by Calculated Risk on 5/17/2023 06:01:00 PM

Wednesday, May 17, 2023

4th Look at Local Housing Markets in April

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in April

A brief excerpt:

Yesterday, housing economist Tom Lawler noted:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.33 million in April, down 2.5% from March’s preliminary pace and down 22.3% from last April’s seasonally adjusted pace.The National Association of Realtors (NAR) is scheduled to release April existing home sales on Thursday, May 18, 2023, at 10:00 AM ET. The consensus is for 4.30 million SAAR.

...

In April, sales in these markets were down 24.7%. In March, these same markets were down 19.4% YoY Not Seasonally Adjusted (NSA).

This is a larger YoY decline NSA in April than in March for these markets, however there was one less selling day in April this year. This data suggests the April existing home sales report will show another significant YoY decline, and the 20th consecutive month with a YoY decline in sales.

Several more local markets to come next week!

April Housing Starts: Near Record Multi-Family Under Construction

by Calculated Risk on 5/17/2023 09:35:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: April Housing Starts: Near Record Multi-Family Under Construction

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Red is single family units. Currently there are 698 thousand single family units (red) under construction (SA). This was down in April compared to March, and 133 thousand below the recent peak in May 2022. Single family units under construction have peaked since single family starts declined sharply. The number of single-family homes under construction will decline further in coming months.

Blue is for 2+ units. Currently there are 977 thousand multi-family units under construction. This is the highest level since September 1973! This is close to the all-time record of 994 thousand in 1973 (being built for the baby-boom generation). For multi-family, construction delays are a significant factor. The completion of these units should help with rent pressure.

Combined, there are 1.675 million units under construction, just 35 thousand below the all-time record of 1.710 million set in October 2022.

Housing Starts at 1.401 million Annual Rate in April

by Calculated Risk on 5/17/2023 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1,401,000. This is 2.2 percent above the revised March estimate of 1,371,000, but is 22.3 percent below the April 2022 rate of 1,803,000. Single‐family housing starts in April were at a rate of 846,000; this is 1.6 percent above the revised March figure of 833,000. The April rate for units in buildings with five units or more was 542,000.

Building Permits:

Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,416,000. This is 1.5 percent below the revised March rate of 1,437,000 and is 21.1 percent below the April 2022 rate of 1,795,000. Single‐family authorizations in April were at a rate of 855,000; this is 3.1 percent above the revised March figure of 829,000. Authorizations of units in buildings with five units or more were at a rate of 502,000 in April.

emphasis added

Click on graph for larger image.

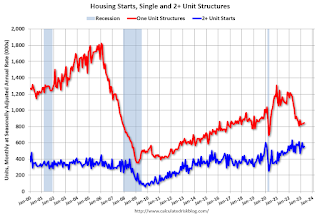

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in April compared to March. Multi-family starts were down 12.2% year-over-year in April.

Single-family starts (red) increased in April and were down 27.9% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in April were slightly above expectations, however, starts in February and March were revised down, combined.

I'll have more later …

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/17/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 12, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 5.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 6 percent compared with the previous week. The Refinance Index decreased 8 percent from the previous week and was 43 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4.8 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 26 percent lower than the same week one year ago.

“Mortgage rates increased last week even as Treasury yields were essentially flat, with the spread between the two rates widening to 310 basis points. Mortgage application activity slowed, as most mortgage rates in the survey increased, with the 30-year fixed rate jumping nine basis points to its highest level in two months at 6.57 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications decreased 5 percent to its slowest pace in a month, as buyers remain wary of this rate volatility, but also as for-sale inventory in many parts of the country remains scarce.

Added Kan, “Refinance applications accounted for 27 percent of all applications and dropped almost 8 percent last week. Most borrowers have lower rates on their mortgages, and those who are in the market are extremely rate sensitive.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.57 percent from 6.48 percent, with points remaining at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 26% year-over-year unadjusted.

Tuesday, May 16, 2023

Wednesday: Housing Starts

by Calculated Risk on 5/16/2023 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for April. The consensus is for 1.396 million SAAR, down from 1.420 million SAAR in March.

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/16/2023 01:10:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in April

A brief excerpt:

From housing economist Tom Lawler:There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.33 million in April, down 2.5% from March’s preliminary pace and down 22.3% from last April’s seasonally adjusted pace.

NAHB: Builder Confidence Increased in May

by Calculated Risk on 5/16/2023 10:13:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 50, up from 45 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Lack of Existing Inventory Boosts Builder Confidence to Key Marker

Limited existing inventory, which has put a renewed emphasis on new construction, resulted in a solid gain for builder confidence in May even as the industry continues to face several challenges, including building material supply chain disruptions and tightening credit conditions for construction loans.

Builder confidence in the market for newly built single-family homes in May rose five points to 50, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the fifth straight month that builder confidence has increased and is the first time that sentiment levels have reached the midpoint mark of 50 since July 2022.

New home construction is taking on an increased role in the marketplace because many home owners with loans well below current mortgage rates are electing to stay put, and this is keeping the supply of existing homes at a very low level. In March, 33% of homes listed for sale were new homes in various stages of construction. That share from 2000-2019 was a 12.7% average. With limited available housing inventory, new construction will continue to be a significant part of prospective buyers’ search in the quarters ahead.

While this is fueling cautious optimism among builders, they continue to face ongoing challenges to meet a growing demand for new construction. These include shortages of transformers and other building materials and tightening credit conditions for residential real estate development and construction brought on by the actions of the Federal Reserve to raise interest rates.

...

All three major HMI indices posted gains in May. The HMI index gauging current sales conditions rose five points to 56, the component charting sales expectations in the next six months increased seven points to 57 and the gauge measuring traffic of prospective buyers increased two points to 33.

Looking at the three-month moving averages for regional HMI scores, the, the Midwest edged up two points to 39, the South increased three points to 52 and the West moved three points higher to 41. The Northeast held steady at 45.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast.

Industrial Production Increased 0.5% in April

by Calculated Risk on 5/16/2023 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

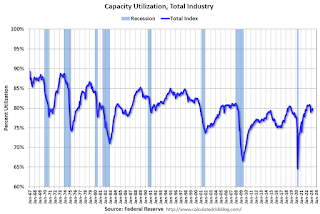

Industrial production rose 0.5 percent in April after moving sideways the previous two months. In April, manufacturing increased 1.0 percent, bolstered by a strong gain in the output of motor vehicles and parts; factory output excluding motor vehicles and parts moved up 0.4 percent. The index for mining rose 0.6 percent, while the index for utilities dropped 3.1 percent, as milder temperatures in April lowered demand for heating. At 103.0 percent of its 2017 average, total industrial production in April was 0.2 percent above its year-earlier level. Capacity utilization edged up to 79.7 percent in April, a rate that is equal to its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 79.7% is at the average from 1972 to 2022. This was at consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 103.0. This is above the pre-pandemic level.

Industrial production was above consensus expectations, however previous months were revised down.

Retail Sales Increased 0.4% in April

by Calculated Risk on 5/16/2023 08:40:00 AM

On a monthly basis, retail sales were up 0.4% from March to April (seasonally adjusted), and sales were up 1.6 percent from April 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for April 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $686.1 billion, up 0.4 percent from the previous month, and up 1.6 percent above April 2022. ... The February 2023 to March 2023 percent change was revised from down 0.6 percent to down 0.7 percent.

emphasis added

Click on graph for larger image.

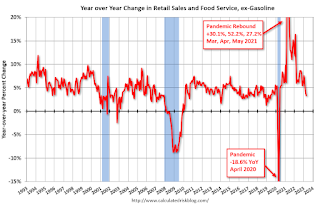

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in April.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.3% on a YoY basis.

Sales in April were below expectations, and sales in March were revised down.

Sales in April were below expectations, and sales in March were revised down.

Monday, May 15, 2023

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey

by Calculated Risk on 5/15/2023 08:46:00 PM

While it may be blessing for rates to be flatter and more predictable lately, the fact that the sideways range is close to long-term highs feels more like a curse. ... Apart from the year-end drift in December and the false start created by strong econ data in February, bonds have spent almost all of their time in the same range for 6 months now. [30 year fixed 6.67%]Tuesday:

emphasis added

• At 8:30 AM ET, Retail sales for April is scheduled to be released. The consensus is for 0.6% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 79.7%.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 45 unchanged from 45 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.