by Calculated Risk on 2/13/2021 07:33:00 PM

Saturday, February 13, 2021

February 13 COVID-19 Test Results and Vaccinations

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 13th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 52 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.64 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,743,784 test results reported over the last 24 hours.

There were 90,199 positive tests.

Over 42,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.1%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are still above the previous peaks.

Schedule for Week of February 14, 2021

by Calculated Risk on 2/13/2021 08:11:00 AM

The key reports this week are January Housing Starts, Retail sales and Existing Home sales.

For manufacturing, the January Industrial Production report, and the February NY and Philly Fed manufacturing surveys will be released this week.

All US markets will be closed in observance of Washington's Birthday.

8:30 AM: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 6.1, up from 3.5.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 1.0% increase in retail sales.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 1.0% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. In December, Retail and Food service sales, ex-gasoline, increased by 4.2% on a YoY basis.

8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.4% increase in PPI, and a 0.3% increase in core PPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 74.8%.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 83, unchanged from 83. Any number above 50 indicates that more builders view sales conditions as good than poor.

11:00 AM: NY Fed: Q4 Quarterly Report on Household Debt and Credit

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 780 thousand from 793 thousand last week.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. This graph shows single and total housing starts since 1968.

The consensus is for 1.655 million SAAR, down from 1.669 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 19.8, down from 26.5.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 6.60 million SAAR, down from 6.76 million.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 6.60 million SAAR, down from 6.76 million.The graph shows existing home sales from 1994 through the report last month.

Friday, February 12, 2021

February 12 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/12/2021 07:14:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 12th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 50.1 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.66 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,816,007 test results reported over the last 24 hours.

There were 102,570 positive tests.

Almost 39,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.6%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are still above the previous peaks.

Minnesota Real Estate in January: Sales Up 16% YoY, Inventory Down 48% YoY

by Calculated Risk on 2/12/2021 02:08:00 PM

From the MNRealtor for the entire state:

Closed sales in January 2021 were 4,789, up 16.2% from 4,120 in January 2020.

Active Listings in January 2021 were 7,860, down 48.3% from 15,213 in January 2020.

Months of Supply was 1.0 Months in January 2021, compared to 2.1 Months in January 2020.

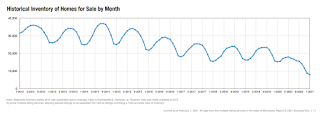

This graph from the Minnesota Association of REALTORS® shows inventory in Minnesota and 2012. Inventory had been trending down, and then declined significantly during the pandemic.

Hotels: Occupancy Rate Declined 30.5% Year-over-year

by Calculated Risk on 2/12/2021 11:05:00 AM

U.S. weekly hotel occupancy remained relatively flat from the previous week, according to STR‘s latest data through Feb. 6.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Jan. 31 through Feb. 6, 2021 (percentage change from comparable week in 2020)::

• Occupancy: 40.9% (-30.5%)

• Average daily rate (ADR): US$91.44 (-29.0%)

• Revenue per available room (RevPAR): US$37.44 (-50.6%)

Lifted by Super Bowl LV, Tampa/St. Petersburg, Florida (62.9%), saw the highest occupancy level among the Top 25 Markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Note: Y-axis doesn't start at zero to better show the seasonal change.

North Texas Real Estate in January: Sales Up 11% YoY, Inventory Down 59% YoY

by Calculated Risk on 2/12/2021 10:12:00 AM

From the NTREIS for North Texas (including Dallas/Ft. Worth):

Single Family Homes sold in January 2021 were 7,010, up 10% January 2020. Condos and Townhomes sold in January 2021 were 491, up 37% from January 2020.

Combined, sales were up 11% year-over-year.

Single Family Active Listings in January 2021 were 7,806, down 62% from January 2020. For Condos and Townhomes, Active Listings in January 2021 were 1,450, down 25% from January 2020.

Combined, active listings declined 59% year-over-year.

Months of Supply was 1.2 Months in January 2021, compared to 3.3 Months in January 2020.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 2/12/2021 08:40:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of February 9th.

From Black Knight: Forbearance Volumes Fall Below 2.7m For First Time Since April 2020

The latest weekly snapshot of our daily McDash Flash Forbearance Tracker shows the number of homeowners in active forbearance fell by 48,000 this week. As was the case last week, the decline was driven by January month-end forbearance plan expirations.The number of loans in forbearance has moved mostly sideways for the last few months.

...

As of Feb. 9, 2.67 million (5% of) homeowners remain in forbearance, marking the first time forbearance volumes have fallen below the 2.7 million threshold since early April. Despite this good news, improvement remains muted, with average monthly declines of less than 2% since early December.

Click on graph for larger image.

Also worth noting is the FHFA’s big announcement this week: borrowers in Fannie Mae/Freddie Mac forbearance plans may be eligible for an extension of up to three months, for a potential grand total of 15 months. This will have material impacts on the 907,000 homeowners currently in GSE forbearance plans, about 30% of whom were set to reach their 12-month expirations at the end of March.

Should Ginnie Mae follow suit and also extend FHA/VA forbearance limits to 15 months, at the current rate of improvement there would still be some 2.5 million homeowners in forbearance at the end of June when the first round of plans hit their new 15-month expirations.

emphasis added

Thursday, February 11, 2021

February 11 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/11/2021 07:15:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 11th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 48 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.62 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,892,736 test results reported over the last 24 hours.

There were 103,024 positive tests.

Over 33,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.4%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are still above the previous peaks.

Atlanta Real Estate in January: Sales Up 9.5% YoY, Inventory Down 52% YoY

by Calculated Risk on 2/11/2021 02:15:00 PM

From the GAMLS for Atlanta:

Total Residential Units Sold in January 2021 were 6,075, up 9.5% from 5,496 in January 2020.

Active Residential Listings in January 2021 were 9,028, down 52.3% from 18,928 in January 2020.

Months of Supply was 1.10 Months in January 2021, compared to 2.51 Months in January 2020.

This graph from the Georgia MLS shows inventory in Atlanta over the last several years - and the sharp decline in inventory at the start of the pandemic.

Houston Real Estate in January: Sales Up 27.5% YoY, Inventory Down 31% YoY

by Calculated Risk on 2/11/2021 12:04:00 PM

From the HAR: Houston Real Estate Kicks Off 2021 With Gusto

Even as the supply of homes across the greater Houston area continues to shrink, homebuyers were out in force in January, snapping up properties that were still on the market and extending the breakneck momentum with which 2020 ended. The luxury housing segment drew the strongest sales activity during the first month of the new year, with homebuyers also driving brisk sales among mid-range homes.Inventory declined 31.3% year-over-year from 38,256 in January 2020 to 26,271 in January 2021. This is just 1.8 months of supply.

According to the latest Houston Association of Realtors (HAR) Market Update, 6,088 single-family homes sold in January compared to 4,769 a year earlier. That accounted for a 27.7 percent increase and marked the eighth straight month of positive sales.

...

Sales of all property types totaled 7,519 – up 27.5 percent from January 2020. Total dollar volume for the month surged 42.8 percent to $2.3 billion.

...

Single-family home sales, total property sales and total dollar volume all rose compared to January 2020. Pending sales shot up 34.5 percent. However, total active listings – or the total number of available properties – fell 31.3 percent as new listings trickled onto the market.

emphasis added

Note that the closed sales in January were for contracts that were mostly signed in November and December.