by Calculated Risk on 11/05/2018 05:02:00 PM

Monday, November 05, 2018

"Mortgage Rates Higher Still, Despite Calmer Market"

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher Still, Despite Calmer Market

Mortgage rates continued pushing up to new 7-year highs today, even if only by a small margin. This is notable because the underlying bond market (the primary factor in mortgage rate movement) suggested that rates should have fallen today. The issue is that bond markets were so weak on Friday that mortgage lenders didn't have a chance to fully adjust their rate sheets to reflect the losses. As such, there were still some losses to deal with this morning, and today's modest bond market improvement wasn't quite enough to offset them. In other words, we began the day with enough of a disadvantage from Friday that it couldn't be overcome. [30YR FIXED - 5.0%]

emphasis added

Update: Framing Lumber Prices Down Year-over-year

by Calculated Risk on 11/05/2018 12:23:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined further in October from the record highs earlier in 2018, and are now down over 20% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through November 2, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 22% from a year ago, and CME futures are down 29% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

ISM Non-Manufacturing Index decreased to 60.3% in October

by Calculated Risk on 11/05/2018 10:04:00 AM

The October ISM Non-manufacturing index was at 60.3%, down from 61.6% in September. The employment index decreased in October to 59.7%, from 62.4%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2018 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 105th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 60.3 percent, which is 1.3 percentage points lower than the September reading of 61.6 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 62.5 percent, 2.7 percentage points lower than the September reading of 65.2 percent, reflecting growth for the 111th consecutive month, at a slower rate in October. The New Orders Index registered 61.5 percent, 0.1 percentage point lower than the reading of 61.6 percent in September. The Employment Index decreased 2.7 percentage points in October to 59.7 percent from the September reading of 62.4 percent. The Prices Index decreased 2.5 percentage points from the September reading of 64.2 percent to 61.7 percent, indicating that prices increased in October for the 32nd consecutive month. According to the NMI®, 17 non-manufacturing industries reported growth. The non-manufacturing sector has again reflected strong growth despite a slight cooling off after a record month in September. There are continued concerns about capacity, logistics and tariffs. The respondents are positive about current business conditions and the economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in October than in September, but this was still a strong reading.

Black Knight Mortgage Monitor: Foreclosure Inventory Falls to Pre-Recession Average

by Calculated Risk on 11/05/2018 08:29:00 AM

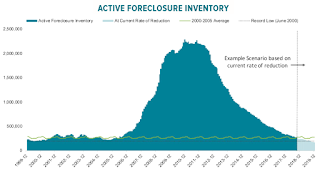

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 3.97% of mortgages were delinquent in September, down from 4.40% in September 2017. Black Knight also reported that 0.52% of mortgages were in the foreclosure process, down from 0.70% a year ago.

This gives a total of 4.49% delinquent or in foreclosure.

Press Release: Black Knight: Interest Rate Increases Cut Refinanceable Population by More than Half in 2018; Housing in 10 States Now Less Affordable than Long-Term Benchmarks

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of September 2018. This month’s report looks at the continued impact of rising interest rates on both the refinanceable population – homeowners with mortgages who could likely qualify for and see at least a 0.75 percent rate reduction from a refinance – and home affordability. As Ben Graboske, executive vice president of Black Knight’s Data & Analytics division explained, over the last two years, millions of homeowners lost an interest rate incentive to refinance.

“Due to rising rates, some 6.5 million homeowners that previously could have benefited from refinancing their mortgages have missed that opportunity,” said Graboske. “On average, these homeowners had a 22-month window to refinance. …"

This month’s data also showed that the national inventory of loans in active foreclosure has fallen to pre-recession averages for the first time since the financial crisis. The improvement is actually even more impressive than it may seem. Taking into account today’s foreclosure rate and the fact that there are 16 percent more active mortgages today than the 2000-2005 average, relatively speaking, foreclosure inventory is actually 40,800 below pre-recession "norms.” At the current rate of reduction (a six-month average annual decline of 27 percent) active foreclosure inventory would hit a record low in September 2019, with fewer than 200,000 cases nationwide.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor showing active foreclosure inventory.

From Black Knight:

• The number of loans in active foreclosure continues to decline at a rapid pace, with some 90K fewer (-25%) active foreclosure cases from one year agoThere is much more in the mortgage monitor.

• September marks the lowest foreclosure inventory since mid-2006 and the first time since the financial crisis that the number of active foreclosures has fallen to pre-recession (2000-2005) averages

• Taking into account today’s foreclosure rate and the fact that there are 16% more active mortgages today than the 20002005 average, relatively speaking, foreclosure inventory is actually 41K below pre-recession "norms”

• At the current rate of reduction (a six-month average annual decline of 27%) active foreclosure inventory would hit a record low in September 2019, with fewer than 200K cases nationwide

Sunday, November 04, 2018

Sunday Night Futures

by Calculated Risk on 11/04/2018 07:00:00 PM

Weekend:

• Schedule for Week of November 4, 2018

• Goldman Sachs on Housing Slowdown

Monday:

• At 10:00 AM ET, the ISM non-Manufacturing Index for October. The consensus is for a decrease to 59.4 from 61.6.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 6 and DOW futures are down 60 (fair value).

Oil prices were down over the last week with WTI futures at $63.00 per barrel and Brent at $72.70 per barrel. A year ago, WTI was at $56, and Brent was at $64 - so oil prices are up about 13% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.74 per gallon. A year ago prices were at $2.52 per gallon, so gasoline prices are up 22 cents per gallon year-over-year.

Goldman Sachs on Housing Slowdown

by Calculated Risk on 11/04/2018 04:03:00 PM

A few brief excerpts from a Goldman Sachs research note today: The Housing Slowdown

The most likely drivers of the slowdown are higher interest rates and tax reform.CR Note: We discussed these two key headwinds at the beginning of the year. Goldman Sachs economists estimate that two-thirds of the recent slowdown is due to higher interest rates.

We expect higher interest rates and tax reform to remain headwinds, but see the low level of homebuilding relative to demographic trends as a medium-run tailwind.CR Note: The demographic tail-wind isn't as strong as I thought a few years ago. There have been more prime age deaths, and less immigration. See Tom Lawler's recent article: Lawler: Deaths, Immigration, and “the Demographics”

Our residential investment model accounts for both of these offsetting forces and currently projects a -1.5% growth pace in 2019.CR Note: So Goldman expects a small decline in residential investment in 2019.

[T]he housing slowdown has added to recession worries. We see such fears as overdone.CR Note: I agree that recession concerns are overblown.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 11/04/2018 09:25:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 27 October

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 21-27 October 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 22-28 October 2017, the industry recorded the following:

• Occupancy: +1.2% to 70.7%

• Average daily rate (ADR): +4.0% to US$134.39

• Revenue per available room (RevPAR): +5.2% to US$95.02

…

Houston, Texas, registered the steepest declines in occupancy (-18.5% to 69.9%) and RevPAR (-23.0% to US$79.01). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, to date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, November 03, 2018

Schedule for Week of November 4, 2018

by Calculated Risk on 11/03/2018 08:11:00 AM

This will be a light week for economic data.

The FOMC meets on Wednesday and Thursday, and no change to policy is expected.

10:00 AM: the ISM non-Manufacturing Index for October. The consensus is for a decrease to 59.4 from 61.6.

10:00 AM ET: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 7.136 million from 7.077 million in July.

The number of job openings (yellow) were up 18% year-over-year, and Quits were up 13% year-over-year.

10:00 AM: Corelogic House Price index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer Credit from the Federal Reserve.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, down from 214 thousand the previous week.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

8:30 AM: The Producer Price Index for October from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for November).

Friday, November 02, 2018

Q4 GDP Forecasts

by Calculated Risk on 11/02/2018 06:31:00 PM

From Goldman Sachs:

Q4 2.6% (qoq ar). [Oct 29 estimate].From Merrill Lynch:

emphasis added

[W]e revise down 4Q GDP to 2.8% from 3.0% [Nov 2 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.9 percent on November 2, down from 3.0 percent on November 1. [Nov 2 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.6%. [Nov 2 estimate]CR Note: These early estimates suggest GDP in the high 2s for Q4.

October Vehicles Sales: 17.5 Million SAAR

by Calculated Risk on 11/02/2018 03:47:00 PM

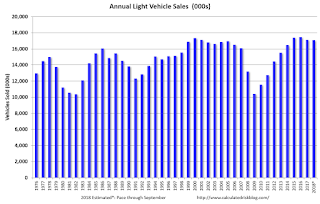

The BEA released their estimate of October vehicle sales. The BEA estimated sales of 17.51 million SAAR in October 2018 (Seasonally Adjusted Annual Rate), up 0.5% from the September sales rate, and down 2.0% from October 2017.

Through October, light vehicle sales are on pace to be mostly unchanged in 2018 compared to 2017.

This would make 2018 the fifth best year on record after 2016, 2015, 2000, and 2017.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated based on the pace of sales during the first ten months.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

My guess is vehicle sales will finish the year with sales lower than in 2017 (sales in late 2017 were boosted by buying following the hurricanes), and will probably be just over 17 million for the year (the lowest since 2014).

A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).