by Calculated Risk on 5/07/2021 01:07:00 PM

Friday, May 07, 2021

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of May 4th.

From Black Knight: Forbearance Volumes Fall by More Than 100K

May continued the strong trend of early forbearance improvements seen each month – the first week of the month saw volumes fall by 105,000 (-4.5%). Declines were seen across the board, with GSE forbearance volumes falling by 39,000 (-5.3%), FHA/VA plan volumes improving by 44,000 (-4.7%) and PLS/portfolio forbearances declining by 22,000 (-3.4%) on the week.

As of May 4, just over 2.2 million (4.2% of) homeowners remain in COVID-19 related forbearance plans, including 2.5% of GSE, 7.4% of FHA/VA and 4.8% of portfolio/PLS loans.

Click on graph for larger image.

Some 73,000 plans are still listed with April 2021 expirations, suggesting opportunity may still remain in coming days for additional moderate improvements to be made. Another 350,000 plans are set to be reviewed for extension/removal in May. That number climbs to nearly 900,000 in June, the final quarterly review before early forbearance entrants begin to reach their 18-month plan expirations later this year.

emphasis added

MBA: "Mortgage Delinquencies Decrease in the First Quarter of 2021"

by Calculated Risk on 5/07/2021 11:13:00 AM

From the MBA: Mortgage Delinquencies Decrease in the First Quarter of 2021

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.38 percent of all loans outstanding at the end of the first quarter of 2021, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 35 basis points from the fourth quarter of 2020, and up 202 basis points from one year ago.

"Mortgage delinquency rates continued to decrease in the first quarter of 2021, as a rebounding job market and stimulus checks helped borrowers stay current on their mortgage payments," said Marina Walsh, MBA's Vice President of Industry Analysis. "Mortgage delinquencies track closely to the U.S. unemployment rate, and with unemployment dropping from last year's spike, many households appear to be doing better."

...

Walsh noted that in the history of MBA's National Delinquency Survey, there has never been such a substantial decline in the delinquency rate over such a short period of time. The mortgage delinquency rate peaked at 8.22 percent in the second quarter of 2020 and within three quarters has dropped by 184 basis points to 6.38 percent. In addition, this quarter's earliest stage delinquencies - the 30-day and 60-day delinquencies combined - dropped to the lowest levels since the inception of the survey in 1979.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q1.

The decrease was in 30 and 60 day buckets, and in foreclosure. 90 delinquencies increased slightly (mostly loans in forbearance).

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 32 basis points to 1.46 percent, the lowest rate since the survey began in 1979. The 60-day delinquency rate decreased 10 basis points to 0.67 percent, the lowest rate since the second quarter of 2000. The 90-day delinquency bucket increased 7 basis points to 4.25 percent.This sharp increase last year in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans on which foreclosure actions were started in the first quarter rose by 1 basis point to 0.04 percent. The percentage of loans in the foreclosure process at the end of the first quarter was 0.54 percent, down 2 basis points from the fourth quarter of 2020 and 19 basis points from one year ago. This is the lowest foreclosure inventory rate since the first quarter of 1982.

The percent of loans in the foreclosure process declined further, and was at the lowest level since 1982.

Comments on April Employment Report

by Calculated Risk on 5/07/2021 09:17:00 AM

The headline jobs number in the April employment report was well below expectations, and employment for the previous two months was revised down.

Earlier: April Employment Report: 266 Thousand Jobs, 6.1% Unemployment Rate

In April, the year-over-year employment change was 14.147 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

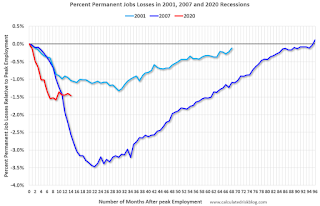

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the April report. (ht Joe Weisenthal at Bloomberg).

This data is only available back to 1994, so there is only data for three recessions.

In April, the number of permanent job losers increased slightly to 3.529 million from 3.432 million in March.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate was unchanged in April at 81.3% from 81.3% in March, and the 25 to 54 employment population ratio increased to 76.9% from 76.8% in March.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons decreased by 583,000 to 5.2 million in April. This decline reflected a drop in the number of people whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is 845,000 higher than in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in April to 5.243 million from 5.826 million in March.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 10.4% from 10.7% in March. This is down from the record high in April 22.9% for this measure since 1994.

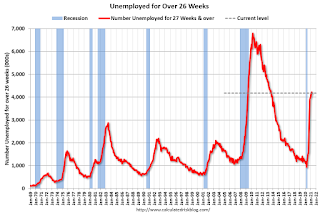

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.183 million workers who have been unemployed for more than 26 weeks and still want a job, down from 4.218 million in March.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was well below expectations, and the previous two months were revised down by 78,000 combined. The headline unemployment rate increased to 6.1%.

April Employment Report: 266 Thousand Jobs, 6.1% Unemployment Rate

by Calculated Risk on 5/07/2021 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 266,000 in April, and the unemployment rate was little changed at 6.1 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains in leisure and hospitality, other services, and local government education were partially offset by employment declines in temporary help services and in couriers and messengers.

...

The change in total nonfarm payroll employment for February was revised up by 68,000, from +468,000 to +536,000, and the change for March was revised down by 146,000, from +916,000 to +770,000. With these revisions, employment in February and March combined is 78,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In April, the year-over-year change was 14.147 million jobs. This was up significantly - since employment collapsed in April 2020.

Total payrolls increased by 266 thousand in March. Private payrolls increased by 218 thousand.

Payrolls for February and March were revised down 78 thousand, combined.

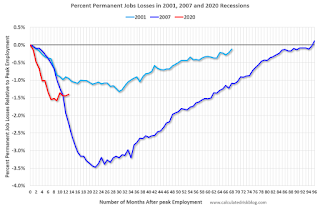

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 61.7% in April, from 61.7% in March. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 61.7% in April, from 61.7% in March. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 57.9% from 57.8% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in April to 6.1% from 6.0% in March.

This was well below consensus expectations, and February and March were revised down by 78,000 combined.

Thursday, May 06, 2021

Friday: Employment Report

by Calculated Risk on 5/06/2021 08:59:00 PM

My April Employment Preview

Goldman April Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for April. The consensus is for 978,000 jobs added, and for the unemployment rate to decrease to 5.7%.

May 6th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 5/06/2021 06:16:00 PM

President Biden has set two vaccinations goals to achieve by July 4th:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) 160 million Americans fully vaccinated.

According to the CDC, on Vaccinations

1) 57.0% of the population over 18 has had at least one dose.

2) 108.1 million Americans are fully vaccinated.

Note: I'll stop posting this daily once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 33,808, down from 34,374 reported yesterday, and well above the post-summer surge low of 23,000.

Goldman April Payrolls Preview

by Calculated Risk on 5/06/2021 03:54:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 1,300k in April (mom sa) ... We estimate a five-tenths decline in the unemployment rate to 5.5%, reflecting rapid job gains partially offset by an expected rise in the participation rate.CR Note: The consensus is for 978 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

emphasis added

Hotels: Occupancy Rate Down 17% Compared to Same Week in 2019

by Calculated Risk on 5/06/2021 01:07:00 PM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

The occupancy rate is down 17% compared to the same week in 2019.

U.S. hotel occupancy remained relatively flat compared with the previous week, according to STR‘s latest data through May 1.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

April 25 through May 1, 2021:

• Occupancy: 57.1%

• Average daily rate (ADR): US$108.80

• Revenue per available room (RevPAR): US$62.13

While the overall weekly data was stagnant, weekend occupancy rose modestly and came in above 70% for the fourth straight week. However, the Top 25 Markets showed a lower occupancy level in aggregate with more properties reopening on top of lower demand.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

April Employment Preview

by Calculated Risk on 5/06/2021 12:31:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for 978 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

Some analysts think this will be a very strong report with maybe 1.5 to 2.1 million jobs added.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, and is now slightly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 742,000 private sector jobs, below the consensus estimate of 830,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be close to expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in April to 55.1%, down from 59.6% last month. This would suggest approximately 10,000 manufacturing jobs added in April. ADP showed 55,000 manufacturing jobs added.

The ISM® Services employment index increased in April to 58.8%, up from 57.7% last month. This would suggest over 300,000 service jobs added in April. ADP showed 636,000 service jobs added.

• Unemployment Claims: The weekly claims report showed a sharp decline in the number of initial unemployment claims during the reference week (include the 12th of the month) from 765,000 in March to 566,000 in April. This would usually suggest a pickup in hiring, although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd still think the economy was in a deep recession! In general, weekly claims have been lower than expectations.

• Weather: The SF Fed estimated that weather boosted employment by about 100 thousand in March, after reducing employment by 100 thousand in February. Weather is probably not a factor for April, but when we compare to March, we have to remember employment was boosted by weather last month.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. n March, the number of permanent job losers decreased slightly to 3.432 million from 3.497 million in February.

• Conclusion: Most of the indicators suggest another strong report in April and many analysts are upgrading their forecasts to over 1 million jobs added. However, my guess is the report will be at or below the consensus.

Las Vegas Real Estate in April: Sales up 89% YoY, Inventory down 70% YoY

by Calculated Risk on 5/06/2021 10:12:00 AM

This report is for closed sales in April; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in February and March.

The Las Vegas Realtors reported Another month, another record for Southern Nevada home prices; LVR housing statistics for April 2021

“These April statistics benefit from a comparison to the same month last year, when our housing market was hit hard by the beginning of this pandemic,” said 2021 LVR President Aldo Martinez. “It’s still striking to see how home prices here and nationwide continue to rise to record levels. April did signify the first month this year when single-family home sales did not exceed the previous month. ...”1) Overall sales (single family and condos) were up 88.8% year-over-year from 2,411 in April 2020 to 4,552 in April 2021.

LVR reported a total of 4,552 existing local homes, condos and townhomes sold during April. Compared to the same time last year, April sales were up 79.0% for homes and up 132.7% for condos and townhomes. So far this year, local home sales are on pace to exceed last year’s total.

…

By the end of April, LVR reported 1,827 single-family homes listed for sale without any sort of offer. Although down from the same period last year, Martinez said “it’s the second straight month where we ended up with more inventory without offers – 3.1% more. The same cannot be said for condos and townhomes. The 519 properties listed without offers in April represent a 13.1% decrease from the previous month and the fifth straight month this year where that inventory continues to decline. This just shows how consumers are adjusting their sights when it comes to affordable housing.”

...

Despite the pandemic, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.9% of all existing local property sales in April. That compares to 1.5% of all sales one year ago, 3.0% of all sales two years ago, 2.5% three years ago and 8.4% four years ago. Martinez suggested that these percentages may rise slightly as some homeowners “may have difficulty coming out of forbearance programs – however nowhere near what we had seen in the last recession.”

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 7,815 in April 2020 to 2,346 in April 2021. Note: Total inventory was down 70.0% year-over-year. And months of inventory is extremely low.

3) Very low level of distressed sales.