by Calculated Risk on 1/10/2022 02:50:00 PM

Monday, January 10, 2022

Q4 2021 Update: Unofficial Problem Bank list Decreased to 57 Institutions

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here are the quarterly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List through December 31, 2021. Since the last update at the end of September 2021, the list decreased by two to 57 institutions after two additions and four removals. Assets increased by $1.7 billion to $56.6 billion, with the change primarily resulting from a $1.7 billion increase from updated asset figures through September 30, 2021. A year ago, the list held 65 institutions with assets of $58.2 billion.

Additions during the fourth quarter included BancCentral, National Association, Alva, OK ($542 million) and Herring Bank, Amarillo, TX ($521 million). Removals during the quarter because of action termination included Texas Citizens Bank, National Association, Pasadena, TX ($515 million); Civis Bank, Rogersville, TN ($189 million); and Canyon Community Bank, National Association, Tucson, AZ ($146 million). CornerstoneBank, Atlanta, GA ($224 million) exited through an unassisted merger. On November 30, 2021, the FDIC released third quarter results and provided an update on the Official Problem Bank List. In that release, the FDIC said there were 46 institutions with assets of $51 billion on the official list, down from the 51 institutions but up in assets from $46 billion in the second quarter of 2021.

With the conclusion of the fourth quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,781 institutions have appeared on a weekly or monthly list since then. Only 3.2 percent of the banks that have appeared on a list remain today as 1,724 institutions have transitioned through the list. Departure methods include 1,017 action terminations, 411 failures, 278 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 411 failures represent 23.1 percent of the 1,781 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

2nd Look at Local Housing Markets in December

by Calculated Risk on 1/10/2022 12:37:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in December

A brief excerpt:

Commenting on the slowdown in sales, Dick Beeson, managing broker at RE/MAX Northwest Realtors, said, "That's to be expected considering inventory in the fourth quarter was down sharply from last year. You can't sell what isn't there."There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a summary of active listings for these housing markets in December. Inventory was down 22.7% in December month-over-month (MoM) from November, and down 34.2% year-over-year (YoY).

Inventory almost always declines seasonally in December, so the MoM decline is not a surprise. Last month, these markets were down 30.5% YoY, so the YoY decline in December is larger than in November. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), Jacksonville, Source: Northeast Florida Association of REALTORS®

Housing Inventory January 10th Update: Inventory Down 0.5% Week-over-week; New Record Low

by Calculated Risk on 1/10/2022 10:09:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines sharply over the holidays, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

Six High Frequency Indicators for the Economy

by Calculated Risk on 1/10/2022 08:22:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

Note: Gasoline consumption returned to pre-pandemic levels.

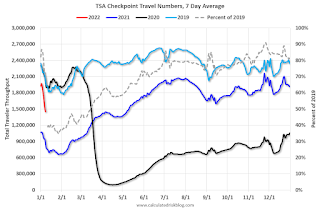

The TSA is providing daily travel numbers.

This data is as of January 8th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 27.9% from the same day in 2019 (72.1% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through January 8, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways, but there has been some decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 24% compared to 2019.

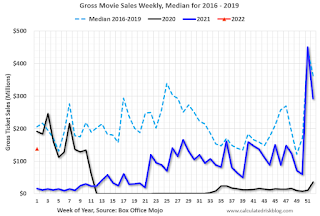

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $138 million last week, down about 33% from the median for the week.

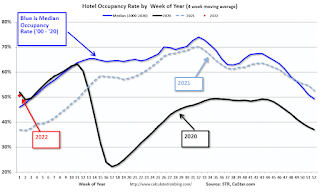

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red dot is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through January 1st. The occupancy rate was down slightly compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through January 8th

This data is through January 8th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 85% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday,January 7th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, January 09, 2022

Sunday Night Futures

by Calculated Risk on 1/09/2022 07:02:00 PM

Weekend:

• Schedule for Week of January 9, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 11 and DOW futures are down 91 (fair value).

Oil prices were up over the last week with WTI futures at $78.90 per barrel and Brent at $81.75 per barrel. A year ago, WTI was at $52, and Brent was at $56 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.29 per gallon. A year ago prices were at $2.31 per gallon, so gasoline prices are up $0.98 per gallon year-over-year.

Lawler: More on Investor Purchases of Single-Family Homes

by Calculated Risk on 1/09/2022 09:55:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: More on Investor Purchases of Single-Family Homes

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Recent reports showing a surge in investor purchases of single-family homes beginning last spring has stunned quite a few housing analysts and led several to reassess the “drivers” of the surprising strength in housing and home prices this year.

One of the reports I’m referring to is from Redfin, and the other is from CoreLogic. While both are based on an analysis of property records, there are key differences.

Before going into some of the potential ramifications of this investor surge, however, I thought it might be useful to discuss these reports – especially in light of a recent “research” report from the trade association “dedicated to advocating on behalf of the single-family rental industry” that completed botched its analysis of these recent reports.

Saturday, January 08, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 1/08/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Rents Still Increasing Sharply Year-over-year

• 1st Look at Local Housing Markets in December

• Apartment Vacancy Rate Declined in Q4

• Will the unprecedented surge in investor purchases of Single Family homes continue?

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free, but please subscribe!.

Schedule for Week of January 9, 2022

by Calculated Risk on 1/08/2022 08:11:00 AM

The key reports this week are December CPI and retail sales.

For manufacturing, the December Industrial Production report will be released.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for December.

10:00 AM: Testimony, Fed Chair Jerome Powell, Nomination Hearing, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for 0.5% increase in CPI, and a 0.5% increase in core CPI.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims.

8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.4% increase in PPI, and a 0.5% increase in core PPI.

10:00 AM, Testimony, Fed Governor Lael Brainard, Nomination Hearing, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

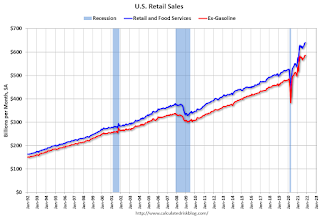

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.0%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for January).

Friday, January 07, 2022

COVID Update Jan 7, 2022

by Calculated Risk on 1/07/2022 09:40:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 207.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 614,552 | 360,566 | ≤5,0002 | |

| Hospitalized3🚩 | 99,690 | 70,676 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,350 | 1,136 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

AAR: December Rail Carloads Down Compared to 2019; Intermodal Up

by Calculated Risk on 1/07/2022 05:01:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

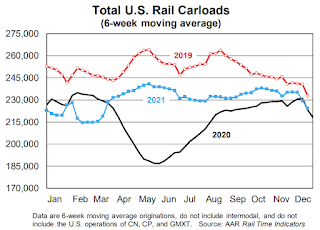

U.S. rail carloads totaled 12.01 million in 2021, up 6.6% over 2020 but down 7.4% from 2019. ...

For intermodal, 2021 was the tale of two halves. The first six months of 2021 saw record-breaking highs, but volume cooled in the second half as global supply chain challenges persisted. For all of 2021, U.S. railroads originated 14.14 million containers and trailers — up 5.1% over 2020, up 3.4% over 2019, and the second most ever for a full year. Only 2018’s 14.47 million was higher.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2019, 2020 and 2021:

U.S. railroads originated 1.14 million total carloads in December 2021, up 3.1% over December 2020 and down 0.7% from December 2019. December was the tenth straight overall year-over-year gain and the fifth straight in the 2%-4% range.

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):Meanwhile, U.S. railroads originated 1.22 million intermodal containers and trailers in December 2021, down 8.2% from December 2020 and the fifth straight year-over-year decline. Volume averaged 244,956 units per week in December 2021, the fewest since May 2020. (December is typically one of the lowest-volume intermodal months of the year.)