by Calculated Risk on 4/22/2024 02:58:00 PM

Monday, April 22, 2024

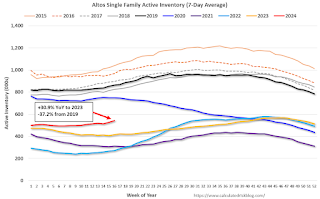

Housing April 22nd Weekly Update: Inventory up 3.0% Week-over-week, Up 30.9% Year-over-year

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

TSA: Airline Travel about 5% Above 2019 Levels

by Calculated Risk on 4/22/2024 10:52:00 AM

The TSA is providing daily travel numbers.

This data is as of April 21st.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA (Blue).

The red line is the percent of 2019 for the seven-day average.

Air travel - as a percent of 2019 - is tracking at about 105% of pre-pandemic levels.

DOT: Vehicle Miles Driven Increased 1.4% year-over-year in February 2024 SA

by Calculated Risk on 4/22/2024 08:14:00 AM

This is something I check occasionally.

The Department of Transportation (DOT) reported:

• Travel on all roads and streets changed by +2.0% (+4.8 billion vehicle miles) for February 2024 as compared with February 2023. Travel for the month is estimated to be 240.2 billion vehicle miles.

• The seasonally adjusted vehicle miles traveled for February 2024 is 274.8 billion miles, a +1.4% ( +3.9 billion vehicle miles) change over February 2023. It also represents a 0.6% change (1.7 billion vehicle miles) compared with January 2024.

• Cumulative Travel for 2024 changed by +0.6% (+2.7 billion vehicle miles). The cumulative estimate for the year is 487.4 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April 2020. Miles driven are now at pre-pandemic levels.

Sunday, April 21, 2024

Sunday Night Futures

by Calculated Risk on 4/21/2024 07:14:00 PM

Weekend:

• Schedule for Week of April 21, 2024

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 17 and DOW futures are up 100 (fair value).

Oil prices were up over the last week with WTI futures at $83.26 per barrel and Brent at $86.96 per barrel. A year ago, WTI was at $78, and Brent was at $83 - so WTI oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.64 per gallon. A year ago, prices were at $3.67 per gallon, so gasoline prices are down $0.03 year-over-year.

When Do Market Participants Expect the Fed to Cut Rates?

by Calculated Risk on 4/21/2024 09:40:00 AM

As of December 2023, looking at the "dot plot", most FOMC participants expected between 2 and 4 rate cuts in 2024:

| As of Dec 2023 Meeting | |

|---|---|

| 25 bp Rate Cuts | FOMC Members |

| No Change | 2 |

| One Rate Cut | 1 |

| Two Rate Cuts | 5 |

| Three Rate Cuts | 6 |

| Four Rate Cuts | 4 |

| More than Four | 1 |

As of the March 2024 meeting, FOMC participants were down to 2 to 3 rate cuts in 2024:

| As of Mar 2024 Meeting | |

|---|---|

| 25 bp Rate Cuts | FOMC Members |

| No Change | 2 |

| One Rate Cut | 2 |

| Two Rate Cuts | 5 |

| Three Rate Cuts | 9 |

| Four Rate Cuts | 1 |

Most market participants expect between 1 and 2 rate cuts this year, with the first cut in September. Here are a couple analyst views:

[W]e revised our Fed forecasts in response to the upside surprise in the March inflation data. We now expect the Fed to start cutting in December rather than June, and we still think cuts will proceed at a quarterly cadence. Importantly, we did not simply push our projected cutting cycle out by two quarters. We removed the June and September 2024 cuts entirely from our forecast, raising the terminal rate by 50bp to 3.5-3.75%.From Goldman Sachs:

The FOMC was already narrowly divided on its three-cut baseline for 2024, and we think it will now need to see the string of three firmer inflation prints from January to March balanced by a series of softer prints in subsequent months.

We continue to expect cuts at a quarterly pace after July, which now implies two cuts in 2024 in July and November.

Saturday, April 20, 2024

Real Estate Newsletter Articles this Week: Single Family Starts Up 22% Year-over-year in March; Multi-Family Starts Down Sharply

by Calculated Risk on 4/20/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Single Family Starts Up 22% Year-over-year in March; Multi-Family Starts Down Sharply

• NAR: Existing-Home Sales Decreased to 4.19 million SAAR in March

• NMHC: "Apartment Market Continues to Loosen"

• 4th Look at Local Housing Markets in March; California Home Sales Down 4.4% YoY in March

• Lawler: Early Read on Existing Home Sales in March

• 3rd Look at Local Housing Markets in March

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of April 21, 2024

by Calculated Risk on 4/20/2024 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q1 GDP, March New Home sales and March Personal Income and Outlays.

For manufacturing, the April Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

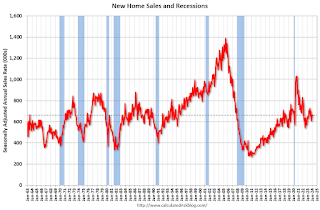

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 670 thousand SAAR, up from 662 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, down from 212 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2024 (Advance estimate). The consensus is that real GDP increased 2.1% annualized in Q1, down from 3.4% in Q4.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 2.0% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for April.

8:30 AM ET: Personal Income and Outlays, March 2024. The consensus is for a 0.5% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.6% YoY, and core PCE prices up 2.7% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 77.9.

Friday, April 19, 2024

April 19th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 4/19/2024 07:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 5,899 | 6,686 | ≤3,0001 | |

| Deaths per Week2 | 779 | 982 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

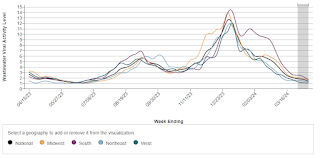

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q1 GDP Tracking: Movin' on Up

by Calculated Risk on 4/19/2024 11:31:00 AM

From BofA:

Since our update last week, 1Q GDP tracking is up two-tenths to 2.1% q/q saar. [Apr 19th estimate]From Goldman:

emphasis added

We left our Q1 GDP forecast unchanged at +3.1% (qoq ar) and our domestic final sales forecast also unchanged at +3.1% (qoq ar). [Apr 18th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.9 percent on April 16, up from 2.8 percent on April 15. [April 16th estimate]

NMHC: "Apartment Market Continues to Loosen"

by Calculated Risk on 4/19/2024 08:10:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Continues to Loosen"

Excerpt:

From the NMHC: Apartment Market Continues to Loosen Amidst Worsening Financing ConditionsThere is much more in the article.Apartment market conditions continued to weaken in the National Multifamily Housing Council’s (NMHC’s) Quarterly Survey of Apartment Market Conditions for April 2024. With the exception of Sales Volume (52), which turned positive this quarter, the Market Tightness (41), Equity Financing (49), and Debt Financing (44) indexes all came in below the breakeven level (50).

...

"[T]he U.S. apartment market continues to absorb historic levels of new supply, resulting in rising vacancy rates and decreasing rent growth.”

...• The Market Tightness Index came in at 41 this quarter – below the breakeven level (50) – indicating looser market conditions for the seventh consecutive quarter. That said, a plurality of respondents (42%) thought market conditions were unchanged compared to three months ago, while 37% thought markets have become looser. Twenty percent of respondents reported tighter markets than three months ago, up from 5% in January.The quarterly index increased to 41 in April from 23 in January. Any reading below 50 indicates looser conditions from the previous quarter.

This index has been an excellent leading indicator for rents and vacancy rates, and this suggests higher vacancy rates and a further weakness in asking rents. This is the seventh consecutive quarter with looser conditions than the previous quarter.