by Calculated Risk on 6/11/2024 08:11:00 AM

Tuesday, June 11, 2024

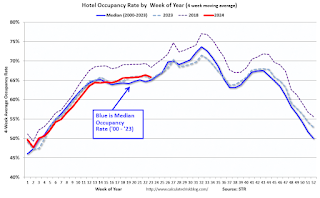

Hotels: Occupancy Rate Increased 0.9% Year-over-year

Due to Memorial Day, the U.S. hotel industry reported lower performance results from the previous week but slightly positive comparisons year over year, according to CoStar’s latest data through 1 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

26 May through 1 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 62.0% (+0.9%)

• Average daily rate (ADR): US$150.87 (+0.1%)

• Revenue per available room (RevPAR): US$93.50 (+1.0%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Monday, June 10, 2024

"Mortgage Rates Slightly Higher to Start Pivotal Week"

by Calculated Risk on 6/10/2024 06:26:00 PM

The event calendar ramps up quickly from here and Wednesday will be the most important day of the month due to the release of pivotal inflation data and an updated rate announcement and outlook from the Fed. While there's no chance of a rate cut or hike at this meeting, we should get more clarity on the Fed's interpretation of the very latest trends in inflation. [30 year fixed 7.17%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

Q1 Update: Delinquencies, Foreclosures and REO

by Calculated Risk on 6/10/2024 01:17:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Q1 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q4 2023 (Q1 2024 data will be released in three weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.2% of loans are under 3%, 58.1% are under 4%, and 77.0% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

AAR: Rail Carloads Down YoY in May, Intermodal Up

by Calculated Risk on 6/10/2024 11:12:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total U.S. carloads were down 6.0% in May 2024 from May 2023, their fifth straight year-over-year decline. Year-to-date total carloads through May were down 5.0%, or 247,984 carloads, from last year and were the lowest in our records that go back to 1988.

We’ve said it before and we’ll say it again: it’s coal’s fault. Coal averaged 49,239 carloads per week in May 2024, down 22.0% from last year and its fifth straight double-digit percentage decline. In our records, only May 2020 and April 2024 had fewer coal carloads. Year-to-date coal carloads in 2024 through May were down 18.3%, or 263,128 carloads, from last year. Still, coal remains the single highest volume carload commodity for U.S. railroads (25% of carloads so far this year).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2022, 2023 and 2024:

Total originated carloads on U.S. railroads in May 2024 were down 6.0%, or 67,145 carloads, from May 2023. The weekly average in May 2024 was 212,160 carloads, virtually the same as in April 2024.

Year-to-date total carloads in 2024 through May were down 5.0% (247,984 carloads) from the same period last year and down 4.4% from the same period in 2022.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):U.S. intermodal volume in May 2024 was up 7.6% (90,744 containers and trailers) over May 2023, its ninth straight gain. Year-to-date intermodal volume through May was 5.57 million units, up 8.7% (443,453 units) over last year but down 3.1% (180,434 units) from 2022.

Housing June 10th Weekly Update: Inventory up 1.1% Week-over-week, Up 37.8% Year-over-year

by Calculated Risk on 6/10/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 09, 2024

Sunday Night Futures

by Calculated Risk on 6/09/2024 06:18:00 PM

Weekend:

• Schedule for Week of June 9, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are little changed (fair value).

Oil prices were down over the last week with WTI futures at $75.37 per barrel and Brent at $79.53 per barrel. A year ago, WTI was at $70, and Brent was at $75 - so WTI oil prices are up about 7% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.40 per gallon. A year ago, prices were at $3.57 per gallon, so gasoline prices are down $0.17 year-over-year.

FOMC Preview: No Change to Fed Funds Rate

by Calculated Risk on 6/09/2024 09:40:00 AM

Most analysts expect there will be no change to the federal funds rate at the meeting this week keeping the target range at 5‑1/4 to 5-1/2 percent. Currently market participants expect the next Fed move to be a 25 bp cut announced at the November FOMC meeting. The market is almost pricing in a 2nd cut in December.

From BofA:

The bottom line is that the stronger-than-expected May employment report remains consistent with our monetary policy outlook for staying on hold. This report showed solid payroll gains with positive implications for consumer spending. We expect the Fed to stay on hold for now and start a gradual cutting cycle in December which will depend on a moderation in the inflation data. The economy may be cooling, but it is not cool.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.0 to 2.4 | 1.9 to 2.3 | 1.8 to 2.1 | |

| Dec 2023 | 1.2 to 1.7 | 1.5 to 2.0 | 1.8 to 2.0 | |

The unemployment rate was at 4.0% in April, at the FOMC projections for Q4. This might be revised up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 3.9 to 4.1 | 3.9 to 4.2 | 3.9 to 4.3 | |

| Dec 2023 | 4.0 to 4.2 | 4.0 to 4.2 | 3.9 to 4.3 | |

As of April 2024, PCE inflation increased 2.7 percent year-over-year (YoY). This is at the high end of the FOMC projections for Q4, and inflation will likely be revised down slightly.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.3 to 2.7 | 2.1 to 2.2 | 2.0 to 2.1 | |

| Dec 2023 | 2.2 to 2.5 | 2.0 to 2.2 | 2.0 | |

PCE core inflation increased 2.8 percent YoY in April. This is also at the high end of the FOMC projections for Q4 2024. However, housing is still distorting the measures of inflation, and the shelter index will continue to decline (monetary policy can't impact what happened in the past), and it is likely projections for core PCE will be revised down slightly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.5 to 2.8 | 2.1 to 2.3 | 2.0 to 2.1 | |

| Dec 2023 | 2.4 to 2.7 | 2.0 to 2.2 | 2.0 to 2.1 | |

Saturday, June 08, 2024

Real Estate Newsletter Articles this Week: "Home ATM" Mostly Closed in Q1

by Calculated Risk on 6/08/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• The "Home ATM" Mostly Closed in Q1

• 1st Look at Local Housing Markets in May

• Asking Rents Mostly Unchanged Year-over-year

• Freddie Mac House Price Index Increased in April; Up 6.5% Year-over-year

• ICE Mortgage Monitor: "Home Prices Cool for Second Straight Month in April"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 9, 2024

by Calculated Risk on 6/08/2024 08:11:00 AM

The key report this week is May CPI.

The FOMC meets on Tuesday and Wednesday, and rates are expected to be unchanged.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for 0.2% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.5% YoY).

2:00 PM: FOMC Statement. The FOMC is expected to leave the Fed Funds rate unchanged at this meeting.

2:00 PM: FOMC Projections This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 229 thousand last week.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

Friday, June 07, 2024

June 7th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 6/07/2024 07:53:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week✅ | 303 | 398 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.