by Calculated Risk on 9/21/2020 08:36:00 AM

Monday, September 21, 2020

CoreLogic: 1.7 Million Homes with Negative Equity in Q2 2020

From CoreLogic: Home Equity Rises Despite the Pandemic: CoreLogic Reports Homeowners Gained Over $620 Billion in Equity in Q2 2020

CoreLogic® ... today released the Home Equity Report for the second quarter of 2020. The report shows U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion, and an average gain of $9,800 per homeowner, since the second quarter of 2019.

Despite a cool off in April, home-purchase activity remained strong in the second quarter of 2020 as prospective buyers took advantage of record-low mortgage rates. This, coupled with constricted for-sale inventory, helped drive home prices up and add to borrower equity through June. However, with unemployment expected to remain elevated throughout the remainder of the year, CoreLogic predicts home price growth will slow over the next 12 months and mortgage delinquencies will continue to rise. These factors combined could lead to an increase of distressed-sale inventory, which could put downward pressure on home prices and negatively impact home equity.

...

Negative equity, also referred to as underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. As of the second quarter of 2020, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

• Quarterly change: From the first quarter of 2020 to the second quarter of 2020, the total number of mortgaged homes in negative equity decreased by 5.4% to 1.7 million homes or 3.2% of all mortgaged properties.

• Annual change: In the second quarter of 2019, 2.1 million homes, or 3.8% of all mortgaged properties, were in negative equity. This number decreased by 15% in the second quarter of 2020 to 1.7 million mortgaged properties in negative equity.

• National aggregate value: The national aggregate value of negative equity was approximately $284 billion at the end of the second quarter of 2020. This is down quarter over quarter by approximately $0.7 billion, or 0.2%, from $285 billion in the first quarter of 2020, and down year over year by approximately $20 billion, or 6.6%, from $304 billion in the second quarter of 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q2 to Q1 2020 equity distribution by LTV. There are still quite a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 2.1 million to 1.7 million.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 9/21/2020 08:14:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

This data is as of September 20th.

The seven day average is down 69% from last year (31% of last year).

There has been a slow increase from the bottom.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 19, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

The 7 day average for New York is still off 66% YoY, and down 31% in Texas. There was a surge in restaurant dining around Labor Day - hopefully mostly outdoor dining.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through September 17th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through September 17th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up over the last few weeks, and were at $15 million last week (compared to usually under $200 million per week in the late Summer / early Fall).

Some movie theaters are reopening (probably with limited seating at first).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through September 12th.

Hotel occupancy is currently down 30% year-over-year (and that is boosted by fires and a hurricane).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

The leisure travel season usually peaks at the beginning of August, and then the occupancy rate typically declines sharply in the Fall. With so many schools closed, the leisure travel season might have lasted longer than usual this year, but it is unlikely business travel will pickup significantly in the Fall.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of September 11th, gasoline supplied was only off about 5.2% YoY (about 94.8% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might be boosting gasoline consumption over the summer - and summer vacation might have lasted a little longer this year.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 18th for the United States and several selected cities.

This data is through September 18th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 56% of the January level. It is at 49% in Chicago, and 59% in Houston.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.This data is through Friday, September 18th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, September 20, 2020

Sunday Night Futures

by Calculated Risk on 9/20/2020 09:00:00 PM

Weekend:

• Schedule for Week of September 20, 2020

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 12:00 PM, Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are donw 12 and DOW futures are down 87 (fair value).

Oil prices were up over the last week with WTI futures at $40.66 per barrel and Brent at $42.74 barrel. A year ago, WTI was at $58, and Brent was at $65 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.16 per gallon. A year ago prices were at $2.66 per gallon, so gasoline prices are down $0.50 per gallon year-over-year.

September 20 COVID-19 Test Results

by Calculated Risk on 9/20/2020 06:09:00 PM

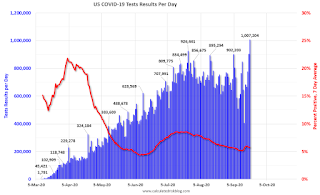

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 826,187 test results reported over the last 24 hours.

There were 37,291 positive tests.

Over 16,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.5% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).

Hotels: Occupancy Rate Declined 30% Year-over-year

by Calculated Risk on 9/20/2020 01:00:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 12 September

U.S. hotel occupancy decreased slightly from the previous week, according to the latest data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

6-12 September 2020 (percentage change from comparable week in 2019):

• Occupancy: 48.5% (-30.2%)

• Average daily rate (ADR): US$98.99 (-25.5%)

• Revenue per available room (RevPAR): US$47.96 (-48.1%)

...

The highest occupancy markets were those housing displaced residents from Hurricane Laura and western wildfires, with Louisiana North (77.2%) and Louisiana South (76.8%) showing the highest levels in the metric. The Oregon Area (73.7%) and California North (73.3%) markets were also among the top 5 highest occupancy levels for the week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

There was some boost by Hurricane Laura and the western fires, but it seems unlikely business travel will pickup significantly in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Sacramento Housing in August: Sales decline Slightly YoY, Active Inventory down 50% YoY

by Calculated Risk on 9/20/2020 12:48:00 PM

Note that August sales are for contracts typically signed in June and July.

From SacRealtor.org: August 2020 Statistics – Sacramento Housing Market – Single Family Homes

August closed with 1,560 sales, down 11.9% from the 1,755 sales in July. Compared to one year ago (1,567), the current figure is down .4%.1) Overall sales decreased to 1,560 in August, down 0.4% from 1,567 in August 2019. Sales were down 11.9% from July 2020 (previous month).

...

The Active Listing Inventory decreased 2.2% from July to August, from 1,266 units to 1,238 units. Compared with August 2019 (2,460), inventory is down 49.7%. The Months of Inventory increased from .7 Months to .8 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) dropped from 9 to 7 and the Average DOM dropped from 25 to 21. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,266 down from 2,460 in August 2019. That is down 49.7% year-over-year. This is the sixteenth consecutive month with a YoY decline in inventory.

Existing home sales for August will be released this coming Tuesday, and will probably be around 5.92 million SAAR.

Saturday, September 19, 2020

September 19 COVID-19 Test Results

by Calculated Risk on 9/19/2020 06:35:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,007,204 test results reported over the last 24 hours. A new record.

There were 46,609 positive tests.

Close to 16,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.6% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).

Schedule for Week of September 20, 2020

by Calculated Risk on 9/19/2020 08:11:00 AM

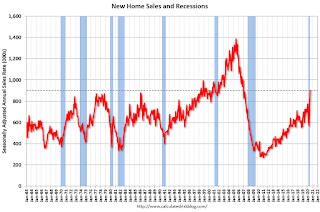

The key reports this week are August New and Existing Home sales.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

Fed Chair Powell testifies three times this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 6.00 million SAAR, up from 5.86 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 6.00 million SAAR, up from 5.86 million in July.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 5.92 million SAAR.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September.

10:30 AM: Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Financial Services, U.S. House of Representatives

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Testimony, Fed Chair Jerome Powell, Coronavirus Response, Before the Select Subcommittee on Coronavirus Crisis, U.S. House of Representatives

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims were 860 thousand the previous week.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 900 thousand SAAR, essentially unchanged from 901 thousand in July.

10:00 AM: Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

11:00 AM: the Kansas City Fed manufacturing survey for September.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

Friday, September 18, 2020

September 18 COVID-19 Test Results

by Calculated Risk on 9/18/2020 06:44:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 903,627 test results reported over the last 24 hours.

There were 47,486 positive tests.

Almost 15,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.3% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/18/2020 02:42:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.92 million in August, up 1.0% from July’s preliminary pace and up 9.0% from last August’s seasonally adjusted pace. Unadjusted sales should show a smaller YOY increase, reflecting this August’s lower business day count relative to last August’s.

Local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by a steamy 11.6% from last August, partly boosted by the mix of home sales but mainly boosted by the lack of available inventory across much of the country combined with strong demand for SF detached homes.

While not all realtor reports include data on new pending sales – and some that do often revise those data significantly – the limited data available suggest that the YOY increase in pending sales again exceeded the YOY gain in closed sales last month.

Projecting the NAR’s inventory estimate for August is tricky. Local realtor/MLS reports suggest that the “inventory” of homes for sale last month was down by about 35% nationwide in August. However, those same local reports for July would have suggested a much sharply YOY drop in inventories than the NAR reported.

Most of these local realtor/MLS reports utilize third-party software, and most exclude all pending contracts from their inventory number. These reports differ from the reports sent to the NAR, and it is my understanding is that most local realtors/MLS include pending listings in the inventory number in their NAR report.

...

Given both the sales and inventory numbers, it’s perhaps not shocking that there has been a rapid acceleration in home prices over the past few months – to the point that one can at least say the single-family housing market has become “frothy,” and perhaps even become a little “bubbly.”

If in fact the recent surge in median sales prices reflects a jump in overall prices (rather than a shift in the mix in sales), it will not show up in some widely followed “repeat-transactions) home price indexes for a few months.

CR Note: The National Association of Realtors (NAR) is scheduled to release August existing home sales on Tuesday, September 22, 2020 at 10:00 AM ET. The consensus is for 6.00 million SAAR.