by Calculated Risk on 1/13/2022 08:16:00 PM

Thursday, January 13, 2022

Friday: Retail Sales, Industrial Production

Friday:

• At 8:30 AM ET, Retail sales for December is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.0%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for January).

And on COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 208.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 782,765 | 587,722 | ≤5,0002 | |

| Hospitalized3🚩 | 128,222 | 95,853 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,729 | 1,263 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

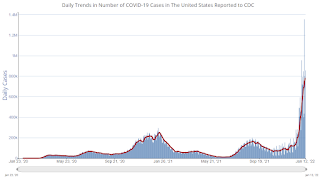

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 15% Compared to Same Week in 2019

by Calculated Risk on 1/13/2022 01:22:00 PM

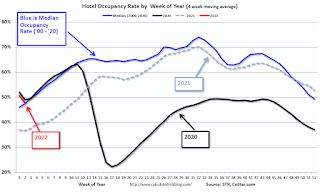

Reflecting post-holiday seasonality, U.S. hotel performance fell from the previous week, according to STR‘s latest data through Jan. 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Jan. 2-8, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 45.4% (-14.9%)

• Average daily rate (ADR): $119.92 (-4.8%)

• Revenue per available room (RevPAR): $54.47 (-19.0%)

Occupancy fell week over week because of a slowdown in leisure demand and a continued absence of business travel due to a Saturday holiday. While ADR also dropped from an all-time high the previous week, the metric came in at roughly 95% of the 2019 comparable. ...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

3rd Look at Local Housing Markets in December

by Calculated Risk on 1/13/2022 10:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in December

A brief excerpt:

Adding Albuquerque, Colorado, Houston, Memphis, Nashville, Sacramento, Santa Clara and South CarolinaThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a summary of active listings for these housing markets in December. Inventory was down 17.7% in December month-over-month (MoM) from November, and down 30.0% year-over-year (YoY).

Inventory almost always declines seasonally in December, so the MoM decline is not a surprise. Last month, these markets were down 26.2% YoY, so the YoY decline in December is larger than in November. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

Totals do not include Denver (included in state total).

Weekly Initial Unemployment Claims Increase to 230,000

by Calculated Risk on 1/13/2022 08:34:00 AM

The DOL reported:

In the week ending January 8, the advance figure for seasonally adjusted initial claims was 230,000, an increase of 23,000 from the previous week's unrevised level of 207,000. The 4-week moving average was 210,750, an increase of 6,250 from the previous week's unrevised average of 204,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 210,750.

The previous week was unrevised.

Weekly claims were above the consensus forecast, perhaps due to the current COVID wave.

Wednesday, January 12, 2022

Thursday: Unemployment Claims, PPI

by Calculated Risk on 1/12/2022 08:52:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims.

• Also, at 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.4% increase in PPI, and a 0.5% increase in core PPI.

• At 10:00 AM, Testimony, Fed Governor Lael Brainard, Nomination Hearing, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

And on COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 208.0 | --- | ≥2321 | |

| New Cases per Day3🚩 | 761,535 | 556,134 | ≤5,0002 | |

| Hospitalized3🚩 | 124,163 | 91,030 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,656 | 1,238 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Fed's Beige Book: "A sudden pull back in leisure travel, hotel occupancy and patronage at restaurants"

by Calculated Risk on 1/12/2022 03:08:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Kansas City based on information collected on or before January 3, 2022."

Economic activity across the United States expanded at a modest pace in the final weeks of 2021. Contacts from many Districts indicated growth continued to be constrained by ongoing supply chain disruptions and labor shortages. Despite the modest pace of growth, demand for materials and inputs, and demand for workers, remained elevated among businesses. Lending activity picked up slightly toward the end of the year, led by commercial real estate borrowers. Consumer spending continued to grow at a steady pace ahead of the rapid spread of the Omicron COVID-19 variant. Most Districts noted a sudden pull back in leisure travel, hotel occupancy and patronage at restaurants as the number of new cases rose in recent weeks. Although optimism remained high generally, several Districts cited reports from businesses that expectations for growth over the next several months cooled somewhat during the last few weeks. The manufacturing sector continued to expand nationally, with some regional differences in the pace of growth. Overall activity in the transportation sector expanded at a moderate pace. While farm incomes were elevated throughout 2021, agricultural conditions were marred by drought conditions across several Districts.

...

Employment grew modestly in recent weeks, but contacts from most Districts reported that demand for additional workers remains strong. Job openings were up but overall payroll growth was constrained by persistent labor shortages. Tightness in labor markets drove robust wage growth nationwide, with some Districts highlighting additional growth in labor costs associated with non-wage benefits. While many contacts noted that wage gains among low-skill workers were particularly strong, compensation growth remained well above historical averages across industries, across worker demographics, and across geographies. Besides wage gains, many contacts indicated adjustments to job demands – such as accommodating part-time work or adjusting qualification requirements – to attract more applicants and retain existing workforces.

emphasis added

Cleveland Fed: Median CPI increased 0.4% and Trimmed-mean CPI increased 0.4% in December

by Calculated Risk on 1/12/2022 12:38:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

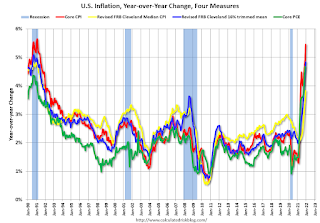

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.4% in December. The 16% trimmed-mean Consumer Price Index increased 0.4% in December. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were up 51% annualized.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Mortgage Rates: Moving on Up; Refinance Activity Will Slow Sharply

by Calculated Risk on 1/12/2022 11:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Mortgage Rates: Moving on Up

A brief excerpt:

The general rule of thumb is refinance activity will be strong if current mortgage rates are 50bps lower than the maximum of the previous year (this is just a general rule - but it works pretty well).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

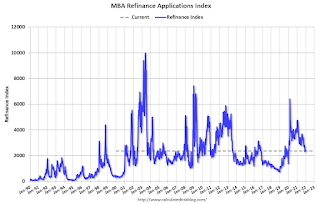

The following graph shows the MBA Refinance Index (Blue) and the change in mortgage rates (Red). The change is calculated as Maximum in Previous Year minus the current rate). When the red line is above 0.5% (more than 50bps decline in mortgage rates), then refinance activity generally picks up.

Currently the maximum for the last year is 3.22% (excluding this week), and with current rates at 3.59%, refinance activity will probably decline significantly over the next few weeks.

BLS: CPI increased 0.5% in December; Core CPI increased 0.6%

by Calculated Risk on 1/12/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in December on a seasonally adjusted basis after rising 0.8 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.0 percent before seasonal adjustment.Both CPI and core CPI were close to expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for shelter and for used cars and trucks were the largest contributors to the seasonally adjusted all items increase. The food index also contributed, although it increased less than in recent months, rising 0.5 percent in December. The energy index declined in December, ending a long series of increases; it fell 0.4 percent as the indexes for gasoline and natural gas both decreased.

The index for all items less food and energy rose 0.6 percent in December following a 0.5-percent increase in November. This was the sixth time in the last 9 months it has increased at least 0.5 percent. Along with the indexes for shelter and for used cars and trucks, the indexes for household furnishings and operations, apparel, new vehicles, and medical care all increased in December. As in November, the indexes for motor vehicle insurance and recreation were among the few to decline over the month.

The all items index rose 7.0 percent for the 12 months ending December, the largest 12-month increase since the period ending June 1982. The all items less food and energy index rose 5.5 percent, the largest 12-month change since the period ending February 1991. The energy index rose 29.3 percent over the last year, and the food index increased 6.3 percent.

emphasis added

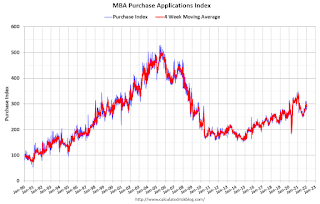

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/12/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 7, 2022. The previous week’s results included an adjustment for the holidays.

... The Refinance Index decreased 0.1 percent from the previous week and was 50 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 51 percent compared with the previous week and was 17 percent lower than the same week one year ago.

“Mortgage rates increased significantly across all loan types last week as the Federal Reserve’s signaling of tighter policy ahead pushed U.S. Treasury yields higher. The 30-year fixed rate hit 3.52 percent, its highest level since March 2020. Rates at these levels are quickly closing the door on refinance opportunities for many borrowers. Although refinance activity changed little over the week, applications remained at their lowest level in over a month, and conventional refinance applications were at their lowest level since January 2020,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The housing market started 2022 on a strong note. Both conventional and government purchase applications showed increases, with FHA purchase applications increasing almost 9 percent, and VA applications increasing more than 5 percent. MBA expects solid growth in purchase activity this year, as demographic drivers and the strong economy support housing demand. However, the strength in growth will be dependent on housing inventory growing more rapidly to meet demand.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.52 percent from 3.33 percent, with points decreasing to 0.45 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 17% year-over-year unadjusted.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).