by Calculated Risk on 6/03/2021 03:58:00 PM

Thursday, June 03, 2021

June 3rd COVID-19 New Cases, Vaccinations, Hospitalizations

According to the CDC, on Vaccinations.

Total doses administered: 297,720,928, as of yesterday 296,912,892. Per Day: 0.81 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.0% | 62.9% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 136.6 | 136.2 | ≥1601 |

| New Cases per Day3 | 14,349 | 15,643 | ≤5,0002 |

| Hospitalized3 | 19,289 | 19,674 | ≤3,0002 |

| Deaths per Day3 | 324 | 328 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the twelve states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania, New Hampshire, Maryland and California are all over 70%.

Next up are Washington at 69.7%, D.C. at 68.5%, New York at 68.2%, Illinois at 67.8%, Minnesota at 67.6%, Virginia at 67.5%, Delaware at 66.8%, Colorado at 66.5% and Oregon at 66.2%.

May Employment Preview

by Calculated Risk on 6/03/2021 12:22:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for 650 thousand jobs added, and for the unemployment rate to decrease to 5.9%.

Some analysts are being cautious this month after the disappointing April report.

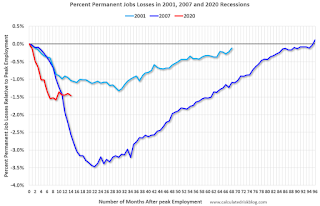

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 978,000 private sector jobs, well above the consensus estimate of 650,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be above expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in May to 50.9%, down from 55.1% last month. This would suggest approximately 15,000 manufacturing jobs lost in May. ADP showed 52,000 manufacturing jobs added.

The ISM® Services employment index decreased in May to 55.3%, from 58.8% last month. This would suggest over 200,000 service jobs added in April. ADP showed 850,000 service jobs added.

• Unemployment Claims: The weekly claims report showed a sharp decline in the number of initial unemployment claims during the reference week (include the 12th of the month) from 566,000 in April to 444,000 in May. This would usually suggest a pickup in hiring, although this might not be very useful right now. In general, weekly claims have been lower than expectations.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the April report.

This data is only available back to 1994, so there is only data for three recessions. In April, the number of permanent job losers increased slightly to 3.529 million from 3.432 million in March.

• Conclusion: The ISM surveys suggest a weaker than expected jobs report, but the ADP report and unemployment claims suggest a stronger than expected report.

May Vehicles Sales decreased to 16.99 Million SAAR

by Calculated Risk on 6/03/2021 10:11:00 AM

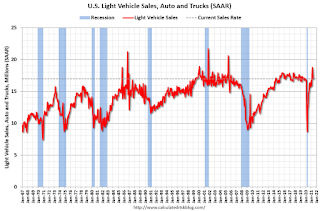

The BEA released their estimate of light vehicle sales for May this morning. The BEA estimates sales of 16.99 million SAAR in May 2021 (Seasonally Adjusted Annual Rate), down 9.5% from the April sales rate, and up 40% from May 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for May (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

Since April 2020, sales have increased, and are now close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 16.99 million SAAR.

Note: dashed line is current estimated sales rate of 16.99 million SAAR.ISM® Services Index Increased to Record High 64.0% in May

by Calculated Risk on 6/03/2021 09:51:00 AM

(Posted with permission). The May ISM® Services index was at 64.0%, up from 62.7% last month. The employment index decreased to 55.3%, from 58.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in May for the 12th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.The employment index decreased to 55.3% from 58.8% in April.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI® reached another all-time high in May, registering 64 percent, which is 1.3 percentage points higher than April’s reading of 62.7 percent. The previous record high was 63.7 percent in March. The May reading indicates the 12th straight month of growth for the services sector, which has expanded for all but two of the last 136 months.

“The Supplier Deliveries Index registered 70.4 percent, up 4.3 percentage points from April’s reading of 66.1 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Prices Index registered 80.6 percent, which is 3.8 percentage points higher than the April reading of 76.8 percent, indicating that prices increased in May, and at a faster rate. The last time the Prices Index was this elevated was when it registered 77.4 percent in July 2008; the all-time high is 83.5 percent in September 2005.

“According to the Services PMI®, all 18 services industries reported growth. The composite index indicated growth for the 12th consecutive month after a two-month contraction in April and May 2020. There was continued growth in the services sector in May. The rate of expansion is very strong, as businesses have reopened and production capacity has increased. However, some capacity constraints, material shortages, weather-related delays, and challenges in logistics and employment resources continue,” says Nieves.

emphasis added

Weekly Initial Unemployment Claims decrease to 385,000

by Calculated Risk on 6/03/2021 08:35:00 AM

The DOL reported:

In the week ending May 29, the advance figure for seasonally adjusted initial claims was 385,000, a decrease of 20,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised down by 1,000 from 406,000 to 405,000. The 4-week moving average was 428,000, a decrease of 30,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised down by 250 from 458,750 to 458,500.This does not include the 76,098 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 93,559 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 458,750.

The previous week was revised down.

Regular state continued claims increased to 3,771,000 (SA) from 3,602,000 (SA) the previous week.

Note: There are an additional 6,368,301 receiving Pandemic Unemployment Assistance (PUA) that decreased from 6,515,657 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,293,842 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 5,191,642.

Weekly claims were lower than the consensus forecast.

ADP: Private Employment increased 978,000 in May

by Calculated Risk on 6/03/2021 08:20:00 AM

Private sector employment increased by 978,000 jobs from April to May according to the May ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast of 650,000 for this report.

“Private payrolls showed a marked improvement from recent months and the strongest gain since the early days of the recovery,” said Nela Richardson, chief economist, ADP. “While goods producers grew at a steady pace, it is service providers that accounted for the lion’s share of the gains, far outpacing the monthly average in the last six months. Companies of all sizes experienced an uptick in job growth, reflecting the improving nature of the panemic and economy.”

emphasis added

The BLS report will be released Friday, and the consensus is for 650 thousand non-farm payroll jobs added in May. The ADP report has not been very useful in predicting the BLS report.

Wednesday, June 02, 2021

Thursday: ADP Employment, Unemployment Claims, ISM Services

by Calculated Risk on 6/02/2021 08:11:00 PM

Thursday:

• At 8:15 AM ET, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 650,000 payroll jobs added in May, down from 742,000 in April.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 395 thousand from 406 thousand last week.

• At 10:00 AM, the ISM Services Index for May. The consensus is for a reading of 63.0, up from 62.7.

June 2nd COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/02/2021 04:04:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 296,912,892, as of yesterday 296,404,240. Per Day: 0.51 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 62.9% | 62.8% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 136.2 | 135.9 | ≥1601 |

| New Cases per Day3 | 15,622 | 17,600 | ≤5,0002 |

| Hospitalized3 | 19,674 | 19,355 | ≤3,0002 |

| Deaths per Day3 | 363 | 380 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the twelve states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania, New Hampshire, Maryland and California are all over 70%.

Next up are Washington at 69.5%, D.C. at 68.4%, New York at 68.1%, Illinois at 67.7%, Minnesota at 67.5%, Virginia at 67.5%, Delaware at 66.7%, Colorado at 66.3% and Oregon at 66.1%.

Fed's Beige Book: "National economy expanded at a moderate pace"

by Calculated Risk on 6/02/2021 02:03:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Cleveland based on information collected on or before May 25, 2021."

The national economy expanded at a moderate pace from early April to late May, a somewhat faster rate than the prior reporting period. Several Districts cited the positive effects on the economy of increased vaccination rates and relaxed social distancing measures, while they also noted the adverse impacts of supply chain disruptions. The effects of expanded vaccination rates were perhaps most notable in consumer spending in which increases in leisure travel and restaurant spending augmented ongoing strength in other spending categories. Light vehicle sales remained solid but were often constrained by tight inventories. Factory output increased further even as significant supply chain challenges continued to disrupt production. Manufacturers reported that widespread shortages of materials and labor along with delivery delays made it difficult to get products to customers. Similar challenges persisted in construction. Homebuilders often noted that strong demand, buoyed by low mortgage interest rates, outpaced their capacity to build, leading some to limit sales. Nonresidential construction increased at a moderate pace, on balance, even as contacts in several Districts said that supply chain disruptions pushed costs higher and, in some cases, delayed projects. Demand for professional and business services increased moderately, while demand for transportation services (including at ports) was exceptionally strong. Lending volumes increased modestly, with gains in both household and business loans. Overall, expectations changed little, with contacts optimistic that economic growth will remain solid.

...

Staffing levels increased at a relatively steady pace, with two-thirds of Districts reporting modest employment growth over the reporting period and the remainder indicating employment gains were moderate. As the spread of COVID-19 continued to slow, employment growth was strongest in food services, hospitality, and retail. Manufacturers also added workers in several Districts. It remained difficult for many firms to hire new workers, especially low-wage hourly workers, truck drivers, and skilled tradespeople. The lack of job candidates prevented some firms from increasing output and, less commonly, led some businesses to reduce their hours of operation. Overall, wage growth was moderate, and a growing number of firms offered signing bonuses and increased starting wages to attract and retain workers. Contacts expected that labor demand will remain strong, but supply constrained, in the months ahead.

emphasis added

Energy expenditures as a percentage of PCE

by Calculated Risk on 6/02/2021 10:07:00 AM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the recently released April PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through April 2021.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In general, energy expenditures as a percent of PCE have been trending down for years.

At the beginning of the pandemic, energy expenditures as a percentage of PCE, fell to a record low of 3.3% in May 2020.