by Calculated Risk on 9/14/2021 09:00:00 PM

Tuesday, September 14, 2021

Wednesday: NY Fed Mfg, Industrial Production

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 18.6, up from 18.3.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 76.4%.

September 14th COVID-19: Almost 1 Million Doses per Day

by Calculated Risk on 9/14/2021 07:51:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.0% | 53.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 179.3 | 176.0 | ≥2321 | |

| New Cases per Day3 | 139,897 | 149,796 | ≤5,0002 | |

| Hospitalized3 | 90,651 | 93,201 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,262 | 1,147 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 15 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.3%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, and Kentucky at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Arizona at 49.8%, Kansas at 49.7%, Ohio at 49.3%, Nevada at 49.3%, Texas at 49.2%, Utah at 48.9% and Alaska at 48.5%.

Click on graph for larger image.

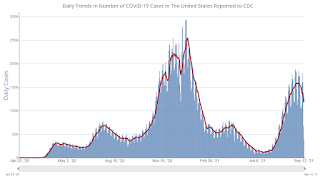

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

House Price to Median Income

by Calculated Risk on 9/14/2021 12:30:00 PM

House Price to Median Income

NOTE: This is the new Newsletter that focuses solely on Real Estate. It is completely Free at this time. Please subscribe!

The Census Bureau released median income data for 2020 today.

Cleveland Fed: Key Measures of Inflation in August

by Calculated Risk on 9/14/2021 11:46:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in August. The 16% trimmed-mean Consumer Price Index rose 0.4% in August. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for July here. "Car and truck rental" were down 65% annualized (reversing some of the previous increase).

This graph shows the year-over-year change for these four key measures of inflation.

Early Look at 2022 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/14/2021 10:18:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 5.8 percent over the last 12 months to an index level of 268.387 (1982-84=100). For the month, the index rose 0.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2020, the Q3 average of CPI-W was 253.412.

The 2020 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 5.8% year-over-year in August, and although this is early - we need the data for September - my current guess is COLA will probably be around 5.8% this year, the largest increase since 5.8% in 2008 - and it is possible this will be the largest increase since 1982 (7.4%).

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2020 yet, but wages probably increased again in 2020. If wages increased the same as in 2019, then the contribution base next year will increase to around $148,200 in 2022, from the current $142,800.

Remember - this is an early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

BLS: CPI increased 0.3% in August, Core CPI increased 0.1%

by Calculated Risk on 9/14/2021 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in August on a seasonally adjusted basis after rising 0.5 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.3 percent before seasonal adjustment.CPI and core CPI were both below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The indexes for gasoline, household furnishings and operations, food, and shelter all rose in August and contributed to the monthly all items seasonally adjusted increase. The energy index increased 2.0 percent, mainly due to a 2.8-percent increase in the gasoline index. The index for food rose 0.4 percent, with the indexes for food at home and food away from home both increasing 0.4 percent.

The index for all items less food and energy rose 0.1 percent in August, its smallest increase since February 2021. Along with the indexes for household operations and shelter, the indexes for new vehicles, recreation, and medical care also rose in August. The indexes for airline fares, used cars and trucks, and motor vehicle insurance all declined over the month.

The all items index rose 5.3 percent for the 12 months ending August, a smaller increase than the 5.4-percent rise for the period ending July. The index for all items less food and energy rose 4.0 percent over the last 12 months, also a smaller increase than the period ending July.

emphasis added

Monday, September 13, 2021

September 13th COVID-19: Data reported on Monday is always low, and will be revised up as data is received

by Calculated Risk on 9/13/2021 09:47:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 53.8% | 53.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 178.7 | 176.0 | ≥2321 | |

| New Cases per Day3 | 117,622 | 152,402 | ≤5,0002 | |

| Hospitalized3 | 87,848 | 93,421 | ≤3,0002 | |

| Deaths per Day3 | 1,077 | 1,213 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 15 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.2%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, and Kentucky at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Arizona at 49.7%, Kansas at 49.5%, Ohio at 49.2%, Nevada at 49.1%, Texas at 49.0%, Utah at 48.8% and Alaska at 48.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Tuesday: CPI

by Calculated Risk on 9/13/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Flat to Start The Week

Mortgage rates were fairly flat to start the new week. This leaves the average lender in the high 2% range for top tier conventional 30yr fixed scenarios (i.e. 20%+ equity, 740+ FICO, owner-occupied, single-family, detached homes). This is just a bit higher than the all-time lows seen at the beginning of the year when rates were in the mid-2% range. [30 year fixed 2.94%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 8:30 AM, The Consumer Price Index for August from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.3% increase in core CPI.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 3.08%"

by Calculated Risk on 9/13/2021 04:00:00 PM

Note: This is as of September 5th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 3.08%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 15 basis points from 3.23% of servicers’ portfolio volume in the prior week to 3.08% as of September 5, 2021. According to MBA’s estimate, 1.5 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 11 basis points to 1.52%. Ginnie Mae loans in forbearance decreased 24 basis points to 3.39%, while the forbearance share for portfolio loans and private-label securities (PLS) decreased 25 basis points to 7.27%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 16 basis points to 3.33%, and the percentage of loans in forbearance for depository servicers decreased 18 basis points to 3.15%.

“The share of loans in forbearance decreased by 15 basis points last week, as forbearance exits jumped to their fastest pace since March. The fast pace of exits outweighed the slight increase in new forbearance requests and re-entries,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Servicer call volume jumped last week as summer came to an end and many borrowers reached the end of their forbearance terms. We anticipate a similarly fast pace of exits in the weeks ahead, which should lead to increased call volume and a further decline in the forbearance share.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.04% to 0.05%."

Second Home Market: South Lake Tahoe in August

by Calculated Risk on 9/13/2021 01:57:00 PM

Early this year, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and will track those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through August 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but solidly above the record low set five months ago, and prices are up sharply YoY. This will be interesting to watch.