by Calculated Risk on 8/20/2021 03:19:00 PM

Friday, August 20, 2021

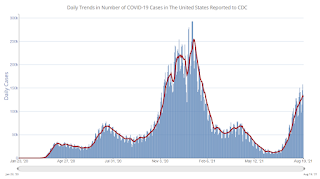

August 20th COVID-19: Cases May be Peaking

The 7-day average deaths is the highest since April 1st.

Total doses administered: 360,634,287, as of a week ago 354,777,950. Average doses last week: 0.84 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.2% | 51.1% | 50.5% | ≥70.0%1 |

| Fully Vaccinated (millions) | 170.0 | 169.6 | 167.7 | ≥2321 |

| New Cases per Day3🚩 | 130,926 | 133,088 | 119,972 | ≤5,0002 |

| Hospitalized3🚩 | 78,399 | 77,214 | 64,658 | ≤3,0002 |

| Deaths per Day3🚩 | 686 | 640 | 585 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.2%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa and Illinois at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Michigan at 49.8%, South Dakota at 48.3%, Ohio at 47.6%, Kentucky at 47.2%, Kansas at 46.9%, Arizona at 46.8%, Alaska at 46.5%, Utah at 46.5%, and Nevada at 46.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Real Estate Agent Comments in August: “Buyer fatigue, Inventory gridlock"

by Calculated Risk on 8/20/2021 11:36:00 AM

Some twitter comments from Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting:

Just surveyed 6,000+ real estate agents across country. Top themes from our 1st ever RESALE agent survey: 1) Buyer fatigue, w/rumblings of remorse. 2) Bidding wars a bit less bonkers. 3) Cash is King & ton of investors. 4) Inventory gridlock. Commentary across country to follow ...

#LosAngeles agent: “20-minute allotted home viewing time slots with offers due next day by noon, & buyers are asked to give up every contingency under the sun.”

#NYC agent: “Luxury home buyers feel the market is overpriced & have backed off.”

#Phoenix agent: “Buyers are nervous they’re overpaying. Sellers are nervous there will be a correction & they missed opportunity to list at a premium. Both sides are crippled with questions & fear.”

#Houston agent: “Some of my clients are waiting to buy due to the high cost/ bidding war. They feel that any house they purchase will be upside down in equity due to the bidding wars that are going on.”

#Boston agent: “Cash is King. More buyers coming to the table with cash for homes priced at $850K+.”

#Bridgeport CT agent: “With the Delta variant, some sellers are hoping for another round of panic buyers.”

#EastBay CA agent: “Finally slowing down, so instead of 40 offers on the homes, we are seeing 6 to 10 offers. Still selling but without the drama.”

#Tampa agent: “Can you imagine how crazy we’re going to be when Canadians are allowed to come in. Their money is burning a hole in their pocket, & they'll be headed here to Florida to spend it.”

#Chicago agent: “Every single weekend since December, I’ve been taking out 1st time buyers ($350k or less). So many offers on the table, & we get declined every single weekend. Just lost 3 more contracts yesterday.”

#Atlanta agent: “Very difficult market for 1st time buyers in $200k to $275k range. Sometimes 50 offers+ & investors are winning! Forget using any assistance programs for 1st time buyers; sellers won’t even consider the offer.”

#Nashville agent: “Some agents write 20 offers for a buyer before they win on a house.”

#Charlotte agent: “Institutional buyers are killing the first-timer.”

#StLouis agent: “Our inventory is choked to almost nothing. People can't list, knowing the lack of homes for sale. We're in gridlock!”

#Columbus OH agent: “Market sucks for FHA buyers. They have almost zero chance to get chosen when cash buyers are going $50k over asking price.”

#Louisville agent: ““All my buyers are paying $15k to $40k over asking. It's the only way to win in these bidding wars. If these people have to sell in 3-5 years due to life changes, they're going to be under water.”

#ColoradoSprings agent: “VA & FHA buyers will be shut out of the market for all intents & purposes unless they have appraisal gap protection.”

#Athens GA agent: “Hard for the average buyer or ‘little man’ to compete. Without cash reserves, buyers do not stand a chance with their offers.”

#Richmond IN agent: “People are making awesome offers to win the multiple offer war, but then trying to renegotiate at inspection time to try & make the price much less than what was accepted.”

#HotSprings AR agent: “At least 1/3 of my buyers are coming from Texas and California.”

#Kalispell MT agent: “Entire state of Montana has been overwhelmed with out-of-state buyers paying cash for properties & pushing purchase prices. Rents are also being pushed to all-time highs. Affordable homes & rentals for our workforce are a major issue.”

#Claremont NH agent: “Beginning to see some buyer pricing resistance in the last couple of weeks & inventory is growing.”

#LakeKenosha IL agent: “Buyers are not going $50k over asking price like they were a month ago.”

#Lansing MI agent: “Starting to see buyers aren’t as quick to guarantee the difference in appraisal value vs. accepted offer price. If they do, they put a limit on the amount they’re willing to pay between appraised value & accepted price.” THE END

Q3 GDP Forecasts: Downward Revisions

by Calculated Risk on 8/20/2021 11:20:00 AM

From BofA:

3Q GDP growth is currently coming in at 4.5%, leaving annual growth to slip to 5.9% this year. We think the Delta variant is a large reason for the soft patch as can be seen by the pullback in spending on leisure services. But we also have to consider the possibility of more permanent supply-side constraints and greater precautionary savings. [August 20 estimate]From Goldman Sachs:

emphasis added

We have lowered our Q3 GDP forecast to +5.5%, reflecting hits to both consumer spending and production. Spending on dining, travel, and some other services is likely to decline in August, though we expect the drop to be modest and brief. Production is still suffering from supply chain disruptions, especially in the auto industry, and this is likely to mean less inventory rebuild in Q3. [August 18 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.5% for 2021:Q3. News from this week’s data releases decreased the nowcast for 2021:Q3 by 0.3 percentage point. [August 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 6.1 percent on August 18, down from 6.2 percent on August 17. [August 18 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 8/20/2021 10:19:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of August 17th.

From Andy Walden at Black Knight: Forbearances Edge Slightly Higher

After dropping by more than 150,000 over the past two weeks, we once again saw active forbearance plans edge up slightly in what has become a well-established mid-month trend.

The week’s 11,000 overall increase was driven entirely by a 12,000 rise in plans among Portfolio/PLS loans and offset by a 1,000 decline in GSE forbearances. FHA/VA plan volumes held flat from the week prior.

According to Black Knight’s McDash Flash forbearance tracker, 1.75 million (3.3% of) borrowers remain in COVID-19 related forbearance plans as of August 17. That population includes 1.9% of GSE, 5.8% of FHA/VA and 4.0% of portfolio-held and privately securitized mortgages.

Plan volumes are now down 110,000 (-5.9%) from the same time last month, with the rate of improvement slowing slightly in recent weeks.

Total plan starts were higher this week, primarily from a rise in re-start activity. New plan starts, though up slightly from last week, remain below the 5-week moving average.

Click on graph for larger image.

Meanwhile, plan removals hit their lowest weekly total since late May, but mainly due to the fact that review activity was low in general this past week.

Of those plans reviewed since last Tuesday, 41% resulted in exits, up from the 36% removal rate the same time last month. Activity is poised to pick up significantly with the first wave of final forbearance expirations only weeks away.

Some 200,000 plans are currently slated for review through the final two weeks of August, with approximately one-third of those reaching their final expiration based on current allowable forbearance term lengths. Volumes of final expirations will increase significantly in September and October.

emphasis added

Black Knight: National Mortgage Delinquency Rate Decreased in July

by Calculated Risk on 8/20/2021 08:26:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: Overall Mortgage Delinquencies Edge Closer to Pre-Pandemic Levels, But 1.45M Remain Seriously Past Due as Foreclosure Moratorium Expired at End of July

• The national delinquency rate saw a 5% reduction in July and at 4.14% is now down by nearly half since May of last yearAccording to Black Knight's First Look report, the percent of loans delinquent decreased 5.2% in July compared to June, and decreased 40% year-over-year.

• Delinquencies have now improved in 12 of the last 14 months, with the two monthly increases being calendar-related as opposed to being indicative of worsening performance

• While overall delinquency volumes continue to edge closer to pre-pandemic levels, the number of serious delinquencies were still significantly elevated as federal foreclosure moratoria expired at the end of July

• Some 1.45 million borrowers remained 90 or more days past due – but not yet in foreclosure – entering August, more than 1 million more than at the onset of the pandemic

• Foreclosure starts remained muted in July, the final month of the foreclosure moratorium on federally backed mortgages, down 58% from the same time last year

• While the number of loans in active foreclosure fell by 5,000 to yet another record low, potential foreclosure activity in the coming months warrants close observation

• After rising in June, prepayment activity slid by 11% in July; however, low 30-year rates in recent weeks have resulted in a modest resurgence in refinance incentive which may impact August prepay numbers

emphasis added

The percent of loans in the foreclosure process decreased 4.0% in July and were down 26% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.14% in July, down from 4.37% in June.

The percent of loans in the foreclosure process decreased in July to 0.26%, from 0.27% in June.

The number of delinquent properties, but not in foreclosure, is down 1,486,000 properties year-over-year, and the number of properties in the foreclosure process is down 50,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2021 | June 2021 | July 2020 | July 2019 | |

| Delinquent | 4.14% | 4.37% | 6.91% | 3.46% |

| In Foreclosure | 0.26% | 0.27% | 0.36% | 0.49% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,206,000 | 2,320,000 | 3,692,000 | 1,807,000 |

| Number of properties in foreclosure pre-sale inventory: | 140,000 | 145,000 | 190,000 | 258,000 |

| Total Properties | 2,346,000 | 2,466,000 | 3,881,000 | 2,065,000 |

Thursday, August 19, 2021

Existing Home Inventory in July: Local Markets

by Calculated Risk on 8/19/2021 06:11:00 PM

I'm gathering existing home data for many local markets, and I'm watching inventory very closely this year.

As I noted in Some thoughts on Housing Inventory

The key for housing in 2021 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in house prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation.Although inventory in these areas is down about 33% year-over-year, inventory is up 13.5% month-to-month (and up 26.5% over the last two months). Seasonally we'd usually expect a small increase in inventory from June to July - so some of this increase is seasonal (as opposed to a shift in the market).

| Existing Home Inventory | |||||

|---|---|---|---|---|---|

| Jul-21 | Jun-21 | Jul-20 | YoY | MoM | |

| Albuquerque | 1,062 | 1,112 | 1,772 | -40.1% | -4.5% |

| Atlanta | 8,668 | 7,787 | 15,442 | -43.9% | 11.3% |

| Austin | 3,294 | 2,265 | 5,309 | -38.0% | 45.4% |

| Boston | 3,719 | 3,822 | 4,853 | -23.4% | -2.7% |

| Charlotte | 4,073 | 3,462 | 7,045 | -42.2% | 17.6% |

| Colorado | 11,126 | 10,405 | 21,959 | -49.3% | 6.9% |

| Denver | 4,056 | 3,122 | 6,449 | -37.1% | 29.9% |

| Des Moines | 2,086 | 1,838 | 2,785 | -25.1% | 13.5% |

| Houston | 27,268 | 24,225 | 34,364 | -20.6% | 12.6% |

| Jacksonville | 4,668 | 4,586 | 7,852 | -40.6% | 1.8% |

| Las Vegas | 3,669 | 3,029 | 6,387 | -42.6% | 21.1% |

| Maryland | 10,164 | 8,550 | 14,685 | -30.8% | 18.9% |

| Memphis | 2,514 | 2,242 | 2,938 | -14.4% | 12.1% |

| Minnesota | 11,854 | 10,919 | 16,861 | -29.7% | 8.6% |

| Nashville | 4,105 | 3,377 | 7,199 | -43.0% | 21.6% |

| New Hampshire | 2,103 | 2,305 | 3,521 | -40.3% | -8.8% |

| North Texas | 12,363 | 9,747 | 18,470 | -33.1% | 26.8% |

| Northwest | 7,948 | 6,358 | 10,259 | -22.5% | 25.0% |

| Phoenix | 6,746 | 5,866 | 8,010 | -15.8% | 15.0% |

| Portland | 3,180 | 2,722 | 4,133 | -23.1% | 16.8% |

| Rhode Island | 2,110 | 1,985 | 2,775 | -24.0% | 6.3% |

| Sacramento | 1,602 | 1,297 | 1,266 | 26.5% | 23.5% |

| San Diego | 3,349 | 3,369 | 5,763 | -41.9% | -0.6% |

| Santa Clara | 1,820 | 1,767 | 1,950 | -6.7% | 3.0% |

| South Carolina | 12,869 | 11,163 | 21,592 | -40.4% | 15.3% |

| Total1 | 152,360 | 134,198 | 227,190 | -32.9% | 13.5% |

| 1excluding Denver (included in Colorado) | |||||

August 19th COVID-19: Over 1,000 Deaths, Over 75,000 Hospitalized, Almost 160,000 Cases Reported Today

by Calculated Risk on 8/19/2021 03:33:00 PM

The 7-day average deaths is the highest since April 24th.

Total doses administered: 359,623,380, as of a week ago 353,859,894. Average doses last week: 0.82 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.1% | 51.0% | 50.4% | ≥70.0%1 |

| Fully Vaccinated (millions) | 169.6 | 169.2 | 167.4 | ≥2321 |

| New Cases per Day3🚩 | 133,055 | 130,562 | 116,740 | ≤5,0002 |

| Hospitalized3🚩 | 76,077 | 74,755 | 62,230 | ≤3,0002 |

| Deaths per Day3🚩 | 640 | 586 | 578 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: New Hampshire at 59.1%, Washington, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa and Illinois at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Michigan at 49.7%, South Dakota at 48.2%, Ohio at 47.5%, Kentucky at 47.1%, Kansas at 46.8%, Arizona at 46.6%, Alaska at 46.5%, Utah at 46.3%, and Nevada at 46.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Central Texas (Austin) Real Estate in July: Sales Down 9% YoY, Inventory Down 24% YoY

by Calculated Risk on 8/19/2021 02:26:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For the Austin-Round Rock area: Central Texas Housing Market Report; July 2021

Residential home sales decreased across the Austin-Round Rock Metropolitan Statistical Area (MSA) for the first time since May 2020, according to the Austin Board of REALTORS® July 2021 Central Texas Housing Report. Despite the dip, the five-county MSA was just 445 homes shy of breaking the all-time home sales record set in July 2020.Closed sales in July 2021 were 4,041, down 9.9% from 4,486 in July 2020.

Active Listings in July 2021 were 3,294, down 38.0% from 5,309 in July 2020.

Inventory in July was up 45% from last month, and up 174% from the all time low in March 2021.

Phoenix Real Estate in July: Sales Down 15% YoY, Active Inventory Down 16% YoY

by Calculated Risk on 8/19/2021 12:46:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 8,715 in July, down 15.4% from 10,303 in July 2020.

2) Active inventory was at 6,746, down 15.8% from 8,010 in July 2020.

3) Months of supply decreased to 1.24 in July from 1.26 in July 2020. This is low.

Inventory in July was up 15.0% from last month, and up 63% from the record low in February 2021.

Rhode Island Real Estate in July: Sales Down 9% YoY, Inventory Down 24% YoY

by Calculated Risk on 8/19/2021 11:59:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For for the entire state of Rhode Island:

Closed sales (single family and condos) in July 2021 were 1,305, down 9.3% from 1,439 in July 2020.

Active Listings (single family and condos) in July 2021 were 2,110, down 24.0% from 2,775 in July 2020.

Inventory in July was up 6.3% from last month, and up 84.6% from the all time low in May 2021.