by Calculated Risk on 4/27/2018 04:05:00 PM

Friday, April 27, 2018

Oil Rigs: "Beginning of Shale's Super-Goldilocks Period?"

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 27, 2018:

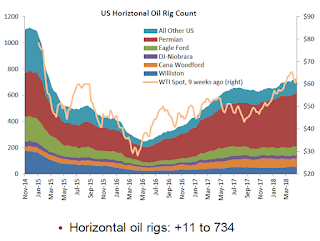

• Total US oil rigs were up, +5 to 825

• Horizontal oil rigs were up, +11 at 734

...

• The major action again was back in the Permian, +6 horizontal oil rigs

• Cana Woodford added 9 rigs, but is still below its level of earlier this year.

• Vertical oil rigs are at their lowest level since November 2016

• The Brent spread has moved up to $6.50 / barrel – and speaks to ungodly demand strength outside the US

• With the current Brent spread, expect continued upward pressure in oil prices

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC."

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in March

by Calculated Risk on 4/27/2018 12:36:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in March was 0.97%, down from 1.06% in February. Freddie's rate is up from 0.92% in March 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to a cycle bottom in the 0.5% to 0.8% range.

Note: Fannie Mae will report for March soon.

Q1 GDP: Investment

by Calculated Risk on 4/27/2018 09:32:00 AM

IMPORTANT NOTE: In the GDP report, real residential investment was unchanged in Q1. But residential investment (RI) as a percent GDP actually increased in Q1! How can that be? The answer is that the price index for residential investment increased sharply in Q1 (up 8.5% annualized). The large increase in the residential investment price index follows what we are hearing from home builders - that material costs have increased sharply (the tariffs haven't helped, but other prices are up too). This hurts both builders and home buyers.

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) was unchanged in Q1 (0.0% annual rate in Q1). Equipment investment increased at a 4.7% annual rate, and investment in non-residential structures increased at a 12.3% annual rate.

On a 3 quarter trailing average basis, RI (red) is up, equipment (green) is solidly positive, and nonresidential structures (blue) is up slightly.

Recently real RI has been soft.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP increased in Q1, and RI has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next couple of years.

The increase is now primarily coming from single family investment and home remodeling.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

BEA: Real GDP increased at 2.3% Annualized Rate in Q1

by Calculated Risk on 4/27/2018 08:34:00 AM

From the BEA: Gross Domestic Product: First Quarter 2018 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.3 percent in the first quarter of 2018, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.9 percent.The advance Q1 GDP report, with 2.3% annualized growth, was above expectations.

...

The increase in real GDP in the first quarter reflected positive contributions from nonresidential fixed investment, personal consumption expenditures (PCE), exports, private inventory investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the first quarter reflected decelerations in PCE, residential fixed investment, exports, and state and local government spending. These movements were partly offset by an upturn in private inventory investment. Imports, which are a subtraction in the calculation of GDP, decelerated.

emphasis added

Personal consumption expenditures (PCE) increased at 1.1% annualized rate in Q1, down from 4.0% in Q4 (this is weak). Residential investment (RI) was unchanged in Q1. Equipment investment increased at a 4.7% annualized rate, and investment in non-residential structures increased at a 12.3% pace.

I'll have more later ...

Thursday, April 26, 2018

Friday: Q1 GDP

by Calculated Risk on 4/26/2018 07:11:00 PM

A few GDP forecasts:

From Merrill Lynch:

[T]he data added 0.2pp to 1Q GDP tracking, bringing it up to 1.9% qoq saar heading into tomorrow's advance release. [April 26 estimate].And from the Altanta Fed: GDPNow

emphasis added

The final GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 2.0 percent on April 26, unchanged from April 17.[April 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.9% for 2018:Q1 and 3.0% for 2018:Q2. [April 20 estimate]Friday:

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2018 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.9% in Q4.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 98.0, up from 97.8.

Vehicle Sales Forecast: Sales Around 17 Million SAAR in April

by Calculated Risk on 4/26/2018 05:48:00 PM

The automakers will report April vehicle sales on Tuesday, May 1st.

Note: There were 24 selling days in April 2018, down from 26 in April 2017.

From WardsAuto: U.S. Light-Vehicle Forecast: April Sets Stage for Strong Q2

The Wards Intelligence forecast calls for U.S. automakers to deliver 1.35 million light vehicles in April. ... The report puts the seasonally adjusted annual rate of sales for the month at 17.1 million units, below last month’s 17.4 million but slightly above year-ago’s 17.0It appears April will be another solid month. So far sales in 2018 are running at about the same rate as in 2017.

emphasis added

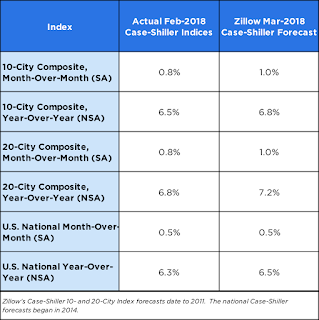

Zillow Case-Shiller Forecast: More Solid House Price Gains in March

by Calculated Risk on 4/26/2018 02:38:00 PM

The Case-Shiller house price indexes for February were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: February Case-Shiller Results and March Forecast: Home Prices Pushed Higher by Inventory Crunch

The kind of sustained, rapid home price growth we’ve been seeing in Case-Shiller and other indices for the past few years is enough to give home buyers of all stripes a headache. And don’t expect things to slow down any time soon.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be larger in March than in February.

...

The pain this rapid growth is causing is widespread, but is especially acute for first-time and lower-income buyers at the bottom end of the market in search of entry-level homes that are appreciating the fastest, in large part because they are in the most demand.

Competition is fierce, offer windows are short and tensions will inevitably run high for many buyers as the spring shopping season unfolds.

More inventory is the one cure sure to take this edge off, and there are some faint signals in more recent data that a shift may be coming – inventory of existing homes has risen for the past three months, and construction activity is at its highest point in a decade.

But buyers in the market now shouldn’t hold their breath. Even if inventory does begin to recover, it will be rising from incredibly low levels and will likely take years to get back to a more ‘normal’ level.

Zillow predicts the March S&P/Case-Shiller U.S. national index, which will not be released until May 29, will climb 6.5 percent year-over year.

Kansas City Fed: Regional Manufacturing Activity "Expanded More Rapidly" in April

by Calculated Risk on 4/26/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded More Rapidly

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded more rapidly in April, and optimism remained high for future activity.So far most of the regional Fed surveys have been solid in April, although Richmond showed some slowing.

“Factory activity accelerated in April despite concerns among many firms about changes in international trade policy,” said Wilkerson. “Price indexes also continued to rise.”

...

The month-over-month composite index was 26 in April, up from readings of 17 in March and 17 in February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity accelerated at both durable and nondurable goods plants, particularly for machinery, plastics, and chemicals. Month-over-month indexes increased considerably. The production index jumped from 20 to 33, and the shipments, new orders, and order backlog indexes also rose. The employment and new orders for exports indexes were unchanged. The raw materials inventory index increased from 11 to 17, while the finished goods inventory index fell slightly.

emphasis added

HVS: Q1 2018 Homeownership and Vacancy Rates

by Calculated Risk on 4/26/2018 10:06:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2018.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was unchanged at 64.2% in Q1, from 64.2% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Weekly Initial Unemployment Claims decrease to 209,000

by Calculated Risk on 4/26/2018 08:33:00 AM

The DOL reported:

In the week ending April 21, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 24,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 232,000 to 233,000. The 4-week moving average was 229,250, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 231,250 to 231,500.The previous week was revised up.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 229,250.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.