by Calculated Risk on 4/23/2018 10:12:00 AM

Monday, April 23, 2018

NAR: "Existing-Home Sales Climb 1.1 Percent in March"

From the NAR: Existing-Home Sales Climb 1.1 Percent in March

Existing-home sales grew for the second consecutive month in March, but lagging inventory levels and affordability constraints kept sales activity below year ago levels, according to the National Association of Realtors®.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.1 percent to a seasonally adjusted annual rate of 5.60 million in March from 5.54 million in February. Despite last month's increase, sales are still 1.2 percent below a year ago.

...

Total housing inventory at the end of March climbed 5.7 percent to 1.67 million existing homes available for sale, but is still 7.2 percent lower than a year ago (1.80 million) and has fallen year-over-year for 34 consecutive months. Unsold inventory is at a 3.6-month supply at the current sales pace (3.8 months a year ago).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (5.60 million SAAR) were 1.1% higher than last month, but were 1.2% below the March 2017 rate.

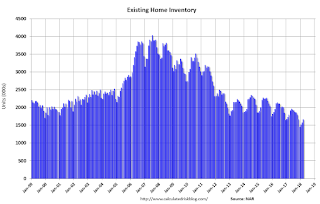

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.67 million in March from 1.59 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.67 million in March from 1.59 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 7.2% year-over-year in March compared to March 2017.

Inventory decreased 7.2% year-over-year in March compared to March 2017. Months of supply was at 3.6 months in March.

Sales were above the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Chicago Fed "Index points to a moderation in economic growth in March"

by Calculated Risk on 4/23/2018 08:36:00 AM

From the Chicago Fed: Index points to a moderation in economic growth in March

Led by slower growth in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) declined to +0.10 in March from +0.98 in February. Three of the four broad categories of indicators that make up the index decreased from February, but two of the four categories made positive contributions to the index in March. The index’s three-month moving average, CFNAI-MA3, decreased to +0.27 in March from +0.31 in February.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in February (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, April 22, 2018

Monday: Existing Home Sales

by Calculated Risk on 4/22/2018 08:34:00 PM

Weekend:

• Schedule for Week of Apr 22, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.28 million SAAR, down from 5.54 million in February. Housing economist Tom Lawler estimates the NAR will reports sales of 5.51 million SAAR for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 16, and DOW futures are down 138 (fair value).

Oil prices were up over the last week with WTI futures at $68.22 per barrel and Brent at $73.91 per barrel. A year ago, WTI was at $49, and Brent was at $50 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.76 per gallon. A year ago prices were at $2.42 per gallon - so gasoline prices are up 34 cents per gallon year-over-year.

Goldman: "Moving Beyond Full Employment"

by Calculated Risk on 4/22/2018 11:53:00 AM

A few brief excerpts from a note by Goldman Sachs economist David Mericle:

... Are we really at full employment? Won’t job growth naturally slow down soon? Why is wage growth so much lower than in previous expansions? ...Mericle argues that the US economy is at or close to "full employment", that job gains will remain healthy for some time, and that wage growth is only "moderately disappointing".

We now see the labor market as at or a bit beyond full employment. ... we estimate a structural unemployment rate of about 4.5%, modestly above the current 4.1% rate. While the cyclical participation gap has recovered more slowly, it too now appears closed. A further cyclical boost to participation is possible, but we expect it to be quite limited.

Meanwhile, the pace of job creation shows no sign of slowing. ... We see little evidence that supply constraints will impose a forceful natural deceleration any time soon, and instead expect robust labor demand to drive the unemployment rate to 3.6% by end-2018 and 3.3% by end-2019, the lowest rate since the Korean War.

We have long stressed that wage growth expectations need to be recalibrated to the meager rate of productivity growth seen this cycle, implying a full employment rate of wage growth of roughly 3%. ... our wage tracker, now running at 2.5%, looks only moderately disappointing. ... signs of acceleration are emerging, notably in our wage survey leading indicator, now running at 3.2% ...

Saturday, April 21, 2018

Schedule for Week of Apr 22, 2018

by Calculated Risk on 4/21/2018 08:11:00 AM

The key economic reports this week are the advance estimate of Q1 GDP, March new and existing home sales, and Case-Shiller house prices.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.28 million SAAR, down from 5.54 million in February.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.28 million SAAR, down from 5.54 million in February.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.51 million SAAR for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for February.

9:00 AM ET: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2018 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for 630 thousand SAAR, up from 618 thousand in February.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 232 thousand the previous week.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

10:00 AM: the Q1 2018 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Gross Domestic Product, 1st quarter 2018 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.9% in Q4.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 98.0, up from 97.8..

Friday, April 20, 2018

Oil Rigs "Middling rig adds"

by Calculated Risk on 4/20/2018 05:41:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 20, 2018:

• Total US oil rigs were up, +5 to 820

• Horizontal oil rigs were up,+6 at 723

...

• Almost all the action was back in the Permian, +9 horizontal oil rigs

• The breakeven oil price to add rigs appears to have crept up from around $48 WTI late last year, to about $56 WTI now.

• The Brent spread remains above $5 / barrel

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Four Q1 GDP Forecasts: Around 2%

by Calculated Risk on 4/20/2018 01:57:00 PM

The advance Q1 GDP report will be released next Friday, April 27th. The consensus is for real GDP growth of 2.1% on a seasonally adjusted annual rate (SAAR) basis.

Here are four Q1 GDP forecast.

From Merrill Lynch:

We expect real GDP growth to slow to 1.7% qoq saar in the advance 1Q report [April 20 estimate].From Nomura:

We expect the first reading of Q1 real GDP growth to come in at 1.6% q-o-q saar [April 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 2.0 percent on April 17, up from 1.9 percent on April 16. [April 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.9% for 2018:Q1 and 3.0% for 2018:Q2. [April 20 estimate]CR Note: It looks like another quarter around 2% or so, although there might still be some residual seasonality in the first quarter.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 4/20/2018 11:59:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

The early consensus is that the NAR will report sales of 5.55 million. However, housing economist Tom Lawler estimates the NAR will report sales of 5.51 million on a seasonally adjusted annual rate (SAAR) basis.

The consensus is pretty close to Lawler's estimate for March. Note: The NAR is scheduled to report March Existing Home Sales on Monday, April 23rd at 10:00 AM ET.

Over the last eight years, the consensus average miss was 145 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | --- |

| 1NAR initially reported before revisions. | |||

BLS: Unemployment Rates Lower in 4 states in March; Kentucky and Maine at New Series Lows

by Calculated Risk on 4/20/2018 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in March in 4 states, higher in 1 state, and stable in 45 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Seventeen states had jobless rate decreases from a year earlier and 33 states and the District had little or no change. The national unemployment rate was unchanged from February at 4.1 percent but was 0.4 percentage point lower than in March 2017.Thirteen states have reached new all time lows since the end of the 2007 recession. These thirteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Kentucky, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas and Wisconsin.

...

Hawaii had the lowest unemployment rate in March, 2.1 percent. The rates in Kentucky (4.0 percent) and Maine (2.7 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Thursday, April 19, 2018

Hotels: Occupancy Rate Up Year-over-Year, Record Q1

by Calculated Risk on 4/19/2018 07:37:00 PM

From HotelNewsNow.com: STR: US hotels set Q1 performance record

The U.S. hotel industry reported record-breaking performance during the first quarter of 2018, according to data from STR.And from HotelNewsNow.com: STR: US hotel results for week ending 14 April

Compared with Q1 2017:

• Occupancy: +0.9% to 61.6%

• Average daily rate (ADR): +2.5% to US$127.37

• Revenue per available room (RevPAR): +3.5% to US$78.46

“The absolute levels for each of the three key performance metrics were the highest STR has ever benchmarked for a Q1,” said Bobby Bowers, STR’s senior VP of operations. “Supply (more than 460 million room nights available) and demand (more than 285 million room nights sold) also reached record levels for a Q1, but demand grew at a much higher rate (+3.0% vs. +2.0%).”

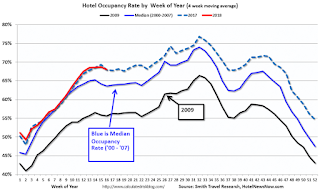

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 8-14 April 2018, according to data from STR. In comparison with the week of 9-15 April 2017, the industry recorded the following:The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

• Occupancy: +6.1% to 68.1%

• Average daily rate (ADR): +5.8% to US$130.57

• Revenue per available room (RevPAR): +12.2% to US$88.95

STR analysts note performance growth was boosted by a favorable comparison with the week of Easter in 2017.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com