by Calculated Risk on 3/24/2019 08:01:00 PM

Sunday, March 24, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of March 24, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5 and DOW futures are up 55 (fair value).

Oil prices were mixed over the last week with WTI futures at $58.79 per barrel and Brent at $66.85 per barrel. A year ago, WTI was at $66, and Brent was at $69 - so oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.63 per gallon. A year ago prices were at $2.63 per gallon, so gasoline prices are unchanged year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 3/24/2019 12:31:00 PM

From HotelNewsNow.com: STR: U.S. hotel results for week ending 16 March

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 10-16 March 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 11-17 March 2018, the industry recorded the following:

• Occupancy: -0.9% to 70.2%

• Average daily rate (ADR): +0.6% to US$134.50

• Revenue per available room (RevPAR): -0.3% to US$94.40

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019 - close, but slightly lower occupancy rate, to-date, compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring travel season, and then increase during the Summer.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, March 23, 2019

Schedule for Week of March 24, 2019

by Calculated Risk on 3/23/2019 08:11:00 AM

The key reports this week are the third estimate of Q4 GDP, February Housing Starts and New Home Sales.

Other key reports include Case-Shiller house prices, and Personal Income for February, and Personal Outlays for January.

For manufacturing, the March Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

8:30 AM ET: Housing Starts for February.

8:30 AM ET: Housing Starts for February. This graph shows single and total housing starts since 1968.

The consensus is for 1.201 million SAAR, down from 1.230 million SAAR in January.

9:00 AM: FHFA House Price Index for January 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.2% year-over-year increase in the Comp 20 index for December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for January from the Census Bureau.

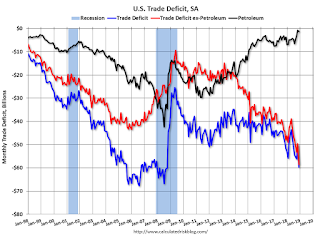

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $57.4 billion. The U.S. trade deficit was at $59.8 billion in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 221 thousand the previous week.

8:30 AM: Gross Domestic Product, 4th quarter 2018 (Third estimate). The consensus is that real GDP increased 2.2% annualized in Q4, down from the initial estimate of 2.6%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 1.0% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for March. This is the last of regional manufacturing surveys for March.

8:30 AM ET: Personal Income, February 2019; Personal Outlays, January 2019. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 60.3, down from 64.7 in February.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 616 thousand SAAR, up from 607 thousand in January.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 97.8.

Friday, March 22, 2019

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 3/22/2019 03:27:00 PM

From Goldman Sachs:

We boosted our Q1 GDP tracking estimate by three tenths to +0.7% (qoq ar). However ... we lowered our past-quarter GDP tracking estimate for Q4 by two tenths to +2.1%. [March 22 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.3% for 2019:Q1 and 1.7% for 2019:Q2. [Mar 22 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2019 is 1.2 percent on March 22, up from 0.4 percent on March 13. [Mar 13 estimate]CR Note: These early estimates suggest real GDP growth will be around 1% annualized in Q1.

BLS: Unemployment Rates at New Series Lows in Alabama, North Dakota, Tennesse and Vermont

by Calculated Risk on 3/22/2019 03:01:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in February in 4 states and stable in 46 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

Iowa, New Hampshire, North Dakota, and Vermont had the lowest unemployment rates in February, 2.4 percent each. The rates in Alabama (3.7 percent), North Dakota (2.4 percent), Tennessee (3.2 percent), and Vermont (2.4 percent) set new series lows.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that the series low for Alaska is above 6%. Four states and the D.C. have unemployment rates above 5%; Alaska, Arizona, New Mexico and West Virginia.

A total of nine states are at the series low.

Comments on February Existing Home Sales

by Calculated Risk on 3/22/2019 11:49:00 AM

Earlier: NAR: Existing-Home Sales Increased to 5.51 million in February

A few key points:

1) Seasonally February is one of the weakest months of the year for existing home sales (See Not Seasonally Adjusted NSA graph below). Since existing home sales are counted at closing, these are properties that usually went under contract during the holidays or in early January. So I wouldn't read too much into the pickup in February. Sales will be stronger seasonally over the next several months. The headline number was not a surprise (see note 3), and the pickup was probably due to lower mortgage rates and a stronger stock market (so buyers were more confident). But the next several months are more important for existing home sales.

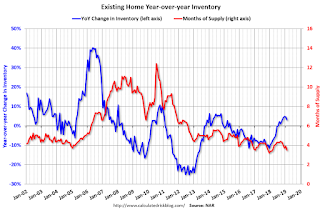

2) Inventory is still low, and was only up 3.2% year-over-year (YoY) in February. This was the seventh consecutive month with a year-over-year increase in inventory, although the YoY increase was smaller in February than in the three previous months.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in February. The consensus was for sales of 5.08 million SAAR, Lawler estimated the NAR would report 5.46 million SAAR in February, and the NAR actually reported 5.51 million SAAR.

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in February (312,000, red column) were below sales in February 2018 (319,000, NSA), and sales were the lowest for February since 2015.

NAR: Existing-Home Sales Increased to 5.51 million in February

by Calculated Risk on 3/22/2019 10:11:00 AM

From the NAR: Existing-Home Sales Surge 11.8 Percent in February

Existing-home sales rebounded strongly in February, experiencing the largest month-over-month gain since December 2015, according to the National Association of Realtors®. Three of the four major U.S. regions saw sales gains, while the Northeast remained unchanged from last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, shot up 11.8 percent from January to a seasonally adjusted annual rate of 5.51 million in February. However, sales are down 1.8 percent from a year ago (5.61 million in February 2018).

...

Total housing inventory at the end of February increased to 1.63 million, up from 1.59 million existing homes available for sale in January, a 3.2 percent increase from 1.58 million a year ago. Unsold inventory is at a 3.5-month supply at the current sales pace, down from 3.9 months in January but up from 3.4 months in February 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (5.51 million SAAR) were up 11.8% from last month, and were 1.8% below the February 2018 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.63 million in February from 1.59 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.63 million in February from 1.59 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 3.2% year-over-year in February compared to February 2018.

Inventory was up 3.2% year-over-year in February compared to February 2018. Months of supply was at 3.5 months in February.

For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...

Thursday, March 21, 2019

Friday: Existing Home Sales

by Calculated Risk on 3/21/2019 08:54:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Move Deeper Into Long-Term Lows

Granted, we're not back to the sub-4% mortgage rates that dominated much of the past 8 years, but breaking into the high 3% range is a valid consideration after the past few days. Yesterday's surprising Fed news hit the rates that were already holding near their lowest levels in well over a year. The net effect has been a decisive break lower with the average lender easily able to offer 4.375% on a typical 30yr fixed scenario. Many lenders are at 4.25% … [30YR FIXED - 4.375%]Friday:

• At 10:00 AM, Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.08 million SAAR, up from 4.94 million. Take the over!

• At 10:00 AM, State Employment and Unemployment (Monthly) for February 2019

Black Knight: National Mortgage Delinquency Rate Increased in February

by Calculated Risk on 3/21/2019 03:43:00 PM

CR Note: It is possible that some of the increase in the delinquency rate in February was due to late tax refunds.

From Black Knight: Black Knight’s First Look: Bucking Historical Seasonal Trend, February Sees Delinquencies Rise; Prepayments Up 11 Percent, Driven by Softening Interest Rates

• Delinquencies rose by 3.7 percent in February, the first February increase in 12 yearsAccording to Black Knight's First Look report for February, the percent of loans delinquent increased 3.7% in February compared to January, and decreased 9.5% year-over-year.

• Despite the monthly rise, delinquencies remain more than 9.5 percent below last year’s level

• At 40,400 for the month, foreclosure starts were down 19.5 percent from January and edged close to September 2018’s 15-year low

• The national foreclosure rate improved marginally and is now down more than 21 percent year-over-year

• Prepayment speeds rose by 11 percent from January’s 18-year low, suggesting an increase in refinance activity driven by the recent decline in 30-year interest rates

The percent of loans in the foreclosure process decreased 0.4% in February and were down 21.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.89% in February, up from 3.75% in January.

The percent of loans in the foreclosure process decreased slightly in February to 0.51% from 0.51% in January.

The number of delinquent properties, but not in foreclosure, is down 179,000 properties year-over-year, and the number of properties in the foreclosure process is down 67,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2019 | Jan 2019 | Feb 2018 | Feb 2017 | |

| Delinquent | 3.89% | 3.75% | 4.30% | 4.21% |

| In Foreclosure | 0.51% | 0.51% | 0.65% | 0.93% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,019,000 | 1,945,000 | 2,198,000 | 2,135,000 |

| Number of properties in foreclosure pre-sale inventory: | 264,000 | 265,000 | 331,000 | 470,000 |

| Total Properties | 2,284,000 | 2,210,000 | 2,528,000 | 2,605,000 |

Existing Home Sales for February: Upside Surprise (Surprise for others)

by Calculated Risk on 3/21/2019 12:37:00 PM

The NAR is scheduled to release Existing Home Sales for February at 10:00 AM on Friday, March 22nd.

The consensus is for 5.08 million SAAR, up from 4.94 million in January. Housing economist Tom Lawler estimates the NAR will reports sales of 5.46 million SAAR for February and that inventory will be up 5.7% year-over-year. Based on Lawler's estimate, I expect existing home sales to be well above the consensus for February.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 9 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month, in January 2018, the consensus was for sales of 5.05 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated the NAR would report 4.92 million, and the NAR reported 4.94 million (as usual Lawler was closer than the consensus).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last almost 9 years, the consensus average miss was 144 thousand, and Lawler's average miss was 67 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | --- |

| 1NAR initially reported before revisions. | |||