by Calculated Risk on 9/11/2019 12:19:00 PM

Wednesday, September 11, 2019

Houston Real Estate in August: Sales up 4% YoY, Inventory Up 8%

From the HAR: Houston Home Sales Sizzle in August

Temperatures weren’t the only thing soaring in August. Home sales registered another hot month, as low mortgage interest rates kept consumers in a buying mood. According to the latest monthly report from the Houston Association of Realtors (HAR), August sales of single-family homes throughout greater Houston totaled 8,679. That is up 3.9 percent year-over-year and marks the second largest one-month sales volume of all time; the record of 8,930 was set just last month. On a year-to-date basis, home sales are running 3.1 percent ahead of 2018’s record volume.Total active inventory was up 8.2% YoY to 45,062 properties from 41,650 properties in August 2018. Sales are on pace for a record year.

...

Housing inventory still remains ahead of 2018 levels. It reached a 4.2-months supply in August compared to 4.0 months a year earlier. So far in 2019, June and July marked the peak of inventory – a 4.3-months supply. Robust inventory and mortgage interest rates currently averaging 3.49 percent (according to Freddie Mac) have created a favorable climate for home buyers and paved the way for one of the strongest summers in Houston real estate history.

Sales of all property types increased 4.1 percent in August, totaling 10,375 units. That marks the second highest one-month volume of all time. The record for total property sales in a single month was 10,444 set just last month, in July 201[9], which also was the first time that figure broke the 10,00[0] mark. Total dollar volume for the month climbed 6.6 percent to $3.1 billion.

“This has been one of the hottest summers in Houston history, both in terms of temperatures and home sales,” said HAR Chair Shannon Cobb Evans with Better Homes and Gardens Real Estate Gary Greene. “The Houston real estate market typically slows a bit once school starts and we get into fall, but with interest rates as low as they’ve been and a steadily growing supply of homes, it’s possible that sales don’t let up until closer to the holidays. The rental segment has also been extremely active and looks to remain that way a while longer.”

emphasis added

Employment: August Diffusion Indexes

by Calculated Risk on 9/11/2019 10:01:00 AM

I haven't posted this in a few months.

The BLS diffusion index for total private employment was at 53.5 in August, down from 57.8 in July.

For manufacturing, the diffusion index was at 51.3, down from 53.9 in August.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall both total private and manufacturing job growth were not widespread in August.

Overall both total private and manufacturing job growth were not widespread in August.Both indexes have been trending down in 2019 - indicating job growth is becoming less widespread across industries.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 9/11/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 6, 2019. This week’s results include an adjustment for the Labor Day holiday.

... The Refinance Index increased 0.4 percent from the previous week and was 169 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index decreased 8 percent compared with the previous week and was 9 percent higher than the same week one year ago.

...

“Mortgages rates continued to decline over the holiday-shortened week, with the 30-year fixed rate decreasing five basis points and remaining near three-year lows,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinances were essentially unchanged, up just 0.4 percent, but August overall was the strongest month of activity so far in 2019. Purchase applications rose around 5 percent, with increases for both conventional and government applications.”

Added Kan, “Purchase activity was 9 percent higher than last year, continuing the trend seen most of the year of solid year-over-year gains.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.82 percent from 3.87 percent, with points increasing to 0.44 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to under 4%.

With lower rates, we saw a recent sharp increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 9% year-over-year.

Tuesday, September 10, 2019

Wednesday: PPI

by Calculated Risk on 9/10/2019 07:40:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for August from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

Port of Los Angeles: Imports increased, Exports decreased in August

by Calculated Risk on 9/10/2019 04:37:00 PM

From the Port of Los Angeles: August Cargo Another Record Breaker at Port of Los Angeles

For the fifth consecutive month, the Port of Los Angeles has set a new single-month cargo record. In August, the Port moved 861,081 Twenty-Foot Equivalent Units (TEUs), the busiest August in the Port’s 112-year history and a 4.2% increase over the same period last year.

Eight months into 2019 overall volumes have increased 5.7% compared to 2018, when the Port set an all-time cargo record.

…

“The final months of 2018 ended with an extraordinary influx of imports to beat expected tariffs on China-origin goods,” Seroka added. “We don’t expect to see those kind of volumes in the months ahead. We need a negotiated settlement of the U.S.-China trade war to restore global trade stability.”

August 2019 imports increased 4.1% to 437,613 TEUs compared to the previous year. Exports decreased 10% to 146,284 TEUs, the 10th consecutive monthly decline of exports.

emphasis added

Seattle Real Estate in August: Sales up 5.1% YoY, Inventory up 25% YoY from Low Levels

by Calculated Risk on 9/10/2019 12:32:00 PM

The Northwest Multiple Listing Service reported Home Buyers Seeking Affordability Are Expanding Search Outside Greater Seattle Job Centers

Depleted inventory continues to frustrate would-be buyers in Western Washington. Many of these potential homeowners are expanding their search beyond the major job centers in King County, according to market watchers who commented on the latest statistics from Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were up 4.1% year-over-year, and active inventory was down 5.7% year-over-year.

The MLS report summarizing August activity shows less than two months of supply system-wide, and only about 1.6 months of supply in the four-county Puget Sound region. The sparse selection is pushing up prices. For last month's sales of single family homes and condos across the 23 counties served by Northwest MLS, prices rose nearly 6.2% compared to a year ago.

...

"While August is always a slower time for listings and sales, what is really surprising this year is the decrease in new listings taken, while pending sales increased," observed Mike Grady, president and COO of Coldwell Banker Bain.

emphasis added

In Seattle, sales were up 5.1% year-over-year, and inventory was up 25% year-over-year from very low levels. The year-over-year increase in inventory has slowed sharply (although still up 25%), and the months of supply is still low in Seattle (1.9 months). In many areas it appears the inventory build that started last year is ending.

BLS: Job Openings "Little Changed" at 7.2 Million in July

by Calculated Risk on 9/10/2019 10:10:00 AM

Notes: In July there were 7.217 million job openings, and, according to the July Employment report, there were 6,063 million unemployed. So, for the seventeenth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (4+ years).

From the BLS: Job Openings and Labor Turnover Summary

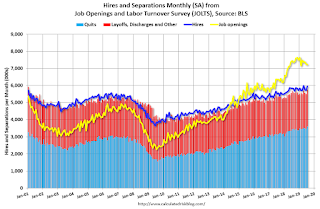

The number of job openings was little changed at 7.2 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Over the month, hires edged up to 6.0 million and separations increased to 5.8 million. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.4 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits edged up to a series high in July of 3.6 million (+130,000). The quits rate was 2.4 percent. The quits level edged up for total private (+127,000) and was little changed for government. Quits increased in health care and social assistance (+54,000) and in federal government (+3,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in July to 7.217 million from 7.248 million in June.

The number of job openings (yellow) are down 3% year-over-year.

Quits are up 3% year-over-year to a new series high. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

Small Business Optimism Index Decreased in August

by Calculated Risk on 9/10/2019 08:50:00 AM

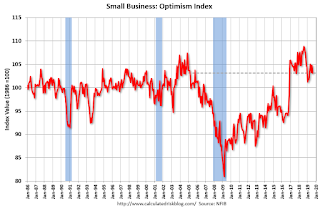

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): August 2019 Report: Small Business Optimism Index

The NFIB Small Business Optimism Index fell 1.6 points to 103.1, remaining within the top 15 percent of readings. Overall, August was a good month for small business. However, optimism slipped because fewer owners said they expect better business conditions and real sales volumes in the coming months.

..

Job creation picked up in August, with an average addition of 0.19 workers per firm compared to 0.12 in July. Finding qualified workers is becoming more and more difficult with a record 27 percent reporting finding qualified workers as their number one problem (up 1 point).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 103.1 in August.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, September 09, 2019

Tuesday: Job Openings

by Calculated Risk on 9/09/2019 07:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Moving Quickly Higher

Mortgage rates moved higher today at the fastest pace in several months today. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]Tuesday:

emphasis added

• At 6:00 AM, NFIB Small Business Optimism Index for August.

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for July from the BLS.

Las Vegas: Convention Attendance and Visitor Traffic up Slightly in 2019 Through July

by Calculated Risk on 9/09/2019 03:27:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2018, visitor traffic declined 0.2% compared to 2017, but was still 7.5% above the pre-recession peak.

Convention attendance declined 2.2% in 2018 from the record high in 2017. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). 2019 is estimate based on data through July 2019.

Convention attendance was up 3.3% in 2019 compared to the same period in 2018.

Visitor traffic was up 0.6% in 2019 compared to the first seven months of 2018.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the slight declines over the last two years was concerning.