by Calculated Risk on 12/22/2021 03:23:00 PM

Wednesday, December 22, 2021

December Vehicle Sales Forecast: Decrease to 12.7 million SAAR

From WardsAuto: December U.S. Light-Vehicle Sales to Record 5-Month High Volume, but Seasonally Adjusted Rate Set to Fall from November (pay content)

Low inventories and supply issues continue to impact vehicle sales, but it appears the supply chain disruption bottom is in.

This graph shows actual sales from the BEA (Blue), and Wards forecast for December (Red).

The Wards forecast of 12.7 million SAAR, would be down about 1% from last month, and down 22% from a year ago (sales were solid in December 2020, as sales recovered from the depths of the pandemic, and weren't yet impacted by supply chain issues).

MBA Updated Economic and Mortgage Forecasts

by Calculated Risk on 12/22/2021 12:38:00 PM

The MBA released their updated Economic and Mortgage forecasts. Their prior forecast (included with several others) is here: 2022 Housing Forecasts: Second Look

A few highlights:

• Total mortgage originations are expected to decrease to $2.61T in 2022, as more of the activity shifts to the purchase market.

- Refinance originations are expected to drop to $870B.

- Purchase originations are forecast to eclipse 2021’s record high and reach $1.74T, backed by strong housing demand and rising home prices and sales.

• Home-price growth is forecast to moderate to 5.1%.

• Mortgage rates are expected to rise throughout the year and reach 4.0% by December 2022.

• Economic growth is forecast to be at 4.0% in 2022, with the unemployment rate declining to 3.5% by the end of the year.

More Analysis on November Existing Home Sales

by Calculated Risk on 12/22/2021 10:53:00 AM

Today, in the Real Estate Newsletter: Existing-Home Sales Increased to 6.46 million in November

Excerpt:

This graph shows existing home sales by month for 2020 and 2021.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

This was the fourth consecutive month with sales down year-over-year. Sales will likely be down YoY in December and probably in January 2022 too since were exceptionally strong last Winter.

...

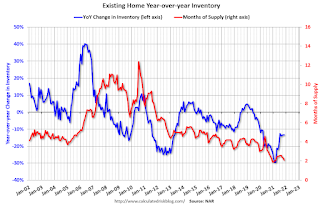

[and on inventory] Months-of-supply at 2.1 months is very low, but still above the record low of 1.9 months set in December 2020 and January 2021. That record will be tested next month.

We will probably see inventory at a new record low over the Winter. Inventory is currently at 1.11 million (according to the NAR), and the record low was 1.03 million in January and February of 2021.

NAR: Existing-Home Sales Increased to 6.46 million in November

by Calculated Risk on 12/22/2021 10:11:00 AM

From the NAR: Existing-Home Sales Continue Upward, Increasing 1.9% in November

Existing-home sales rose in November, denoting three consecutive months of increases, according to the National Association of Realtors®. Three of the four major U.S. regions reported growth in monthly sales, while the fourth region held steady in November. From a year-over-year perspective, only one region experienced a rise in sales as the three others saw home sales decline.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 1.9% from October to a seasonally adjusted annual rate of 6.46 million in November. Sales fell 2.0% from a year ago (6.59 million in November 2020).

...

Total housing inventory at the end of November amounted to 1.11 million units, down 9.8% from October and down 13.3% from one year ago (1.28 million). Unsold inventory sits at a 2.1-month supply at the current sales pace, a decline from both the prior month and from one year ago.

emphasis added

Click on graph for larger image.

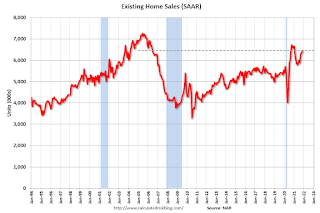

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (6.46 million SAAR) were up 1.9% from last month and were 2.0% below the November 2020 sales rate.

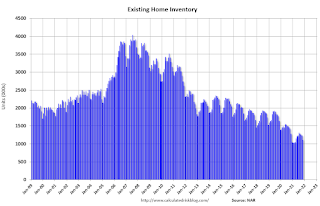

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.11 million in November from 1.23 million in October.

According to the NAR, inventory decreased to 1.11 million in November from 1.23 million in October.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 13.3% year-over-year in November compared to November 2020.

Inventory was down 13.3% year-over-year in November compared to November 2020. Months of supply declined to 2.1 months in November from 2.3 months in October.

This was above the consensus forecast. I'll have more later.

Q3 GDP Growth Revised up to 2.3% Annual Rate

by Calculated Risk on 12/22/2021 08:33:00 AM

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, Third Quarter 2021

Real gross domestic product (GDP) increased at an annual rate of 2.3 percent in the third quarter of 2021, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 6.7 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 1.7% to 2.0%. Residential investment was revised up from -8.3% to -7.7%.

The “third” estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.1 percent. The update primarily reflects upward revisions to personal consumption expenditures (PCE) and private inventory investment that were partly offset by a downward revision to exports. Imports, which are a subtraction in the calculation of GDP, were revised down.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 12/22/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 17, 2021.

... The Refinance Index increased 2 percent from the previous week and was 42 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 9 percent lower than the same week one year ago.

“Mortgage applications fell last week, driven by a 3 percent decline in purchase applications. Both conventional and government purchase applications were down, while the average purchase loan increased for the second straight week to $416,200 – the second highest amount ever. The elevated loan size is an indication that activity is more on the higher end of the market,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Home-price appreciation growth remains faster than historical averages and inventory, particularly for starter homes, continues to trail strong demand.”

Added Kan, “The 30-year fixed rate decreased to 3.27 percent – its lowest level in four weeks – and helped spur an increase in refinances across all loan types. FHA and VA refinances jumped 4 percent and 12 percent, respectively.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.27 percent from 3.30 percent, with points increasing to 0.41 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

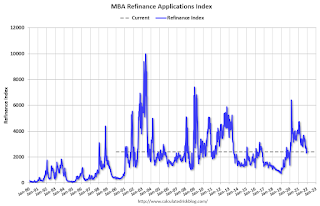

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains slightly elevated, but down sharply from last year.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, December 21, 2021

Wednesday: GDP, Existing Home Sales

by Calculated Risk on 12/21/2021 07:45:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 3rd quarter 2021 (Third estimate). The second estimate of GDP was 2.1%.

• Also at 8:30 AM, Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 6.20 million SAAR, down from 6.34 million. Housing economist Tom Lawler expects the NAR to report sales of 6.45 million SAAR for November.

From CR on COVID (mostly focus on hospitalizations and deaths, although new cases are rising rapidly):

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 61.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 204.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 149,331 | 119,281 | ≤5,0002 | |

| Hospitalized3🚩 | 60,907 | 58,452 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,188 | 1,148 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of cases reported.

Housing Wire: "Move over Fannie, the non-QM loan is in the fast lane"

by Calculated Risk on 12/21/2021 02:42:00 PM

CR Note: I've mentioned the increasing use of non-QM loans before.

Here is an interesting article on non-QM loans By Bill Conroy at Housing Wire: Move over Fannie, the non-QM loan is in the fast lane. Some brief excerpts:

The universe of non-QM single-family mortgage products is broad and difficult to define in a few words, but the definition matters because a huge slice of the borrowers in this non-QM category represent the heartbeat of the U.S. economy. Within its sweep are the self-employed as well as entrepreneurs who buy single-family investment properties — and who can’t qualify for a mortgage using traditional documentation, such as payroll income. As a result, they must rely on alternative documentation, including bank statements, assets or, in the case of rental properties, debt-service coverage ratios.The size of the market is relatively small (about $25 billion in 2021 but growing). And the underwriting is generally solid, but this will be a segment of mortgage lending to watch.

...

Non-QM mortgages also go to a slice of borrowers facing credit challenges — such as a recent bankruptcy or slightly out-of-bounds credit scores. The loans may include interest-only, 40-year terms or other creative financing features often designed to lower monthly payments on the front-end of the mortgage — often with an eye toward refinancing or selling the property in the short-term future.

5th Look at Local Housing Markets in November

by Calculated Risk on 12/21/2021 11:47:00 AM

Today, in the Real Estate Newsletter: 5th Look at Local Housing Markets in November

Excerpt:

This update adds Boston, Indiana, and Washington, D.C.

...

Here is a summary of active listings for these housing markets in November. Inventory was down 15.3% in November month-over-month (MoM) from October, and down 26.0% year-over-year (YoY).

Inventory almost always declines seasonally in November, so the MoM decline is not a surprise. Last month, these markets were down 22.5% YoY, so the YoY decline in November is larger than in October. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3. Totals do not include Denver or Minneapolis (included in state totals).

Cleveland Fed: "What’s Holding Back Employment"

by Calculated Risk on 12/21/2021 09:45:00 AM

From the Cleveland Fed: What’s Holding Back Employment in the Recovery from the COVID-19 Pandemic?. Excerpts:

Bureau of Labor Statistics data indicate that five million jobs lost during the pandemic have not been recovered, but it is difficult to ascertain how many workers will return to available jobs. The Census Bureau’s Household Pulse Survey includes a detailed set of reasons for nonemployment, including households’ responses to the pandemic that provide a new perspective on reasons for not working. Among prime-age workers, reasons for nonemployment during the SARS-CoV-2 (COVID-19) pandemic have shifted substantially from mostly labor demand reasons to primarily labor supply inhibitors. At this point, most nonemployment is connected to three categories: sickness and concerns about COVID-19; child- and eldercare responsibilities; and the residual category “other reasons.” The persistence of these answers and the characteristics of individuals’ providing these answers point to barriers to fully recovering prior employment rates.

emphasis added

...

Click on graph for larger image.

The Household Pulse Survey shows that while the initial shock from the pandemic affected mostly labor demand, persistent supply-side barriers have kept previously employed people from returning to employment. There are various distinct reasons why people are not returning to employment, and the severity of these issues varies by demographic group. Some of these reasons for nonemployment point to persistent shifts in the labor force that may not resolve with the end of the pandemic. The lack of affordable and accessible childcare largely affects women with young children and will likely continue to keep some of these women out of the labor force even after the end of the pandemic because of the increased cost of childcare and the long-term job separations experienced by these mothers. Differences in virus fears and virus risks may make return to employment slower for Black workers, especially in areas with low vaccination rates. The largest category of reasons is “other reasons,” but lower-income and less-educated individuals are substantially overrepresented in this category. These individuals have long had lower workforce participation rates, and research on the benefits cliffs has revealed many situations in which increasing work can lower family incomes because of discrete cutoffs for other benefits. These distinct barriers all have different implications for the labor force and different solutions beyond ending the current public health crisis. By distinguishing which reasons for nonemployment are most limiting for each demographic group, we can better design policies that will help address specific issues for the populations most affected.