by Calculated Risk on 10/20/2020 08:56:00 AM

Tuesday, October 20, 2020

Comments on September Housing Starts

Earlier: Housing Starts at 1.415 Million Annual Rate in September

Total housing starts in September were below expectations, and starts in July and August were revised down. The weakness in September was due to the volatile multi-family sector (apartments are under pressure from COVID).

The housing starts report showed starts were up 1.9% in September compared to August, and starts were up 11.1% year-over-year compared to September 2019.

Single family starts were up 22% year-over-year. Low mortgage rates and limited existing home inventory have given a boost to single family housing starts.

The first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 11.1% in September compared to September 2019.

Last year, in 2019, starts picked up towards the end of the year, so the comparisons were easy in the first seven months of the year..

Starts, year-to-date, are up 5.5% compared to the same period in 2019. This is below my forecast for 2020, but I didn't expect a pandemic!

I expect starts to remain solid, but the growth rate will slow.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off the pandemic.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Housing Starts at 1.415 Million Annual Rate in September

by Calculated Risk on 10/20/2020 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,415,000. This is 1.9 percent above the revised August estimate of and is 11.1 percent above the September 2019 rate of 1,274,000. Single-family housing starts in September were at a rate of 1,108,000; this is 8.5 percent above the revised August figure of 1,021,000. The September rate for units in buildings with five units or more was 295,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,553,000. This is 5.2 percent above the revised August rate of 1,476,000 and is 8.1 percent above the September 2019 rate of 1,437,000. Single-family authorizations in September were at a rate of 1,119,000; this is 7.8 percent above the revised August figure of 1,038,000. Authorizations of units in buildings with five units or more were at a rate of 390,000 in September.

emphasis added

Click on graph for larger image.

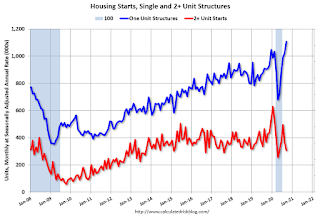

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were down in September compared to August. Multi-family starts were down 17% year-over-year in September.

Single-family starts (blue) increased in September, and were up 22% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in September were below expectations - due to weakness in multi-family - and starts in July and August were revised down.

I'll have more later …

Monday, October 19, 2020

Free Webinar Tuesday: UCI Professor Chris Schwarz 2021 Economic and Financial Forecast at 2:00 PM ET

by Calculated Risk on 10/19/2020 09:36:00 PM

UCI Professor Chris Schwarz and I have presented together before. Always interesting!

He will be offering his thoughts on the economy, Tuesday, October 20th at 11:00 AM PT (2:00 PM ET).

"2021 Economic and Financial Forecast Presented by the Newport Beach Chamber of Commerce and the UCI Paul Merage School of Business'

You can register here.

Tuesday: Housing Starts

by Calculated Risk on 10/19/2020 08:52:00 PM

Tuesday:

• At 8:30 AM ET, Housing Starts for September. The consensus is for 1.450 million SAAR, up from 1.416 million SAAR.

• At 10:00 AM, State Employment and Unemployment (Monthly) for September 2020

October 19 COVID-19 Test Results

by Calculated Risk on 10/19/2020 06:44:00 PM

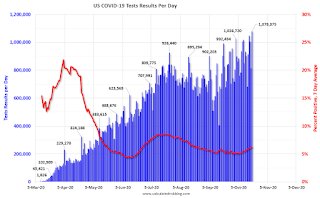

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,079,375 test results reported over the last 24 hours.

There were 57,148 positive tests.

Almost 13,000 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.3% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high 7-day average cases before the end of October.

MBA Survey: "Share of Mortgage Loans in Forbearance Declines to 5.92%"

by Calculated Risk on 10/19/2020 04:00:00 PM

Note: This is as of October 11th.

From the MBA: Share of Mortgage Loans in Forbearance Declines to 5.92%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 40 basis points from 6.32% of servicers’ portfolio volume in the prior week to 5.92% as of October 11, 2020. According to MBA’s estimate, 3.0 million homeowners are in forbearance plans.

...

“The share of loans in forbearance declined across all loan types, primarily because of borrower forbearance plans expiring at the six-month mark. Federally backed loans under the CARES Act are eligible to be extended for up to 12 months, but borrowers must contact their servicer for an extension. Without that contact, borrowers exit forbearance, whether they are delinquent or current on their loan,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Borrowers with federally backed mortgages should contact their servicer if they still have a hardship due to the pandemic.”

Added Fratantoni, “The steady improvement for Fannie Mae and Freddie Mac loans highlights the improvement in some segments of the job market and broader economy. The slower decline for Ginnie Mae loans continues to show that this improvement has not been uniform, and that many are still struggling to regain their footing.”

...

By stage, 26.32% of total loans in forbearance are in the initial forbearance plan stage, while 72.08% are in a forbearance extension. The remaining 1.60% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/19/2020 02:22:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.38 million in September, up 6.3% from August’s preliminary pace and up 17.9% from last September’s seasonally adjusted pace. Unadjusted sales should show a larger YOY increase, reflecting this September’s higher business day count relative to last September’s.

Local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by a steamy 13.2% from last September , partly reflecting the mix of home sales but mainly the unprecedentedly low available inventory of homes for sale (partly pandemic combined with a surge in demand for SF homes (also partly pandemic related).

On the inventory front, local relator/MLS reports, as well as reports from entities that track residential listings across the country, indicate the YOY decline in inventories last month exceeded the previous month’s sharp drop. How this will translate into the NAR’s inventory estimate, however, is unclear. As I noted last month, most publicly-available local realtor/MLS reports show inventories excluding listings with pending contracts. That is not always the case, however, for the reports send by realtors/MLS to the NAR. Given the surge in pending listings over the several months, there is a huge difference between inventory measures including pending listings and those excluding pending listings.

...

With significantly fewer (relative to a year ago) single-family detached homeowners listing their homes for sale (which is definitely related to the pandemic) and significantly more householders shifting preferences from urban rental/multi-unit property living to single-family detached living (also definitely pandemic-related), the net result has been a plunge in “supply” relative to “demand.” When one then factors in the sizeable decline in mortgage rates this year, it perhaps is not too surprising that single-family detached home process are rising so rapidly.

It is also not too surprising that rents in many areas of the country, and especially in large densely populated cities, have declined significantly over the past few months.

CR Note: The National Association of Realtors (NAR) is scheduled to release September existing home sales on Thursday, October 22, 2020 at 10:00 AM ET. The consensus is for 6.25 million SAAR.

DOT: Vehicle Miles Driven decreased 12.3% year-over-year in August

by Calculated Risk on 10/19/2020 12:35:00 PM

The Department of Transportation (DOT) reported:

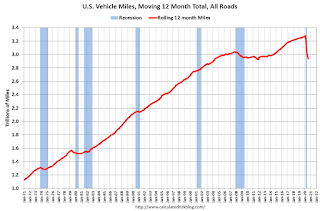

Travel on all roads and streets changed by -12.3% (-35.3 billion vehicle miles) for August 2020 as compared with August 2019. Travel for the month is estimated to be 251.3 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for August 2020 is 239.7 billion miles, a -11.8% (-32.2 billion vehicle miles) decline from August 2019. It also represents a 0.8% increase (2 billion vehicle miles) compared with July 2020.

Cumulative Travel for 2020 changed by -15.3% (-332.5 billion vehicle miles). The cumulative estimate for the year is 1,844.4 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Miles driven declined during the great recession, and the rolling 12 months stayed below the previous peak for a record 85 months.

Miles driven declined sharply in March, and really collapsed in April.

This graph shows the YoY change in vehicle miles driven.

This graph shows the YoY change in vehicle miles driven.Miles driven rebounded in May through August, but is still down 12.3% YoY (seasonally adjusted).

NAHB: Builder Confidence Increased to 85 in October, Record High

by Calculated Risk on 10/19/2020 10:04:00 AM

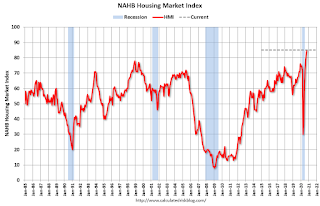

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 85, up from 83 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Continues Record Climb

In a further show of strength for the housing sector, builder confidence in the market for newly-built single-family homes increased two points to 85 in October, further surpassing the previous all-time high of 83 recorded in September, according to the latest NAHB/Wells Fargo Housing Market Index (HMI). These are the first two months the index has ever been above 80.

The housing market continues to be a bright spot for the economy, supported by increased buyer interest in the suburbs, exurbs and small towns. Moreover, NAHB analysis published last week showed that new single-family home sales are outpacing starts by a historic margin. Bridging this gap will require either a gain in construction volume or reductions in available inventory, which is already at a historic low in terms of month’s supply.

Buyer traffic remains high and record-low interest rates are keeping demand strong as the concept of ‘home’ has taken on renewed importance for work, study and other purposes during and after the virus-induced downturn. However, it is becoming increasingly challenging to build affordable homes as shortages of lots, labor, lumber and other key building materials are lengthening construction times.

...

All the HMI indices posted or matched their highest readings ever in October. The HMI index gauging current sales conditions rose two points to 90, the component measuring sales expectations in the next six months increased three points to 88 and the measure charting traffic of prospective buyers held steady at 74.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased six points to 82, the Midwest increased three points to 75, the South rose three points to 82 and the West increased five points to 90.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.

Housing and homebuilding have been one of the best performing sectors during the pandemic.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 10/19/2020 08:17:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of Oct 18th.

The seven day average is down 64% from last year (36% of last year).

There has been a slow increase from the bottom.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 17, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Note that dining is turning in the northern states - Illinois, Pennsylvania, and New York - but holding up in the southern states.

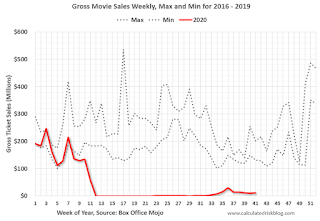

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through October 15th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through October 15th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up slightly over the last couple of months, and were at $12 million last week (compared to usually around $150 million per week in the early Fall).

Some movie theaters have reopened (probably with limited seating).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through October 10th.

Hotel occupancy is currently down 29.2% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

So far there has been little business travel pickup that usually happens in the Fall.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of October 9th, gasoline supplied was off about 8.3% YoY (about 91.7% of last year).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might have boosted gasoline consumption and the expense of air travel.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 17th for the United States and several selected cities.

This data is through October 17th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 56% of the January level. It is at 49% in Chicago, and 59% in Houston.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.This data is through Friday, October 16th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".