by Calculated Risk on 9/15/2019 07:43:00 PM

Sunday, September 15, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of September 15, 2019

• FOMC Preview

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 4.9, up from 4.8.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 11 and DOW futures are down 88 (fair value).

Note: Oil futures are up about 10% following the attack on the Saudi oil facilities. Oil prices were up over the last week with WTI futures at $60.84 per barrel and Brent at $67.85 barrel. A year ago, WTI was at $69, and Brent was at $78 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.55 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are down 30 cents year-over-year.

FOMC Preview

by Calculated Risk on 9/15/2019 09:55:00 AM

The consensus is the FOMC will cut the Fed Funds rate 25 bps to a range of 1.75% to 2.0% at the meeting this week. A 50 bps cut is not impossible, but seems unlikely at this meeting.

A key will be if the FOMC signals another rate cut in October. The hints could be in the press conference, or in the dot plot.

Revisions to the economic projections will probably be minor, and the statement will probably be mostly unchanged from July.

Here are the June FOMC projections.

Q1 real GDP growth was at 3.1% annualized, and Q2 at 2.0%. Currently most analysts are projecting around 1.5% to 2% in Q3. So the GDP projections will probably be little changed.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Jun 2019 | 2.0 to 2.2 | 1.8 to 2.0 | 1.8 to 2.0 |

| Mar 2019 | 1.9 to 2.2 | 1.8 to 2.0 | 1.7 to 2.0 |

The unemployment rate was at 3.7% in August. The unemployment rate projection for Q4 2019 will probably be little changed.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Jun 2019 | 3.6 to 3.7 | 3.6 to 3.9 | 3.7 to 4.1 |

| Mar 2019 | 3.6 to 3.8 | 3.5 to 3.9 | 3.6 to 4.0 |

As of July 2019, PCE inflation was up 1.4% from July 2018. This was below the projected range for 2019 however it appears inflation has picked up a little recently - and this projection will probably be mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Jun 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

PCE core inflation was up 1.6% in July year-over-year. The projection for core PCE for 2019 will probably be mostly unchanged.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Jun 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.9 to 2.0 | 2.0 to 2.1 | 2.0 to 2.1 |

In general the economy has been tracking the June projections.

Saturday, September 14, 2019

Schedule for Week of September 15, 2019

by Calculated Risk on 9/14/2019 08:11:00 AM

The key economic reports this week are August Housing Starts and Existing Home Sales.

For manufacturing, August Industrial Production, and the September New York and Philly Fed surveys, will be released this week.

The FOMC is expected to cut the Fed Funds rate 25bps on Wednesday, and the Fed's Q2 Flow of Funds report will be released on Friday.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 4.9, up from 4.8.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

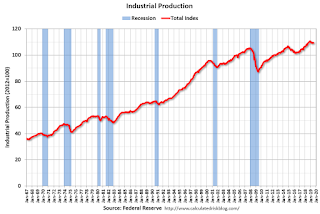

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.5%.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 66, unchanged from 66 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.250 million SAAR, up from 1.191 million SAAR.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The Fed is expected to lower the Fed Funds rate 25bps at this meeting..

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 204 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 11.3, down from 16.8.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.38 million SAAR, down from 5.42 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.38 million SAAR, down from 5.42 million in July.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for August 2019

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Friday, September 13, 2019

"Mortgage Rates' Week Goes From Bad to Worse"

by Calculated Risk on 9/13/2019 05:21:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates' Week Goes From Bad to Worse

Mortgage rates were already having their worst week since 2016 as of yesterday afternoon. Rather than help to heal some of the damage, today's bond market momentum only made things worse. Whether we're looking at 10yr Treasury yields a broad indicator of longer-term rates or average mortgage lender offerings, this week now ranks among the top 3 in the past decade in terms of the overall move higher. At this point, we'd have to go back to the trauma of 2013's 'taper tantrum' to see anything bigger. [Today's Most Prevalent Rates 30YR FIXED - 3.875%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since 2014.

This graph is interactive at the Mortgage News Daily site, and you could view mortgage rates back to the mid-1980s - click here for graph.

Q3 GDP Forecasts: Around 1.5% to 2.0%

by Calculated Risk on 9/13/2019 01:01:00 PM

From Merrill Lynch:

3Q and 2Q GDP tracking remain at 2.0% qoq saar. [Sept 13 estimate]From Goldman Sachs:

emphasis added

Following this morning’s data, we boosted our Q3 GDP tracking estimate by one tenth to +2.0% (qoq ar). [Sept 13 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.6% for 2019:Q3 and 1.1% for 2019:Q4. [Sept 13 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 1.8 percent on September 13, down from 1.9 percent on September 11. [Sept 13 estimate]CR Note: These early estimates suggest real GDP growth will be around 1.5% to 2.0% annualized in Q3.

Sacramento Housing in August: Sales Down 6.5% YoY, Active Inventory DOWN 22% YoY

by Calculated Risk on 9/13/2019 11:15:00 AM

From SacRealtor.org: Median sale price, sales volume decrease for August

August ended with 1,567 sales, a 7.4% decrease from the 1,693 sales last month. Compared to the same month last year (1,676), the current figure is down 6.5%.1) Overall sales decreased to 1,567 in August, down from 1,676 in August 2018. Sales were down 7.4% from July 2019 (previous month), and down 6.5% from August 2018.

...

The Active Listing Inventory increased 1.4% from 2,425 to 2,460 units. The Months of Inventory increased from 1.4 to 1.6 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [Note: Compared to August 2018, inventory is down 22.3%] .

...

The Median DOM (days on market) increased from 11 to 12 and the Average DOM increased from 23 to 25. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,567 sales this month, 74.5% (1,167) were on the market for 30 days or less and 89.8% (1,407) were on the market for 60 days or less.

emphasis added

2) Active inventory was at 2,460, down from 3,167 in August 2018. That is down 22.3% year-over-year. This is the fourth consecutive YoY decline following 20 months of YoY increases in inventory.

This is a market that didn't pickup in August, even with the recent decline in mortgage rates. However, most of the decline in mortgage rates were in August, and sales are reported at the close of escrow, so we will probably see a pickup in coming months.

Retail Sales increased 0.4% in August

by Calculated Risk on 9/13/2019 08:40:00 AM

On a monthly basis, retail sales increased 0.4 percent from July to August (seasonally adjusted), and sales were up 4.1 percent from August 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $526.1 billion, an increase of 0.4 percent from the previous month, and 4.1 percent above August 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in August.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.The increase in August was slightly above expectations. Sales in June and July were revised up. Overall a solid report.

Thursday, September 12, 2019

Friday: Retail Sales

by Calculated Risk on 9/12/2019 10:31:00 PM

Friday:

• At 8:30 AM ET, Retail sales for August will be released. The consensus is for a 0.3% increase in retail sales.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for September).

LA area Port Traffic Down Year-over-year in August

by Calculated Risk on 9/12/2019 04:38:00 PM

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down slightly in August compared to the rolling 12 months ending in July. Outbound traffic was down 0.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing (although down slightly this year), and exports have mostly moved sideways over the last 8 years.

Early Look at 2020 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/12/2019 02:00:00 PM

The BLS reported this morning:

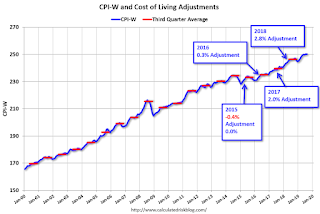

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.5 percent over the last 12 months to an index level of 250.112 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2018, the Q3 average of CPI-W was 246.352.

The 2018 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.5% year-over-year in August, and although this is early - we need the data for July, August and September - my current guess is COLA will probably be around 1.5% this year, the smallest increase since 2016.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2018 yet, but wages probably increased again in 2018. If wages increased the same as in 2017, then the contribution base next year will increase to around $137,600 in 2020, from the current $132,900.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).