, what's your solution for this problem?" And I tell people all the time, "There is no 'solution' to this problem. That's why it sucks so bad. That's why you don't let problems like this develop in the first place."

“It is going to be slog to work though this, but there is no easy way to do it,” Ms. Bair said about her plan during an interview in her office here. “We haven’t seen the trough of the credit cycle yet.”

I might even be willing to grant Bair an occasional indulgence in hoocoodanode if she'd just quit trying to pretend that she--or anyone else--can "work through this" in any meaningful way, "this" being the deflation of the housing bubble. I mean, one does what one can. I don't object to anyone making lemonade where the opportunity presents itself, nor do I fault anyone for taking whatever limited measures are possible to ease the pain for individual homeowners. But anyone who continues to pretend that "preventing foreclosure" is a "solution" to the problem here is lying to the public. Trying to "prevent" the results of a home-mortgage credit bubble isn't "solving" anything, it's keeping your finger in the dike and waiting for a miracle.

Besides the fact that Sheila Bair is still, as far as I know, the head of the FDIC, not the National Homeowners Association. Her concern for homeowners is nice and everything, but she's supposed to be regulating banks and thrifts. The FDIC needs to be worrying about "foreclosing" on some troubled banks, not pretending that troubled banks can avoid the consequences of a bubble by refusing to let mortgage loans fail.

We Get Mail

by Anonymous on 8/27/2008 07:21:00 AM

It used to be, whenever I had no inspiration for a blog post at all, I could just go slumming over at one of the broker boards and find something for edification of my readers or just comic relief. These days, it seems, I just have to check my email.

Yesterday I was being asked to help write a hardship letter, which was certainly an understandable request since I have offered advice on that subject in the past and so, you might say, I asked for it. Today I am being asked to do somebody else's homework. I publish the following in its entirety with the exception of the name:

hiSince I have examined my conscience and discovered that I have no scruples about subjecting people who ask me to do their story problems for them to a high degree of risk, I hereby invite the Calculated Risk commenting community to assist. Please explain to "A" here how to derive a VaR of 419. You may of course assume as many can openers--or as much convexity--as you need to. Remember that your answer could be going into A's frat house files, so please approach this with the appropriate degree of seriousness.

i saw in your blog that you are a risk expert.

for university purpose i am supposed to calculate a value at risk of an option.

the optoin is a call option on 1000 shares for one year with strike price at 10$. the delta of this option is 1.5, meaning that if the share price goes up by 1bp the option by 1.5bp

daily volatilty is 12cents, the value at risk for 95% is supposed to be 419. how do i get this? oh it is delta normal

thank you

A____

Tuesday, August 26, 2008

Olive Garden Warns

by Calculated Risk on 8/26/2008 08:27:00 PM

Another casual dining chain feels the pinch ...

From the WSJ: Olive Garden's Parent Warns on Profit

A surprise warning on earnings by Darden Restaurants Inc. suggests that sit-down restaurants will continue struggling through the fall after a dismal summer.Just more evidence that the 2nd half recovery has been cancelled.

...

"The environment was weaker this quarter than it's been for a while," Darden Chief Executive Clarence Otis said in an interview. Asked how the overall industry will perform during the next few months, he said "We're not counting on it getting a whole lot better."

In coming months, restaurants are expected to close more locations, build fewer new ones, offer more low-priced promotions and tighten worker scheduling to contain labor costs ...

emphasis added

Contest: Predict New Home Sales

by Calculated Risk on 8/26/2008 06:10:00 PM

UPDATE: I remain very bearish on housing, especially on prices and existing home sales.

***bumped*** have fun!

There is wide disagreement in the comments on how much further New Home Sales will decline. Last year we had a contest on existing home sales (winners here). Note: although I didn't enter the contest, I predicted, at the end of 2006, existing home sales of 5.6 to 5.8 million for 2007.

So, for fun, here is a little contest to predict New Home sales for 2008 and 2009.

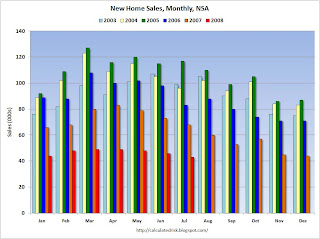

First, a little help ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows annual New Home sales vs. New Home sales through July for each year.

Through July this year, there have been 327K New Homes sold (subject to revision). For the last 45 years, the median number of new homes sold through July is 61%, so 2008 is currently on pace for 534K homes sold.

The rate of sales (SAAR) has been declining all year, just like the previous two years, so I think sales will be below the normal ratio of July to Annual sales, and I'm going to pick 515K for 2008.

For 2009, I think sales will be about the same as 2008 or pick up slightly. My guess is a slight pick-up in sales or about 540K in 2009 (although I will not change my contest pick, I might change my view).

If you'd like to enter, please just post a comment in a format like this:

CR's picks:

2008: 515K

2009: 540K

Best of luck to all (winners each year will be announced in February of the following year - before all revisions).

Carteret Mortgage to Close

by Calculated Risk on 8/26/2008 05:31:00 PM

From Bloomberg: Carteret Mortgage Will Close, Chief Executive Says (hat tip Dave)

Carteret Mortgage Corp., a closely held mortgage broker that originated more than $4 billion in loans in 2006, plans to close in several weeks, said Chief Executive Officer Eric Weinstein.Just a reminder that Mortgage brokers are still going out of business. Carteret had more than 4,500 employees at one time, and operated in 45 states.

``We ran out of money,'' Weinstein, 49, said in an interview today. ``We're not technically out of business yet, but we're winding it down and trying to do the best we can for everybody.''

Weinstein said the ... company has about 800 employees ...

FDIC Problem Bank List Increases

by Calculated Risk on 8/26/2008 03:42:00 PM

UPDATE: FDIC Press Release: Insured Bank and Thrift Earnings Fell to $5.0 Billion in the Second Quarter

From Bloomberg: FDIC Says Banks on `Problem List' Rose 30% in Second Quarter

The U.S. Federal Deposit Insurance Corp. said its ``problem list'' of banks increased [to] 117 ``problem'' banks as of June 30, up from 90 in the first quarter and the highest since mid 2003 ... FDIC-insured lenders reported net income of $4.96 billion, down from $36.8 billion in the same quarter a year ago.Also CNBC reported that the FDIC insurance fund ratio fell to 1.01%, below the 1.15% required by law. So the FDIC will probably have to raise rates for insurance.

``Quite frankly, the results were pretty dismal, and we don't see a return to the high earnings levels of previous years any time soon,'' FDIC Chairman Sheila Bair said at a news conference.

...

Lenders on the FDIC's ``problem list'' had assets of $78 billion at the end of the second quarter, an increase from the $26.3 billion at the end of the first quarter, the agency said.

Case Shiller: Real National Prices Decline to Q4 2002 Levels

by Calculated Risk on 8/26/2008 11:40:00 AM

The first graph compares real and nominal Case-Shiller Home Prices through Q2 2008 (real is current index adjusted using CPI less Shelter). Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms, the Case-Shiller National Home price index is off 25% from the peak. Real prices are now back to the Q4 2002 level (nominal prices are back to mid-2004).

With existing home inventory at record levels, and tighter lending standards, prices will probably continue to decline over the next few years - perhaps another 15% to 25% in real terms on a national basis. The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

There is some correlation, but there are other factors that impact PCE such as changes in income, consumer borrowing and other assets prices (like the stock market). I still think YoY PCE growth will turn negative in the coming quarters, but so far PCE has held up pretty well given the sharp decline in real house prices.

July New Home Sales

by Calculated Risk on 8/26/2008 10:00:00 AM

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 515 thousand. Sales for June were revised down to 503 thousand.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for July since the recession of '91. (NSA, 43 thousand new homes were sold in July 2008, the same as in July '91).

As the graph indicates, there was no spring selling season in 2008.

********************************  The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff. Sales of new one-family houses in July 2008 were at a seasonally adjusted annual rate of 515,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.4 percent (±11.6%)* above the revised June rate of 503,000, but is 35.3 percent (±7.3%) below the July 2007estimate of 796,000.

And one more long term graph - this one for New Home Months of Supply. "Months of supply" is at 10.1 months.

"Months of supply" is at 10.1 months.

Note that this doesn't include cancellations, but that was true for the earlier periods too. The months of supply is down from the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of July was 416,000. This represents a supply of 10.1months at the current sales rate.

Inventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

Looking forward, I'm much more pessimistic about existing home sales, and existing home prices, than new home sales.

More Advice on Hardship Letters

by Anonymous on 8/26/2008 09:43:00 AM

Loyal readers, or just people with too little mental stimulation in their lives, will remember a post I did way back in May on how not to write a hardship letter. In that post, I suggested, quite explicitly, that anyone writing a hardship letter to a servicer in aid of getting a workout proposal approved should:

*Focus on establishing that a workout is necessary, meaning establishing that you cannot afford to pay your mortgage under its original terms.

*Not focus on explaining why all this happened or seeking sympathy, since it doesn't matter why it happened--servicers do workouts when they make sense for the servicer, not when they are moved to feel sorry for anyone.

*Write in your own voice about your own situation, rather than relying on elegant form letters or rhetorical flourishes. Nobody cares about polish; they care about your verified monthly budget and the terms of the workout you are requesting. If the math is correct there, you can misspell most of the words and dangle all the modifiers and you'll still get your workout. This is not an essay contest.

*Present a proposal that will work. You may be the most sympathetic borrower ever to cross Loss Mit's desk, but if your proposal does not work out, it is not a "workout" (did you wonder where that term came from?).

So what did I find in my inbox this morning?

The following missive:Hi, Tanta.

As I am committed to the notion that names should be changed to protect the unwary, I left that part off. We shall refer to my correspondent as Ms. Short Sale. Sure, I could have written the following to Ms. Short Sale personally, but apparently the public service message I was trying to get across in the original post didn't work for everyone, so as a public service I shall repeat some of it again in hopes that it will take this time.

I read your article "How Not to Write a Hardship Letter" on the website Calculated risk. I am finding writing my hardship letter to be the most challenging part of my short-sale package. I can't help but laugh at that things that have led up to my hardship, and it seems that one thing leads to another and it's just a big can of messy worms that I've somehow opened and can't get cleaned up to figure out how to articulate concisely in the letter in a way that will make an impact in my favor to get the short-sale approved.

I need help, and am wondering if I could hire you to hear out my story and write mine? If not, do you have any advice on how I can go about finding someone to write it?

Thank you very much!!!

Dear Ms. Short Sale:

I am happy to hear that you are in one of those hardship situations that is actually pretty amusing. Most people who write to Loss Mit aren't exactly chuckling.

However, if you had read my post with a bit more attention, you would have noticed that my advice is not to spend any time "explaining" your circumstances. Whether they are funny or not. I pointed out that your purpose in a hardship letter is to 1) document the financial necessity of a workout and 2) propose a plan that will work. You are caught up in the idea of making an "impact" on your servicer. You need to ditch that idea right now. This is not a resume cover letter. It is not a sales pitch. It is not an essay-writing contest. It is a business letter that needs to be concise and to the point.

Sadly, you could not possibly afford what I would charge to hear your story and write your letter. If you could, I suspect you could bring cash to closing to settle your loan for the full amount due. Since you are requesting a short sale, I must believe that you don't have that kind of money sitting around.

I will, however, once again give you some good free advice. It may not be what you want to hear, but this is a chronic problem in the advice-giving gig.

You want the servicer to approve a short sale. You therefore need to establish that:

1. You cannot afford to keep the home or you must move for some good reason and cannot afford to pay the difference between the sales proceeds and your loan amount. It does not really matter at this point why this situation has arisen. You simply need to document that it is what it is. Explain what your income is, what your expenses are, what savings you have, why you have to move, etc. If you are asking for a short sale because you have to move, simply say that. For example, say that you have been relocated by your employer or you need to move closer to family in order to reduce your expenses. This is not an invitation to open your funny can of worms and tell everyone all about your situation that is totally unique and high-impact and all that. If you cannot document that you cannot afford to repay your loan--and you don't actually have to move--then I don't know what business you have asking for a short sale.

2. Provide evidence that you have attempted to list your property at a price at least equal to your indebtedness, and that this has not been possible. Your realtor can supply your listing history, a price opinion, or other information to establish that you will have to list the property for less than the loan amount in order to get it sold. If you are not working with a realtor, your servicer will question how hard you are trying to sell this house.

3. Propose a sales price that you wish the servicer to approve. No one will give you "blanket approval" for a short sale as such; you will only get approved to sell at a specified minimum price. The servicer will not suggest this price; you have to. That is how negotiations work in this case. Do not expect the servicer to put any cards on the table until you have. They are not that stupid. Your requested price should be backed up by a broker price opinion. The servicer will probably get one, too, if it takes your request seriously.

4. If you already have an offer on your property, as long as this offer came out of some good-faith effort to market the property for as high a price as the market will bear, then request approval to execute a sales contract at this price. If you have never listed the property and the offer is from your brother-in-law, you are not likely to be approved. You need to demonstrate that you have made all practical attempts to fetch the highest sales price possible, in order to protect the lender's interests as much as possible. If you cannot demonstrate that, there's no point in writing your letter at all.

5. Explain clearly that either you have no subordinate liens on this property, or you are seeking approval from any second mortgage holder for the short sale as well. If the existence of a second lien is part of your "can of worms," you will have to address that. If you want your first mortgage servicer to negotiate on your behalf with your second mortgage servicer, you will need to say so. You will need to bear in mind that this negotiation may not be very successful if you are simply asking the second lien lender to wipe out its entire loan with no cost to you. Offering to pay the second lien lender a couple thousand dollars for its trouble--or to sign a note so that you can pay a couple thousand in installments--would be appropriate. If you cannot possibly afford to contribute anything to the junior lien, your first mortgage servicer may have to do that in order to get the deal approved. This will increase the first servicer's loss. You will have to take that into account when you propose your sales price.

6. If you must use exclamation points, one is sufficient.

It is possible that you are having trouble drafting your letter simply because you are not clear about the purpose of the letter. The above advice should help you get clear on that. It is also possible, of course, that you are having trouble drafting your letter because what you want doesn't actually make much sense or because you haven't actually tried listing your property or talking to a realtor and are just trying to float a trial balloon to see what the servicer will do. You want to be very honest with yourself if this is the case, because you won't get anywhere with your servicer if it is. As I said in my original post, you are writing a business letter with a business proposition in it, and you need to demonstrate that you are doing your part to resolve this situation.

Sadly, the world is full of people who would take your money to write a letter for you. You are actually probably quite fortunate that you asked someone who won't. If you have money to spend, get yourself an appraisal or a broker price opinion from a reputable RE agent who has experience with short sales. Once you have that, you'll know how to write your letter because you will have the basis for a concrete proposal. And that is all the "impact" you need to have on your lender.

Good luck and best wishes,

Tanta

Case-Shiller: House Prices Decline in June

by Calculated Risk on 8/26/2008 09:24:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for June this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index - I'll have more on that later. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index was off 7.0% annual rate in June (from May), and is off 20.3% from the peak.

The Composite 20 index was off 5.9% annual rate in June (from May), and is off 18.8% from the peak.

Prices are still falling, but the rate of monthly price declines has slowed a little. Some of this may be seasonal, and prices will probably continue to decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.0% over the last year.

The Composite 20 is off 15.9% over the last year.

More on prices later ... including Q2 data, selected cities, and real prices.

Monday, August 25, 2008

WSJ: Regulators Step Up Bank Actions

by Calculated Risk on 8/25/2008 10:07:00 PM

From the WSJ: Regulators Step Up Bank Actions

The Federal Reserve and the Office of the Comptroller of the Currency, two of the nation's primary bank regulators, have issued more ... memorandums of understanding so far this year than they did for all of 2007 ...It will be interesting to see how many banks are on double secret probation!

The depth of problems in the banking sector will become clearer Tuesday when the Federal Deposit Insurance Corp. updates its list of "problem" institutions. ...

Take A Load Off Fannie

by Calculated Risk on 8/25/2008 06:05:00 PM

"The story of Fannie Mae, as narrated by The Band"

WaMu Offering 5% 12 Month CDs

by Calculated Risk on 8/25/2008 03:50:00 PM

From WaMu: a 5% 12 month FDIC insured CD. (hat tip Anthony)

Just saying ... WaMu is paying 5% in an environment when few banks are paying over 4.25% and most banks are under 4% for one year CD.

JPMorgan: Fannie & Freddie Investments Decline by Half

by Calculated Risk on 8/25/2008 02:55:00 PM

From the JPMorgan SEC 8-K filing today:

JPMorgan Chase & Co. disclosed today that it held approximately $1.2 billion par value of Fannie Mae and Freddie Mac perpetual preferred stock. Such securities are held in the Firm's investment portfolio and are marked to market through the Firm's earnings. The Firm estimates that such preferred stocks have declined in value by approximately an aggregate $600 million in the third quarter to date, based on current market values. The precise amount of losses that may be incurred on these securities for the third quarter is difficult to determine, given the significant volatility being experienced in the market values of these securities.Many banks hold preferred shares in Fannie and Freddie, and the impact could be widespread.

OTS Expresses Concerns about BankUnited Financial

by Calculated Risk on 8/25/2008 12:22:00 PM

From the BankUnited Financial Corporation 10-Q filed with the SEC today (see page 22 for more):

BankUnited has been advised by the OTS of certain concerns that BankUnited has agreed to address. ... These measures include efforts to seek to raise at least $400 million of capital and to submit an alternative capital plan to be applicable if the Company is unable to raise the $400 million; termination of the option ARM loan program (other than in the wealth management area and, in certain limited circumstances, for loan modifications); termination of reduced and no documentation loan programs; reduction of the portfolio of negative amortization loans; and enhanced monitoring and internal reporting, as well as reporting to regulators on option ARM loan reduction efforts, preservation and enhancement of capital, mortgage insurance and liquidity strength. The Bank also agreed to enhance its policies and procedures regarding the Bank’s allowance for loan losses, including increasing the allowance to a level which has already been attained. The Bank has also agreed to maintain capital ratios substantially in excess of the minimum required ratios to be deemed well-capitalized upon raising the agreed upon amount of capital. The OTS has advised that the Bank must limit its asset growth and notify it prior to: adding directors or senior executive officers; making certain kinds of severance and other forms of payments; entering into, renewing, extending, or revising any compensatory or benefits arrangements with any director or officer; entering into any third-party contracts out of the normal course of business; and issuing any capital distribution, such as dividends. Based on a recent notification, BankUnited believes that, unless it raises significant capital, the OTS will reclassify the Bank to adequately capitalized primarily due to the deterioration in the Bank’s non-traditional mortgage loan portfolio, the concentration of risk associated with that portfolio, and a resultant need for significant additional capital. The Company has continued its efforts to raise capital. Management believes that the Bank will maintain its well-capitalized status if the Company’s capital raising efforts are successful. There can be no guarantee that any of the measures already taken or in progress will be successful or satisfy the concerns of the OTS, and additional restrictions may be imposed on BankUnited’s activities in the future that could have a material adverse effect on BankUnited’s financial position and operations.

Subsequent to June 30, 2008, the FHLB commenced a review of our borrowing capacity, which is ongoing. The FHLB has advised us that it has changed its position regarding collateral held by affiliates, and that $736 million of pledged collateral from our affiliated REIT may not be fully eligible to support borrowings. Management is assessing alternatives for addressing this issue. Additionally, during the quarter ended June 30, 2008, we instituted the use of brokered deposits. The Bank had $268 million of brokered deposits at June 30, 2008 and $774 million as of August 15, 2008. OTS and FDIC regulations limit the use of brokered deposits in certain situations, including requiring a prior waiver from the FDIC if the Bank were reclassified as adequately capitalized.

emphasis added

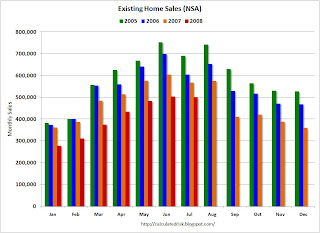

July Existing Home Sales: Record Inventory

by Calculated Risk on 8/25/2008 10:00:00 AM

From NAR: July Existing-Home Sales Show Gain

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 3.1 percent to a seasonally adjusted annual rate¹ of 5.00 million units in July from a downwardly revised level of 4.85 million in June, but are 13.2 percent lower than the 5.76 million-unit pace in July 2007.

...

Total housing inventory at the end of July rose 3.9 percent to 4.67 million existing homes available for sale, which represents an 11.2.-month supply at the current sales pace, up from a 11.1-month supply in June.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2008 (5.00 million SAAR) were the weakest July since 2000 (4.82 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested last month that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means that normal activity (ex-foreclosures) is running around 3.3 million SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September).

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September). Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

But there is some evidence lenders are holding off foreclosing, perhaps trying for workouts, or maybe the lenders are just overwhelmed - and many of these units are probably not included in inventory. And there are definitely homeowners waiting for a "better market" - and those homeowners will probably keep the supply high for a few years.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels have peaked for the year, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year.

My forecast was for Months of Supply to peak at about 12 months this year and this metric is pretty close.

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.NSA sales were reported at 501 thousand in July, however about one-third of those were foreclosure resales. This means regular sales are less than half the level of July 2005 and 2006.

NYT: The GSEs Invent the Risk Premium

by Anonymous on 8/25/2008 09:59:00 AM

Either I've finally lost what passes for my mind, or business press's increased fixation on blaming every problem in the mortgage market on Fannie Mae and Freddie Mac has just about jumped the shark. I don't know how else to explain this, from the NYT:

MORTGAGE rates are typically driven by the financial market’s outlook for long-term interest rates, but not always. Policy changes at Fannie Mae and Freddie Mac, the two government-sponsored companies that buy most mortgages issued by United States lenders, recently helped drive that point home.Um, what kind of profound mental confusion could make someone write those first two sentences? Mortgage rates have always been driven by the market "outlook for long-term interest rates," they still are, and they always will be. So have Treasury rates and the yield the local bank offers you on your certificate of deposit. That yield curve thingy. You've heard of it, maybe.

This month, Fannie and Freddie increased the fees they charge lenders for many loans, effectively bumping up interest rates for many borrowers who have marginal credit. The companies also tightened their policies on refinance loans that enable an owner to take cash out of a home.

But mortgage rates have never been "purely" about the bond market's outlook for benchmark yields, since the benchmarks, like U.S. Treasuries, are credit risk-free investments. Treasuries are backed by the full faith and credit of the U.S. Government, which has financial resources that Joe Blow the homebuyer doesn't have. Mortgage loans, like corporate bonds, have credit risk: the borrower might default and you might not get all your money back.

This is why interest rates on home mortgages are always higher than the rate on risk-free bonds of equivalent duration, like Treasury notes. If they weren't, nobody would invest in mortgages, they'd just buy the risk-free bonds. Are you still with me, everyone?

So there are always two main ingredients of mortgage rates, comparable-duration bond yields and the credit risk premium. And the credit risk premium, theoretically as well as practically, can fluctuate pretty widely, depending on, well, one's "outlook" for credit risk.

Fannie and Freddie have always guaranteed the credit risk of the mortgage-backed securities they issue. That is what they do and why they're here. In the "required yields" they establish for the loans they securitize, there has always been this little extra bit that they do not pass through to investors; it's the part they keep for themselves to cover credit losses, because they do not pass credit losses on to investors. You can call it a guarantee fee or a loan-level pricing adjustment or a post-settlement fee, if you want to be technical, or you can just call it a "credit risk premium."

One possibility here is that the GSEs are increasing their credit risk premium--which, in the absence of marked changes in required net yield to the end investor, will appear to make mortgage rates rise "independently" of other long-term interest rates--because, well, current conditions in the housing and mortgage market suggest that mortgages are pretty risky right now, credit-wise. One thing that indicates the extent of this risk, of course, is that by and large nobody but the GSEs are buying mortgage loans right now. Perhaps this is what is confusing the Times reporter: if Fannie and Freddie had any competition right now--if there were anyone else out there buying loans--it might be more obvious that everyone increases risk premiums when perceived credit risk rises. But really, you know. When nobody else but the government-chartered investors are in the market, that can be understood to mean that risk is so high that nobody else is even feeling strong enough to be willing put a price on it. The absence of competitors in a market often suggests that risk has risen in that market. If you've ever tried to get flood insurance, you may have noticed this phenomenon.

Of course, there's another way to look at this, which is that in the last five to seven years it did not "appear" that there was much of a risk premium in mortgage rates because, well, there wasn't much of one. Since we cannot actually open a newspaper or get on the internet without another story of horrible losses taken by investors in mortgages whose "cushion" for defaults--their credit risk premium--was ludicrously low given the riskiness of the mortgages they were investing in, we might have concluded by now that things like the increased risk premiums that the GSEs are now charging are something along the lines of a return to "normal" interest rates. Normal rates being ones that have a realistic risk premium in them.

These two issues do, actually, converge: if the GSEs are the only ones buying loans right now, then they are likely to be buying more of the kinds of loans that private investors used to buy before they quit buying anything. Unless they want to go the same way their private competitors have gone, they have to either tighten standards or raise risk premiums or a combination of both, since it's pretty obvious that the private investor loans of the last few years--mostly subprime, Alt-A, and jumbo--were pretty seriously underpriced. Mortgage markets really aren't that weirder than any other market: you can't make up a negative margin on volume.

This Times piece strikes me as just a somewhat subtler version of the "GSEs Refuse to Save the Day" rhetoric we've seen expressed somewhat more stridently before. What else can we make of this:

Those buying homes will have little choice but to absorb the cost. But the new policies will be felt more by those thinking of refinancing mortgages.Ohhh-kaaay. If you have to buy--apparently people do "have to" buy--you just have to pay a higher interest rate than buyers did until recently. But if you already have a mortgage and refinancing doesn't look promising right now because the rate you have is lower than the rate on a new loan--you're really suffering? Well, OK, what we seem to mean is that if you "have to" refinance--to get cash or to get out of some crazy high-risk ARM--then you will feel some pain. Because apparently Fannie and Freddie aren't willing to take borrowers who "have to" supplement their income with cash-outs or bail out of loans that let them buy too much house without charging extra for it.

Strangely enough, the Times piece makes pretty clear that this "charging extra" doesn't really amount to all that much, relatively speaking. Another eighth of a percent on the annual interest rate isn't exactly going to hit the usury ceiling any time soon. It also provides a nifty little chart showing that one-year ARM rates are still out there with a pretty decent discount. If you don't like paying 6.93% (in New York) for a 30-year fixed, you can always get an ARM for 6.01%. What? You don't want an ARM because you're afraid rates will rise in the future? And we thought rates no longer had anything to do with such expectations . . .