by Calculated Risk on 2/25/2019 02:21:00 PM

Monday, February 25, 2019

February Vehicle Sales Forecast: 16.6 Million SAAR

From JD Power: J.D. Power and LMC Automotive Forecast February 2019

"The year is off to its slowest start since 2014 with the industry set to post sales declines again in February. While retail sales through the first two months will be down more than 4%, it's important to note that January and February are among the lowest volume sales months of the year." (Last year the two months combined to account for only 13.5% of the annual total.)This forecast is for sales to be about the same level as in January, and down from 16.9 million SAAR in February 2018.

Looking ahead to the coming months, the industry should expect to receive a slight boost with the recovery of any lost sales due to inclement weather. [Forecast: total sales 16.6 million SAAR]

Dallas Fed: "Texas Manufacturing Expansion Continues"

by Calculated Risk on 2/25/2019 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to expand in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, slipped four points to 10.1, indicating a slight deceleration in output growth.So far the regional surveys have been mixed for February.

Most other measures of manufacturing activity also suggested continued but slower expansion in February. The new orders index fell five points to 6.9, its lowest reading in more than two years. Similarly, the capacity utilization index fell eight points to 7.1 and reached a two-year low. Meanwhile, the shipments index was largely unchanged at 10.7.

Perceptions of broader business conditions improved notably in February. The general business activity index rose 12 points to 13.1 after posting weak readings the prior two months. The company outlook index rose seven points to 14.2, a four-month high. The index measuring uncertainty regarding companies’ outlooks retreated 12 points to 4.1, its lowest reading in nine months.

Labor market measures suggested stronger employment growth and little change in workweek length in February. The employment index rebounded from 6.6 to 12.6.

emphasis added

Black Knight: National Mortgage Delinquency Rate Decreased in January

by Calculated Risk on 2/25/2019 09:19:00 AM

From Black Knight: Black Knight’s First Look: January’s Prepayment Rate Lowest in More Than 18 Years as Seasonal Home Sale Reductions Outweigh Rise in Refinance Incentive

• The national delinquency rate fell by 3.5 percent and is now nearly 13 percent below last year’s levelAccording to Black Knight's First Look report for January, the percent of loans delinquent decreased 3.45% in January compared to December, and decreased 12.9% year-over-year.

• Foreclosure starts rose seasonally month-over-month but were down more than 19 percent year-over-year

• The number of loans in active foreclosure continued its downward trend; there are now 265,000 active foreclosures, down 72,000 from one year ago

...

• Despite recent declines in interest rates, January’s prepayment rate was the lowest since November 2000

• Seasonal reductions in home sales outweighed any early, rate-driven rise in refinance incentive

The percent of loans in the foreclosure process decreased 2.2% in January and were down 22.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.75% in January, down from 3.88% in December.

The percent of loans in the foreclosure process decreased slightly in January to 0.51% from 0.52% in December.

The number of delinquent properties, but not in foreclosure, is down 257,000 properties year-over-year, and the number of properties in the foreclosure process is down 72,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2019 | Dec 2018 | Jan 2018 | Jan 2017 | |

| Delinquent | 3.75% | 3.88% | 4.31% | 4.25% |

| In Foreclosure | 0.51% | 0.52% | 0.66% | 0.94% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,945,000 | 2,013,000 | 2,202,000 | 2,162,000 |

| Number of properties in foreclosure pre-sale inventory: | 265,000 | 271,000 | 337,000 | 481,000 |

| Total Properties | 2,210,000 | 2,283,000 | 2,539,000 | 2,643,000 |

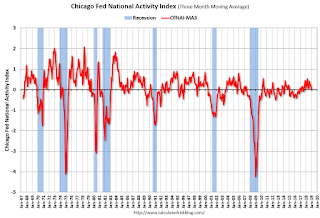

Chicago Fed "Index Points to Slower Economic Growth in January"

by Calculated Risk on 2/25/2019 08:53:00 AM

From the Chicago Fed: Index Points to Slower Economic Growth in January

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.43 in January from +0.05 in December. One of the four broad categories of indicators that make up the index decreased from December, and two of the four categories made negative contributions to the index in January. The index’s three-month moving average, CFNAI-MA3, decreased to a neutral reading in January from +0.16 in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was at the historical trend in January (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, February 24, 2019

Sunday Night Futures

by Calculated Risk on 2/24/2019 07:35:00 PM

Weekend:

• Schedule for Week of February 24, 2019

Monday:

• At 8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 7 and DOW futures are up 63 (fair value).

Oil prices were up over the last week with WTI futures at $57.36 per barrel and Brent at $67.25 per barrel. A year ago, WTI was at $62, and Brent was at $65 - so WTI oil prices are down year-over-year, although Brent is up slightly.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.40 per gallon. A year ago prices were at $2.50 per gallon, so gasoline prices are down 10 cents per gallon year-over-year.

February 2019: Unofficial Problem Bank list decreased to 76 Institutions

by Calculated Risk on 2/24/2019 12:51:00 PM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for February 2019. During the month, the list decreased by a net of two institutions to 76 banks after three removals and one addition. Aggregate assets dropped to $52.8 billion from $55.2 billion at month earlier, with $1.9 billion of the $2.4 billion decline due to the release of updated financials. A year ago, the list held 101 institutions with assets of $20.5 billion.

Removals included Beach Community Bank, Fort Walton Beach, FL ($468 million) because of action termination; Gunnison Valley Bank, Gunnison, UT ($71 million) because of an unassisted merger; and Maryland Financial Bank, Towson, MD ($42 million) because of voluntary liquidation.

Added this month was Fort Gibson State Bank, Fort Gibson, OK ($61 million) because the FDIC issued it a Prompt Corrective Action order on January 9, 2019. Strange, the FDIC has yet to provide public notice of a safety & soundness consent order against this bank.

On February 21, 2019 the FDIC released industry results for the fourth quarter of 2018. In that release, the FDIC disclosed that the Official Problem Bank List includes 60 institutions with assets of $48.5 billion, down from 71 institutions with assets of $53.3 billion in the third quarter of 2018.

Saturday, February 23, 2019

Schedule for Week of February 24, 2019

by Calculated Risk on 2/23/2019 08:11:00 AM

Some key catch up reports this week! The key reports are Q4 GDP and December Housing Starts.

Other key reports include Case-Shiller house prices, and Personal Income and Outlays for December, and Personal Income for January.

For manufacturing, the February Dallas, Richmond and Kansas City manufacturing surveys will be released.

Fed Chair Jerome Powell will provide the semi-annual Monetary Policy report to Congress this week.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

8:30 AM ET: Housing Starts for December.

8:30 AM ET: Housing Starts for December. This graph shows single and total housing starts since 1968.

The consensus is for 1.256 million SAAR, unchanged from 1.256 million SAAR.

9:00 AM: FHFA House Price Index for December 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for December.

9:00 AM: S&P/Case-Shiller House Price Index for December.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.5% year-over-year increase in the Comp 20 index for December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

10:00 AM: Testimony by Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 3.0% decrease in the index.

10:00 AM: Testimony by Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 216 thousand the previous week.

8:30 AM: Gross Domestic Product, 4th quarter 2018 (Initial estimate). The consensus is that real GDP increased 2.4% annualized in Q4, down from 3.4% in Q3.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 55.8, down from 56.7 in January.

10:00 AM: the Q4 2018 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of regional manufacturing surveys for February.

8:30 AM ET: Personal Income and Outlays for December, and Personal Income for January. The consensus is for a 0.4% increase in personal income, and for a 0.2% decrease in personal spending. And for the Core PCE price index to increase 0.2%. This release also includes Personal Income for January. The consensus is for a 0.4% increase in personal income.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 55.0, down from 56.6 in January.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 55.0, down from 56.6 in January.Here is a long term graph of the ISM manufacturing index.

The PMI was at 56.6% in January, the employment index was at 55.5%, and the new orders index was at 58.2%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 95.5.

Friday, February 22, 2019

Q4 GDP Forecasts: High-1s, Low-2s, 2018 Annual GDP around 2.8%

by Calculated Risk on 2/22/2019 02:01:00 PM

The BEA has announced that the Q4 advanced GDP report will be combined with the 2nd estimate of GDP, and will be released on Feb 28th.

From Merrill Lynch:

Weak retail sales data and inventory build caused a 0.8pp decline in our 4Q GDP tracking estimate to 1.5% from 2.3% [Feb 14 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.3% for 2018:Q4 and 1.2% for 2019:Q1. [Feb 22 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 1.4 percent on February 21, down from 1.5 percent on February 14. [Feb 21 estimate]CR Note: These estimates suggest GDP in the high 1s for Q4.

Using the middle of these three forecasts (about 1.8% real GDP growth in Q4), that would put 2018 annual GDP growth at around 2.8%. This would be the best year since 2015, but lower than many forecasts.

Fannie and Freddie: Combined REO inventory declined in Q4, Down 21% Year-over-year

by Calculated Risk on 2/22/2019 01:48:00 PM

Fannie and Freddie reported results for Q4 2018. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 7,100 at the end of Q4 2018 compared to 8,299 at the end of Q4 2017.

For Freddie, this is down 91% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 20,156 at the end of Q4 2018 compared to 26,311 at the end of Q4 2017.

For Fannie, this is down 88% from the 166,787 peak number of REOs in Q3 2010.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in 2018, and combined inventory is down 21% year-over-year.

This is close to normal levels of REOs.

MBA: The Unemployment Rate and Mortgage Delinquency Rate

by Calculated Risk on 2/22/2019 09:52:00 AM

An interesting chart from the Mortgage Bankers Association’s (MBA):

Last week, MBA Research released fourth quarter of 2018 results of its National Delinquency Survey (NDS). The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties was 4.06 percent – down 41 basis points from the previous quarter, 111 basis points from the fourth quarter of 2017 and at its lowest level since the first quarter of 2000.

In this week’s chart, we show the relationship between the unemployment rate, supplied by the U.S. Bureau of Labor Statistics (BLS), and the mortgage delinquency rate for all loans over a 30‐year period.

Nine years ago (the first quarter of 2010) during the aftermath of the Great Recession, the unemployment rate reached 9.83 percent, and the mortgage delinquency rate was at its peak of 10.06 percent. Fast forward to last year’s fourth quarter, the unemployment rate was 3.80 percent and nearing 50‐year lows, and the mortgage delinquency rate (4.06 percent) was at an 18‐year low.

Click on graph for larger image.

Click on graph for larger image.The close tracking between unemployment and mortgage delinquency rates from the period 1988‐2008 appears less pronounced than from 2008‐2018. For example, the unemployment rate reached 7.63 percent in the third quarter of 1992, while the mortgage delinquency rate was relatively low in comparison, at 4.58 percent. Possible factors influencing this change include differences in mortgage product mix and criteria, borrower behavior and recession severity.CR Note: The mortgage delinquency rate is currently near all time lows for this series.