by Calculated Risk on 6/15/2018 09:21:00 AM

Friday, June 15, 2018

Industrial Production Decreased 0.1% in May

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged down 0.1 percent in May after rising 0.9 percent in April. Manufacturing production fell 0.7 percent in May, largely because truck assemblies were disrupted by a major fire at a parts supplier. Excluding motor vehicles and parts, factory output moved down 0.2 percent. The index for mining rose 1.8 percent, its fourth consecutive month of growth; the output of utilities moved up 1.1 percent. At 107.3 percent of its 2012 average, total industrial production was 3.5 percent higher in May than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.9% is 1.9% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in May to 107.3. This is 23% above the recession low, and 2% above the pre-recession peak.

NY Fed: Manufacturing "Business activity continued to grow strongly in New York State"

by Calculated Risk on 6/15/2018 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity expanded at a faster pace than in May. The general business conditions index rose five points to 25.0, its highest level in several months. … The index for number of employees climbed ten points to 19.0, its highest level thus far in 2018, pointing to a pickup in employment levels.This was above the consensus forecast and a strong reading.

emphasis added

Thursday, June 14, 2018

Friday: Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 6/14/2018 06:56:00 PM

Friday:

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 19.6, down from 20.1.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.0%.

• At 10:00 AM: State Employment and Unemployment (Monthly) for May 2018

• Also at 10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

LA area Port Traffic Increases YoY in May

by Calculated Risk on 6/14/2018 01:06:00 PM

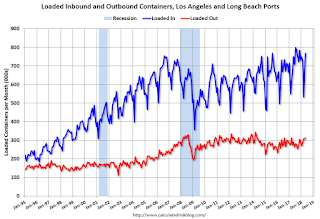

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.2% compared to the rolling 12 months ending in April. Outbound traffic was up 0.7% compared to the rolling 12 months ending in April.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have picked up recently.

Duy: FOMC Recap

by Calculated Risk on 6/14/2018 11:09:00 AM

A few excerpts from Tim Duy at Fed Watch: FOMC Recap

The Federal Open Market Committee (FOMC) completed their June meeting with a 25 basis point rate hike, bringing the target range for the federal funds rate to 1.75-2.0 percent. The accompanying Summary of Economic Projections (SEP) revealed a modestly more optimistic outlook, as expected. The improving outlook prompted an upward revision to rate hike expectations with the median policymaker anticipating four rate hikes this year, up from three in March. The Fed dropped the explicit forward guidance language in the statement as they work to encourage market participants to undertake a more nuanced, data-driven approach to assessing the future path of rate hikes.

With the economy chugging along at a respectable clip that could exceed 4 percent in the second quarter, the Federal Reserve upgraded its assessment of growth from “moderate” to “solid.” Expected growth for 2018 as a whole rose from 2.7 to 2.8 percent while the unemployment forecast fell from 3.8 percent to 3.6 percent. If history is any guide, that forecast remains too pessimistic given the expected pace of growth this year.

…

Bottom Line: Pay attention to the interplay of the rate and economic forecasts and the flow of data. The pace of data will almost certainly not slow sufficiently to prevent the Fed from hiking in September and probably December. I would say September is essentially a lock at this point. I also think you need to pencil in rate hikes in March and June of 2019. Recognize though that by mid-2019 the data might reflect the lagged impact of past tightening and the yield curve is likely to be fairly flat; both factors would slow the pace of rate hikes. The Fed will face a more difficult choice if the data holds strong while the yield curve inverts.

Retail Sales increased 0.8% in May

by Calculated Risk on 6/14/2018 08:48:00 AM

On a monthly basis, retail sales increased 0.8 percent from April to May (seasonally adjusted), and sales were up 5.9 percent from May 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $502.0 billion, an increase of 0.8 percent from the previous month, and 5.9 percent above May 2017. ... The March 2018 to April 2018 percent change was revised from up 0.2 percent to up 0.4 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in May.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.The increase in May was above expectations, and sales in March and April, combined, were revised up.

Weekly Initial Unemployment Claims decrease to 218,000

by Calculated Risk on 6/14/2018 08:33:00 AM

The DOL reported:

In the week ending June 9, the advance figure for seasonally adjusted initial claims was 218,000, a decrease of 4,000 from the previous week's unrevised level of 222,000. The 4-week moving average was 224,250, a decrease of 1,250 from the previous week's unrevised average of 225,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,250.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, June 13, 2018

"Mortgage Rates Higher Following Fed Forecasts"

by Calculated Risk on 6/13/2018 05:53:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher Following Fed Forecasts

Mortgage rates moved higher today, following the Fed's much-anticipated policy announcement. Although the Fed changed quite a few words from the announcement's previous iteration (far more than normal), it wasn't the announcement itself that did the damage. Rather, it was the Fed members' economic projections, which include an assessment of where the Fed Funds Rate will likely be at the end of the next few years.Thursday:

Specifically, a few of the Fed members who'd been holding out for slightly lower rates in 2018 moved their forecasts up enough to increase the odds of a 4th rate hike by December. … The net effect was a slight increase in rates that leaves us a little bit closer to the 7-year highs seen in mid-May. [30YR FIXED - 4.625%-4.75%]

emphasis added

• At 8:30 AM ET, Retail sales for May will be released. The consensus is for a 0.4% increase in retail sales. Retail and Food service sales, ex-gasoline, increased by 4.0% on a YoY basis.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, up from 222 thousand the previous week.

FOMC Projections and Press Conference Link

by Calculated Risk on 6/13/2018 02:15:00 PM

Statement here.

Powell press conference video here.

On the projections, the changes were minor. The projections for GDP in 2018 are near the top of the March range, and the bottom of the range was revised up slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.7 to 3.0 | 2.2 to 2.6 | 1.8 to 2.0 |

| Mar 2018 | 2.6 to 3.0 | 2.2 to 2.6 | 1.8 to 2.1 |

| Dec 2017 | 2.2 to 2.6 | 1.9 to 2.3 | 1.7 to 2.0 |

The unemployment rate was at 3.8% in May. So the unemployment rate projection for 2018 was revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Jun 2018 | 3.6 to 3.7 | 3.4 to 3.5 | 3.4 to 3.7 |

| Mar 2018 | 3.6 to 3.8 | 3.4 to 3.7 | 3.5 to 3.8 |

| Dec 2017 | 3.7 to 4.0 | 3.6 to 4.0 | 3.6 to 4.2 |

As of April, PCE inflation was up 2.0% from April 2017. PCE inflation projections were revised up for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.0 to 2.1 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Dec 2017 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.8% in April year-over-year. Core PCE inflation was revised up slightly for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 1.9 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Dec 2017 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 6/13/2018 02:02:00 PM

Information received since the Federal Open Market Committee met in May indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Recent data suggest that growth of household spending has picked up, while business fixed investment has continued to grow strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were Jerome H. Powell, Chairman; William C. Dudley, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Loretta J. Mester; Randal K. Quarles; and John C. Williams.

emphasis added