by Calculated Risk on 6/20/2022 08:06:00 AM

Monday, June 20, 2022

Five High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of June 19th.

Click on graph for larger image.

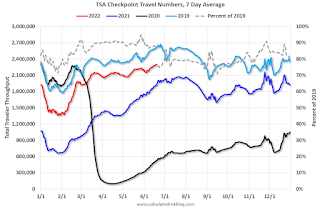

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.1% from the same day in 2019 (87.9% of 2019). (Dashed line)

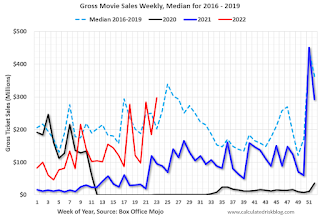

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $297 million last week, up about 47% from the median for the week due to Jurassic Park.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through June 11th. The occupancy rate was down 4.1% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

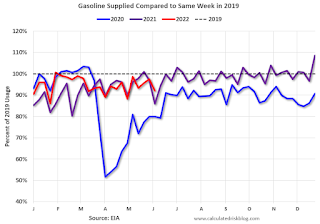

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of June 10th, gasoline supplied was down 7.9% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, June 17th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, June 19, 2022

3rd Look at Local Housing Markets in May; Inventory Up, Sales Down, New Listings Picking Up

by Calculated Risk on 6/19/2022 10:12:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in May

A brief excerpt:

This is the third look at local markets in May. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I update these tables throughout each month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

We are seeing a significant change in inventory, and maybe a pickup in new listings. So far, most of the increase in inventory has been due to softer demand - likely because of higher mortgage rates - but we need to keep an eye on new listings too.

On a national basis, we saw record low inventory levels over the Winter. Last year, inventory didn’t bottom seasonally until early April. This year inventory bottomed in February (normal seasonal timing), and recent data from Altos Research and Realtor.com, indicate active inventory was up year-over-year in May. I expect the local market reports will show inventory up year-over-year in May too.

...

And a table of May sales. Sales in these areas were down 5.8% YoY, Not Seasonally Adjusted (NSA). There was one extra business day in May 2022 compared to May 2021, so the Seasonally Adjusted headline number will likely show a larger decline than 5.8%.

The National Association of Realtors (NAR) is scheduled to release May existing home sales on Tuesday, June 21, 2022, at 10:00 AM ET. The consensus is for 5.41 million SAAR.

Housing economist Tom Lawler expects the NAR to report “seasonally adjusted annual rate of 5.35 million in May, down 4.6% from April’s preliminary pace and down 9.6% from last May’s seasonally adjusted pace.”

Saturday, June 18, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 6/18/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Slowdown in Showings, Sharp Decline in California Pending Sales, Inventory Surges

• Fed Chair Powell: "Homebuyers need a bit of a reset"

• Comparing the Current Housing Market to the 1978 to 1982 period

• May Housing Starts: All-Time Record Housing Units Under Construction

• 2nd Look at Local Housing Markets in May

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of June 19, 2022

by Calculated Risk on 6/18/2022 08:11:00 AM

The key reports this week are May New and Existing Home Sales.

Fed Chair Powell provides the Semiannual Monetary Policy Report to Congress on Wednesday and Thursday.

All US markets will be closed in observance of Juneteenth National Independence Day

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

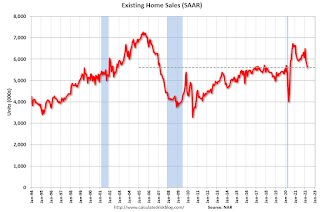

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.41 million SAAR, down from 5.61 million.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.41 million SAAR, down from 5.61 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.35 million SAAR for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:30 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand down from 229 thousand last week.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to Congress, Before the Committee on Financial Services, U.S. House of Representatives

4:30 PM: The Fed will release the annual Bank Stress Tests results.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 580 thousand SAAR, down from 591 thousand in April.

10:00 AM: University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 50.2.

Friday, June 17, 2022

COVID June 17, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 6/17/2022 09:01:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.9 | --- | ≥2321 | |

| New Cases per Day3 | 100,733 | 109,098 | ≤5,0002 | |

| Hospitalized3🚩 | 24,201 | 23,686 | ≤3,0002 | |

| Deaths per Day3 | 266 | 326 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

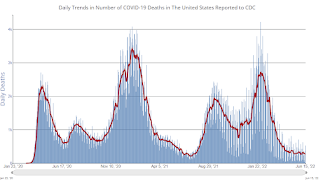

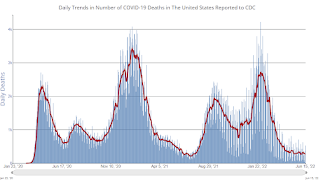

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Realtor.com Reports Weekly Inventory Up 17% Year-over-year

by Calculated Risk on 6/17/2022 04:16:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending June 11, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

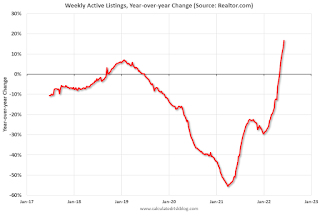

• Active inventory continued to grow, rising 17% above one year ago. Inventory was roughly even with last year’s levels at the beginning of May and the gains have mounted each week. Still, our May Housing Trends Report showed that the active listings count remained nearly 50 percent below its level at the beginning of the pandemic. In other words, we’re starting to add more options, but the market needs even more before home shoppers have a selection that’s roughly equivalent to the pre-pandemic housing market.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 17% YoY now. It will be important to watch if that trend continues.

Q2 GDP Forecasts: Moving Down

by Calculated Risk on 6/17/2022 01:11:00 PM

From BofA:

We are now tracking 1.5% qoq saar growth for 2Q, down from 2.5% qoq saar previously as retail sales were weak in May. [June 17 estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +2.8% (qoq ar). (Lowered it yesterday from 3.0%) [June 17 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 0.0 percent on June 16, unchanged from June 15 after rounding. [June 16 estimate]

Slowdown in Showings, Sharp Decline in California Pending Sales, Inventory Surges

by Calculated Risk on 6/17/2022 10:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Slowdown in Showings, Sharp Decline in California Pending Sales, Inventory Surges

A brief excerpt:

The following data is courtesy of David Arbit, Director of Research at the Minneapolis Area REALTORS® and NorthstarMLS (posted with permission). Here is a link to their data.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the 7-day average showings for the Twin Cities area for 2019, 2020, 2021, and 2022. The 7-day average showings (red) is currently off 22% from 2019.

There was a huge dip in showings in 2020 (black) at the start of the pandemic, and then showing were well above 2019 (blue) levels for the rest of the year. And showings in 2021 (gold) were very strong in the first half of the year, and then were closer to 2019 in the 2nd half.

Click on graph for larger image.

Note that there were dips in showings during holidays (July 4th, Memorial Day, Thanksgiving and Christmas), and also dips related to protests and curfews related to the deaths of George Floyd and Daunte Wright.

2022 (red) started off solid but is now below the previous three years.

Industrial Production Increased 0.2 Percent in May

by Calculated Risk on 6/17/2022 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

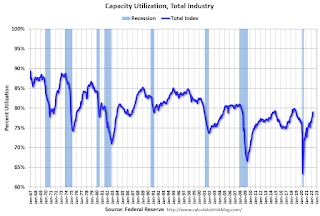

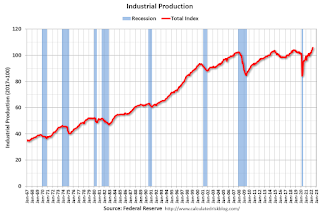

Total industrial production moved up 0.2 percent in May. Output has increased in every month of the year so far, with an average monthly gain of nearly 0.8 percent. In May, manufacturing output declined 0.1 percent after three months when growth averaged nearly 1 percent; the indexes for utilities and mining rose 1.0 percent and 1.3 percent, respectively, in May. At 105.7 percent of its 2017 average, total industrial production in May was 5.8 percent above its year-earlier level. Capacity utilization edged up to 79.0 percent, 0.5 percentage point below its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 79.0% is 0.5% below the average from 1972 to 2020. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in May to 105.7. This is above the pre-pandemic level.

The change in industrial production was below consensus expectations.

Thursday, June 16, 2022

Friday: Industrial Production

by Calculated Risk on 6/16/2022 09:02:00 PM

Friday:

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, State Employment and Unemployment (Monthly) for May 2022

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.9 | --- | ≥2321 | |

| New Cases per Day3 | 102,750 | 109,841 | ≤5,0002 | |

| Hospitalized3🚩 | 24,160 | 23,598 | ≤3,0002 | |

| Deaths per Day3 | 265 | 326 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.