by Calculated Risk on 8/10/2020 08:28:00 PM

Monday, August 10, 2020

Tuesday: PPI, Delinquency Survey

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for July.

• At 8:30 AM, The Producer Price Index for July from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.1% increase in core PPI.

• At 12:00 PM, MBA Q2 National Delinquency Survey

August 10 COVID-19 Test Results

by Calculated Risk on 8/10/2020 06:56:00 PM

Note: There are some states having reporting problems.

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 716,229 test results reported over the last 24 hours.

There were 41,807 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.8% (red line). This the lowest percent positive since late June.

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 7.44%" of Portfolio Volume

by Calculated Risk on 8/10/2020 04:00:00 PM

Note: This is as of August 2nd. The share of mortgage loans in forbearance decreased, but there was a slight uptick in forbearance requests last week.

From the MBA: Share of Mortgage Loans in Forbearance Decreases for the Eighth Straight Week to 7.44%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 23 basis points from 7.67% of servicers’ portfolio volume in the prior week to 7.44% as of August 2, 2020. According to MBA’s estimate, 3.7 million homeowners are in forbearance plans. ...

“The share of loans in forbearance declined at a more rapid pace last week, with many borrowers who had been making payments while in forbearance deciding to exit. New forbearance requests increased, but are still well below the level of exits,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Some of the decline in the share of Ginnie Mae loans in forbearance was due to additional buyouts of delinquent loans from Ginnie Mae pools, which result in these FHA and VA loans being reported in the portfolio category.”

Added Fratantoni, “The job market data in July came in better than expected. However, the unemployment rate is still quite high, and the elevated level of layoffs and slowing pace of hiring will make it more difficult for borrowers to get back on track – particularly if there is not an extension of relief.”

By stage, 40.87% of total loans in forbearance are in the initial forbearance plan stage, while 58.43% are in a forbearance extension. The remaining 0.70% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last eight weeks.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week from 0.10% to 0.12%"

Fannie and Freddie: REO inventory declined sharply in Q2, Down 35% Year-over-year

by Calculated Risk on 8/10/2020 01:29:00 PM

Note, from Fannie: "The decline in single-family REO properties in the first half of 2020 compared with the first half of 2019 was primarily due to the

suspension of foreclosures and a reduction in REO acquisitions from serious delinquencies aged greater than 180 days. With

instruction from FHFA, we have prohibited our servicers from completing foreclosures on our single-family loans through at

least August 31, 2020, except in the case of vacant or abandoned properties. In addition, some states and local governments

have enacted additional foreclosure constraints that extend beyond that timeframe."

As a result of COVID-19, Fannie and Freddie kept disposing of REO in Q2, but there were very few acquisitions.

Fannie and Freddie earlier reported results earlier for Q2 2020. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 2,812 at the end of Q2 2020, compared to 5,869 at the end of Q2 2019.

For Freddie, this is down 96% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 12,675 at the end of Q2 2020 compared to 17,913 at the end of Q2 2019.

For Fannie, this is down 92% from the 166,787 peak number of REOs in Q3 2010.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q2 2020, and combined inventory is down 35% year-over-year.

This is probably lower than a normal level of REO.

It takes a long time to go from delinquency to foreclosure to REO. And homeowners who are struggling are probably in forbearance.

So any increase in REOs from COVID-19 won't happen for a long time. Since underwriting has been fairly solid over the last decade, I don't expect a huge increase in COVID-19 related REOs unless the health crisis goes on for an extended period.

Seattle Real Estate in July: Sales up 10% YoY, Inventory down 15% YoY

by Calculated Risk on 8/10/2020 12:44:00 PM

The Northwest Multiple Listing Service reported Opportunities abound for home buyers and sellers, but brokers say "don't delay"

Brokers added the largest monthly number of new listings during July since May 2019, but pent-up demand from homebuyers meant inventory remained tight, according to Northwest Multiple Listing Service (NWMLS) representatives who commented on the latest housing activity report.There were 9,840 sales in July 2020, up 3% from 9,540 sales in July 2019.

…

MLS member-brokers reported 9,840 closed sales during July, up slightly more than 3% from a year ago and the highest volume since June 2018 when they notched 10,072 completed transactions.

emphasis added

The press release is for the Northwest. In King County, sales were up 4.3% year-over-year, and active inventory was down 32% year-over-year.

In Seattle, sales were up 10.4% year-over-year, and inventory was down 15.3% year-over-year.. This puts the months-of-supply in Seattle at just 1.5 months.

The closed sales are for contracts mostly signed in May and June, and as expected, there was a rebound in the July report.

BLS: Job Openings increased to 5.9 Million in June

by Calculated Risk on 8/10/2020 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to 5.9 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Hires decreased to 6.7 million in June, but was still the second highest level in the series history. The largest monthly increase in hires occurred in May 2020. Total separations increased to 4.8 million. Within separations, the quits rate rose to 1.9 percent while the layoffs and discharges rate was unchanged at 1.4 percent. These changes in the labor market reflected a limited resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in June to 5.889 million from 5.371 million in May.

The number of job openings (yellow) were down 18% year-over-year.

Quits were down 25% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings increased in June, but were still down sharply YoY.

NMHC: Rent Payment Tracker Finds Decline in People Paying Rent in August

by Calculated Risk on 8/10/2020 09:07:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 79.3 Percent of Apartment Households Paid Rent as of August 6

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 79.3 percent of apartment households made a full or partial rent payment by August 6 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: This is for larger, professionally managed properties. It appears fewer people are paying their rent this year compared to last year (down 1.9 percentage points from a year ago). But this hasn't fallen off a cliff - yet - with the expiration of the extra unemployment benefits.

This is a 1.9-percentage point, or 223,000-household decrease from the share who paid rent through August 6, 2019 and compares to 77.4 percent that had paid by July 6, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“While President Trump announced executive orders relating to rental assistance and continued unemployment benefits, it is unclear when and if those resources will be available to families. NMHC continues to urge the Trump administration and Congressional leaders to restart negotiations and reach a comprehensive agreement on the next COVID relief package. It is critical lawmakers take urgent action to support and protect apartment residents and property owners through an extension of the benefits as well as targeted rental assistance. That support, not a broad-based eviction moratorium, will keep families safely and securely housed as the nation continues to recover from the pandemic.”

emphasis added

High Frequency Indicators for the Economy

by Calculated Risk on 8/10/2020 08:49:00 AM

Note: I've added a New York specific indicator - subway usage - at the bottom.

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On Aug 9th, the seven day average was 699,675 compared to the seven average of 2,543,977 a year ago.

The seven day average is down 72.5% from last year. There had been a slow steady increase from the bottom, but air travel has mostly moved sideways over the last several weeks.

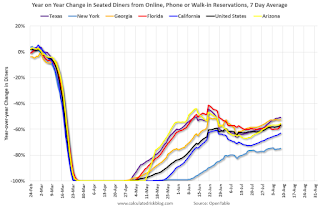

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through Aug 8, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

The 7 day average for New York is still off 75%.

Texas is down 51% YoY. Note that dining declined in many areas as the number of COVID cases surged. It appears dining is increasing again (probably mostly outdoor dining).

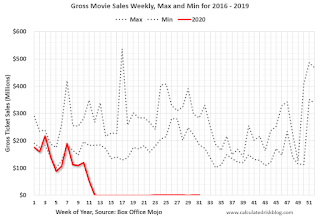

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through August 6th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through August 6th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up a slightly from the bottom, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for twenty weeks.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This data is through August 1st.

COVID-19 crushed hotel occupancy, however the occupancy rate has increased in 15 of the last 16 weeks, and is currently down 35% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Usually hotel occupancy starts to pick up seasonally in early June and decline towards the end of summer. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline consumption compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline consumption compared to the same week last year of .At one point, gasoline consumption was off almost 50% YoY.

As of July 31st, gasoline consumption was only off about 11% YoY (about 89% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might be boosting gasoline consumption over the summer.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 8th for the United States and several selected cities.

This data is through August 8th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 53% of the January level. It is at 48% in New York, and 55% in Houston.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.This data is through Friday, August 7th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings"

Sunday, August 09, 2020

Monday: Job Openings

by Calculated Risk on 8/09/2020 08:07:00 PM

Weekend:

• Schedule for Week of August 9, 2020

• State and Local Education Employment in August

Monday:

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for June from the BLS.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $41.59 per barrel and Brent at $44.69 barrel. A year ago, WTI was at $55, and Brent was at $61 - so WTI oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.16 per gallon. A year ago prices were at $2.66 per gallon, so gasoline prices are down $0.50 per gallon year-over-year.

August 9 COVID-19 Test Results

by Calculated Risk on 8/09/2020 05:30:00 PM

Note: There are some states having reporting problems.

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 711,984 test results reported over the last 24 hours.

There were 51,291 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.2% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.