by Calculated Risk on 9/18/2006 12:50:00 PM

Monday, September 18, 2006

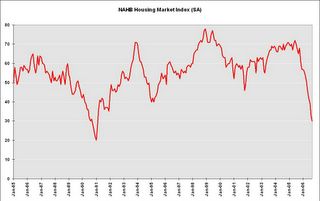

NAHB: Builder Confidence Falls to 15 Year Low

UPDATE: The National Association of Home Builders reports: Builder Confidence Slips Further in September

Click on graph for larger image.

Reflecting increasing builder concerns about conditions in the market for new single-family homes, the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) declined for an eighth consecutive month to a level of 30 in September. This amounted to a three-point drop from an upwardly revised 33 reading in August, and is the lowest level the index has reached since February of 1991.Once again this shows that the housing bust is national and is getting worse.

"Builders are adopting an increasingly cautious attitude in their near-term outlook for new-home sales," said NAHB Chief Economist David Seiders. "They’re experiencing falling sales, rising sales cancellations, and increasing inventories of unsold units. And although many builders are offering substantial incentives to bolster sales and limit cancellations, many potential buyers now are waiting on the sidelines to see how the market shakes out before proceeding with a home purchase."

"We are in the midst of an anticipated adjustment period as the housing market subsides from the record-breaking and unsustainable highs of the past few years," Seiders noted. "Our forecast projects the numbers flattening out around the middle of next year and gradually moving back up towards trend in 2008."

...

Two of the three component indexes declined in August. The component that gauges current single-family home sales declined five points to 32, while the component gauging expected sales in the next six months fell four points to 37. The component gauging traffic of prospective buyers remained even from last month, at 22.

The HMI fell in three out of four regions in September. The largest decline was registered in the Northeast, where a six-point drop brought the HMI to 28. The HMI fell five points to 38 in the West and fell three points to 38 in the South. The HMI held steady at 16 in the Midwest, where fundamentally weak economic conditions continue to weigh on the market.