by Calculated Risk on 6/10/2022 09:43:00 AM

Friday, June 10, 2022

Realtor.com Reports Weekly Inventory Up 13% Year-over-year

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending June 4, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, rising 13% above one year ago. The turnaround in the number of homes for sale continues and year over year growth signals that this is more than just a seasonal improvement. Inventory was roughly on par with last year’s levels at the beginning of May and is now up 13% at the beginning of June. Nevertheless, our May Housing Trends Report showed that the active listings count remained nearly 50 percent below its level at the beginning of the pandemic. In other words, we’re starting to add more options, but home shoppers continue to see a relatively low number of homes for sale.

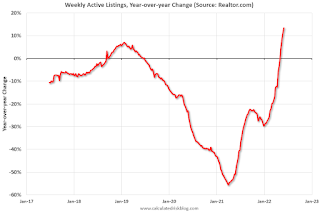

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 13% YoY now. It will be important to watch if that trend continues.

BLS: CPI increased 1.0% in May; Core CPI increased 0.6%

by Calculated Risk on 6/10/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.0 percent in May on a seasonally adjusted basis after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.6 percent before seasonal adjustment.The consensus was for 0.7% increase in CPI, and a 0.5% increase in core CPI. Both were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The increase was broad-based, with the indexes for shelter, gasoline, and food being the largest contributors. After declining in April, the energy index rose 3.9 percent over the month with the gasoline index rising 4.1 percent and the other major component indexes also increasing. The food index rose 1.2 percent in May as the food at home index increased 1.4 percent.

The index for all items less food and energy rose 0.6 percent in May, the same increase as in April. While almost all major components increased over the month, the largest contributors were the indexes for shelter, airline fares, used cars and trucks, and new vehicles. The indexes for medical care, household furnishings and operations, recreation, and apparel also increased in May.

The all items index increased 8.6 percent for the 12 months ending May, the largest 12-month increase since the period ending December 1981. The all items less food and energy index rose 6.0 percent over the last 12 months. The energy index rose 34.6 percent over the last year, the largest 12-month increase since the period ending September 2005. The food index increased 10.1 percent for the 12-months ending May, the first increase of 10 percent or more since the period ending March 1981.

emphasis added

Thursday, June 09, 2022

Friday: CPI

by Calculated Risk on 6/09/2022 09:11:00 PM

Friday:

• At 8:30 AM ET, The Consumer Price Index for May from the BLS. The consensus is for 0.7% increase in CPI, and a 0.5% increase in core CPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for June).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 109,032 | 100,915 | ≤5,0002 | |

| Hospitalized3🚩 | 23,341 | 21,693 | ≤3,0002 | |

| Deaths per Day3🚩 | 306 | 258 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

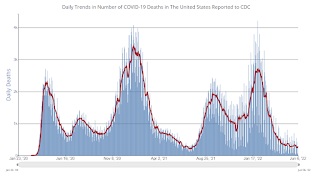

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Hotels: Occupancy Rate Down 12.1% Compared to Same Week in 2019

by Calculated Risk on 6/09/2022 04:17:00 PM

Note: This was lowered by the timing of the holiday.

Reflecting an expected post-Memorial Day holiday slowdown, U.S. hotel performance fell from the previous week, according to STR‘s latest data through June 4.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

May 29 through June 4, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 63.2% (-12.1%)

• Average daily rate (ADR): $147.35 (+11.3%)

• Revenue per available room (RevPAR): $93.16 (-2.2%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

The Home ATM Still Open in Q1 2022; Closing Soon

by Calculated Risk on 6/09/2022 01:37:00 PM

Today, in the Real Estate Newsletter: The Home ATM Still Open in Q1 2022; Closing Soon

Excerpt:

First, here is the quarterly increase in mortgage debt from the Federal Reserve’s report since 2000. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (All ad free, most content free).

In Q1 2022, mortgage debt increased $222 billion, slightly lower than the three previous quarters. Note the almost 7 years of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all MEW.

...

The bottom line is the recent increase in MEW is not concerning - it is far less as a percent of disposable personal income than during the bubble, and most homeowners have substantial equity.

Also, it is very likely that MEW will decrease sharply in 2022 as refinance activity declines due to higher mortgage rates. I expect significantly lower levels of MEW in the last three quarters of2022.

Fed's Flow of Funds: Household Net Worth Decreased $0.55 Trillion in Q1

by Calculated Risk on 6/09/2022 12:22:00 PM

The Federal Reserve released the Q1 2022 Flow of Funds report today: Financial Accounts of the United States.

The net worth of households and nonprofits fell to $149.3 trillion during the first quarter of 2022. The value of directly and indirectly held corporate equities decreased $3.0 trillion and the value of real estate increased $1.7 trillion.

...

Household debt increased 8.3 percent at an annual rate in the first quarter of 2022. Consumer credit grew at an annual rate of 8.7 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 8.6 percent.

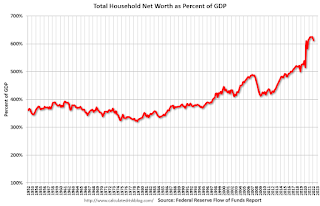

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

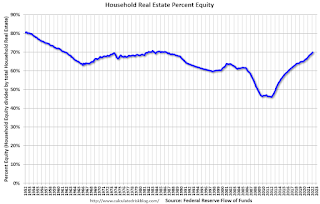

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2022, household percent equity (of household real estate) was at 69.9% - up from 69.2% in Q4, 2021. This is the highest percent equity since the 1980s.

Note: This includes households with no mortage debt.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.Mortgage debt increased by $222 billion in Q1.

Mortgage debt is up $1.27 trillion from the peak during the housing bubble, but, as a percent of GDP is at 49.1% - up from Q4 - and down from a peak of 73.3% of GDP during the housing bust.

The value of real estate, as a percent of GDP, increased in Q1, and is well above the average of the last 30 years.

CoreLogic: 1.1 million Homeowners with Negative Equity in Q1 2022

by Calculated Risk on 6/09/2022 10:38:00 AM

From CoreLogic: US Homeowners Gained Over $60,000 in Equity Per Borrower in Q1 2022 as Historic Home Price Growth Continues, CoreLogic Reports

CoreLogic® ... today released the Homeowner Equity Report (HER) for the first quarter of 2022. The report shows U.S. homeowners with mortgages (which account for roughly 62% of all properties) have seen their equity increase by 32.2% year over year, representing a collective equity gain of $3.8 trillion, and an average gain of $63,600 per borrower, since the first quarter of 2021.

...

“Price growth is the key ingredient for the creation of home equity wealth,” said Patrick Dodd, president and CEO at CoreLogic. “Home prices were up by 20% in March compared to one year earlier in CoreLogic’s national Home Price Index. This has led to the largest one-year gain in average home equity wealth for owners and is expected to spur a record amount of home-improvement spending this year.”

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the first quarter of 2022, the quarterly and annual changes in negative equity were:

• Quarterly change: From the fourth quarter of 2021 to the first quarter of 2022, the total number of mortgaged homes in negative equity decreased by 5.3% to 1.1 million homes, or 2% of all mortgaged properties.

• Annual change: In the first quarter of 2021, 1.4 million homes, or 2.6% of all mortgaged properties, were in negative equity. This number decreased by 23%, or approximately 300,000 properties, in the first quarter of 2022.

Because home equity is affected by home price changes, borrowers with equity positions near (+/- 5%) the negative equity cutoff are most likely to move out of or into negative equity as prices change, respectively. Looking at the first quarter of 2022 book of mortgages, if home prices increase by 5%, 130,000 homes would regain equity; if home prices decline by 5%, 167,000 properties would fall underwater.

emphasis added

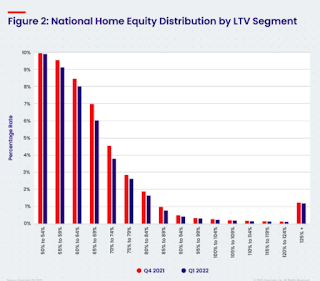

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q1 2022 to Q4 2021 equity distribution by LTV. There are still a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.4 million to 1.1 million.

Weekly Initial Unemployment Claims Increase to 229,000

by Calculated Risk on 6/09/2022 08:34:00 AM

The DOL reported:

In the week ending June 4, the advance figure for seasonally adjusted initial claims was 229,000, an increase of 27,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 200,000 to 202,000. The 4-week moving average was 215,000, an increase of 8,000 from the previous week's revised average. The previous week's average was revised up by 500 from 206,500 to 207,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 215,000.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, June 08, 2022

Thursday: Unemployment Claims, Q1 Flow of Funds

by Calculated Risk on 6/08/2022 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 210 thousand up from 200 thousand last week.

• At 12:00 PM, Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 104,511 | 103,774 | ≤5,0002 | |

| Hospitalized3🚩 | 23,230 | 21,425 | ≤3,0002 | |

| Deaths per Day3🚩 | 291 | 275 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Homebuilder Comments in May: “Builder metrics quickly deteriorating"

by Calculated Risk on 6/08/2022 05:12:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in May: “Builder metrics quickly deteriorating"

A brief excerpt:

Read these comments. These are clear signs of a market shift.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

...

#Austin builder: “Some parts of town where finished homes are now taking a month to sell versus hours. Market is definitely correcting. Incentives are back and seeing some builders cutting prices on inventory.”

...

#Birmingham builder: “Steep decline in sales over past 2 weeks.”

...

#Greenville builder: “Lowest traffic in many months.”

#LosAngeles builder: “Seeing more cancellations due to payment shock for those in backlog that didn't lock rates.”

...

#Portland builder: “Incentives are back in the market.”