by Calculated Risk on 10/20/2020 04:08:00 PM

Tuesday, October 20, 2020

Lehner: "COVID’s Impact on State and Local Governments"

Josh Lehner, at the Oregon Office of Economic Analysis, has an interesting post today: COVID’s Impact on State and Local Governments

This started with a seemingly basic question: “Why is public sector employment down so much this year?” The normal pattern we see is that the public sector is more of a stabilizing force in the economy. Job losses and budget cuts come with a delay as it usually takes time for lower levels of economic activity to translate into fewer tax collections. Those impacts usually hit the budget the fiscal year after the recession starts. However, so far in 2020 local governments have shed nearly as many jobs as the private sector. Both the size of the losses and swiftness with which they came is highly unusual.

Click on graph for larger image.

Click on graph for larger image.After digging into the data it is quite clear that the local government job losses are not a result of your standard budget cuts. That traditional recessionary dynamic is likely to come, but will hit next year, not this. The losses today are directly related to the pandemic and social distancing ...Without fiscal relief from the Federal Government, we will probably see significant state and local government layoffs next year. There is much more in the post.

In terms of higher education, the impacts of the pandemic, social distancing, and online schooling are clear. ... Besides education, the public sector does a lot of things. Employment here is down largely due to zoos, convention centers, recreation facilities, public pools, libraries and the like being limited during the pandemic. The losses in public administration are relatively small to date.

All of that said, there is still the traditional recessionary dynamic at play. Those impacts will largely come next year, not this.

emphasis added

Phoenix Real Estate in September: Sales Up 18.5% YoY, Active Inventory Down 40% YoY

by Calculated Risk on 10/20/2020 12:57:00 PM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 9,305 in September, up from 8,878 in August, and up from 7,850 in September 2019. Sales were up 4.8% from August 2020 (last month), and up 18.5% from September 2019.

2) Active inventory was at 8,400, down from 13,936 in September 2019. That is down 40% year-over-year.

3) Months of supply decreased to 1.48 in September, down from 1.52 in August. This is very low.

Sales are reported at the close of escrow, so these sales were mostly signed in July and August.

CAR on California September Housing: Sales up 21% YoY, Active Listings down 48% YoY

by Calculated Risk on 10/20/2020 11:01:00 AM

The CAR reported: California housing market outperforms expectations, breaking record high median price for fourth straight month, C.A.R. reports

California’s home-buying season extended further into September as home sales climbed to their highest level in more than a decade, and the median home price set another high for the fourth straight month, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in July and August. Sales-to-date, through September, are down 3.7% compared to the same period in 2019.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 489,590 units in September, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

September’s sales total climbed above the 400,000 level for the third straight month since the COVID-19 crisis depressed the housing market earlier this year and was the highest sales level recorded since February 2009. September sales rose 5.2 percent from 465,400 in August and were up 21.2 percent from a year ago, when 404,030 homes were sold on an annualized basis.

...

For-sale properties continued to be added to the market at a pace slower than normal, and housing supply remained significantly below last year’s level. The year-over-year decline of 48.4 percent in September was the fourth consecutive month with active listings falling more than 40 percent from the prior year.

emphasis added

BLS: September Unemployment rates down in 30 States, Higher in 8 States

by Calculated Risk on 10/20/2020 10:51:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in September in 30 states, higher in 8 states, and stable in 12 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. All 50 states and the District had jobless rate increases from a year earlier. The national unemployment rate declined by 0.5 percentage point over the month to 7.9 percent but was 4.4 points higher than in September 2019.Hawaii and Nevada are being impacted by the lack of tourism.

Nonfarm payroll employment increased in 30 states, decreased in 3 states, and was essentially unchanged in 17 states and the District of Columbia in September 2020.

...

Hawaii had the highest unemployment rate in September, 15.1 percent, followed by Nevada, 12.6 percent. Nebraska had the lowest rate, 3.5 percent, followed by South Dakota, 4.1 percent, and Vermont, 4.2 percent.

Comments on September Housing Starts

by Calculated Risk on 10/20/2020 08:56:00 AM

Earlier: Housing Starts at 1.415 Million Annual Rate in September

Total housing starts in September were below expectations, and starts in July and August were revised down. The weakness in September was due to the volatile multi-family sector (apartments are under pressure from COVID).

The housing starts report showed starts were up 1.9% in September compared to August, and starts were up 11.1% year-over-year compared to September 2019.

Single family starts were up 22% year-over-year. Low mortgage rates and limited existing home inventory have given a boost to single family housing starts.

The first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 11.1% in September compared to September 2019.

Last year, in 2019, starts picked up towards the end of the year, so the comparisons were easy in the first seven months of the year..

Starts, year-to-date, are up 5.5% compared to the same period in 2019. This is below my forecast for 2020, but I didn't expect a pandemic!

I expect starts to remain solid, but the growth rate will slow.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off the pandemic.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Housing Starts at 1.415 Million Annual Rate in September

by Calculated Risk on 10/20/2020 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,415,000. This is 1.9 percent above the revised August estimate of and is 11.1 percent above the September 2019 rate of 1,274,000. Single-family housing starts in September were at a rate of 1,108,000; this is 8.5 percent above the revised August figure of 1,021,000. The September rate for units in buildings with five units or more was 295,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,553,000. This is 5.2 percent above the revised August rate of 1,476,000 and is 8.1 percent above the September 2019 rate of 1,437,000. Single-family authorizations in September were at a rate of 1,119,000; this is 7.8 percent above the revised August figure of 1,038,000. Authorizations of units in buildings with five units or more were at a rate of 390,000 in September.

emphasis added

Click on graph for larger image.

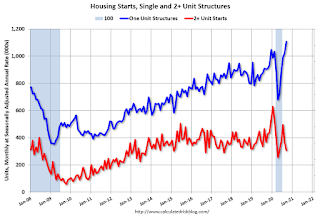

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were down in September compared to August. Multi-family starts were down 17% year-over-year in September.

Single-family starts (blue) increased in September, and were up 22% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in September were below expectations - due to weakness in multi-family - and starts in July and August were revised down.

I'll have more later …

Monday, October 19, 2020

Free Webinar Tuesday: UCI Professor Chris Schwarz 2021 Economic and Financial Forecast at 2:00 PM ET

by Calculated Risk on 10/19/2020 09:36:00 PM

UCI Professor Chris Schwarz and I have presented together before. Always interesting!

He will be offering his thoughts on the economy, Tuesday, October 20th at 11:00 AM PT (2:00 PM ET).

"2021 Economic and Financial Forecast Presented by the Newport Beach Chamber of Commerce and the UCI Paul Merage School of Business'

You can register here.

Tuesday: Housing Starts

by Calculated Risk on 10/19/2020 08:52:00 PM

Tuesday:

• At 8:30 AM ET, Housing Starts for September. The consensus is for 1.450 million SAAR, up from 1.416 million SAAR.

• At 10:00 AM, State Employment and Unemployment (Monthly) for September 2020

October 19 COVID-19 Test Results

by Calculated Risk on 10/19/2020 06:44:00 PM

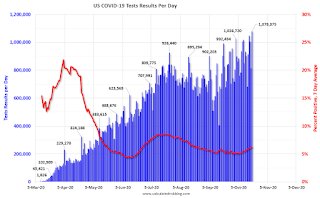

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,079,375 test results reported over the last 24 hours.

There were 57,148 positive tests.

Almost 13,000 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.3% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high 7-day average cases before the end of October.

MBA Survey: "Share of Mortgage Loans in Forbearance Declines to 5.92%"

by Calculated Risk on 10/19/2020 04:00:00 PM

Note: This is as of October 11th.

From the MBA: Share of Mortgage Loans in Forbearance Declines to 5.92%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 40 basis points from 6.32% of servicers’ portfolio volume in the prior week to 5.92% as of October 11, 2020. According to MBA’s estimate, 3.0 million homeowners are in forbearance plans.

...

“The share of loans in forbearance declined across all loan types, primarily because of borrower forbearance plans expiring at the six-month mark. Federally backed loans under the CARES Act are eligible to be extended for up to 12 months, but borrowers must contact their servicer for an extension. Without that contact, borrowers exit forbearance, whether they are delinquent or current on their loan,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Borrowers with federally backed mortgages should contact their servicer if they still have a hardship due to the pandemic.”

Added Fratantoni, “The steady improvement for Fannie Mae and Freddie Mac loans highlights the improvement in some segments of the job market and broader economy. The slower decline for Ginnie Mae loans continues to show that this improvement has not been uniform, and that many are still struggling to regain their footing.”

...

By stage, 26.32% of total loans in forbearance are in the initial forbearance plan stage, while 72.08% are in a forbearance extension. The remaining 1.60% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.