by Calculated Risk on 11/30/2022 08:33:00 AM

Wednesday, November 30, 2022

Q3 GDP Growth Revised Up to 2.9% Annual Rate

From the BEA: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), Third Quarter 2022

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the third quarter of 2022, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 1.4% to 1.7%. Residential investment was revised down from -26.4% to -26.8%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.6 percent. The second estimate primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased more than previously estimated

...

Real gross domestic income (GDI) increased 0.3 percent in the third quarter, in contrast to a decrease of 0.8 percent in the second quarter (revised). The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 1.6 percent in the third quarter, in contrast to a decrease of 0.7 percent (revised) in the second quarter.

emphasis added

ADP: Private Employment Increased 127,000 in November

by Calculated Risk on 11/30/2022 08:21:00 AM

Private sector employment increased by 127,000 jobs in November and annual pay was up 7.6 percent year-over-year, according to the November ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”)This was below the consensus forecast of 200,000. The BLS report will be released Friday, and the consensus is for 200 thousand non-farm payroll jobs added in November.

The jobs report and pay insights use ADP’s fine-grained anonymized and aggregated payroll data of over 25 million U.S. employees to provide a representative picture of the labor market. The report details the current month’s total private employment change, and weekly job data from the previous month. ADP’s pay measure uniquely captures the earnings of a cohort of almost 10 million employees over a 12-month period.

“Turning points can be hard to capture in the labor market, but our data suggest that Federal Reserve tightening is having an impact on job creation and pay gains,” said Nela Richardson, chief economist, ADP. “In addition, companies are no longer in hyper-replacement mode. Fewer people are quitting and the post-pandemic recovery is stabilizing.”

emphasis added

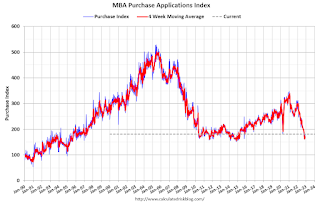

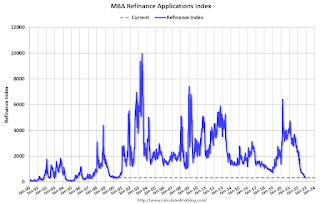

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/30/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 25, 2022. This week’s results include an adjustment for the observance of the Thanksgiving holiday.

... The Refinance Index decreased 13 percent from the previous week and was 86 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index decreased 31 percent compared with the previous week and was 41 percent lower than the same week one year ago.

“Mortgage rates declined again last week, following bond yields lower. The 30-year fixed mortgage rate decreased to 6.49 percent and has now fallen 57 basis points over the past four weeks. Additionally, mortgage rates for most other loan types declined,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The economy here and abroad is weakening, which should lead to slower inflation and allow the Fed to slow the pace of rate hikes. Purchase activity increased slightly after adjusting for the Thanksgiving holiday, but the decline in rates was still not enough to bring back refinance activity. Refinance applications fell another 13 percent, and the refinance share of applications was at 26 percent. Both measures were at their lowest levels since 2000.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 6.49 percent from 6.67 percent, with points remaining at 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, November 29, 2022

Wednesday: GDP, ADP Employment, Job Openings, Pending Home Sales, Fed Chair Powell and More

by Calculated Risk on 11/29/2022 09:23:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 200,000 jobs added, down from 239,000 in October.

• At 8:30 AM: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), 3rd Quarter 2022. The consensus is that real GDP increased 2.7% annualized in Q3, up from the advance estimate of 2.6% in Q3.

• At 9:45 AM: Chicago Purchasing Managers Index for November.

• At 10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

• At 10:00 AM: Pending Home Sales Index for October. The consensus is for a 5.0% decrease in the index.

• At 10:30 AM: (likely) FDIC Quarterly Banking Profile, Third quarter.

• At 1:30 PM: Speech, Fed Chair Jerome Powell, Economic Outlook, Inflation, and the Labor Market, At the Brookings Institution, 1775 Massachusetts Avenue N.W., Washington, D.C.

• At 2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

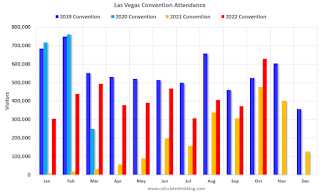

Las Vegas October 2022: Visitor Traffic Down Just 0.8% Compared to 2019; Convention Traffic UP

by Calculated Risk on 11/29/2022 06:34:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: October 2022 Las Vegas Visitor Statistics

With an improving conventions segment combined with several events including the dual weekend When We Were Young music festival, two Raiders home games and the NASCAR South Point 400 race, the month saw the destination host over 3.6M visitors, nearly matching the tally of October 2019.

Reaching the highest level since November 2019, overall hotel occupancy reached 87.7% (+6.1 pts YoY and down ‐2.3 pts vs. October 2019). Weekend occupancy reached 94.0%, a level not seen since the 94.8% figure of February 2020, the month immediately preceding the COVID shutdown, while Midweek occupancy reached 85.1%, the highest figure since October 2019's 87.1% tally.

Strong demand during the month supported by major events and conventions shattered the monthly record for ADR as avg. daily room rates approached $210, +20.8% YoY and +55.1% ahead of October 2019 while RevPAR surpassed $184 for the month, +29.9% YoY and +51.1% over October 2019

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 0.8% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

FHFA Announces Baseline Conforming Loan Limit Will Increase to $726,200

by Calculated Risk on 11/29/2022 01:12:00 PM

High-Cost Areas increase to $1,089,300.

Here is the official announcement from the FHFA: FHFA Announces Conforming Loan Limit Values for 2023

The Federal Housing Finance Agency (FHFA) today announced the conforming loan limit values (CLLs) for mortgages to be acquired by Fannie Mae and Freddie Mac (the Enterprises) in 2023. In most of the United States, the 2023 CLL value for one-unit properties will be $726,200, an increase of $79,000 from $647,200 in 2022.

...

The new ceiling loan limit for one-unit properties will be $1,089,300, which is 150 percent of $726,200.

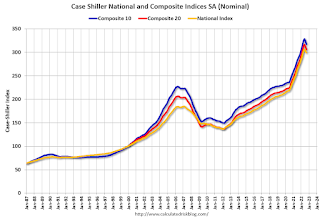

Comments on September Case-Shiller and FHFA House Prices

by Calculated Risk on 11/29/2022 09:51:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index "Continued to Decline" to 10.6% year-over-year increase in September

Excerpt:

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for September were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller Home Price Indices for “September” is a 3-month average of July, August and September closing prices. July closing prices include some contracts signed in May, so there is a significant lag to this data.

The MoM decrease in Case-Shiller was at -0.76% seasonally adjusted. This was the third consecutive MoM decrease, and slightly less than the decrease last month. This suggests prices fell sharply for September closings.

On a seasonally adjusted basis, prices declined in all of the Case-Shiller cities on a month-to-month basis. The largest monthly declines seasonally adjusted were in San Francisco (-2.2%), Phoenix (-2.1%) and Las Vegas (-2.1%). San Francisco has fallen 10.3% from the peak in May 2022.

...

The September Case-Shiller report is mostly for contracts signed in the May through August period when 30-year mortgage rates were in the low-to-mid 5% range. The October report will mostly be for contracts signed in the June through September period - when rates were mostly in the low-to-mid 5% range (except September).

The impact from higher rates in September and October will not show up significantly for a few more months.

Case-Shiller: National House Price Index "Continued to Decline" to 10.6% year-over-year increase in September

by Calculated Risk on 11/29/2022 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3-month average of July, August and September closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Continued to Decline in September

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 10.6% annual gain in September, down from 12.9% in the previous month. The 10-City Composite annual increase came in at 9.7%, down from 12.1% in the previous month. The 20- City Composite posted a 10.4% year-over-year gain, down from 13.1% in the previous month.

Miami, Tampa, and Charlotte reported the highest year-over-year gains among the 20 cities in September. Miami led the way with a 24.6% year-over-year price increase, followed by Tampa in second with a 23.8% increase, and Charlotte in third with a 17.8% increase. All 20 cities reported lower price increases in the year ending September 2022 versus the year ending August 2022.

...

Before seasonal adjustment, the U.S. National Index posted a -1.0% month-over-month decrease in September, while the 10-City and 20-City Composites posted decreases of -1.4% and -1.5%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.8%, and the 10-City and 20-City Composites both posted decreases of -1.2%.

In September, all 20 cities reported declines before and after seasonal adjustments.

“As has been the case for the past several months, our September 2022 report reflects short-term declines and medium-term deceleration in housing prices across the U.S.,” says Craig J. Lazzara, Managing Director at S&P DJI. “For example, the National Composite Index fell -1.0% in September, and now stands 10.6% above its year-ago level. We see comparable patterns in our 10- and 20-City Composites, which declined -1.4% and -1.5%, respectively, bringing their year-over-year gains down to 9.7% and 10.4%. For all three composites, year-over-year gains, while still well above their historical medians, peaked roughly six months ago and have decelerated since then.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is down 1.2% in September (SA).

The Composite 20 index is down 1.2% (SA) in September.

The National index is 62% above the bubble peak (SA), and down 0.8% (SA) in September. The National index is up 119% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 9.7% year-over-year. The Composite 20 SA is up 10.4% year-over-year.

The National index SA is up 10.6% year-over-year.

Annual price increases were lower than expected. I'll have more later.

Monday, November 28, 2022

Tuesday: Case-Shiller House Prices

by Calculated Risk on 11/28/2022 08:47:00 PM

Bonds were effectively closed for a 4-day weekend starting with Thanksgiving last Thursday. True, Friday was technically open for half a day, but volume and participation were so light as to make any of the movement questionable. This is typical of any Friday after Thanksgiving.Tuesday:

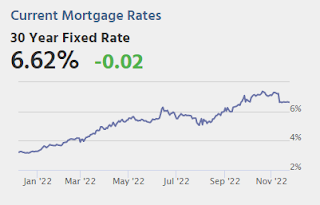

The following Monday (or "today" in today's case) tends to be a transitional day with plenty of holiday vibes intact but stronger participation compared to the previous trading session. ... [30 year fixed 6.62%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for September. The consensus is for a 14.4% year-over-year increase in the Composite 20 index for September.

• Also at 9:00 AM, FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index. The 2023 Conforming loan limits will also be announced.

Join the CalculatedRisk Newsletter subscriber chat

by Calculated Risk on 11/28/2022 11:10:00 AM

Today I’m announcing the CalculatedRisk Newsletter subscriber chat.

This is a conversation space in the Substack app that is exclusively for CalculatedRisk Newsletter subscribers — kind of like a group chat or live hangout. I’ll post short prompts, thoughts, and updates that come my way, and you can jump into the discussion.

To join the chat, you’ll need to download the Substack app (messages are sent via the app, not email).

NOTE: The app is currently only available for iOS but will be available for Android and web very soon.

First, subscribe to the CalculatedRisk Newsletter.

Then download the substack app by clicking this link

Open the app and tap the Chat icon. It looks like two bubbles in the bottom bar, and you’ll see a row for my chat inside.