by Calculated Risk on 11/28/2022 08:57:00 AM

Monday, November 28, 2022

Housing November 28th Weekly Update: Inventory Decreased Slightly Week-over-week

Click on graph for larger image.

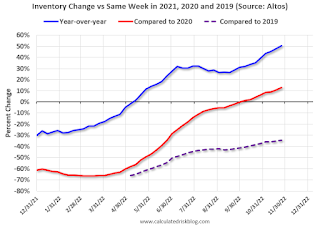

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 34.4%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 11/28/2022 08:29:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of November 27th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 7.2% below the same week in 2019 (92.8% of 2019). (Dashed line)

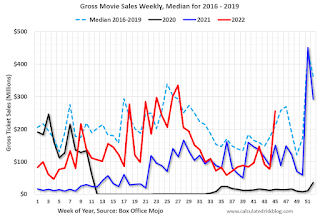

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $142 million last week, down about 45% from the median for the week.

NOTE: This is the previous week data, since hotel data wasn't released during the holiday week.

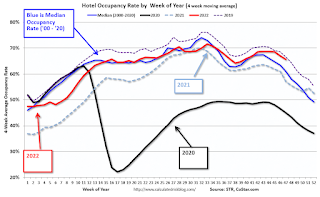

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Nov 12th. The occupancy rate was up 0.9% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

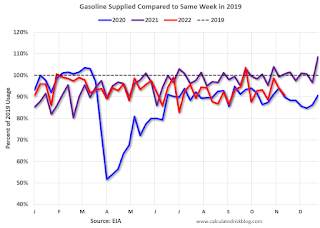

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of November 18th, gasoline supplied was down 9.4% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, November 27, 2022

Sunday Night Futures

by Calculated Risk on 11/27/2022 07:34:00 PM

Weekend:

• Schedule for Week of November 27, 2022

Monday:

• AT 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 17 and DOW futures are down 110 (fair value).

Oil prices were down over the last week with WTI futures at $76.06 per barrel and Brent at $83.47 per barrel. A year ago, WTI was at $70, and Brent was at $73 - so WTI oil prices are up 9% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.62 per gallon. A year ago, prices were at $3.39 per gallon, so gasoline prices are up $0.23 per gallon year-over-year.

Realtor.com Reports Weekly Active Inventory Up 49% Year-over-year; New Listings Down 17%

by Calculated Risk on 11/27/2022 10:20:00 AM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Nov 19, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

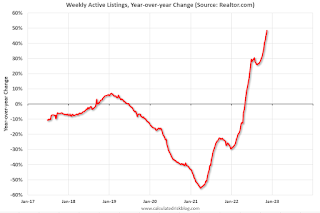

• Active inventory continued to grow, increasing 49% above one year ago. Inventory accelerated again, notching a sixth straight week of growth in the yearly trend roughly at or above 2%–in this case nearly double.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 17% from one year ago. This marks a twentieth straight week of year over year declines in homeowners listing their home for sale, a tangible reflection of the ongoing decline in seller confidence.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Saturday, November 26, 2022

Real Estate Newsletter Articles this Week: "With rising cancellations, the Census Bureau overestimates New Home sales"

by Calculated Risk on 11/26/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Increased in October; Completed Inventory Increased With rising cancellations, the Census Bureau overestimates sales

• Lawler: Likely "Dramatic shift" in Household Formation has "Major implications" for 2023

• Final Look at Local Housing Markets in October

• Case-Shiller, FHFA House Prices Indexes and Conforming Loan Limits will be released on Tuesday

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of November 27, 2022

by Calculated Risk on 11/26/2022 08:11:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the 2nd estimate of Q3 GDP, the September Case-Shiller and FHFA house price indexes, October Personal Income & Outlays (and PCE), the November ISM manufacturing index, and November vehicle sales.

Fed Chair Powell speaks on the economic outlook, inflation and the labor market on Thursday.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

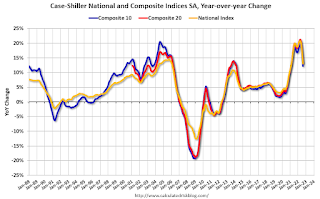

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 14.4% year-over-year increase in the Composite 20 index for September.

9:00 AM: FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index. The 2023 Conforming loan limits will also be announced.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 200,000 jobs added, down from 239,000 in October.

8:30 AM: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), 3rd Quarter 2022. The consensus is that real GDP increased 2.7% annualized in Q3, up from the advance estimate of 2.6% in Q3.

9:45 AM: Chicago Purchasing Managers Index for November.

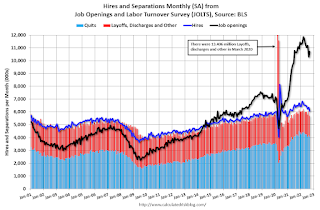

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 10.717 million from 10.280 million in August.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 5.0% decrease in the index.

1:30 PM: Speech, Fed Chair Jerome Powell, Economic Outlook, Inflation, and the Labor Market, At the Brookings Institution, 1775 Massachusetts Avenue N.W., Washington, D.C.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

10:30 AM: (likely) FDIC Quarterly Banking Profile, Third quarter.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, down from 240 thousand last week.

8:30 AM ET: Personal Income and Outlays, October 2022. The consensus is for a 0.4% increase in personal income, and for a 0.8% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.2% YoY, and core PCE prices up 5.0% YoY.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 50.0%, down from 50.2%.

10:00 AM: Construction Spending for October. The consensus is for 0.3% decrease in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 14.9 million SAAR in November, unchanged from the BEA estimate of 14.9 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

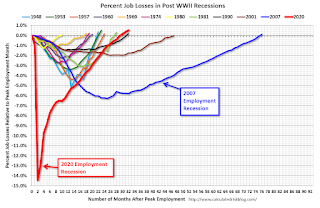

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 261,000 jobs added in October, and the unemployment rate was at 3.7%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, as of August, all of the jobs had returned and, as of October, were 804 thousand above pre-pandemic levels.

Friday, November 25, 2022

COVID Nov 25, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 11/25/2022 08:08:00 PM

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths). Data has switched to weekly.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 305,082 | 281,691 | ≤35,0001 | |

| Hospitalized2 | 21,293 | 21,578 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,644 | 2,266 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Case-Shiller, FHFA House Prices Indexes and Conforming Loan Limits will be released on Tuesday

by Calculated Risk on 11/25/2022 10:38:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller, FHFA House Prices Indexes and Conforming Loan Limits will be released on Tuesday

Brief excerpt:

Last week, the National Association of Realtors® (NAR) reported that median house prices were up 6.6% year-over-year (YoY) in October. This is down from the peak growth rate of 25.2% YoY in May 2021.You can subscribe at https://calculatedrisk.substack.com/.

Last month, Case-Shiller reported that the National Index was up 13.0% YoY in August, down from a YoY peak of 20.8% in March 2022.

The median prices reported by the NAR are for the most recent month only, so the prices are very timely. However, the prices can be distorted by the mix of homes sold.

Case-Shiller is a repeat sales index (they compare the current price of home to the previous sales price), and it a three-month average. So, the most recent report (for August), was actually for homes closed in June, July and August.

Although median prices can be distorted by the mix and repeat sales indexes (like Case-Shiller and the FHFA) are more accurate measures of house prices, the median price index might provide earlier hints on the direction of prices.

The following graph shows YoY price changes for the NAR median house prices, Case-Shiller National price index, and the FHFA purchase-only index (Fannie and Freddie loans only).

Most of the time, the NAR median price leads the Case-Shiller index, and even though the Case-Shiller September index will show a solid YoY gain, I expect house price growth to decelerate further in coming months and turn negative YoY soon.

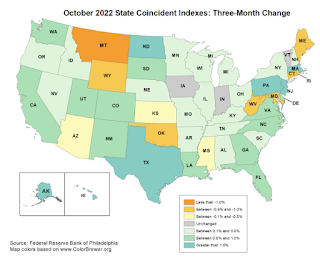

Philly Fed: State Coincident Indexes Increased in 20 States in October

by Calculated Risk on 11/25/2022 09:15:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2022. Over the past three months, the indexes increased in 36 states, decreased in 11 states, and remained stable in three, for a three-month diffusion index of 50. Additionally, in the past month, the indexes increased in 20 states, decreased in 22 states, and remained stable in eight, for a one-month diffusion index of -4. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 0.7 percent over the past three months and 0.1 percent in OctoberNote: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is mostly positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In October 23 states had increasing activity including minor increases.

Thursday, November 24, 2022

Five Economic Reasons to be Thankful

by Calculated Risk on 11/24/2022 11:28:00 AM

Here are five economic reasons to be thankful this Thanksgiving. (Hat Tip to Neil Irwin who started doing this years ago)

1) The Unemployment Rate is Near 50 Year Low

The unemployment rate is down from 4.6% a year ago (October 2021).

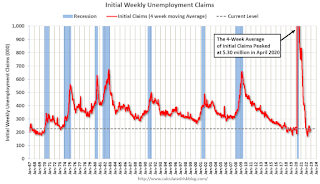

2) Low unemployment claims.

This graph shows the 4-week moving average of weekly claims since 1971.

This graph shows the 4-week moving average of weekly claims since 1971.The dashed line on the graph is the current 4-week average.

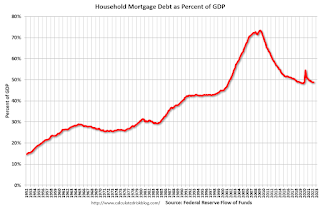

3) Mortgage Debt as a Percent of GDP is much lower than during Housing Bubble

This graph shows household mortgage debt as a percent of GDP.

This graph shows household mortgage debt as a percent of GDP. Mortgage debt is up $1.46 trillion from the peak during the housing bubble, but, as a percent of GDP is at 48.9%, down from a peak of 73.3% of GDP during the housing bust.

4) Mortgage Delinquency Rate at Lowest Level since at least 1979

The percent of loans in the foreclosure process increased year-over-year in Q3 with the end of the foreclosure moratoriums.

5) Household Debt burdens at Low Levels

This graph, based on data from the Federal Reserve, shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

This graph, based on data from the Federal Reserve, shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).This data suggests aggregate household cash flow is in a solid position.