by Calculated Risk on 6/30/2020 08:52:00 PM

Tuesday, June 30, 2020

Wednesday: ADP Employment, ISM Mfg Index, Construction Spending, FOMC Minutes

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 3,000,000 payroll jobs added in June, up from 2,760,000 lost in May.

• At 10:00 AM, ISM Manufacturing Index for June. The consensus is for the ISM to be at 49.0, up from 43.1 in May.

• At 10:00 AM, Construction Spending for May. The consensus is for a 1.0% increase in construction spending.

•All day, Light vehicle sales for June from the BEA. The consensus is for light vehicle sales to be 13.0 million SAAR in June, up from 12.2 million in May (Seasonally Adjusted Annual Rate).

• At 2:00 PM, FOMC Minutes, Meeting of June 9-10, 2020

June 30 COVID-19 Test Results

by Calculated Risk on 6/30/2020 05:59:00 PM

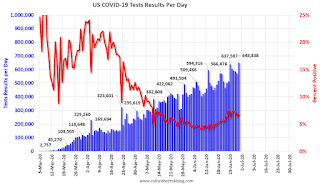

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 648,838 test results reported over the last 24 hours. This is the most test results reported daily.

There were 44,358 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Fannie Mae: Mortgage Serious Delinquency Rate Increased in May

by Calculated Risk on 6/30/2020 04:09:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency increased to 0.89% in May, from 0.70% in April. The serious delinquency rate is up from 0.70% in May 2019.

This is the highest serious delinquency rate since June 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 3.09% are seriously delinquent (up from 2.64% in April). For loans made in 2005 through 2008 (3% of portfolio), 5.22% are seriously delinquent (up from 4.41%), For recent loans, originated in 2009 through 2018 (95% of portfolio), only 0.53% are seriously delinquent (up from 0.38%). So Fannie is still working through a few poor performing loans from the bubble years.

With COVID-19, this rate will increase significantly in June and July (it takes time since these are mortgages three months or more past due).

I believe mortgages in forbearance will be counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

Las Vegas Visitor Authority: "No Convention Attendance, Hotel Occupancy 2.8%" in May

by Calculated Risk on 6/30/2020 02:33:00 PM

From the Las Vegas Visitor Authority: May 2020 Las Vegas Visitor Statistics

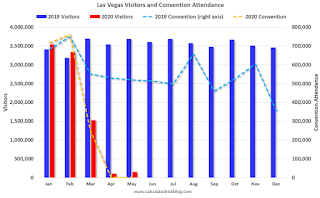

Reflecting the continued shutdown in place due to the COVID-19 pandemic, Las Vegas visitation in May (approx. 151k visitors) was a small fraction of typical levels.Here is the data from the Las Vegas Convention and Visitors Authority.

Like April, May saw no measurable convention attendance occurring in the destination.

Occupancy for the month came in at 2.8% as most of the destination's 148k+ hotel rooms were temporarily closed during the shutdown, while the average day rates (ADR) among the open properties neared $61.

Click on graph for larger image.

Click on graph for larger image. The blue and red bars are monthly visitor traffic (left scale) for 2019 and 2020. The dashed blue and orange lines are convention attendance (right scale).

Convention traffic in May was down 100% compared to May 2019.

And visitor traffic was down 96% YoY.

The number of visitors will increase in June (the casinos started to reopen on June 4th), but will still be down significantly from last year.

Fed Chair Powell: "Coronavirus and CARES Act" at 12:30 PM ET

by Calculated Risk on 6/30/2020 11:52:00 AM

Here is Fed Chair Powell's prepared testimony: Coronavirus and CARES Act

The livestream is here starting at 12:30 PM ET.

"Chemical Activity Barometer Falls Slightly In June"

by Calculated Risk on 6/30/2020 10:34:00 AM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Falls Slightly In June

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), eased 0.3 percent in June on a three-month moving average (3MMA) basis following a 4.6 percent decline in May. On a year-over-year (Y/Y) basis, the barometer fell 12.0 percent in June.

The unadjusted data show a 3.5 percent gain in June following a 2.2 percent gain in May and a 6.3 percent decline in April. The diffusion index rose from 35 percent to 53 percent. The diffusion index marks the number of positive contributors relative to the total number of indicators monitored. The CAB reading for May was revised upward by 2.68 points and the April reading was revised upward by 0.05 points.

“While the latest CAB reading is consistent with a recession, two consecutive months of gains in the unadjusted data is a positive development,” said Kevin Swift, chief economist at ACC. “We’ll want to see at least another month of gains in order to conclude that the economy has turned a corner.”

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer (CAB) compared to Industrial Production.

Although the CAB (red) generally leads Industrial Production (blue), they both collapsed together with the sudden stop of the economy in March. The unadjusted CAB data suggests that Industrial Production probably bottomed, but the CAB is not indicating a strong rebound.

Case-Shiller: National House Price Index increased 4.7% year-over-year in April

by Calculated Risk on 6/30/2020 09:07:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3 month average of February, March and April prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: Annual Home Price Gains Remained Steady In April According To S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.7% annual gain in April, up from 4.6% in the previous month. The 10-City Composite annual increase came in at 3.4%, remaining the same as last month. The 20-City Composite posted a 4.0% year-over-year gain, up from 3.9% in the previous month.

Phoenix, Seattle and Minneapolis reported the highest year-over-year gains among the 19 cities (excluding Detroit) in April. Phoenix led the way with an 8.8% year-over-year price increase, followed by Seattle with a 7.3% increase and Minneapolis with a 6.4% increase. Twelve of the 19 cities reported higher price increases in the year ending April 2020 versus the year ending March 2020.

...

The National Index posted a 1.1% month-over-month increase, while the 10-City and 20-City Composites posted increases of 0.7% and 0.9% respectively before seasonal adjustment in April. After seasonal adjustment, the National Index posted a month-over-month increase of 0.5%, while the 10- City and 20-City Composites both posted 0.3% increases. In April, all 19 cities (excluding Detroit) reported increases before seasonal adjustment, while 16 of the 19 cities reported increases after seasonal adjustment.

"April’s housing price data continue to be remarkably stable,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index rose by 4.7% in April 2020, with comparable growth in the 10- and 20-City Composites (up 3.4% and 4.0%, respectively). In all three cases, April’s year-over-year gains were ahead of March’s, continuing a trend of gently accelerating home prices that began last fall. Results in April continued to be broad-based. Prices rose in each of the 19 cities for which we have reported data, and price increases accelerated in 12 cities.

“As was the case in March, we have data from only 19 cities this month, since transactions records for Wayne County, Michigan (in the Detroit metropolitan area) continue to be unavailable. This is, so far, the only directly visible impact of COVID-19 on the S&P CoreLogic Case-Shiller Indices. The price trend that was in place pre-pandemic seems so far to be undisturbed, at least at the national level. Indeed, prices in 12 of the 20 cities in our survey were at an all-time high in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 3.4% compared to April 2019. The Composite 20 SA is up 4.0% year-over-year.

The National index SA is up 4.7% year-over-year.

I'll have more later.

Monday, June 29, 2020

Tuesday: Case-Shiller House Prices, Fed Chair Powell Testimony

by Calculated Risk on 6/29/2020 08:44:00 PM

Note: Here is Fed Chair Powell's prepared testimony: Coronavirus and CARES Act

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue at All-Time Lows, But Caveats Remain

Mortgage rates were unchanged to slightly lower today, bringing the average lender right in line with all-time lows. [30YR FIXED - 2.95%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for April. The consensus is for a 3.8% year-over-year increase in the Comp 20 index for April.

• At 9:45 AM, Chicago Purchasing Managers Index for June.

• At 12:30 PM, Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Financial Services, U.S. House of Representatives

June 29 COVID-19 Test Results

by Calculated Risk on 6/29/2020 06:15:00 PM

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 569,394 test results reported over the last 24 hours.

There were 36,490 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases Slightly to 8.47%" of Portfolio Volume

by Calculated Risk on 6/29/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 8.47%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 8.48% of servicers’ portfolio volume in the prior week to 8.47% as of June 21, 2020. According to MBA’s estimate, 4.2 million homeowners are in forbearance plans.

...

“The overall share of loans in forbearance declined for the second week in a row, led by the third straight drop in GSE loans,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Many borrowers initially received a three-month forbearance term, and as of June 21, 17 percent of loans in forbearance have now been extended, with the largest share of those being Ginnie Mae loans.”

Added Fratantoni, “The level of forbearance requests remains quite low as of mid-June. The rebound in the housing market is likely one of the factors that is providing confidence to both potential homebuyers and existing homeowners during these troubled times.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) decreased across all investor types: from 0.15% to 0.14%."