by Calculated Risk on 12/07/2021 08:39:00 AM

Tuesday, December 07, 2021

Trade Deficit Decreased to $67.1 Billion in October

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $67.1 billion in October, down $14.3 billion from $81.4 billion in September, revised.

October exports were $223.6 billion, $16.8 billion more than September exports. October imports were $290.7 billion, $2.5 billion more than September imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in October.

Exports are up 18% compared to October 2020; imports are up 22% compared to October 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $31.4 billion in October, from $30.0 billion in October 2020.

CoreLogic: House Prices up 18% YoY in October

by Calculated Risk on 12/07/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: US Annual Home Price Growth at a Record 18% in October, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2021.

U.S. annual home price growth remained strong at 18% in October, the highest recorded in the 45-year history of the index. Nonetheless, monthly price growth has slowed from its April peak and signals a moderation in price growth that the CoreLogic HPI Forecast projects will continue to slow in coming months.

Despite affordability challenges, a recent CoreLogic consumer survey shows that over half of respondents across every age cohort said that owning a home has always been a goal of theirs — further supporting the outlook that consumer desire for homeownership remains.

“New household formation, investor purchases and pandemic-related factors driving demand for the limited supply of available for-sale homes continues to propel the upward spiral of U.S. home prices,” said Frank Martell, president and CEO of CoreLogic. “However, we expect home price growth to moderate over the near term as many buyers take a break for the holidays.”

...

Nationally, home prices increased 18% in October 2021, compared to October 2020. On a month-over-month basis, home prices increased by 1.3% compared to September 2021.

...

Home price gains are projected to slow to a 2.5% increase by October 2022 as affordability and economic concerns deter some potential buyers and additional for-sale inventory becomes available.

"Single-family detached houses remain the preferred home for buyers during the pandemic,” said Dr. Frank Nothaft, chief economist at CoreLogic. “This is reflected in the 19.5% annual price rise for detached houses, which marks another record-high for the CoreLogic Home Price Index.”

emphasis added

Monday, December 06, 2021

Tuesday: Trade Deficit, Corelogic House Prices

by Calculated Risk on 12/06/2021 07:17:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Started Flat, But Moved Higher in The Afternoon

Mortgage rates have been in a very narrow, sideways range since October. During that time, the average 30yr fixed rate hasn't moved by more than an eighth of a percent in either direction. Today was no exception.Tuesday:

...

These so-called mid-day reprices can happen in either direction. It didn't look like we would see any today based on market movement in the first 90 minutes. After that, bond began to deteriorate, ultimately forcing lenders to issue negative reprices. Keep in mind that we're dealing with very small adjustments in the bigger picture. The point is that rates are now slightly higher than they were on Friday afternoon. [30 year fixed 3.22%]

emphasis added

• At 8:00 AM ET, Corelogic House Price index for October.

• At 8:30 AM, Trade Balance report for October from the Census Bureau. The consensus is the trade deficit to be $67.0 billion. The U.S. trade deficit was at $80.9 billion in September.

December 6th COVID-19: 60% of US Population Fully Vaccinated

by Calculated Risk on 12/06/2021 03:09:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 60.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 199.3 | --- | ≥2321 | |

| New Cases per Day3🚩 | 103,823 | 87,603 | ≤5,0002 | |

| Hospitalized3🚩 | 49,176 | 46,003 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,154 | 733 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.3%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 51.0%.

Next up (total population, fully vaccinated according to CDC) are Tennessee at 49.8%, Arkansas at 49.8%, Georgia at 49.4%, Louisiana at 49.2%, North Dakota at 49.2%, and West Virginia at 49.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

As Forbearance Ends

by Calculated Risk on 12/06/2021 02:54:00 PM

Today, in the Real Estate Newsletter: As Forbearance Ends

Excerpt:

An analysis from Black Knight today, in their monthly mortgage monitor, indicates most borrowers are successfully leaving forbearance. Out of the 7.7 million borrowers that entered COVID related forbearance, only a small fraction are in foreclosure or delinquent (and not in active loss mitigation). Here is a chart from Black Knight:

...

In a previous post, Forbearance Will Not Lead to a Huge Wave of Foreclosures, I presented some data and argued “that most homeowners in forbearance have sufficient equity in their homes, and there will not be a huge wave of foreclosures like following the housing bubble.”

So far, the data suggests the vast majority of borrowers that were in forbearance will return to current status. I’ll continue to track the data over the next few months, but this isn’t a huge concern.

Black Knight Mortgage Monitor for September: "More than 750K borrowers left forbearance plans over the past 45 days"

by Calculated Risk on 12/06/2021 12:24:00 PM

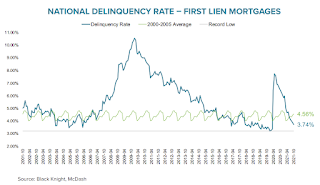

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 3.74% of mortgage were delinquent in September, down from 3.91% of mortgages in August, and down from 6.44% in September 2020. Black Knight also reported that 0.26% of mortgages were in the foreclosure process, down from 0.33% a year ago.

This gives a total of 4.07% delinquent or in foreclosure.

Press Release: Tappable Equity Surges $254 Billion in Q3 to All-Time High of $9.4 Trillion as Cash-Out Refinance Borrowers Pull Largest Quarterly Volume of Equity in 14 Years

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI) released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. Though the rate of home price appreciation has begun to slow in recent months, the explosive growth of the last few years has driven tappable equity – the amount available for a mortgage holder to access while retaining at least a 20% equity stake in their home – to one new height after another. According to Black Knight Data & Analytics President Ben Graboske, a nearly-quarter-trillion dollar increase in tappable equity over the third quarter has resulted in not only yet another record high, but also the lowest total market leverage on record.

“Home price growth in the third quarter – while less than half that of Q2’s history-making rate – added more than $250 billion to Americans’ already record levels of tappable equity,” said Graboske. “The aggregate total of $9.4 trillion is up an astonishing 32% from the same time last year and nearly 90% higher than the pre-Great Recession peak in 2006. As prices have surged over the past 18 months, the average mortgage-holder’s equity stake has risen by $53,000. That works out to nearly $178,000 available in tappable equity to the average homeowner with a mortgage before hitting a maximum combined loan-to-value ratio of 80%. What’s more, in the third quarter, homeowners tapped into their equity at the highest rate in more than 14 years as cash-outs made up 54% of all refinances.

...

This month’s Mortgage Monitor also examines the impact of rising prices and interest rates on home affordability, finding that the monthly mortgage payment (principal and interest) to purchase the average-priced home with 20% down has jumped by nearly 25% since the start of the year. Factoring in incomes as well as prices across the country, it now requires 22.4% of the median income to purchase the average-priced home with 20% down and a 30-year mortgage. This is the largest share of income required for a home purchase since late 2018, when interest rates were near 5%, but still far below the 34%+ payment-to-income ratio reached in 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• The national delinquency rate, at 3.74%, is just over a half percentage point above the all-time low, set in January 2020

• Serious delinquencies fell by more than 10% (-127K) in October as the first wave of forbearance entrants returned to making mortgage payments

• Further improvement is expected in coming weeks as most borrowers exiting forbearance plans are still working through loss mitigation options with their lenders

• There are still nearly 700K more seriously delinquent mortgages (including those in active forbearance plans) than there were prior to the pandemic

And on the current status of loans that have exited forbearance:

And on the current status of loans that have exited forbearance: • More than 750K borrowers left forbearance plans over the past 45 days, and while the dust continues to settle on their post-forbearance performance, early trends are like other recent exit monthsThere is much more in the mortgage monitor.

• Trends are also becoming clearer among earlier forbearance exits, with fewer than 15% of borrowers who left plans in May remaining either delinquent (8%) or in post-forbearance loss mitigation (5%), a share that falls below 10% among those exiting before the end of April

• Among borrowers who left plans from September through November, only 7% are no longer in loss mitigation and remain delinquent, but 38% of such exits – and as many as 53% of those who exited in early November – remain in loss mitigation, as servicers and borrowers work through available options

• Given the large volume of exit activity over the past 45 days, all eyes will be on the success rate of those loss mitigation efforts in coming weeks

Housing Inventory December 6th Update: Inventory Down 6.5% Week-over-week

by Calculated Risk on 12/06/2021 10:17:00 AM

Tracking existing home inventory is very important this year and in 2022.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 12/06/2021 08:17:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

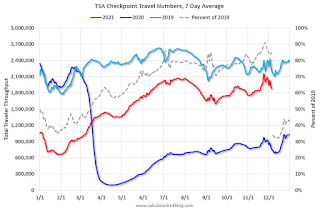

The TSA is providing daily travel numbers.

This data is as of December 5th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 15.2% from the same day in 2019 (84.8% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 4, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend but declined after the holiday - and is mostly moving sideways. The 7-day average for the US is unchanged compared to 2019.

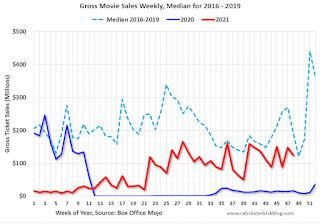

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $123 million last week, down about 36% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through November 27th. The occupancy rate was up 5.0% compared to the same week in 2019. This was the first week this year that was up compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of November 26th, gasoline supplied was down 2.6% compared to the same week in 2019.

There have been ten weeks this year that gasoline supplied was up compared to the same week in 2019 - so consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 4th

This data is through December 4th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 108% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, December 3rd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 05, 2021

Sunday Night Futures

by Calculated Risk on 12/05/2021 09:01:00 PM

Weekend:

• Schedule for Week of December 5, 2021

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 24 and DOW futures are up 260 (fair value).

Oil prices were down over the last week with WTI futures at $66.26 per barrel and Brent at $69.88 per barrel. A year ago, WTI was at $46, and Brent was at $49 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.35 per gallon. A year ago prices were at $2.14 per gallon, so gasoline prices are up $1.11 per gallon year-over-year.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/05/2021 08:47:00 AM

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now closer to normal (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Jed Kolko's article from 2014 (currently Chief Economist at Indeed) "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through September 2021). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bubble, however the recent price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors has been moving back towards more normal levels.