by Calculated Risk on 1/23/2020 01:30:00 PM

Thursday, January 23, 2020

LA area Port Traffic Down Year-over-year in December

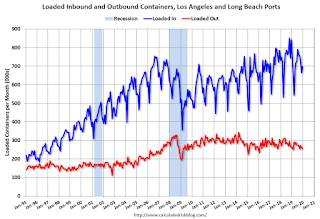

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.7% in December compared to the rolling 12 months ending in November. Outbound traffic was down 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports had been increasing (although down in 2019), and exports have mostly moved sideways over the last 8 years - but have also moved down recently.

Kansas City Fed: "Tenth District Manufacturing Activity Nearly Flat in January"

by Calculated Risk on 1/23/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Nearly Flat in January

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity was nearly flat in January while expectations for future activity expanded.Another weak Tenth District manufacturing report.

“Regional factory activity was down only slightly in January, and firms reported a modest increase in employment,” said Wilkerson. “Contacts reported slightly less difficulty finding workers than six months ago, but still over 60 percent of firms were experiencing labor shortages.”

...

The month-over-month composite index was -1 in January, slightly higher than -5 in December and -2 in November. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The slight decrease in district manufacturing activity was driven by declines in: nonmetallic mineral products, primary metal, fabricated metal products, computer and electronic products, beverage and tobacco products, and printing manufacturing, while several other industries improved. Most month-over-month indexes remained slightly negative in January, and inventories continued to decline. However, the month-over-month employment index rose back into positive territory for the first time in over six months and the supplier delivery time index was also slightly positive.

emphasis added

Weekly Initial Unemployment Claims Increase to 211,000

by Calculated Risk on 1/23/2020 08:33:00 AM

The DOL reported:

In the week ending January 18, the advance figure for seasonally adjusted initial claims was 211,000, an increase of 6,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 204,000 to 205,000. The 4-week moving average was 213,250, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 216,250 to 216,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,250.

This was lower than the consensus forecast.

Wednesday, January 22, 2020

Thursday: Unemployment Claims

by Calculated Risk on 1/22/2020 06:55:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Maintaining Longer-Term Lows For Now

Mortgage rates remained in line with 3-month lows today for the average lender. Several lenders offered marginally better terms compared to yesterday, but in those cases, the only changes were to the upfront costs associated with the same rates quoted yesterday. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED 3.625 -3.75%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, up from 214,000 last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

AIA: "Architecture Billings Index Ends Year on Positive Note"

by Calculated Risk on 1/22/2020 02:16:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Ends Year on Positive Note

Demand for design services in December increased for the third month in a row, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 52.5 for December reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). During December, both the new project inquiries and design contracts scores were positive, posting scores of 58.7 and 53.4 respectively.

“Despite the ongoing slowdown in billings in the Northeast, balanced growth across sectors and regions looks more positive for the coming year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Factors outside of the construction sector, such as trade policy and international events, could still impact demand for design services, however recent fears about a downturn in construction activity have largely subsided.”

...

• Regional averages: West (54.0); South (52.2); Midwest (51.9); Northeast (44.0)

• Sector index breakdown: commercial/industrial (54.0); multi-family residential (51.0); mixed practice (50.8); institutional (50.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.5 in December, up from 51.9 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some increase in CRE investment in 2020.

Black Knight's First Look: National Mortgage Delinquency Rate Decreased in December

by Calculated Risk on 1/22/2020 12:59:00 PM

From Black Knight: Black Knight’s First Look: Strong Close to 2019 Pushes Mortgage Delinquency Rate to Near Record Low

• Mortgage delinquencies fell by nearly 4% month-over-month to within 0.04% of the record low set in May 2019 and more than 12% below last year’s levelAccording to Black Knight's First Look report for December, the percent of loans delinquent decreased in December compared to November, and decreased 12.4% year-over-year.

• The national foreclosure rate fell again in December to reach a new 14-year low, and the lowest on record outside the final five months of 2005

• 2019 ended with just over two million borrowers past due on their mortgage (including active foreclosures) – down 236,000 from the same time last year and the lowest year-end volume since the turn of the century

• After falling by 19% in November, prepayment rates ticked upward in December, suggesting that the recent leveling off of interest rates has had a flattening effect on refinance activity

The percent of loans in the foreclosure process decreased 1.6% in December and were down 11.6% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.40% in December, down from 3.53% in November.

The percent of loans in the foreclosure process decreased to 0.46% from 0.47% in November.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2019 | Nov 2019 | Dec 2018 | Dec 2017 | |

| Delinquent | 3.40% | 3.53% | 3.88% | 4.71% |

| In Foreclosure | 0.46% | 0.47% | 0.52% | 0.65% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,803,000 | 1,868,000 | 2,013,000 | 2,412,000 |

| Number of properties in foreclosure pre-sale inventory: | 245,000 | 248,000 | 271,000 | 331,000 |

| Total Properties Delinquent or in foreclosure | 2,047,000 | 2,116,000 | 2,283,000 | 2,743,000 |

Comments on December Existing Home Sales

by Calculated Risk on 1/22/2020 10:42:00 AM

Earlier: NAR: Existing-Home Sales Increased to 5.54 million in December

A few key points:

1) Existing home sales were up 10.8% year-over-year (YoY) in December. This was the sixth consecutive month with a YoY increase - following 16 consecutive months with a YoY decrease in sales.

2) Inventory is very low, and was down 8.5% year-over-year (YoY) in December. Inventory always decreases sharply in December as people take their homes off the market for the holidays. However, based on the data I've collected, this was the lowest level for inventory in at least three decades (the previous low was 1.43 million in December 1993).

3) Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown.

Then sales picked up in the second half of 2019 as interest rates declined.

Existing home sales in 2019 (5.344 million) finished the year essentially unchanged from 2018 (5.343 million).

Sales NSA in December (434,000, red column) were the highest for December since 2016.

Overall this was a solid report. The very low level of inventory will be something to watch in 2020.

NAR: Existing-Home Sales Increased to 5.54 million in December

by Calculated Risk on 1/22/2020 10:13:00 AM

From the NAR: Existing-Home Sales Climb 3.6% in December

Existing-home sales grew in December, bouncing back after a slight fall in November, according to the National Association of Realtors®. Although the Midwest saw sales decline, the other three major U.S. regions reported meaningful growth last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 3.6% from November to a seasonally-adjusted annual rate of 5.54 million in December. Additionally, overall sales took a significant bounce, up 10.8% from a year ago (5.00 million in December 2019).

...

Total housing inventory at the end of December totaled 1.40 million units, down 14.6% from November and 8.5% from one year ago (1.53 million). Unsold inventory sits at a 3.0-month supply at the current sales pace, down from the 3.7-month figure recorded in both November and December 2018. Unsold inventory totals have dropped for seven consecutive months from year-ago levels, taking a toll on home sales.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December (5.54 million SAAR) were up 3.6% from last month, and were 10.8% above the December 2018 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.40 million in December from 1.64 million in November. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.40 million in December from 1.64 million in November. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 8.5% year-over-year in December compared to December 2018.

Inventory was down 8.5% year-over-year in December compared to December 2018. Months of supply decreased to 3.0 months in December.

This was higher than the consensus forecast. For existing home sales, a key number is inventory - and inventory is at record lows. I'll have more later …

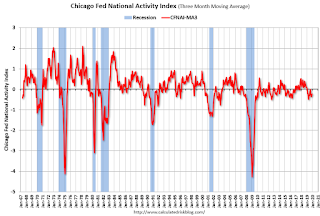

Chicago Fed "Index Points to Slower Economic Growth in December"

by Calculated Risk on 1/22/2020 08:37:00 AM

From the Chicago Fed: Chicago Fed National Activity Index points to slower economic growth in December

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.35 in December from +0.41 in November. Three of the four broad categories of indicators that make up the index decreased from November, and three of the four categories made negative contributions to the index in December. The index’s three-month moving average, CFNAI-MA3, moved up to –0.23 in December from –0.31 in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in December (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 1/22/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 17, 2020.

... The Refinance Index decreased 2 percent from the previous week and was 116 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 8 percent higher than the same week one year ago.

...

“Mortgage applications dipped slightly last week after two weeks of healthy increases, but even with a slight decline, the total pace of applications remains at an elevated level. The purchase market has started 2020 on a strong note, running 8 percent higher than the same week a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinance applications remained near the highest level since October 2019, as the 30-year fixed rate was unchanged at 3.87 percent, while the 15-year fixed rate decreased to its lowest level since November 2016. Even with more positive developments surrounding the U.S. and China trade negotiations and healthy retail sales data, investors seemed cautious and maintained their demand for safer U.S. Treasuries, which kept yields lower. Our expectation is that rates will stay along this same narrow range.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) remained unchanged at 3.87 percent, with points decreasing to 0.27 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 8% year-over-year.