by Calculated Risk on 9/28/2024 02:11:00 PM

Saturday, September 28, 2024

Real Estate Newsletter Articles this Week: Case-Shiller National HPI Up 5.0% year-over-year in July

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 5.0% year-over-year in July

• New Home Sales Decrease to 716,000 Annual Rate in August

• Inflation Adjusted House Prices 1.5% Below 2022 Peak

• Fannie and Freddie: Single Family Serious Delinquency Rate Ticked Up in August

• Watch Months-of-Supply!

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of September 29, 2024

by Calculated Risk on 9/28/2024 08:11:00 AM

The key report scheduled for this week is the September employment report on Friday.

Other key indicators include the September ISM Manufacturing and Services indices and September auto sales.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 46.5, up from 46.1 in August.

1:55 PM: Speech, Fed Chair Jerome Powell, Economic Outlook, At the National Association for Business Economics (NABE) Annual Meeting, Nashville, Tenn

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

10:00 AM: ISM Manufacturing Index for September. The consensus is for a reading of 47.6, up from 47.2 in August.

10:00 AM: Construction Spending for August. The consensus is for a 0.1% increase.

All day: Light vehicle sales for September.

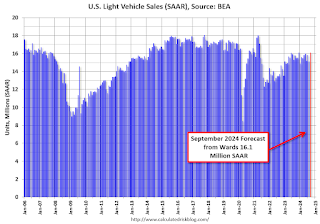

All day: Light vehicle sales for September.The consensus is for sales of 15.7 million SAAR, up from 15.1 million SAAR in August (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 110,000 jobs added, up from 99,000 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, up from 218 thousand last week.

10:00 AM: the ISM Services Index for September.

8:30 AM: Employment Report for September. The consensus is for 145,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

8:30 AM: Employment Report for September. The consensus is for 145,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.There were 142,000 jobs added in August, and the unemployment rate was at 4.2%.

This graph shows the jobs added per month since January 2021.

Friday, September 27, 2024

September 27th COVID Update: Wastewater Measure Declining

by Calculated Risk on 9/27/2024 07:20:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week🚩 | 1,239 | 1,176 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Fannie and Freddie: Single Family Serious Delinquency Rate Ticked Up in August

by Calculated Risk on 9/27/2024 05:32:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rate Ticked Up in August

Brief excerpt:

Single-family serious delinquencies increased slightly in August, and multi-family serious delinquencies decreased slightly.

...

Freddie Mac reports that the multi-family delinquencies rate decreased to 0.38% in August, down from 0.39% in July, and down from the recent peak of 0.44% in January.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth slowed, vacancy rates increased and borrowing costs increased sharply. The rate surged higher in January and has moved mostly sideways at an elevated level since then.

ICE: "Home prices continued to cool in August, with prices up +3.0%" YoY

by Calculated Risk on 9/27/2024 11:46:00 AM

Note: This is a repeat sales index (like Case-Shiller and FHFA). ICE is releasing this index early this month.

From ICE:

• Home prices continued to cool in August, with prices up +3.0% from the same time last year according to the ICE Home Price Index, marking the slowest rate of home price growth in over a year

• On an adjusted basis prices rose by +0.12% in the month – the slowest adjusted monthly growth since last November – equivalent to a seasonally adjusted annualized rate (SAAR) of +1.4%

• While those soft monthly gains suggest that the annual home price growth rate may slow further in September, the market may be poised to catch a two different tail winds in coming months

• The first will come from softer comparable sales from late 2023 when mortgage rates had climbed above 7.5%, with the second coming from easing 30-year rates and improved affordability in September

• August home price gains were driven by mortgage rates in the high 6% range in July, before they trended sharply lower through August and September

• September home prices were driven by rates in the mid-6% range, while October prices will be driven by 30-year rates that have been in the low 6% range

• It will be worth watching the housing supply/demand and price dynamics closely in coming months given the sharp downward trend in mortgage rates in recent weeks Price growth slowed across two-thirds of the nation’s largest markets in August

• The strongest cooling was seen in the Midwest and Northeast – areas of the country that, while slightly cooler than recent months, continue to see the strongest home price growth nationwide

• On the other end of the spectrum, 1 in 4 of the nation’s largest markets saw prices edge lower on a seasonally adjusted basis, led by North Port, Cape Coral, Austin TX, Memphis, Tucson, and Atlanta

• A dozen major markets are now seeing home prices below last year’s levels, including Cape Coral and North Port where prices are down 6.4% and 5.7%, respectively, from this same time last year

• Of the 12 markets where prices have fallen over the past 12 months, 7 are in the state of Florida along with San Francisco, Austin, San Antonio, Memphis, and New Orleans

emphasis added

Q3 GDP Tracking: Around 3%

by Calculated Risk on 9/27/2024 10:50:00 AM

From BofA:

Since our last weekly publication, our 3Q GDP tracking estimate is down two-tenths to 2.3% q/q saar while 2Q GDP came in at 3.0% q/q saar in the final official estimate. [Sept 27th estimate]From Goldman:

emphasis added

The details of yesterday’s durable goods report and this morning’s Advance Economic Indicators report were stronger than our previous GDP tracking assumptions, while the details of the PCE report were slightly softer. On net, we boosted our Q3 GDP tracking estimate by 0.2pp to +3.2% (quarter-over-quarter annualized). Our Q3 domestic final sales estimate stands at +2.8%. [Sept 27th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 3.1 percent on September 27, up from 2.9 percent on September 18. After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, a decline in the nowcast of real personal consumption expenditures growth was more than offset by increases in the nowcasts of real gross private domestic investment growth and the contribution of net exports to third-quarter real GDP growth. [Sept 27th estimate]

PCE Measure of Shelter Increases to 5.3% YoY in August

by Calculated Risk on 9/27/2024 09:15:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through August 2024.

Since asking rents are mostly flat year-over-year, these measures will slowly continue to decline over the next year.

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):Key measures are slightly below the Fed's target on a 3-month basis. Note: There appears to be some residual seasonality distorting PCE prices in Q1, especially in January.

3-month annualized change:

Core PCE Prices: 2.1%

Core minus Housing: 1.5%

Personal Income increased 0.2% in August; Spending increased 0.2%

by Calculated Risk on 9/27/2024 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $50.5 billion (0.2 percent at a monthly rate) in August, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $34.2 billion (0.2 percent) and personal consumption expenditures (PCE) increased $47.2 billion (0.2 percent).The August PCE price index increased 2.2 percent year-over-year (YoY), down from 2.5 percent YoY in July, and down from the recent peak of 7.2 percent in June 2022.

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Real DPI increased 0.1 percent in August and real PCE increased 0.1 percent; goods increased less than 0.1 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through August 2024 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and PCE was below expectations.

Using the two-month method to estimate Q3 real PCE growth, real PCE was increasing at a 3.3% annual rate in Q3 2024. (Using the mid-month method, real PCE was increasing at 2.6%). This suggests solid PCE growth in Q3.

Thursday, September 26, 2024

Friday: Personal Income & Outlays

by Calculated Risk on 9/26/2024 08:21:00 PM

Thursday:

• At 8:30 AM ET Personal Income and Outlays, August 2024. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 67.7.

September Vehicle Sales Forecast: 16.1 million SAAR, Up 2% YoY

by Calculated Risk on 9/26/2024 04:19:00 PM

From WardsAuto: September U.S. Light-Vehicle Sales Forecast for 9-Month-High SAAR Despite Drop in Volume (pay content). Brief excerpt:

If September’s outlook holds true, Q3 sales will decline 1.8% year-over-year. However, deliveries in October-December, goosed by two additional selling days vs. the year-ago period, are forecast to rise 7.4% from like-2023, leaving volume for entire-2024 at 15.9 million, up from 2023’s 15.5 million.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for September (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 16.1 million SAAR, would be up 6.4% from last month, and up 2.1% from a year ago.