by Calculated Risk on 2/08/2023 04:25:00 PM

Wednesday, February 08, 2023

U.S. Courts: Bankruptcy Filings Decline 6 Percent in 2022

From the U.S. Courts: Bankruptcy Filings Drop 6.3 Percent

Bankruptcy filings fell 6.3 percent for the 12-month period ending Dec. 31, 2022, continuing a fall that coincided with the start of the COVID-19 pandemic. But individual filings under Chapter 13 increased significantly.

Annual bankruptcy filings in calendar year 2022 totaled 387,721, compared with 413,616 cases in 2021, according to statistics released by the Administrative Office of the U.S. Courts.

Business filings fell 6 percent, from 14,347 to 13,481 in the year ending Dec. 31, 2022. Non-business bankruptcy filings fell 6.3 percent, to 374,240, compared with 399,269 in the previous year.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 1997.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

Second Home Market: South Lake Tahoe in January

by Calculated Risk on 2/08/2023 01:39:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through January 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up over 50% from the record low set in February 2022, and up 24% year-over-year. Prices are up 1.1% YoY (and the YoY change has been trending down).

1st Look at Local Housing Markets in January

by Calculated Risk on 2/08/2023 09:36:00 AM

Today, in the Calculated Risk Real Estate Newsletter:

1st Look at Local Housing Markets in January

A brief excerpt:

This is the first look at local markets in January. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in January were mostly for contracts signed in November and December. Since 30-year fixed mortgage rates were over 6% for all of November and December closed sales were down significantly year-over-year in January, however, the impact was probably not as severe as for closed sales in December (rates were the highest in October and November 2022 when contracts were signed for closing in December)..

...

Median sales prices for single family homes were down 2.3% year-over year (YoY) in Las Vegas, and down 3.5% YoY in San Diego and up 0.4% YoY in the Northwest (Seattle).

...

In January, sales were down 35.9%. In December, these same markets were down 42.1% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline than in December for these early reporting markets. The early data suggests NAR reported sales will rebound in January to the mid-4 million range (Seasonally adjusted annual rate) from 4.02 million SAAR in December.

This will still be a significant YoY decline, and the 17th consecutive month with a YoY decline.

Note: Even if existing home sales activity bottomed in December, there are usually two bottoms for housing - the first for activity and the second for prices. See Has Housing "Bottomed"?

Many more local markets to come!

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 2/08/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

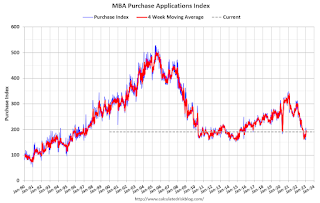

Mortgage applications increased 7.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 3, 2023.

... The Refinance Index increased 18 percent from the previous week and was 75 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 37 percent lower than the same week one year ago.

“Applications rose last week as the 30-year fixed mortgage rate inched lower to 6.18 percent, its fifth consecutive weekly decline. The 30-year fixed rate is almost a percentage point below its recent high of 7.16 percent in October 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Both purchase and refinance applications increased last week and have shown gains in three of the past four weeks because of lower rates. Overall applications remained 58 percent lower than a year ago and rates are still significantly higher, however, this week’s results are a step in the right direction. Purchase activity that was put on hold last year due to the quick runup in rates is gradually coming back as rates ease and housing demand remains strong, driven by supportive demographics and the ongoing strength in the job market.”

Added Kan, “The average loan size on a purchase application increased to $428,500 – the largest average since May 2022. This increase is a sign that the recent upward trend in purchase activity remains skewed toward larger loan sizes and less first-time homebuyer activity, as entry level housing remains undersupplied, and buyers struggle with affordability in many markets.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.18 percent from 6.19 percent, with points decreasing to 0.64 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

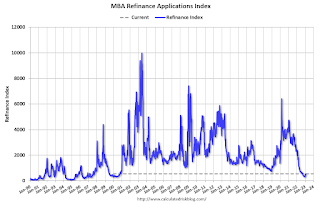

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 37% year-over-year unadjusted. This has increased a little with lower rates, but is still near housing bust levels.

According to the MBA, purchase activity is down 37% year-over-year unadjusted. This has increased a little with lower rates, but is still near housing bust levels.Tuesday, February 07, 2023

Leading Index for Commercial Real Estate Decreases in January

by Calculated Risk on 2/07/2023 07:48:00 PM

From Dodge Data Analytics: Dodge Momentum Index Dips in January

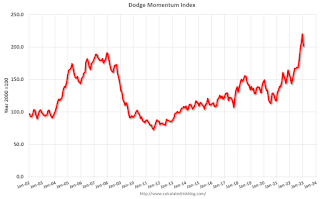

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, fell 8.4% in January to 201.5 (2000=100) from the revised December reading of 220.0. In January, the commercial component of the DMI fell 10.0%, and the institutional component receded 4.7%.

“The Dodge Momentum Index weakened in January, after 10 consecutive months of gains. While planning activity slowed, the Index remains elevated, and the volume of projects remains steady,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “After such strong growth in 2022, we expect the Index to work its way back towards historical norms this year, in tandem with weaker economic growth. Overall, levels of planning activity remained comparatively strong over the month — which bodes well for the construction sector.”

Weakness in commercial planning in January was broad-based, with office, warehouse, retail and hotel activity declining. Slower activity in education and amusement projects drove down the institutional portion of the Index, nullifying the impact of gains in healthcare and public planning over the month. On a year-over-year basis, the DMI remains 32% higher than in January 2022. The commercial component was up 40%, and the institutional component was 16% higher.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 201.5 in January, down from 220.0 in December.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction into 2023.

Freddie Mac House Price Index Declines for 7th Consecutive Month in December

by Calculated Risk on 2/07/2023 11:20:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Declines for 7th Consecutive Month in December

A brief excerpt:

Freddie Mac recently reported that its “National” Home Price Index (FMHPI) declined for the seventh consecutive month on a seasonally adjusted basis in December, putting the National FNHPI down 2.5% from its May 2022 peak, and down 5.0% Not Seasonally Adjusted (NSA) from the peak.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

On a year-over-year basis, the National FMHPI was up 4.1% in December, down from 6.0% YoY in November. The YoY increase peaked at 19.3% in July 2021.

In December, 36 states and D.C. were below their 2022 peaks in December, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Arizona (-8.5%), Idaho (-7.2%), Nevada (-6.8%), Washington (-6.7%), California (-6.3%), Utah (-5.4%), and Colorado (-5.2%).

...

Based on the recent trend, this index will be negative year-over-year in March.

Wholesale Used Car Prices Increased in January, Down 12.8% Year-over-year

by Calculated Risk on 2/07/2023 09:37:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increase in January

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased 2.5% in January compared to December. The Manheim Used Vehicle Value Index (MUVVI) rose to 224.8, down 12.8% from a year ago. January’s increase was driven in part by the seasonal adjustment. The non-adjusted price change in January was an increase of 1.5% compared to December, moving the unadjusted average price down 11.0% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit increased to $67.4 Billion in December

by Calculated Risk on 2/07/2023 08:40:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $67.4 billion in December, up $6.4 billion from $61.0 billion in November, revised.

December exports were $250.2 billion, $2.2 billion less than November exports. December imports were $317.6 billion, $4.2 billion more than November imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in December.

Exports are up 8% year-over-year; imports are up 2% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back. Both have decreased recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive.

The trade deficit with China decreased to $23.5 billion in December, from $36.2 billion a year ago.

CoreLogic: House Prices up 6.9% YoY in December; Declined 0.4% MoM in December NSA

by Calculated Risk on 2/07/2023 08:00:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Peak Fall Mortgage Rates Further Cooled Home Price Growth in December, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2022.

The effect of rising mortgage rates on housing demand in 2022 became even more evident in December, with annual home price growth dipping to 6.9%, down from a series high of 20% appreciation in April. Only nine states registered double-digit year-over-year price increases in December, compared with 48 that posted double-digit gains in April.

...

“The continued slowing of home prices at the end of 2022 reflects weaker housing market demand, primarily caused by higher mortgage rates and a more pessimistic economic outlook in general,” said Selma Hepp, chief economist at CoreLogic. “But while prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.”

“Some exurban regions that became increasingly popular during the COVID-19 pandemic saw prices jump and affordability erode at the time, but these areas are now seeing major corrections,” Hepp continued. “And while price deceleration will likely persist into the spring of 2023, when the market will probably see some year-over-year declines, the recent decrease in mortgage rates has stimulated buyer demand and could result in a more optimistic homebuying season than many expected.”

...

U.S. home prices (including distressed sales) increased by 6.9% year over year in December 2022 compared to December 2021. On a month-over-month basis, home prices declined by 0.4% compared to November 2022.

emphasis added

Monday, February 06, 2023

Tuesday: Trade Deficit, Fed Chair Powell

by Calculated Risk on 2/06/2023 09:00:00 PM

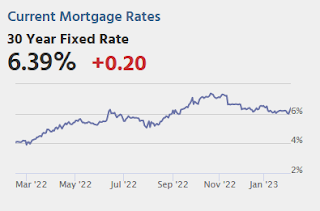

Mortgage rates were already under quite a bit of pressure on Friday following the stunningly strong jobs report in the morning. Strong economic data is generally bad for rates. One reason for that is the data's impact on decisions made by the Federal Reserve. This is especially true of the jobs report. ...Tuesday:

In the space of just two days, the average lender is nearly half a percent higher on a top tier conventional 30yr scenario. [30 year fixed 6.39%]

emphasis added

• At 8:00 AM ET, CoreLogic House Price index for December.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $68.5 billion. The U.S. trade deficit was at $61.5 billion in November.

• At 12:40 PM, Discussion Fed Chair Jerome Powell, Conversation with David Rubenstein, Chairman of the Economic Club of Washington, D.C. at the Economic Club of Washington, D.C.